Subrogation Form In Medical Billing

Description

How to fill out Subrogation Agreement In Favor Of Medical Provider?

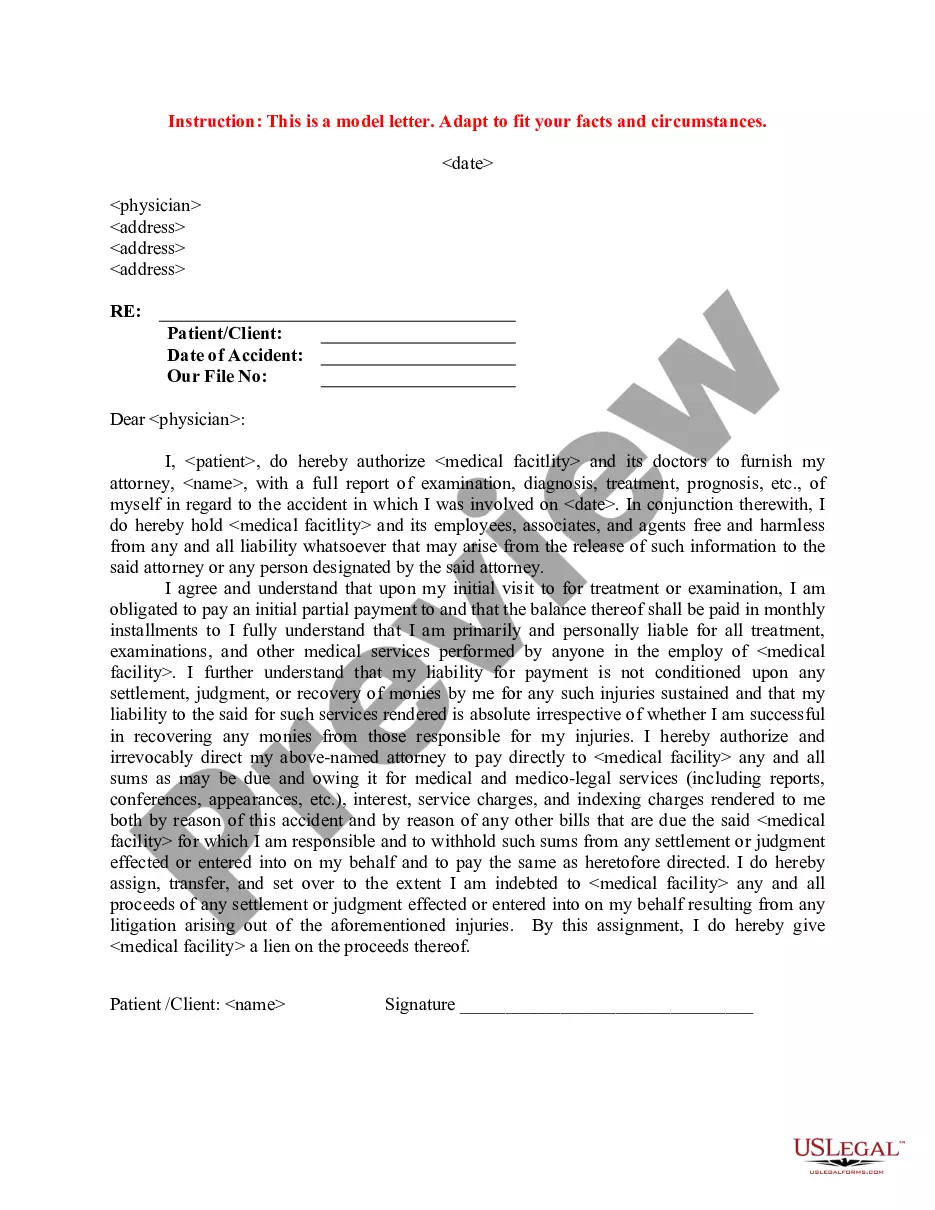

The Subrogation Document in Medical Billing presented here is a versatile legal template crafted by expert attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal professionals more than 85,000 validated, state-tailored documents for any business and personal scenario. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware safeguarding.

Register with US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Browse through the file you looked for and preview it or examine the form description to verify it meets your needs. If it doesn’t, utilize the search feature to locate the right one. Click 'Buy Now' once you have found the template you need.

- Register and Log Into your account.

- Select the subscription plan that fits your needs and establish an account. Use PayPal or a credit card to complete your payment swiftly. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Subrogation Document in Medical Billing (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the forms.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with an eSignature.

- Re-download your documents if necessary.

- Access the same document again whenever needed. Open the 'My documents' tab in your account to re-download any previously purchased documents.

Form popularity

FAQ

Another possibility of subrogation occurs within the health care sector. If, for example, a health insurance policyholder is injured in an accident and the insurer pays $20,000 to cover the medical bills, that same health insurance company is allowed to collect $20,000 from the at-fault party to reconcile the payment.

As to the format, a subrogation letter should include: Letter creation date. The name of the insured and the name of the at-fault party. The sum paid to the insured. Summary of the damages. Request for the policy number of the recipient. Request to contact the insurance company and contact details.

In health insurance, subrogation refers to the legal right of an insurance company ? after payment of a loss ? to recover monies from the responsible party's insurance carrier. For Health Advantage, it refers to those times when another insurance carrier may be responsible for payment of medical care.

Another possibility of subrogation occurs within the health care sector. If, for example, a health insurance policyholder is injured in an accident and the insurer pays $20,000 to cover the medical bills, that same health insurance company is allowed to collect $20,000 from the at-fault party to reconcile the payment.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.