Debt Collector Harassment Person Without Permission

Description

How to fill out Letter Informing Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Locating a reliable source for the most up-to-date and appropriate legal templates is part of the challenge of navigating bureaucracy.

Selecting the correct legal documents demands precision and careful consideration, which is why it’s crucial to obtain samples of Debt Collector Harassment Person Without Permission exclusively from trustworthy sources, such as US Legal Forms. An incorrect form can waste your time and prolong the situation you are facing.

Eliminate the complications associated with your legal documentation. Discover the extensive library of US Legal Forms where you can find legal templates, assess their suitability for your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Examine the form’s details to confirm it meets the requirements of your state and county.

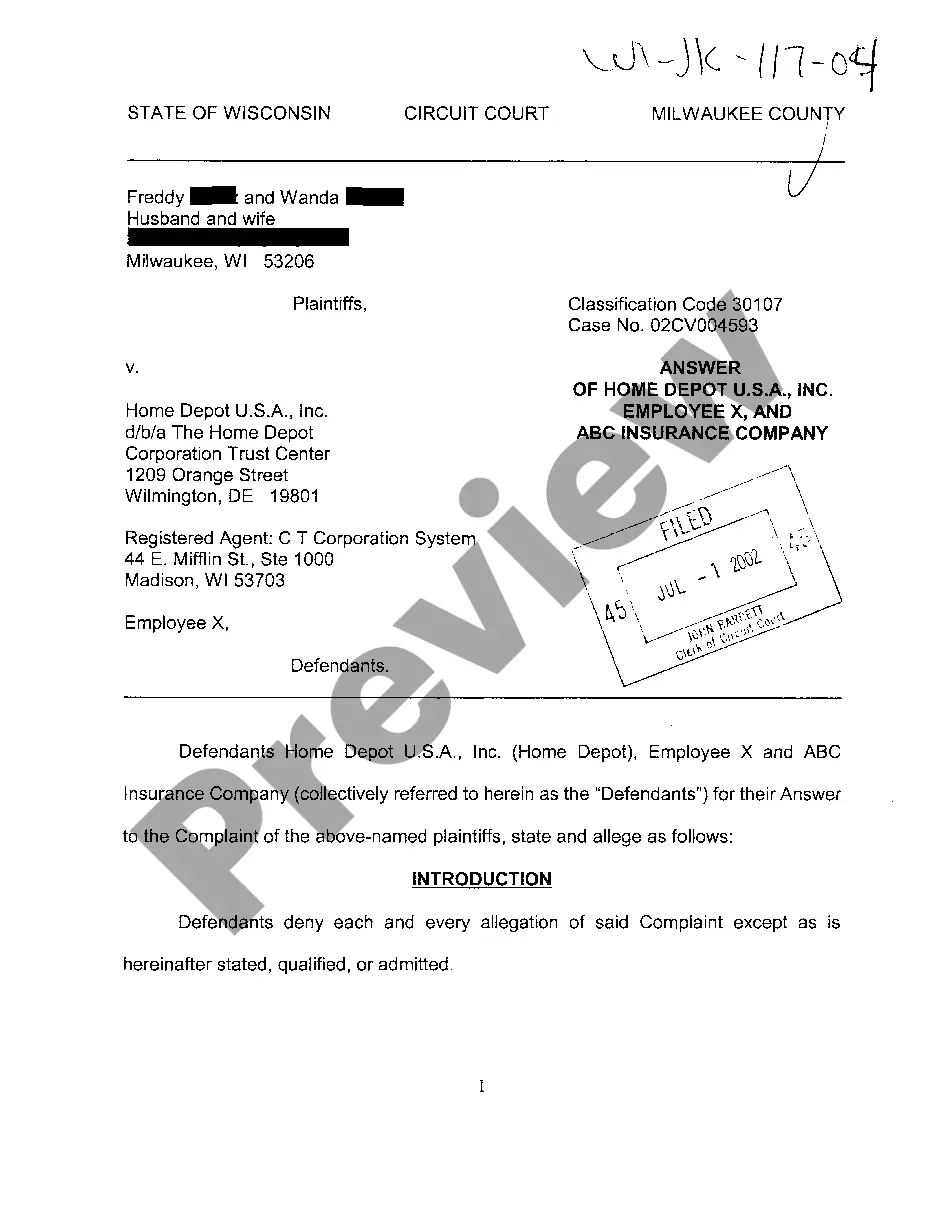

- Check the form preview, if available, to ensure the template is indeed what you need.

- Return to the search and locate the appropriate document if the Debt Collector Harassment Person Without Permission does not fulfill your requirements.

- Once you are confident about the form’s relevance, proceed to download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven’t created an account yet, click Buy now to obtain the form.

- Select the pricing plan that aligns with your preferences.

- Continue with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Debt Collector Harassment Person Without Permission.

- Once you have the form on your device, you can edit it using the editor or print it to fill it out manually.

Form popularity

FAQ

The key phrase is: 'I do not wish to be contacted anymore.' This clear statement forces debt collectors to respect your wishes and cease communication. Knowing this phrase is essential in addressing debt collector harassment without permission effectively.

However, the Federal Trade Commission recently clarified the rules regarding collections, now clarifying that collectors cannot call you more than seven times within a seven-day period or within seven days of speaking to you about a debt.

If you believe a debt collector is violating the law, you may report your complaint with the Attorney General's Office. The Office uses complaints to learn about misconduct.

This is where we get our "7-in-7" concept. You can attempt to contact a consumer about 1 debt 7 times in 7 days. And it's the "1 debt" that's key here. Phone numbers do not matter; how many debts your agency has for the consumer does.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB. You can also contact your state's attorney general. Learn more about debt collection.

There are laws to prohibit debt collectors from placing repeated or continuous telephone calls to annoy, abuse, or harass you or others who share your phone number. They're also prohibited from communicating with you at times or places that are inconvenient for you.