Caci Life Expectancy Table

Description

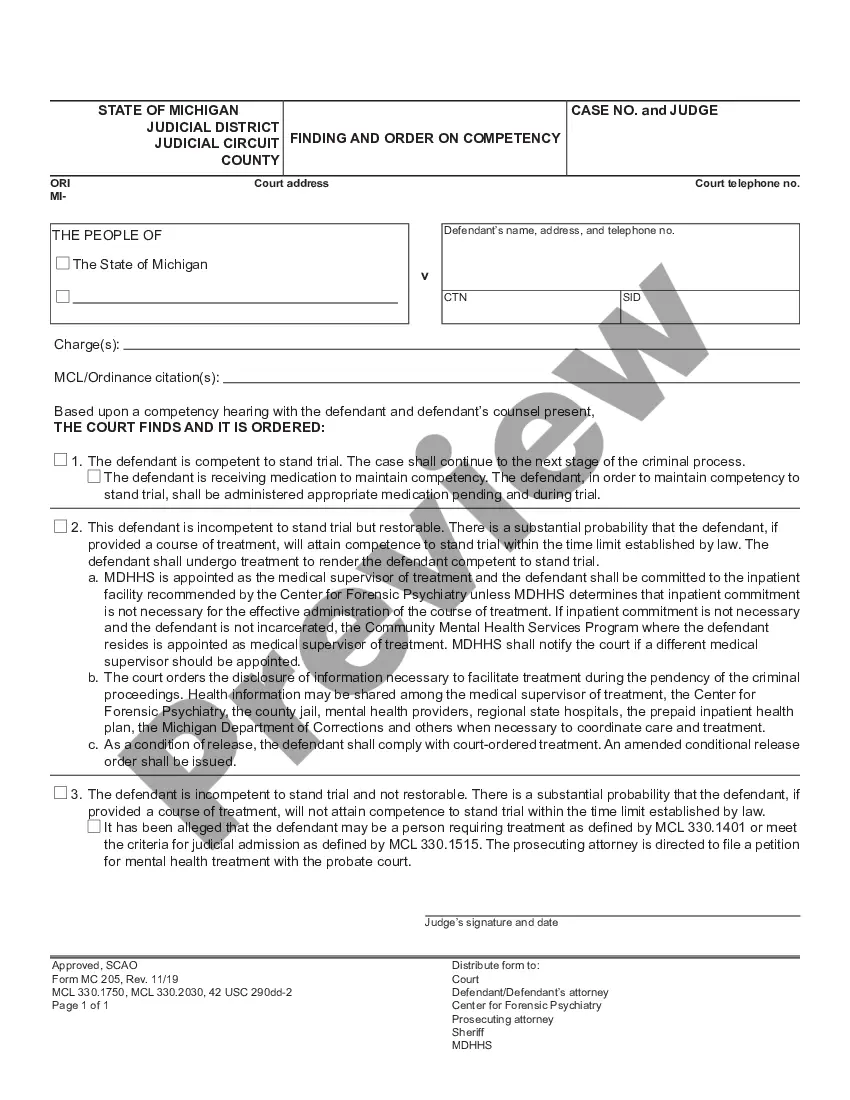

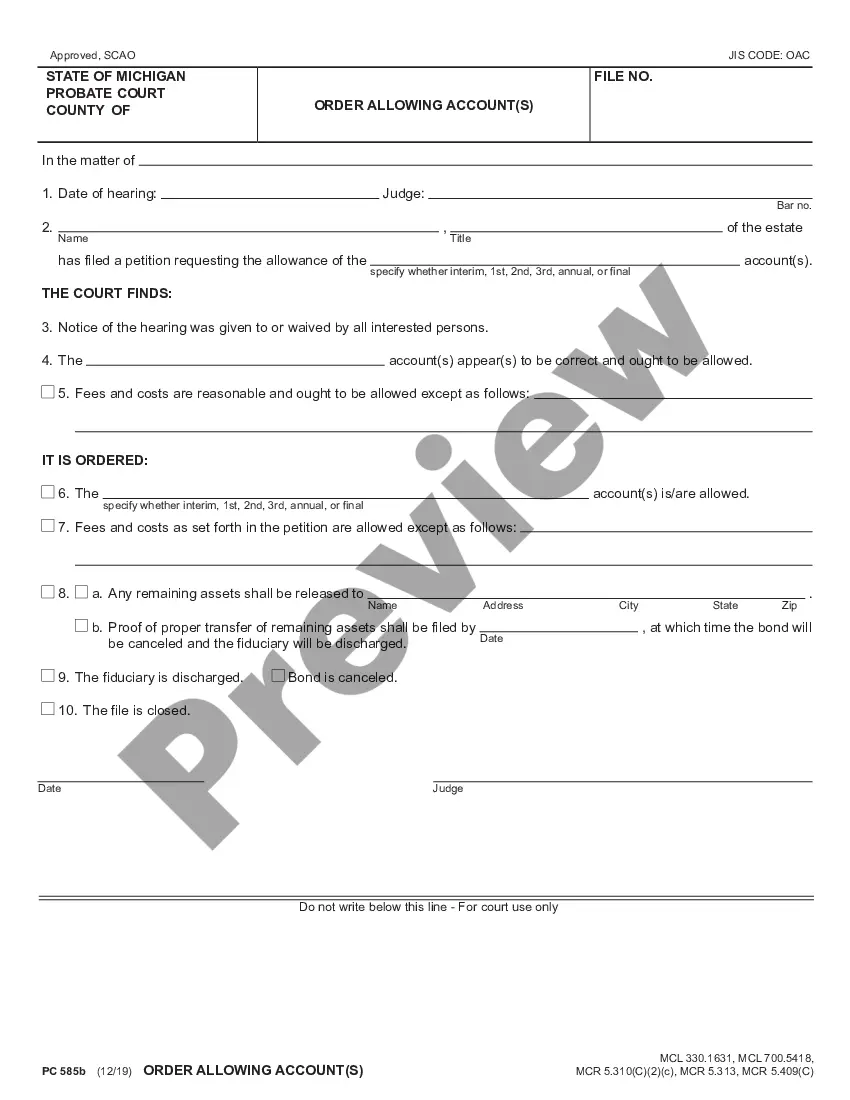

How to fill out Jury Instruction - 3.2 Work Life Expectancy?

Regardless of whether for commercial reasons or for individual matters, everyone must confront legal issues at some point in their life.

Completing legal documentation necessitates meticulous attention, starting with selecting the suitable form template. For example, if you choose an incorrect version of a Caci Life Expectancy Table, it will be turned down when submitted. Thus, it is vital to have a reliable source of legal documents such as US Legal Forms.

With a vast US Legal Forms catalog available, you do not have to waste time searching for the correct template across the internet. Make use of the library’s straightforward navigation to find the appropriate template for any situation.

- Obtain the necessary template using the search bar or catalog navigation.

- Review the form’s details to ensure it corresponds with your situation, state, and county.

- Click on the preview of the form to assess it.

- If it is the incorrect document, return to the search option to find the Caci Life Expectancy Table template you need.

- Download the file if it aligns with your requirements.

- If you possess a US Legal Forms account, just click Log in to retrieve previously saved templates in My documents.

- In the case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing plan.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you prefer and download the Caci Life Expectancy Table.

- Once it is saved, you can fill out the form using editing software or print it and finish it manually.

Form popularity

FAQ

When choosing a life expectancy table, it is important to consider the specific demographic group and context you are analyzing. The Caci life expectancy table is particularly useful in legal proceedings, as it provides credible estimates based on a reliable set of data. Using this table can help ensure that your calculations are accurate and relevant to the case at hand.

Calculating the life expectancy index involves analyzing various factors, including age, occupation, and health status, to project average lifespan. The process requires statistical methods to derive a numerical value that reflects this expectancy. The Caci life expectancy table serves as a helpful tool, providing a visual representation of these calculations for legal cases.

CACI jury instructions 3927 specifically pertain to life expectancy calculations in legal contexts. This instruction guides jurors on how to evaluate the expected lifespan of an individual when determining compensatory damages. Utilizing the Caci life expectancy table can enhance jurors' understanding of these calculations, ensuring fair and informed decisions.

CACI stands for California Civil Jury Instructions. This term refers to the set of guidelines and instructions that juries must follow in civil cases within California. Understanding the CACI life expectancy table is essential because it can help jurors assess damages related to loss of life in personal injury cases.

To calculate a life expectancy table, you first need to collect demographic data, such as age, gender, and relevant health factors. Next, you analyze mortality rates based on this data to predict the average number of years a person is expected to live. The Caci life expectancy table provides a structured format for presenting this information, making it easier for users to interpret results.

To calculate RMD using the life expectancy table, start by finding your specific life expectancy factor in the Caci life expectancy table for your age. Then, take your account balance from the end of the previous year and divide it by this factor. This calculation will ensure you know the exact amount to withdraw, helping you stay compliant and manage your finances effectively.

The CACI 700 basic standard of care refers to the legal benchmarks for care providers as established in California. It guides what is considered acceptable treatment in different medical scenarios, helping to protect patients' rights. Understanding this standard can aid it’s application, especially when using resources like the Caci life expectancy table for legal cases.

Calculating life expectancy from a life table involves referencing data that illustrates age-specific mortality rates. You can find the average expected lifespan for specific ages listed in the Caci life expectancy table. Using this information allows individuals to understand longevity, which is crucial for retirement planning.

The basic formula for calculating RMD is simple. You take the total balance of your account as of the end of the previous year and divide it by the life expectancy factor from the Caci life expectancy table. This formula helps you determine the minimum amount you need to withdraw annually to avoid penalties.

To calculate your Required Minimum Distribution (RMD) using the Caci life expectancy table, first identify your life expectancy factor based on your age. Then, divide your retirement account balance as of December 31 of the previous year by this factor. This calculation helps ensure you fulfill your retirement withdrawal requirements effectively.