Debt Collection Debtor With A Regular Income

Description

How to fill out Letter Informing Debt Collector Of False Or Misleading Misrepresentations In Collection Activities - Falsely Representing That Debtor Has Or Is Committing Criminal Fraud By Nonpayment Of A Debt?

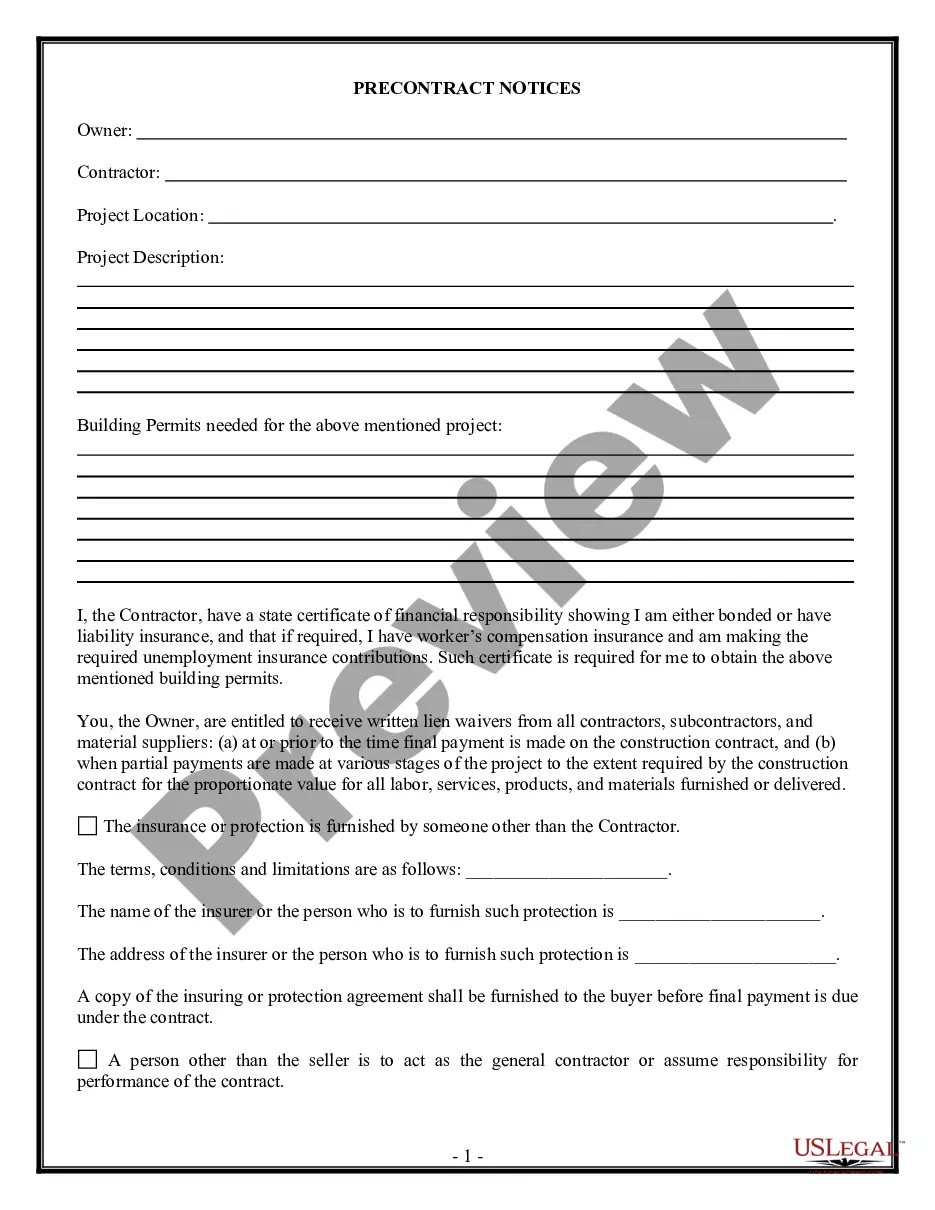

Handling legal paperwork and operations could be a time-consuming addition to the day. Debt Collection Debtor With A Regular Income and forms like it often require you to search for them and understand how to complete them correctly. Consequently, if you are taking care of economic, legal, or personal matters, having a comprehensive and hassle-free online catalogue of forms close at hand will go a long way.

US Legal Forms is the best online platform of legal templates, boasting more than 85,000 state-specific forms and a variety of tools to assist you complete your paperwork easily. Explore the catalogue of appropriate documents accessible to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Safeguard your papers management operations having a top-notch services that allows you to put together any form in minutes without additional or hidden cost. Simply log in in your account, locate Debt Collection Debtor With A Regular Income and download it straight away from the My Forms tab. You may also gain access to formerly saved forms.

Could it be the first time using US Legal Forms? Register and set up up a free account in a few minutes and you will get access to the form catalogue and Debt Collection Debtor With A Regular Income. Then, follow the steps listed below to complete your form:

- Make sure you have found the right form by using the Review feature and looking at the form information.

- Select Buy Now once ready, and choose the monthly subscription plan that is right for you.

- Press Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of experience assisting users manage their legal paperwork. Obtain the form you want today and streamline any operation without having to break a sweat.

Form popularity

FAQ

To record the bad debt recovery transaction, debit your Accounts Receivable account and credit your Bad Debts Expense account. Next, record the bad debt recovery transaction as income. Debit your Cash account and credit your Accounts Receivable account.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.