Executor Es

Description

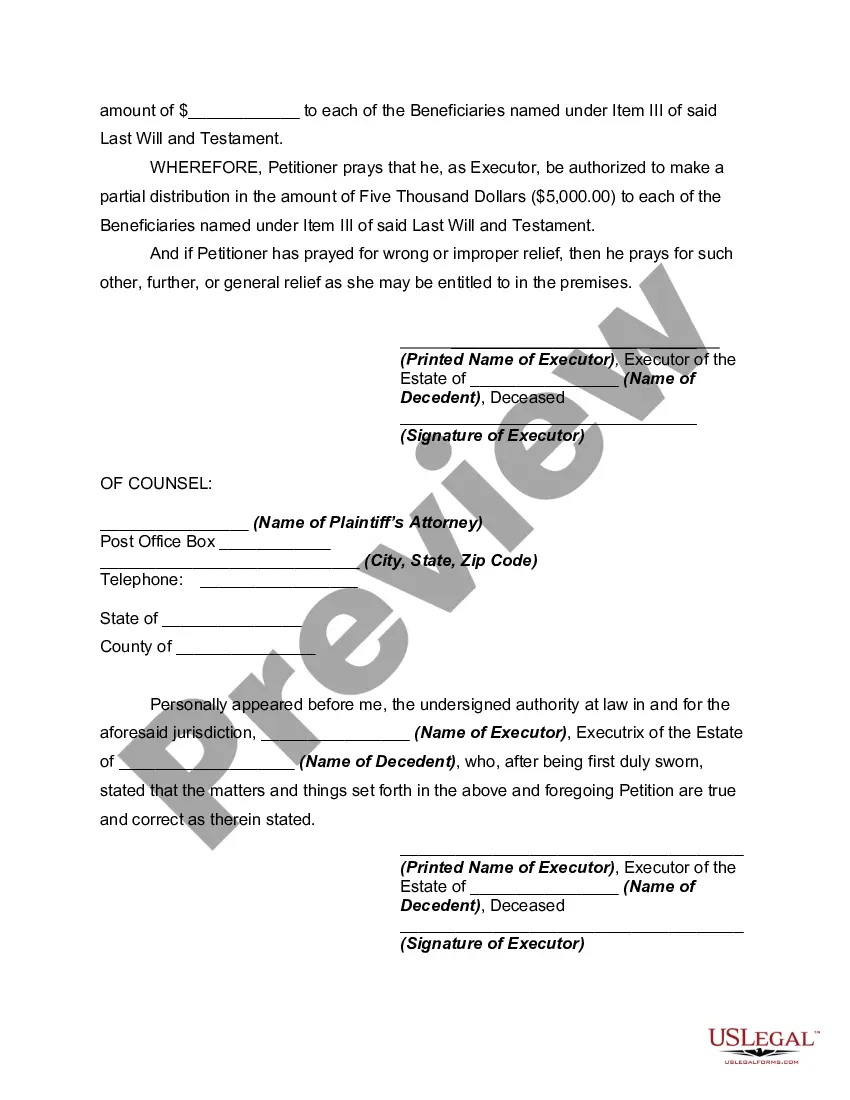

How to fill out Petition For Partial And Early Distribution Of Estate?

- If you're an existing user, log in to your account and download the necessary form template by clicking the Download button. Ensure your subscription is active; if not, renew it based on your payment plan.

- For new users, first check the Preview mode and form description. Confirm that you’ve selected the correct document that aligns with your requirements and local jurisdiction.

- If you need an alternative template, use the Search tab to locate the correct one. Once you find a suitable document, proceed to the next step.

- To purchase your document, click the Buy Now button and select your preferred subscription plan. Remember to create an account to access the library's resources.

- Complete your purchase by providing your payment details via credit card or PayPal to finalize your subscription.

- Once purchased, download the form to your device. You can access it anytime through the My Forms section in your profile.

By following these straightforward steps, you can efficiently navigate through the extensive online library of over 85,000 legal forms available at US Legal Forms.

With access to premium experts for assistance with form completion, ensure your documents are precise and legally sound. Start your process today!

Form popularity

FAQ

When choosing an executor, it is best to select someone trustworthy, organized, and capable of handling financial matters. Ideally, this person should have a good understanding of your family dynamics and your wishes. Many people choose a family member or a close friend, but it's also wise to consider a professional with experience in estate administration. Using US Legal Forms can help you evaluate potential executors and clarify your expectations.

The first thing an executor must do is gather and protect the assets of the estate. This involves making an inventory of all property, including real estate, bank accounts, and personal belongings. Afterward, the executor needs to secure these assets by ensuring property is maintained and preventing unauthorized access. Efficient asset management can be simplified through resources like US Legal Forms, ensuring that nothing is overlooked.

It is crucial to leave comprehensive information for your executor to ensure they can effectively manage your estate. This should include your important documents, account details, and a list of assets and debts. Clear instructions regarding your wishes regarding property distribution and family dynamics can also help guide them. Platforms like US Legal Forms can help you prepare this information in an organized manner, easing your executor's burden.

The first step as an executor is to locate the deceased person's will, if one exists. Next, you will need to file the will with the probate court, initiating the legal procedure for administering the estate. It is essential to understand your responsibilities at this stage, as proper filing ensures a smooth transition for handling the estate. Consider using US Legal Forms to assist with essential paperwork and understand your obligations.

Executors often make mistakes such as failing to keep clear records of all transactions related to the estate. This can lead to confusion and disputes among beneficiaries. Additionally, some executors overlook the need to communicate regularly with heirs, which can cause frustration and mistrust. Utilizing platforms like US Legal Forms can help executors stay organized and informed throughout the process.

Being an executor can come with several challenges, such as managing complex paperwork, making difficult decisions, and dealing with potentially contentious family dynamics. Additionally, this role can be time-consuming and may require extensive knowledge of legal requirements. Understanding these responsibilities is crucial, and utilizing resources like USLegalForms can help mitigate some of these challenges and ease the process.

Yes, executor fees are typically considered taxable income by the IRS. As an executor, you must report these fees on your personal tax return. However, you can also deduct any related expenses incurred while performing your duties. It's advisable to consult a tax professional for detailed guidance on how these fees might affect your tax situation.

To file taxes as an executor of an estate, begin by gathering all financial records of the estate, including income and expenses. You will use Form 1041 to report the estate’s income, deductions, and tax liability. Make sure the form is filled accurately to comply with tax laws. Using USLegalForms can provide templates and further assistance to ensure you file correctly.

You may avoid taxes on executor fees by ensuring that they are classified correctly on your tax return. Generally, executor fees are considered income, but you can potentially deduct certain expenses related to your duties. Consulting with a tax professional can help you understand any deductions or exemptions available. Utilizing resources from USLegalForms can aid in navigating the necessary paperwork.

To prove your role as an executor, you will need the original will and, usually, a court document known as letters testamentary. This document officially designates you as the executor and gives you the authority to act on behalf of the estate. Always keep copies of these documents handy for various communications and filings required throughout the process.