Stock Redemption Example

Description

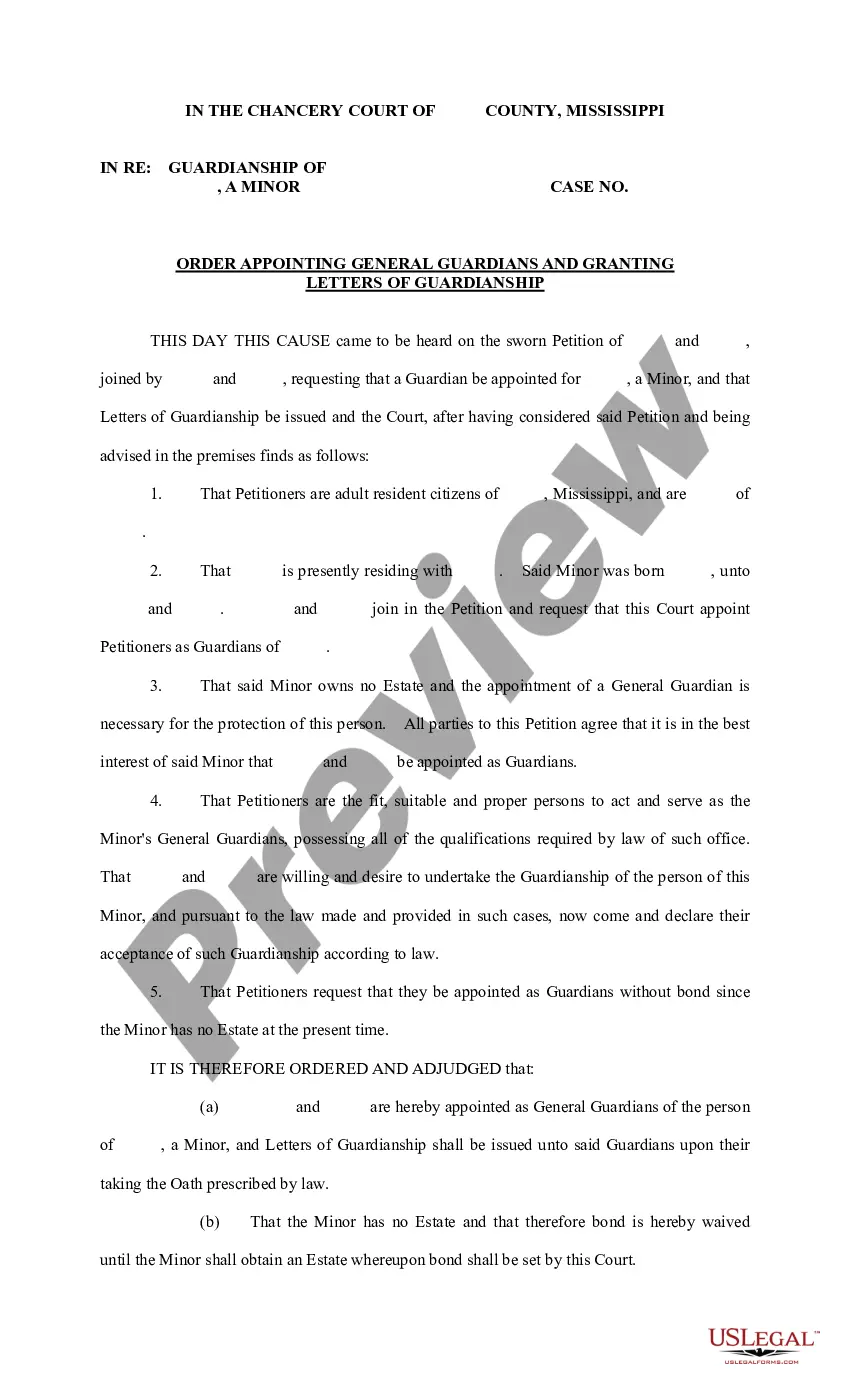

How to fill out Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

Gaining access to legal documents that adhere to federal and state laws is vital, and the web provides numerous choices to select from.

However, what's the benefit of spending time searching for the correct Stock Redemption Example specimen online when the US Legal Forms digital library already houses such documents in one convenient location.

US Legal Forms stands as the largest online legal repository with over 85,000 editable templates crafted by legal professionals for any business and personal situation.

Leverage the most comprehensive and user-friendly legal documentation service!

- They are easy to navigate with all files categorized by state and intended use.

- Our specialists stay updated with legal amendments, ensuring your document remains current and compliant when obtaining a Stock Redemption Example from our platform.

- Acquiring a Stock Redemption Example is straightforward and quick for both existing and new users.

- If you already possess an account with a valid subscription, Log In and save the document example you need in your preferred format.

- If you're new to our platform, follow the instructions below.

Form popularity

FAQ

Start your journey in applying for services by creating a One DHS Account or logging into the One DHS Customer Portal. From the One DHS Customer Portal you can access applications for SNAP, Families First, Child Support, Child Care Payment Assistance, upload documents, check case status, file an appeal and much more.

In Tennessee, the process begins when the executor, named in the will or an administrator appointed by the court if there's no will, files a petition with the probate court. The court then oversees the entire process ensuring all debts are paid and remaining assets are distributed to the correct heirs or beneficiaries.

To change your address or transfer your case, please call the Family Assistance Service Center at 1 (866) 311-4287. It is important to confirm that the office has your correct address. Additionally, you may also use the Family Assistance Office locator to notify your county office.

Who is eligible for Tennessee Food Stamp Program? Household Size*Maximum Income Level (Per Year)1$18,9542$25,6363$32,3184$39,0004 more rows

You have three options to submit your Change Form: 1) Upload documentation online using the portal at fileupload.dhs.tn.gov 2) Deliver documentation to your local TDHS office 3) Mail verification documentation to: Family Assistance Division Department of Human Services, P.O. Box 620001 Memphis TN 38181.

The majority of SNAP households are on ?Simplified Reporting?. This means you do not have to report to DTA any changes most of the time. - except for when you have to do paperwork. (an Interim Report or a Recertification to keep your SNAP benefits.)

Gross monthly income ? that is, household income before any of the program's deductions are applied ? generally must be at or below 130 percent of the poverty line. For a family of three, the poverty line used to calculate SNAP benefits in federal fiscal year 2024 is $2,072 a month.

Start your journey in applying for services by creating a One DHS Account or logging into the One DHS Customer Portal. From the One DHS Customer Portal you can access applications for SNAP, Families First, Child Support, Child Care Payment Assistance, upload documents, check case status, file an appeal and much more.