Garnishment Leave Withholding

Description

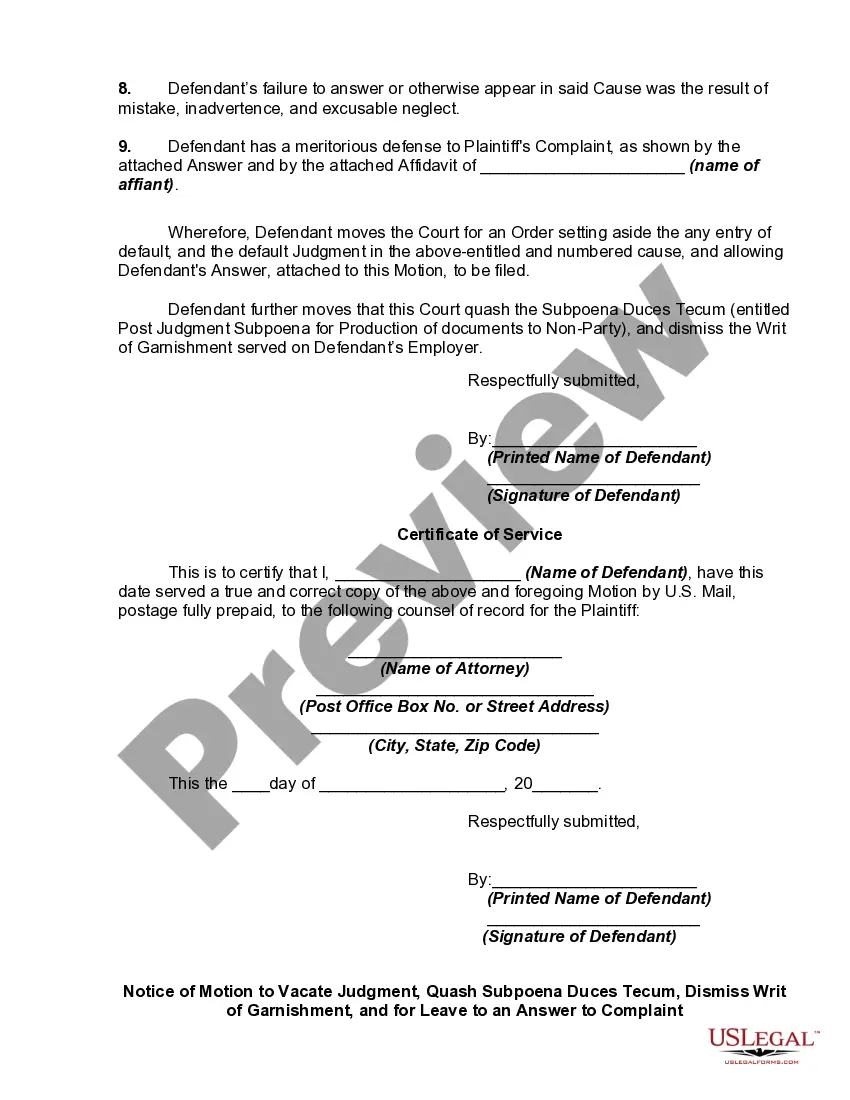

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Creating legal documents from the ground up can occasionally be quite daunting. Some situations may require extensive research and significant financial investment.

If you're looking for a more straightforward and cost-effective method to generate Garnishment Leave Withholding or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can rapidly access state- and county-compliant documents meticulously prepared for you by our legal experts.

Utilize our service whenever you require trusted and dependable resources through which you can conveniently locate and download the Garnishment Leave Withholding. If you're familiar with our site and have previously established an account, simply Log In, choose the template, and download it immediately or access it again later in the My documents section.

Download the document, then fill it out, sign it, and print it. US Legal Forms prides itself on a solid reputation and over 25 years of experience. Join us today and simplify the form completion process!

- Not registered yet? No problem. Registering takes only a few minutes, and you can easily browse the catalog.

- Before proceeding to download the Garnishment Leave Withholding, consider these recommendations.

- Review the form preview and descriptions to ensure you have located the correct form.

- Verify that the form you choose adheres to the laws and regulations of your state and county.

- Select the most appropriate subscription plan to purchase the Garnishment Leave Withholding.

Form popularity

FAQ

In Minnesota, garnishment rules specify how creditors can collect on debts by withholding a portion of your wages. Generally, creditors can garnish up to 25% of your disposable earnings, or the amount by which your weekly income exceeds 40 times the federal minimum wage, whichever is less. You can also seek exemptions for certain types of income, such as public benefits. For detailed guidance on garnishment leave withholding, consider using the resources available on the US Legal Forms platform to navigate these rules effectively.

By paying the debt off before it goes to court, you can stop the garnishment from ever happening. If you can't repay the debt or making payments is extremely difficult the best move is to contact the creditor. Ignoring creditors generally creates more problems than it avoids.

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.

If you claim an exemption, you should (i) fill out the claim for exemption form and (ii) deliver or mail the form to the clerk's office of this court. You have a right to a hearing within seven business days from the date you file your claim with the court.

You may claim your exemptions from garnishment by filing an affidavit with the court describing the exemption and your claim to it. Your affidavit also must be sent to the judgment creditor and any attorney for the judgment creditor.

How do I object to a garnishment? You do this by filing a Garnishment Exemption Claim Form with the court that issued the garnishment. You may be able to do this by yourself, but it is not recommended. You may lose income or property if you don't know the law.