Sample Motion To Vacate Default Without Judgment

Description

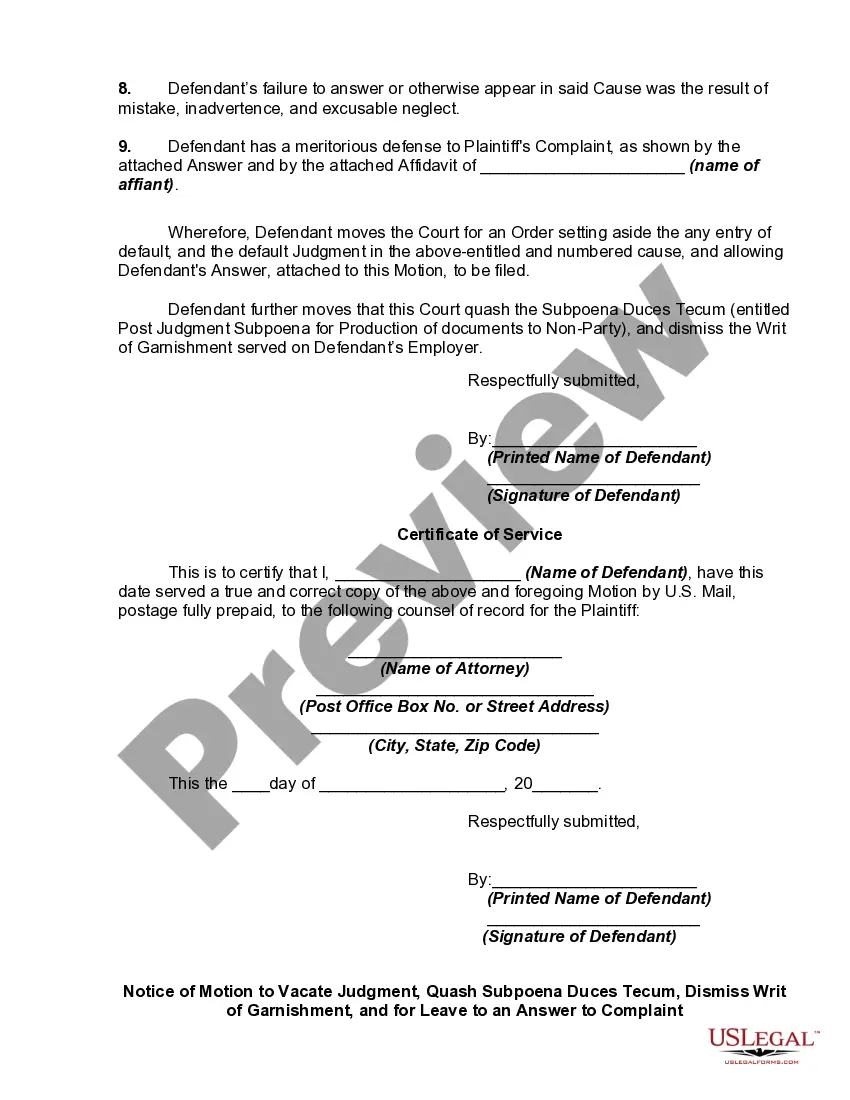

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Securing a reliable source for obtaining the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal document mandates accuracy and meticulousness, which highlights the necessity of sourcing samples of Sample Motion To Vacate Default Without Judgment exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your current situation.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms collection where you can discover legal templates, evaluate their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your sample.

- Access the form details to verify its suitability for your state's specifications.

- View the form preview, if available, to confirm it is the one you require.

- Return to the search function to locate the correct document if the Sample Motion To Vacate Default Without Judgment does not meet your needs.

- Once you are certain of the form's appropriateness, download it.

- If you are a signed-up user, click Log in to verify and access your selected forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing plan that aligns with your preferences.

- Proceed with the registration to complete your order.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Sample Motion To Vacate Default Without Judgment.

- Once you have the form saved on your device, you can modify it with the editor or print it out and fill it in by hand.

Form popularity

FAQ

Yes, you can remove a judgment from your credit report under certain conditions. If you successfully file a sample motion to vacate default without judgment, and the court grants it, the judgment may then be removed from your credit report. Additionally, you can dispute inaccuracies directly with credit bureaus. Using services from US Legal Forms can facilitate the documentation needed to address such issues efficiently.

Removing a default judgment involves filing a sample motion to vacate default without judgment. You must explain why the judgment should be lifted, which may include showing the court that you were unaware of the lawsuit or unable to attend. After filing the motion, a hearing will usually be scheduled where you can present your case. Engaging with resources from US Legal Forms can help streamline this process by providing necessary forms and guidance.

To remove a default judgment, you typically need to file a sample motion to vacate default without judgment in the appropriate court. This motion requests the court to overturn the judgment based on specific reasons, such as not receiving proper notice of the original court date. It's essential to gather supporting documents and evidence to strengthen your case. Utilizing platforms like US Legal Forms can assist you in preparing your motion correctly.

To verify a Vermont resale certificate, you may call the Department of Taxes at 802-828-2505 Option 2 to verify the Vermont Tax Account Number provided in the Form S-3 is valid and active.

Searching for Vermont businesses is done through the Vermont Secretary of State. Vermont Corporations and LLCs are searchable by the following criteria: Business Name. Business ID.

Form SUT-451, Sales and Use Tax Return, together with payment, are due on the dates indicated.

You can check to see if the trade name that you'd like is available by using the business search tool provided by the Vermont Secretary of State. It's also worthwhile conducting an online search and checking the US Patent and Trademark Office database to see if your trade name is being used in any other areas.

Before you begin to do business in Vermont, you must register your business with the Vermont Secretary of State. The Secretary of State's website offers an Online Business Service Center with guidance to get your started.

To take the exemption, you must provide a Form S-3, Vermont Sales Tax Exemption Certificate for Purchases for Resale, by Exempt Organizations, and by Direct Pay Permit. You also must have a Vermont Sales and Use Tax account with the Department.

Vermont does not have a statewide general business license, but special licenses, permits, or certifications from state agencies or boards are required for a number of occupations, businesses, and business activities.