Form 1 For Real Estate

Description

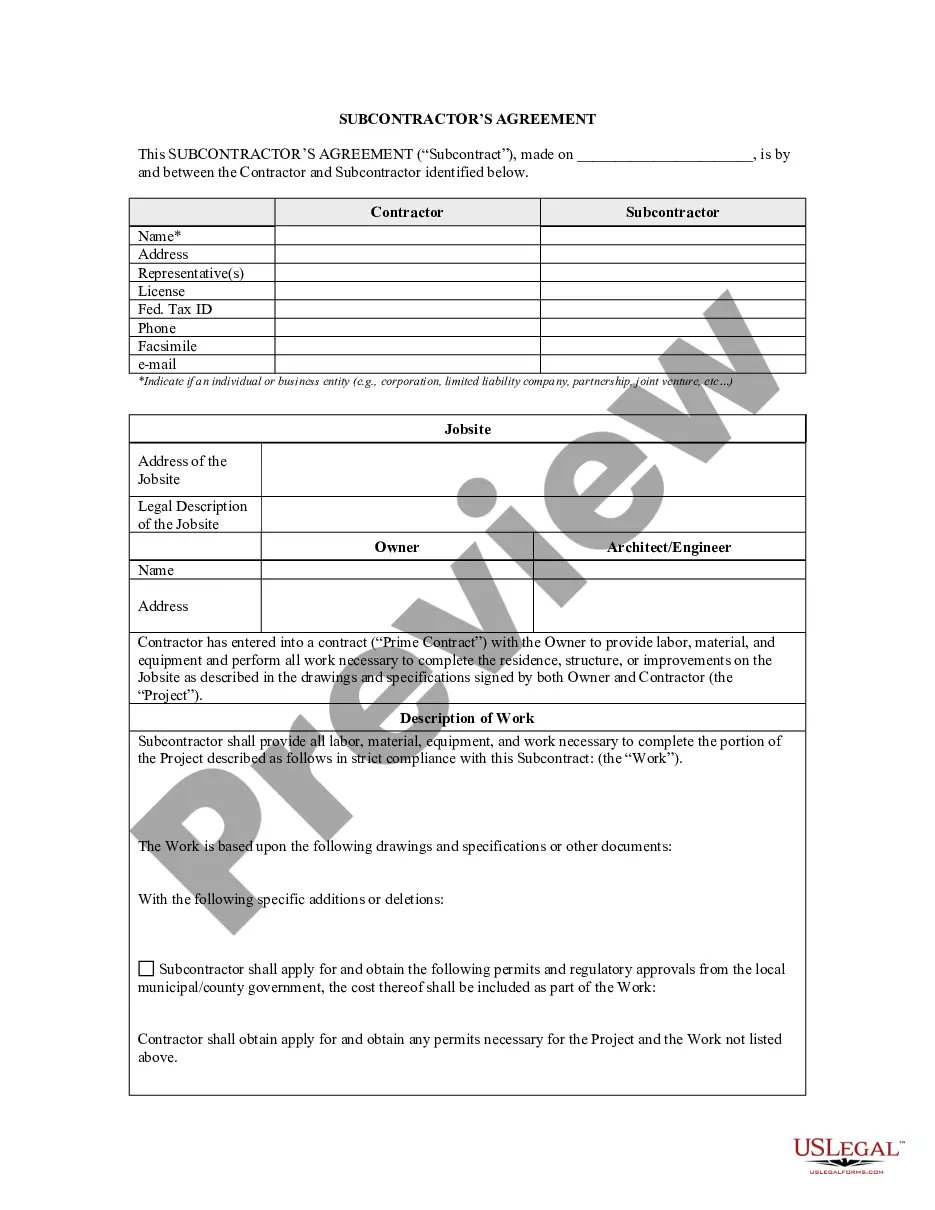

How to fill out Right Of Way And Easement For Additional Pipeline?

- Log into your US Legal Forms account if you're an existing user and click the Download button to retrieve your template. Ensure your subscription is active; renew it if necessary.

- If you're new to US Legal Forms, start by previewing the form to confirm it meets your local jurisdiction requirements.

- Search for any additional forms you may need by using the search tab to ensure you have the proper document.

- Purchase the required form by selecting your preferred subscription plan and creating an account.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Once purchased, download the form and access it anytime in the 'My Documents' section of your profile.

By following these steps, you can streamline your document management and ensure you have the right forms at your fingertips.

Start leveraging the extensive resources of US Legal Forms for your real estate transactions today!

Form popularity

FAQ

In Maryland, late payments may incur interest charges and additional penalties that can accumulate quickly. This is especially relevant when dealing with Form 1 for real estate, where timely payments are essential for compliance. Being proactive in managing your payments can save you from unforeseen costs. Utilizing sites like Uslegalforms can help you stay on track with payment deadlines.

The Maryland late filing penalty can incur a percentage of the amount due, with additional fees depending on how late the return is filed. Specifically, when using Form 1 for real estate, it's crucial to address any late submissions quickly to reduce penalties. Even if you're late, reliable resources like Uslegalforms can assist you in making the correct submissions timely.

Failing to file an Annual Report in Maryland can lead to significant consequences, including the potential for your business entity to be marked as inactive. Furthermore, you may face fines and penalties for non-compliance. Always ensure to use tools like Form 1 for real estate to stay organized and meet your filing obligations. Uslegalforms simplifies this process for you.

For individuals, the penalty for late filing can vary based on several factors, including the type of tax return filed. When it comes to Form 1 for real estate, filing late might result in a fine or interest on unpaid taxes. It's best to submit your return promptly to avoid these penalties. Platforms like Uslegalforms streamline the process, helping you file correctly and on time.

In Maryland, any business or individual owning personal property must file a Maryland personal property return. This includes property used for business purposes and may also cover certain taxable items, such as equipment and supplies. Understanding your obligation is crucial, and using Form 1 for real estate facilitates this process. Uslegalforms provides easy-to-use templates that cater to your specific needs.

Filing Form 1 for real estate late in Maryland can result in penalties. Generally, the state imposes penalties based on the value of the property not reported on time. It's essential to file as soon as possible to minimize additional costs. Uslegalforms can help you complete your filing accurately and on time.

You can easily obtain real estate forms, including Form 1 for real estate, from various online platforms. UsLegalForms offers a comprehensive library where you can find and download legal documents tailored to real estate transactions. This resource ensures that you have access to reliable and up-to-date forms. Simply visit our website, and you can access these documents anytime.

Florida has several essential disclosure forms, including Form 1 for real estate, Form 2, and Form 9. Each of these forms serves a vital purpose in promoting transparency among public officials. It's important to know which forms apply to your situation, as compliance helps maintain ethical standards. Uslegalforms provides guidance on these forms to ensure you meet all necessary requirements efficiently.

In Florida, individuals who hold positions of public trust must file Form 1 for real estate. This includes elected officials, members of certain boards, and candidates running for office. By submitting this form, they disclose their financial interests, which ensures transparency in real estate dealings. Using uslegalforms can simplify this process, making it easier for you to prepare and submit Form 1.

With Form 1, you should carefully fill out all required information related to the property ownership or transaction details. Once completed, this form should be submitted to the relevant authorities or used in your real estate dealings to keep accurate records. Ensuring the proper handling of Form 1 for real estate can enhance the clarity and legality of your property matters. For assistance, consider using as USLegalForms platform to guide you through the process efficiently.