A Subchapter S Corporation Is Intended For Small Businesses That Have

Description

How to fill out Sample Redemption Agreement - Executive Stock Purchase Agreement Of Pic N Save Corp.?

Drafting legal documents from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a a simpler and more cost-effective way of preparing A Subchapter S Corporation Is Intended For Small Businesses That Have or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant forms carefully put together for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the A Subchapter S Corporation Is Intended For Small Businesses That Have. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the library. But before jumping straight to downloading A Subchapter S Corporation Is Intended For Small Businesses That Have, follow these tips:

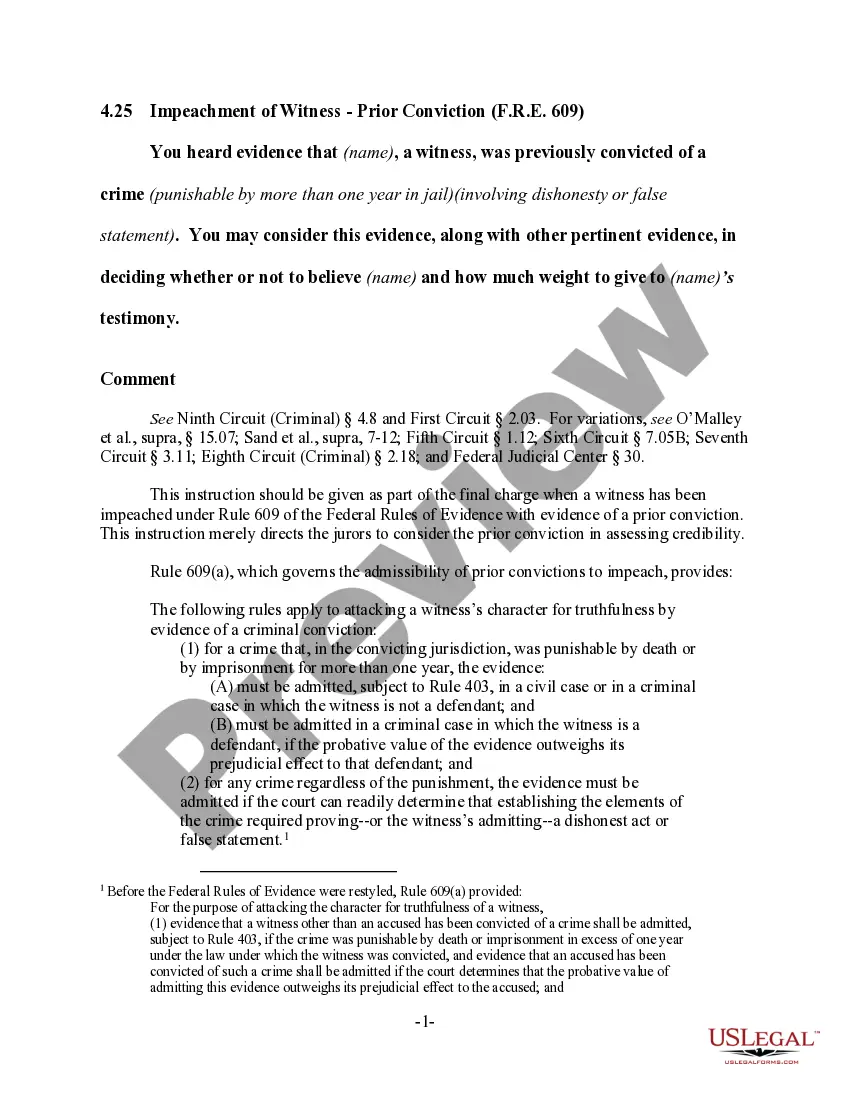

- Check the form preview and descriptions to make sure you have found the document you are searching for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the A Subchapter S Corporation Is Intended For Small Businesses That Have.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and turn form completion into something easy and streamlined!

Form popularity

FAQ

Subchapter S corporations, or S corporations, are corporations that are taxed on a "flow -through" basis. This means that tax liabilities from income (or deductions from losses) are passed onto the corporations' shareholders to be declared individually.

Example of S Corporation Taxation Roberts, Inc. is an S corporation in Florida. Jack owns 51 percent and Jill owns 49 percent. Their net profits were $20 million for the last tax year. When they prepare their individual tax returns, Jack will claim $10.2 million in income while Jill will claim $9.8 million.

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. ... Have no more than 100 shareholders. Have only one class of stock.

That gives it certain advantages over the more common C corp, The S corp is available only to small businesses with 100 or fewer shareholders, and is an alternative to the limited liability company (LLC).

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.