Subrogation For Cigna

Description

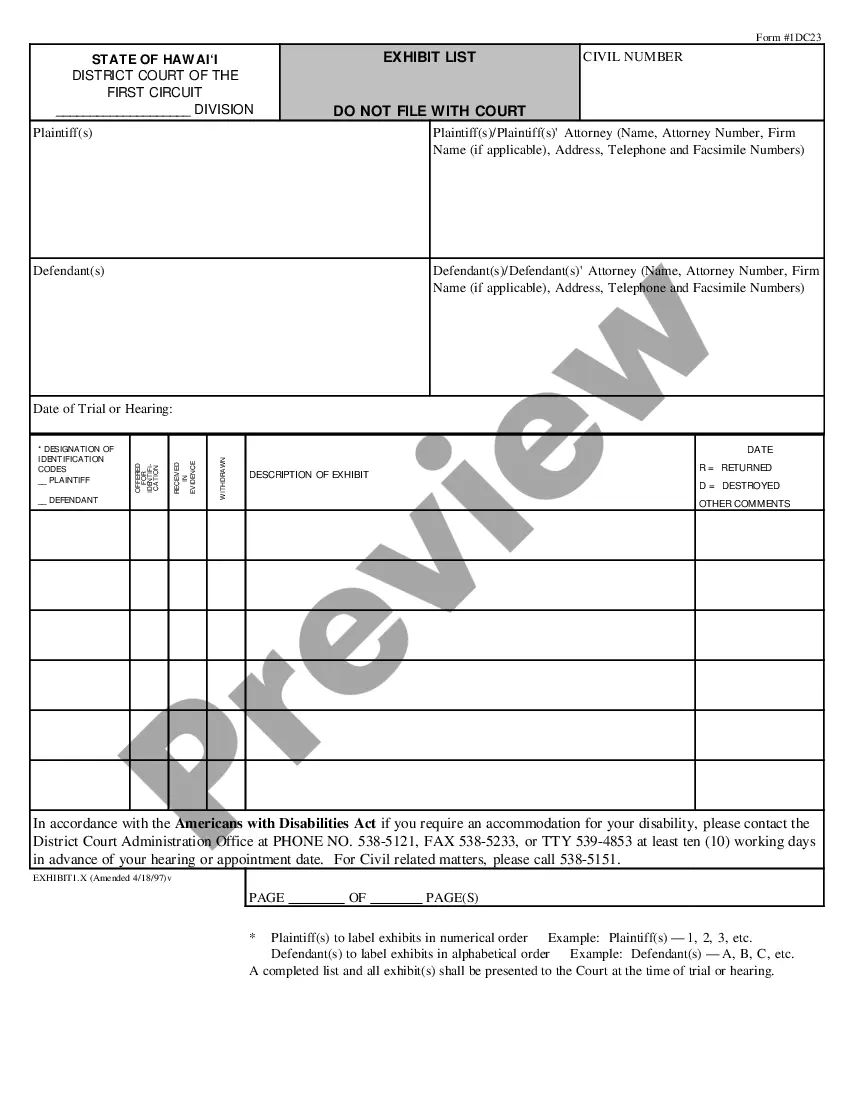

How to fill out Subrogation Agreement Between Insurer And Insured?

- Visit the US Legal Forms website and create an account if you’re new to the service.

- Browse through the extensive library of over 85,000 legal forms. Use the search bar to find specific subrogation forms for Cigna.

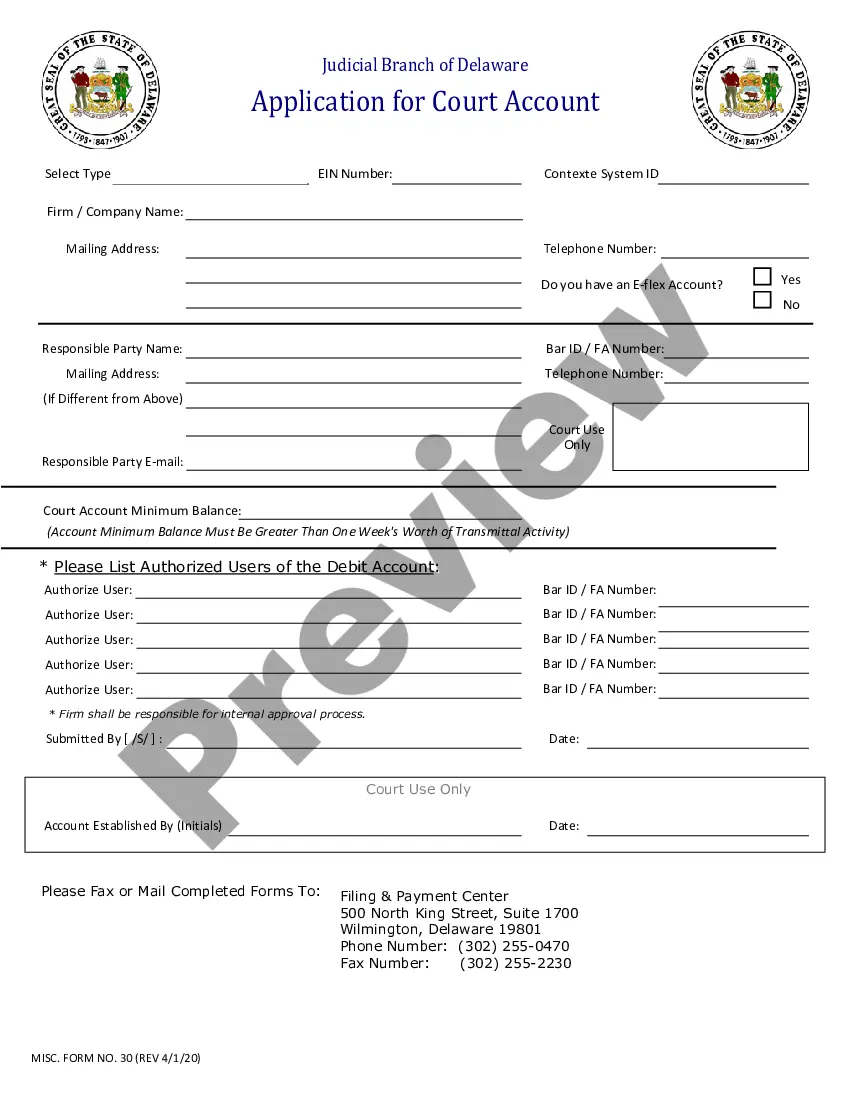

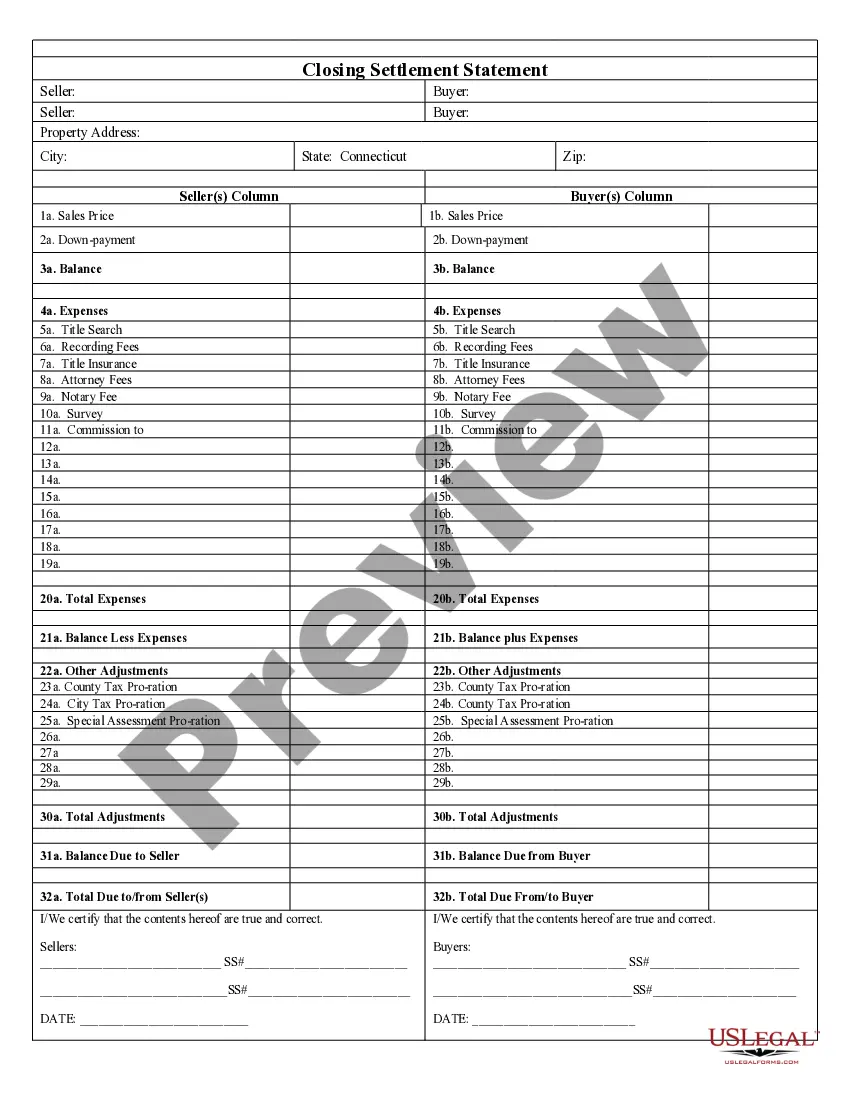

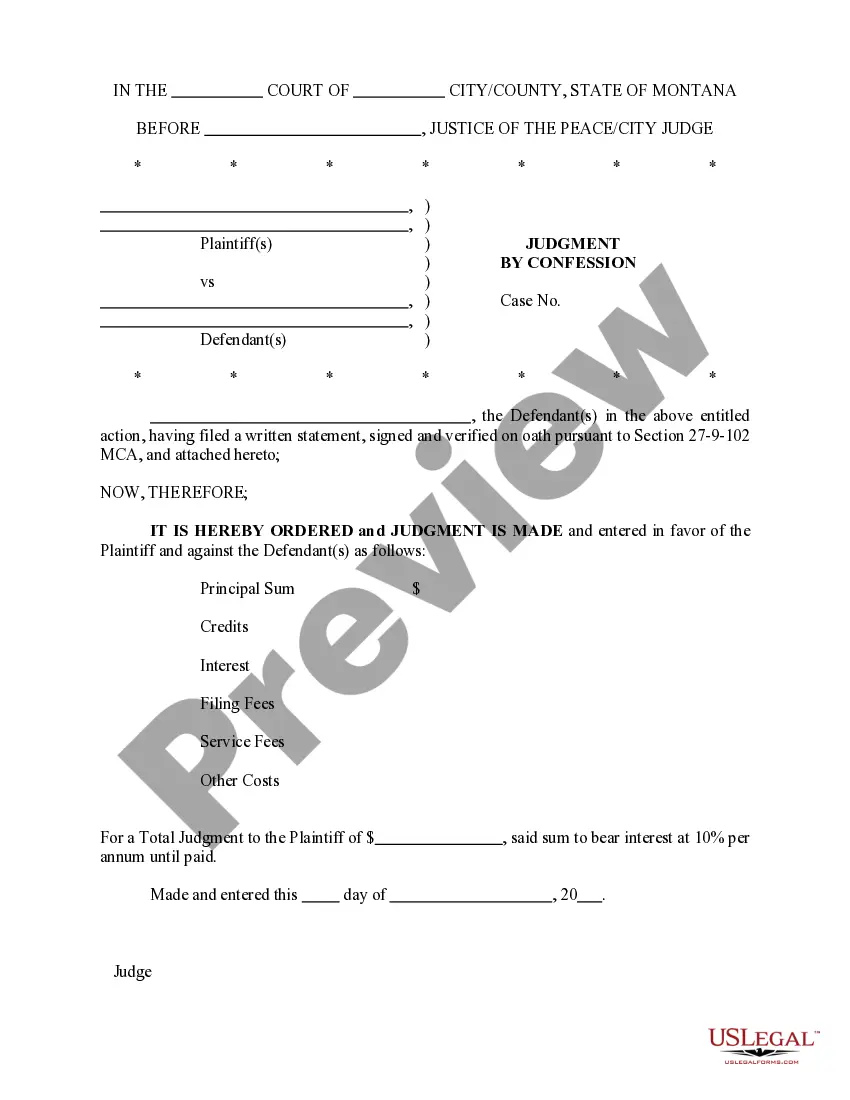

- Review the available forms in Preview mode to ensure they meet your needs and adhere to your jurisdiction's requirements.

- Select the appropriate form and click on the Buy Now button to choose your preferred subscription plan.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Once the purchase is confirmed, download the form to your device and access it anytime from the My Forms menu in your profile.

US Legal Forms empowers users with a robust collection of legal documents which allows individuals and attorneys to execute forms quickly and efficiently. The platform offers more forms than its competitors at a similar cost, enhancing accessibility for all users.

Take charge of your legal needs today! Explore US Legal Forms to find your subrogation forms for Cigna and ensure a smooth claims process.

Form popularity

FAQ

Failure to respond to a subrogation letter can lead to negative outcomes, such as legal action taken against you by your insurance company. For Cigna, not addressing the letter may also mean losing out on your rights or options regarding the claim. Furthermore, it can damage your relationship with your insurer, impacting future coverage. To protect your interests, it's wise to respond in a timely manner.

When you receive a subrogation letter, the first step is to read it carefully to understand its implications. Then, consider contacting your insurance provider to clarify any doubts. If necessary, you can seek legal advice to help guide your response. Taking these actions can help you manage the situation effectively and understand your options.

Ignoring a subrogation letter can lead to significant consequences. Insurance companies, including Cigna, may take legal action to recover costs from you. Additionally, it may impact your future claims and your relationship with your insurer. It’s crucial to address these letters promptly to avoid complications.

Agreeing to a waiver of subrogation can have significant implications for your coverage. It can limit your ability to recover damages from third parties, particularly in subrogation for Cigna cases. Weigh the advantages and disadvantages carefully, and consider consulting with a legal expert to understand your best options.

Subrogation can be beneficial in that it helps insurance companies recover costs from parties at fault for an accident. This process, including subrogation for Cigna, can ultimately lead to lower insurance premiums over time. However, understanding the implications and your own rights is necessary to navigate the situation effectively.

Ignoring a subrogation letter is not advisable and can lead to negative consequences. Responding is essential when dealing with subrogation for Cigna, as ignoring it could complicate your claims process. Make sure to analyze the letter thoroughly and respond accordingly to protect your interests.

Yes, Cigna engages in subrogation as part of its claims management process. Subrogation for Cigna helps the company recover costs from third parties who are responsible for a covered loss. Understanding how Cigna handles subrogation can empower you during the claims process.

Yes, responding to a subrogation letter is crucial to protect your rights. This step is important, especially when navigating through subrogation for Cigna. Providing a timely response can help prevent further issues with your insurance coverage and ensure that your claims are handled properly.

Dealing with insurance subrogation requires understanding your policy and the claims involved. Start by reviewing the subrogation for Cigna details and gather relevant documents related to your claim. You may also want to consult with a legal professional or use platforms like UsLegalForms to guide you through the process effectively.

Yes, you should respond to a subrogation letter, especially when it comes to subrogation for Cigna. Ignoring the letter could lead to complications or misunderstandings regarding your insurance coverage. It is important to address the claims made and provide any necessary information to clarify your situation.