Agreement Associate Contract Format

Description

How to fill out Employment Agreement With Associate Pastor?

Legal administration can be daunting, even for experienced professionals.

When you are interested in a Contract Associate Agreement Template and lack the time to devote to finding the appropriate and current version, the processes may be stressful.

Gain access to a resource library of articles, tutorials, and guides pertinent to your situation and needs.

Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Review tool to locate Contract Associate Agreement Template and obtain it.

Make sure the template is valid in your state or county.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to see the documents you have previously downloaded and to organize your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all features of the library.

- Here are the steps to follow after obtaining the form you need.

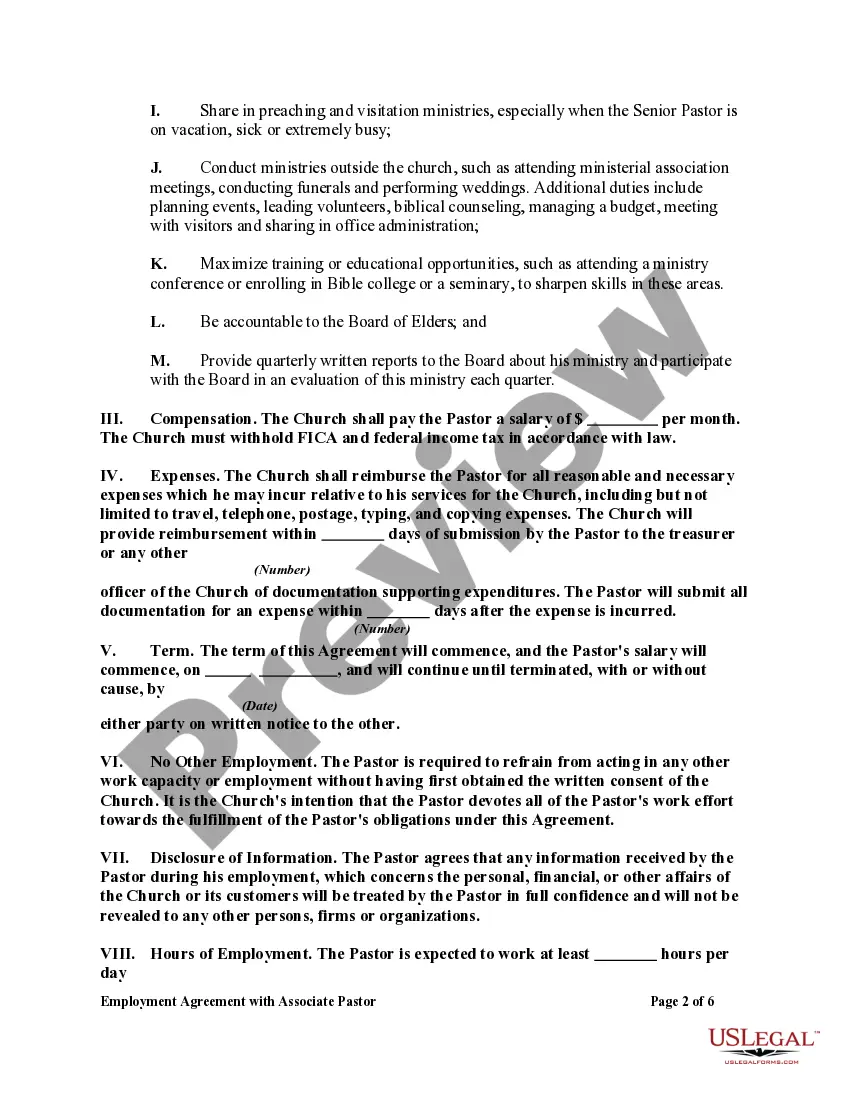

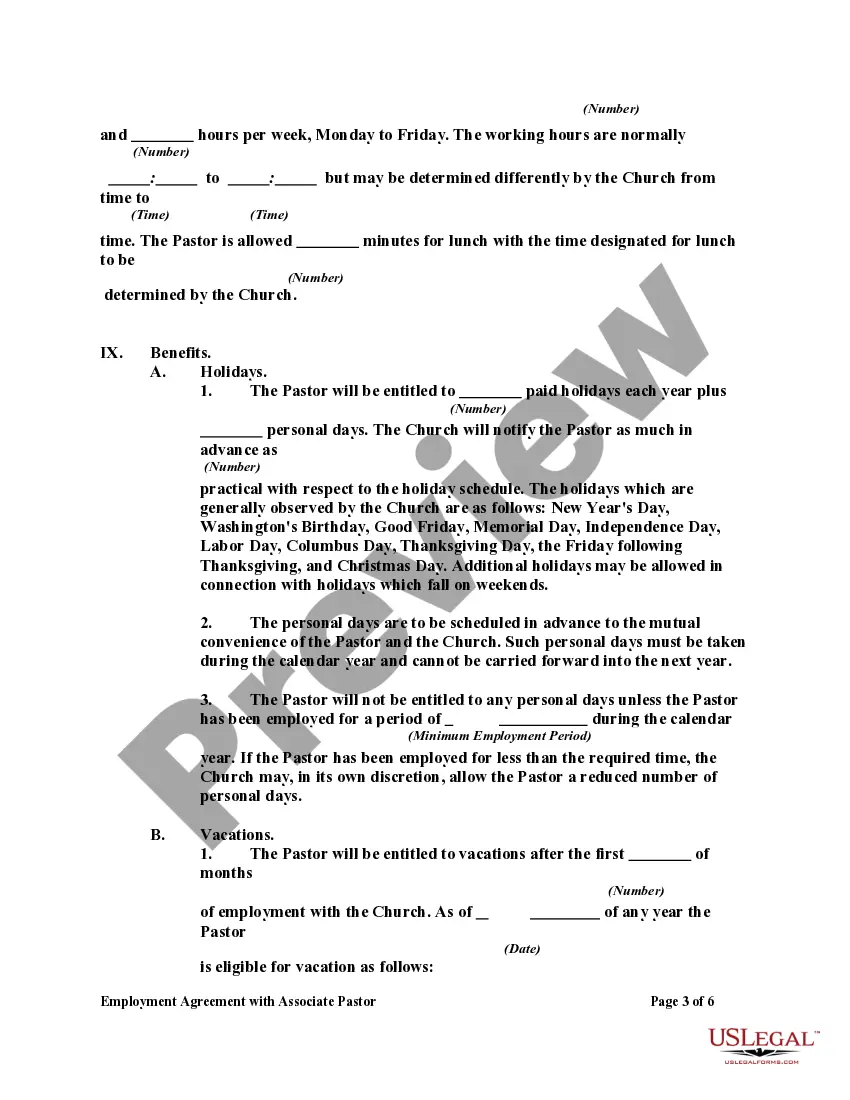

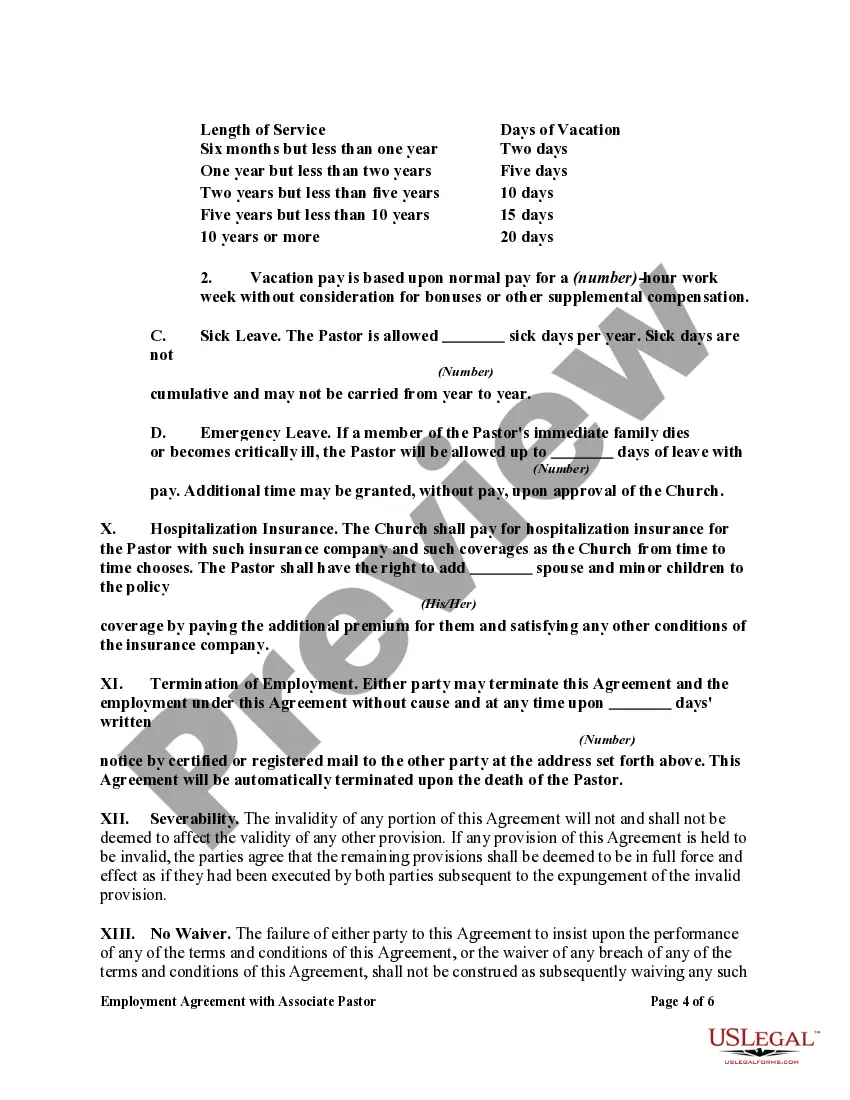

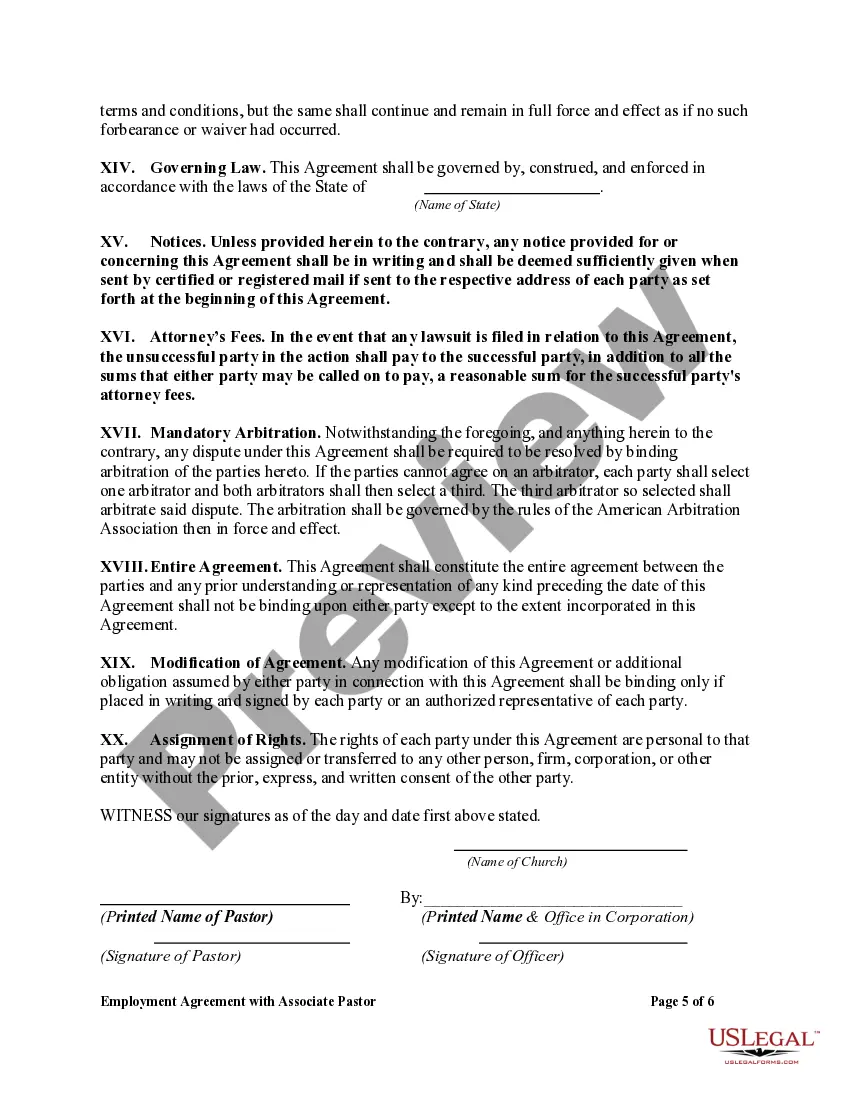

- Confirm it is the appropriate form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all needs you may have, from personal to business paperwork, in one place.

- Utilize advanced tools to complete and handle your Contract Associate Agreement Template.

Form popularity

FAQ

To reinstate your domestic corporation, please contact our office at sos.corp@nebraska.gov to receive the reinstatement application, report and fee worksheet. Submit the application and report by filing either in-person or by mail. Online filing is not available.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office. It typically takes the state 10 days to process your paperwork after they receive it.

(4) The filing fee for the filing of a biennial report under section 21-514 shall be thirty dollars if the filing is submitted in writing and twenty-five dollars if the filing is submitted electronically pursuant to section 84-511 for the series limited liability company and thirty dollars if the filing is submitted in ...

A statement of authority is a two-page document filed with the Secretary of State (currently a $50 filing fee) alerting third parties which members or employees of a limited liability company (LLC) have authority to bind the company in its business dealings with third parties.

How much does it cost to open an LLC in Nebraska? It costs $100 to start a Nebraska LLC. This is a one-time filing fee for the LLC Certificate of Organization when filed online. If you file the Certificate of Organization by mail instead, it costs a little more: $110.

LLCs will file the Statement of Dissolution, which lets the state know of its intention to dissolve. Once the LLC finishes winding up, it can file a Statement of Termination affirming that its affairs have all closed. You'll provide the name of the company and the date on which it dissolved.

To amend the articles of incorporation, the members of the board of directors of the corporation shall file with the governing body of the local political subdivision an application in writing seeking permission to amend the articles of incorporation and specifying in the application the amendment proposed to be made.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office. It typically takes the state 10 days to process your paperwork after they receive it.