Garnishment Leave With You

Description

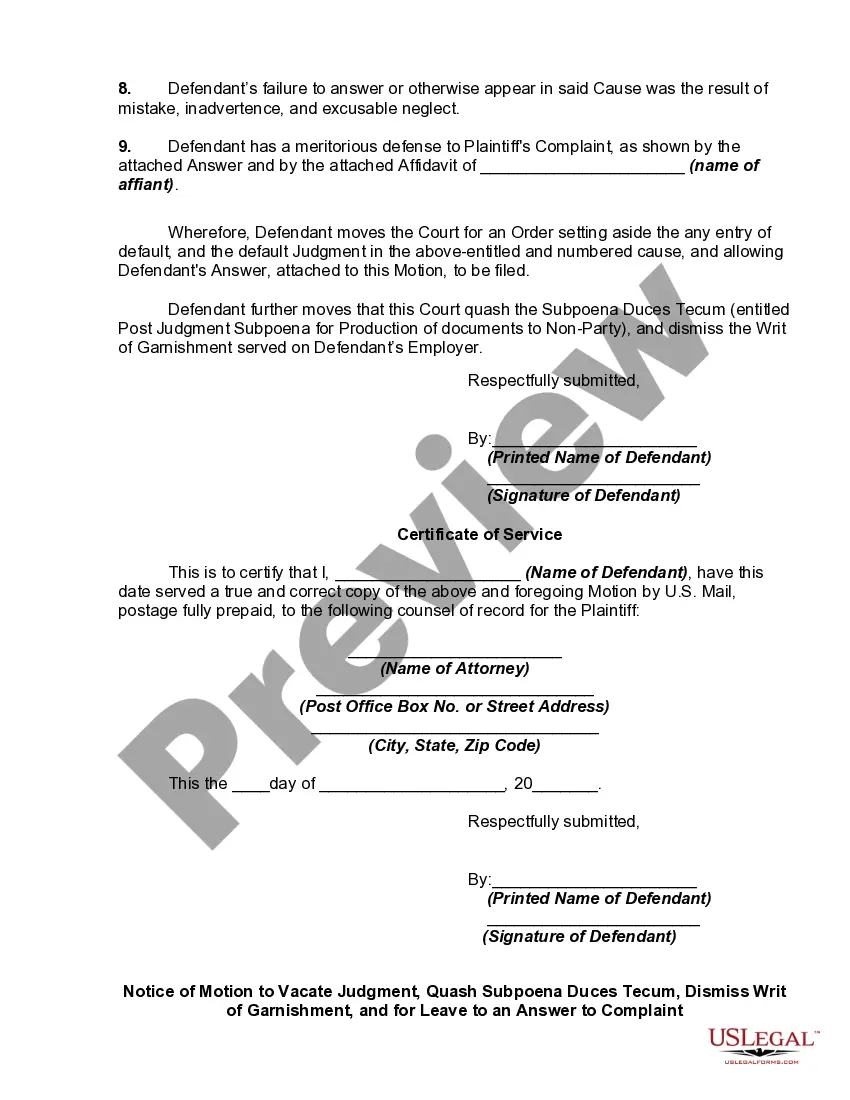

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Creating legal documents from the beginning can occasionally be intimidating. Certain situations may require extensive research and significant financial investment.

If you seek a more straightforward and cost-effective method of producing Garnishment Leave With You or any other documents without unnecessary complications, US Legal Forms is readily available.

Our online collection of more than 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal concerns. With just a few clicks, you can promptly access forms that comply with state and county regulations, meticulously prepared by our legal professionals.

Utilize our platform whenever you require dependable and trustworthy services that allow you to effortlessly locate and download the Garnishment Leave With You. If you are already familiar with our services and have an existing account, simply Log In to your account, choose the form, and download it or re-download it anytime in the My documents section.

Verify that the template you select aligns with the laws and regulations of your state and county. Choose the appropriate subscription plan to acquire the Garnishment Leave With You. Download the document, then complete, certify, and print it. US Legal Forms is known for its strong reputation and over 25 years of experience. Join us now and make document execution simple and efficient!

- Don’t have an account? No problem.

- It takes minimal time to register and browse the catalog.

- Before downloading Garnishment Leave With You, adhere to these guidelines.

- Examine the form preview and descriptions to confirm you have located the form you need.

Form popularity

FAQ

While it may seem concerning, your employer generally cannot terminate your employment just because your wages are garnished. Federal law safeguards employees from being fired under these circumstances. However, if your employer has specific policies that conflict with this, they might decide otherwise. To navigate these complexities, US Legal Forms offers resources to help you understand your options and protect your rights regarding garnishment leave with you.

It's important to understand that an employer typically cannot fire you solely because your wages are being garnished. The law protects employees from discrimination based on wage garnishment, which means your job should remain secure. However, if your employer has a policy against hiring or retaining employees with garnishments, they might take action. If you find yourself in this situation, consider seeking guidance and resources available through our platform at US Legal Forms, which can help you understand your rights.

In Minnesota, garnishment involves legal procedures that allow creditors to collect debts directly from your wages or bank accounts. The amount that can be garnished depends on your disposable earnings and is typically limited to 25% of your weekly disposable income. It's important to note that certain types of income, like Social Security benefits, may be exempt from garnishment. If you need help understanding these rules, the US Legal Forms platform provides resources and documents to guide you through the garnishment leave with you process.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

A wage garnishment is any legal or equitable procedure through which some portion of a person's earnings is required to be withheld for the payment of a debt.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673.)