Expense Form Document Without Comments

Description

How to fill out Expense Account Form?

Securing a reliable source to retrieve the latest and pertinent legal templates is a significant part of dealing with bureaucracy.

Locating the appropriate legal documents necessitates accuracy and meticulousness, which is why it's crucial to obtain samples of Expense Form Document Without Comments solely from trusted providers, such as US Legal Forms. An incorrect template will squander your time and delay your current situation.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms collection where you can find legal templates, verify their applicability to your situation, and download them instantly.

- Use the catalog browsing options or search bar to locate your template.

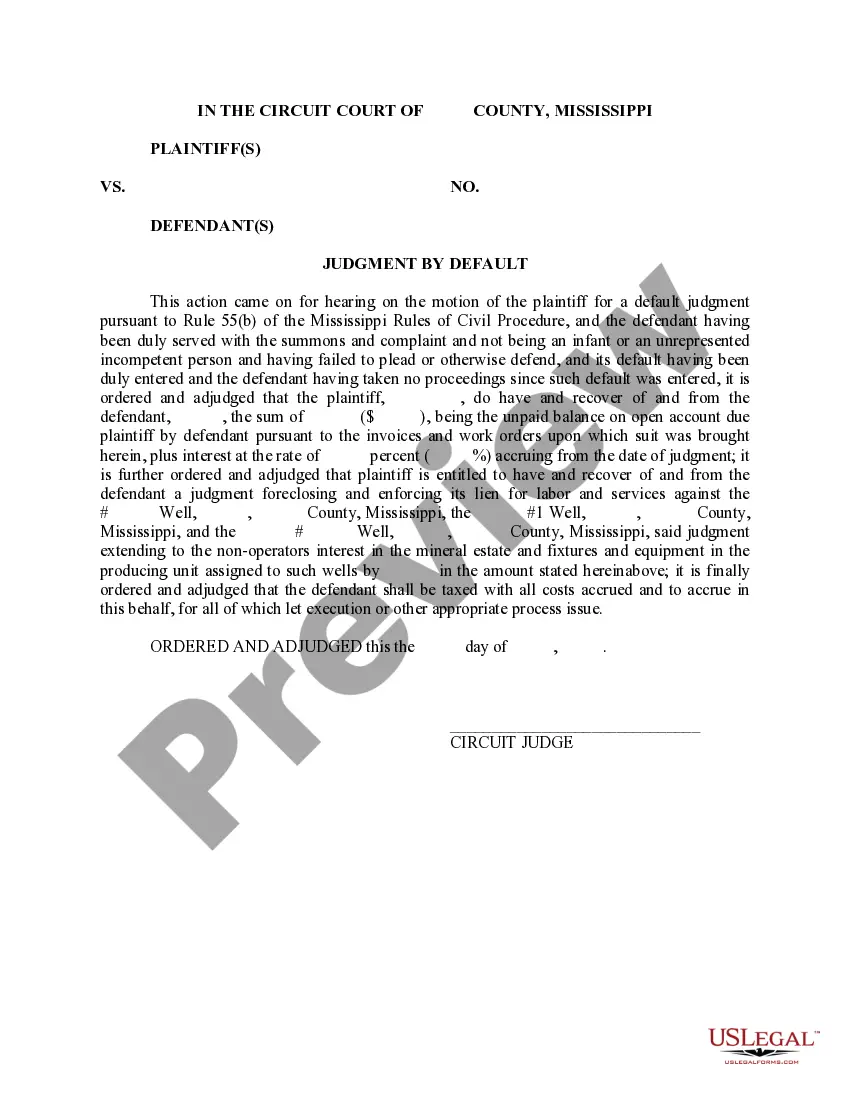

- Examine the form’s details to determine if it meets the standards of your state and locality.

- Check the form preview, if available, to confirm that the form is indeed the one you seek.

- Continue searching and find the correct document if the Expense Form Document Without Comments does not meet your needs.

- If you are confident about the form’s applicability, proceed to download it.

- As a registered user, click Log in to verify and access your chosen templates in My documents.

- If you haven’t created an account yet, click Buy now to acquire the template.

- Select the payment plan that aligns with your needs.

- Proceed with the registration to complete your acquisition.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Expense Form Document Without Comments.

- After obtaining the form on your device, you can modify it using the editor or print it and complete it manually.

Form popularity

FAQ

6 Steps To Create An Expense Report: A Guide For Small Businesses Select a Template or Use an Accounting Software. ... Add or Delete Columns. ... Report Expenses as a Different Line Item. ... Calculate the Total. ... Attach Associated Receipts. ... Print or Send the Report.

An expense summary report is a compacted report of your company's expenses in a period ? monthly, quarterly, or yearly. It determines the amount of money a specific company area needs for its projects and other activities. It is also essential for budget planning and tax reporting.

One of the key parts of the expense reimbursement process is expense reports. They allow businesses to track and categorise expense claims made by individual employees or business departments throughout the year. In many ways they're essential for the smooth running of a business.

An expense report typically has the following information that you'll need to provide: Name, department, and contact information. ... List of itemized expense names. ... Date of purchase for each item. ... Receipts. ... Total amount spent. ... Purpose of the expense. ... Actual cost of item (subtraction of discounts) ... Repayment amount sought.

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.