Garnishment Leave For Spouse

Description

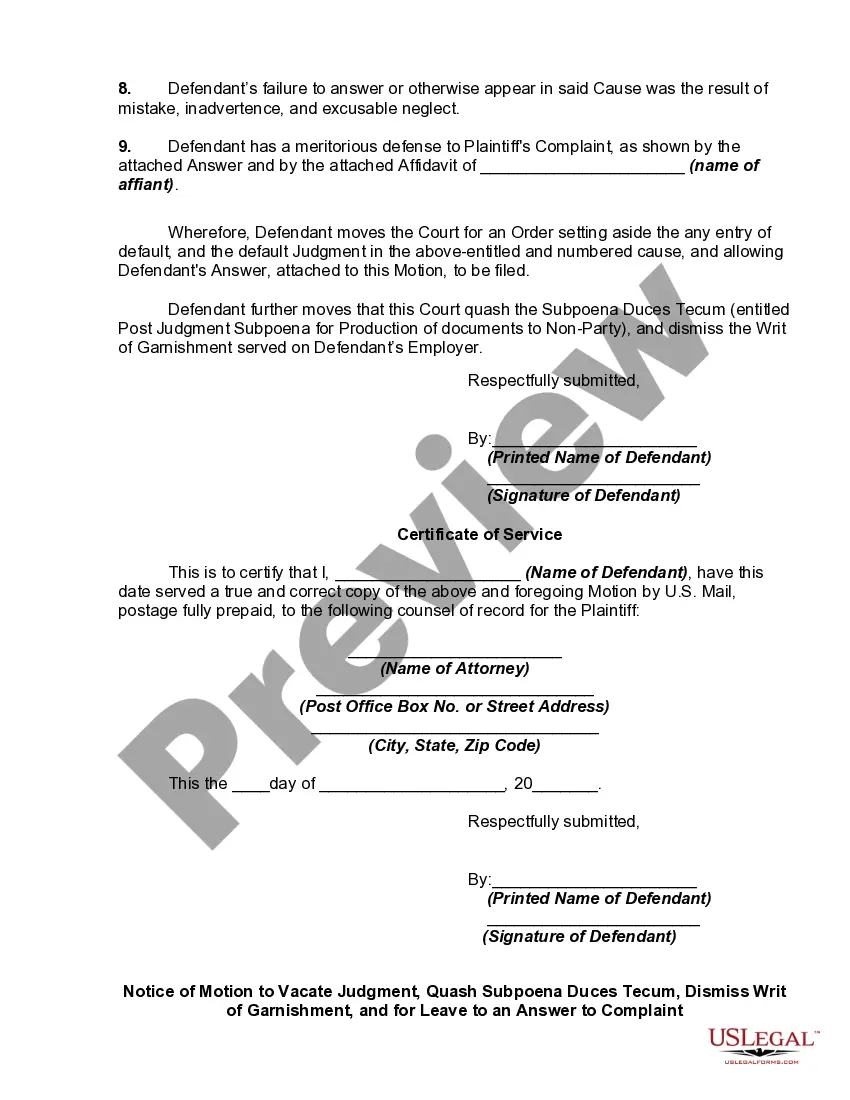

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Handling legal documentation and processes can be a labor-intensive addition to your schedule. Garnishment Leave For Spouse and similar forms generally necessitate that you locate them and figure out how to fill them out accurately.

Consequently, whether you are addressing financial, legal, or personal issues, having a thorough and straightforward online directory of forms readily available will be extremely beneficial.

US Legal Forms is the leading online source of legal templates, providing over 85,000 state-specific documents and various tools to assist you in completing your paperwork with ease.

Explore the collection of relevant documents available to you with just one click.

Then, follow the steps below to complete your form: Ensure you have found the correct form by utilizing the Preview function and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of expertise helping users manage their legal paperwork. Obtain the document you need today and streamline any process effortlessly.

- US Legal Forms offers you forms that are specific to your state and county available for download at any time.

- Protect your document management processes with a premium service that enables you to prepare any form in just a few minutes without any additional or hidden fees.

- Simply Log In to your account, find Garnishment Leave For Spouse, and obtain it immediately in the My documents section.

- You can also retrieve previously saved forms.

- Is it your first time using US Legal Forms? Register and create an account in a few minutes, and you will gain access to the form directory and Garnishment Leave For Spouse.

Form popularity

FAQ

In most cases, you are not responsible for your wife's personal debts unless you jointly signed for them or live in a community property state. However, if a wage garnishment for spousal support is in place, it may affect your finances. It's important to understand your rights and responsibilities regarding any debts. For personalized guidance, consider exploring resources on uslegalforms, which can help clarify your situation.

Yes, a spouse can be garnished if they are jointly responsible for a debt. However, garnishment leave for spouse typically applies to shared debts or obligations. If your partner's financial situation is affected by your individual debts, it may be beneficial to seek advice on how to manage garnishments effectively. Understanding the rules can help you both make informed financial decisions.

Your debt can affect your partner, especially if you share financial accounts or live in a community property state. In situations involving garnishment leave for spouse, your financial obligations may impact your partner's credit score or financial stability. It’s important to maintain transparency about debts and plan together to manage them effectively. Building a solid financial strategy benefits both partners.

When your spouse is in debt, start by discussing the situation openly and honestly. Explore options such as budgeting together or seeking financial counseling to address the issue. If garnishment leave for spouse may come into play, consider reaching out to legal experts or platforms like uslegalforms for guidance. Taking proactive steps can help both of you navigate through financial challenges.

Your wife is typically not responsible for your individual debts unless both of you have co-signed on loans or accounts. In situations where garnishment leave for spouse is relevant, it’s essential to clarify which debts are shared. Understanding your legal obligations helps to avoid unnecessary financial strain on your relationship. Communication about finances can also strengthen your partnership.

In Minnesota, garnishment rules require creditors to follow specific legal procedures to collect debts. Generally, they must notify the debtor and provide details about the garnishment leave for spouse if applicable. The law also limits the amount that can be garnished from wages, ensuring that individuals still have enough to cover basic living expenses. Familiarizing yourself with these rules can help protect your finances.

In general, your spouse cannot be garnished for your individual debt unless they are a joint account holder or have shared responsibility for that specific debt. Garnishment leave for spouse typically targets individual obligations. However, if your debt affects shared finances, it may impact your spouse indirectly. Understanding your financial situation is crucial.

Yes, a spouse can sometimes be held responsible for certain debts, especially in community property states. In these cases, both partners share liability for debts incurred during the marriage. Understanding garnishment leave for spouse is vital, as this can affect your financial stability. To protect yourself, consider using resources like US Legal Forms, which can provide guidance on these legal matters.

Generally, your wages cannot be garnished solely for your wife's debt unless you reside in a community property state. In these states, both spouses may be held liable for certain debts incurred during the marriage. It's essential to examine the specifics of garnishment leave for spouse within your jurisdiction. If you're unsure, seeking legal advice can help you navigate these complexities.

In most cases, your wages cannot be garnished for your spouse's debt. However, if you live in a community property state, creditors may seek garnishment of your wages to satisfy shared debts. Understanding how garnishment leave for spouse works is important, as each state has different laws regarding debt responsibility. Consulting with a legal expert can provide clarity on your specific situation.