Validate You Owe For Everything Meaning

Description

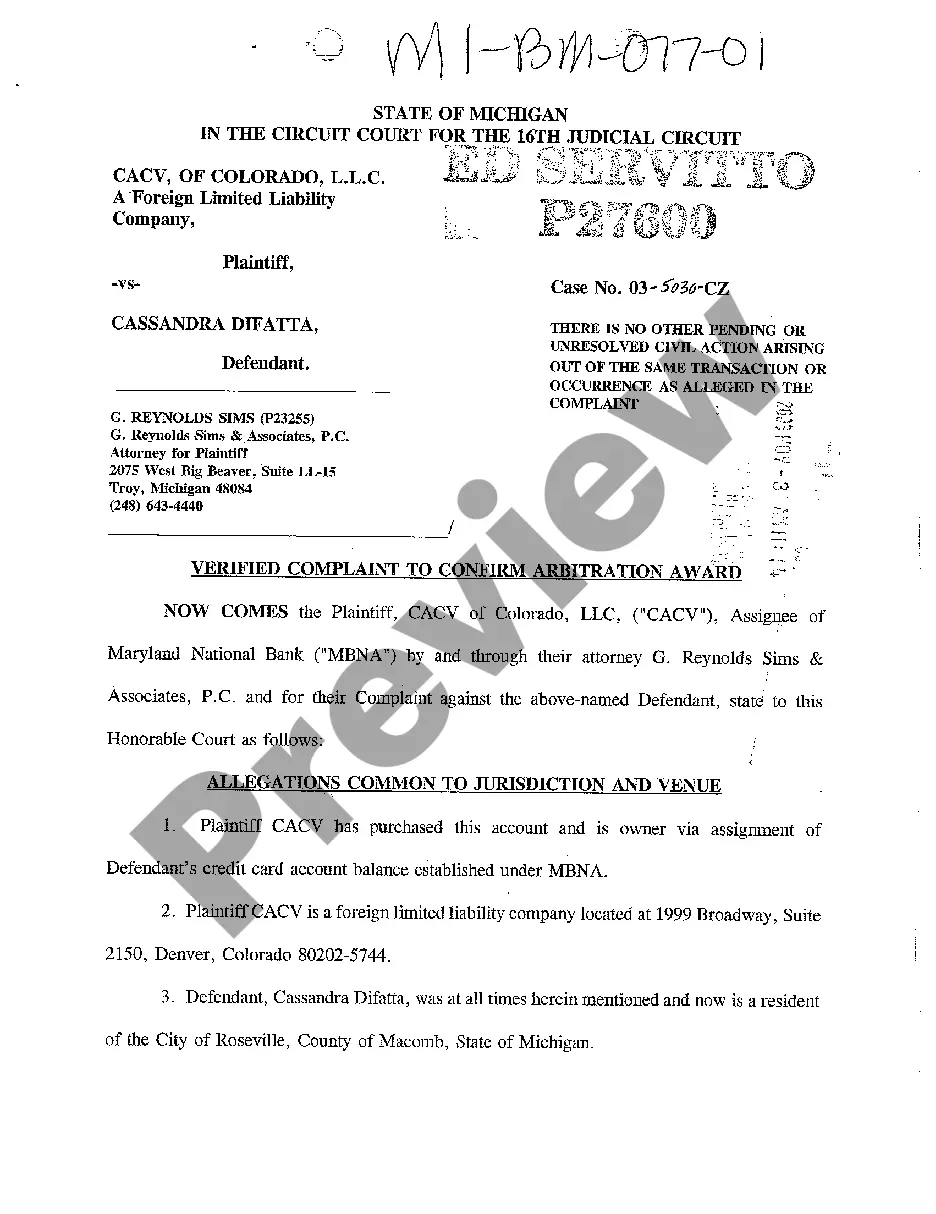

How to fill out Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Utilizing legal templates that adhere to federal and state laws is crucial, and the internet provides numerous choices to select from.

However, what is the purpose of spending time looking for the appropriate Validate You Owe For Everything Meaning example online if the US Legal Forms online library already compiles such templates in one location.

US Legal Forms is the largest digital legal catalog with over 85,000 fillable templates created by attorneys for diverse professional and personal circumstances. They are easy to navigate, with all documents classified by state and intended use. Our experts keep abreast of legislative changes, ensuring that your paperwork is always current and compliant when obtaining a Validate You Owe For Everything Meaning from our site.

Click Buy Now once you have found the correct form and choose a subscription plan. Register for an account or Log In and complete the payment using PayPal or a credit card. Select the format for your Validate You Owe For Everything Meaning and download it. All templates found through US Legal Forms are reusable. To re-download and fill out previously acquired forms, access the My documents tab in your account. Take advantage of the most extensive and user-friendly legal document service!

- Acquiring a Validate You Owe For Everything Meaning is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you're new to our site, follow the steps below.

- Review the template using the Preview option or through the text description to confirm it satisfies your needs.

- Search for another sample using the search tool at the top of the page if needed.

Form popularity

FAQ

Debt collectors have 30 days to validate a debt after you request evidence. During this time, they are legally obligated to prove that their claim is valid, allowing you to validate you owe for everything meaning. If they fail to respond or provide adequate proof within this timeframe, they must stop all collection activities. Ensuring you know your rights as a consumer can be empowering, and services like US Legal Forms can assist in managing this process effectively.

When a debt is validated, the collector must provide evidence supporting their claim. This process ensures you understand the details and validate you owe for everything meaning. If the collector cannot validate the debt, they must cease collection efforts and may even have to remove the debt from your credit report. Consequently, your financial standing could improve, giving you peace of mind.

Yes, a debt validation letter is an important tool for consumers. This letter helps you confirm the legitimacy of the debt, ensuring you validate you owe for everything meaning. When you receive a debt validation letter, it forces the collector to provide proof of the debt, which protects you from paying invalid claims. By utilizing platforms like US Legal Forms, you can easily generate a debt validation letter tailored to your needs.

The time it takes to validate debt varies, but you should receive a response within 30 days after your request. However, gathering necessary evidence and communicating with creditors may extend this duration. To streamline the validation process and truly understand how to validate you owe for everything meaning, consider leveraging the tools available at USLegalForms.

If a collection agency refuses to validate your debt, you have several options. You can file a complaint against them with the Consumer Financial Protection Bureau or your state’s attorney general. Additionally, learning how to validate you owe for everything meaning ensures you can take further steps to protect your rights, and resources like USLegalForms may help you navigate this situation.

Yes, debt validation can be an effective tool in managing your financial obligations. When correctly executed, it forces the collector to provide documentation proving that you owe the debt. This process empowers you to validate you owe for everything meaning and potentially challenge debts that are inaccurate or fraudulent.

Debt validation can take anywhere from 30 days to several months, depending on the complexity of the debt. During this time, you can gather your documentation and ensure that your rights are protected. It’s wise to stay proactive and utilize resources available, such as USLegalForms, to navigate the process of validating you owe for everything meaning.

The 7 day rule for collections states that a debt collector must notify you of the debt within seven days of their first contact. This notice should include important details about the debt, such as the amount owed and your rights. Understanding this rule helps you validate you owe for everything meaning, ensuring you’re well informed about your obligations.

Filling out a debt validation letter requires clear structure and detail. Begin with your personal information and then clearly state your request for validation of the debt. Include any specifics about the debt, such as account numbers or amounts, to help the collector provide accurate information. By following this structured approach, you can efficiently validate you owe for everything meaning and maintain clear communication.

Responding to debt validation involves delivering a clear and concise answer to the debt collector. Start by stating whether you recognize the debt, and include any disputes you may have. It's essential to assert your rights and request documentation that supports their claim, helping you to validate you owe for everything meaning effectively. If needed, you can utilize resources like US Legal Forms to guide you through the response process.