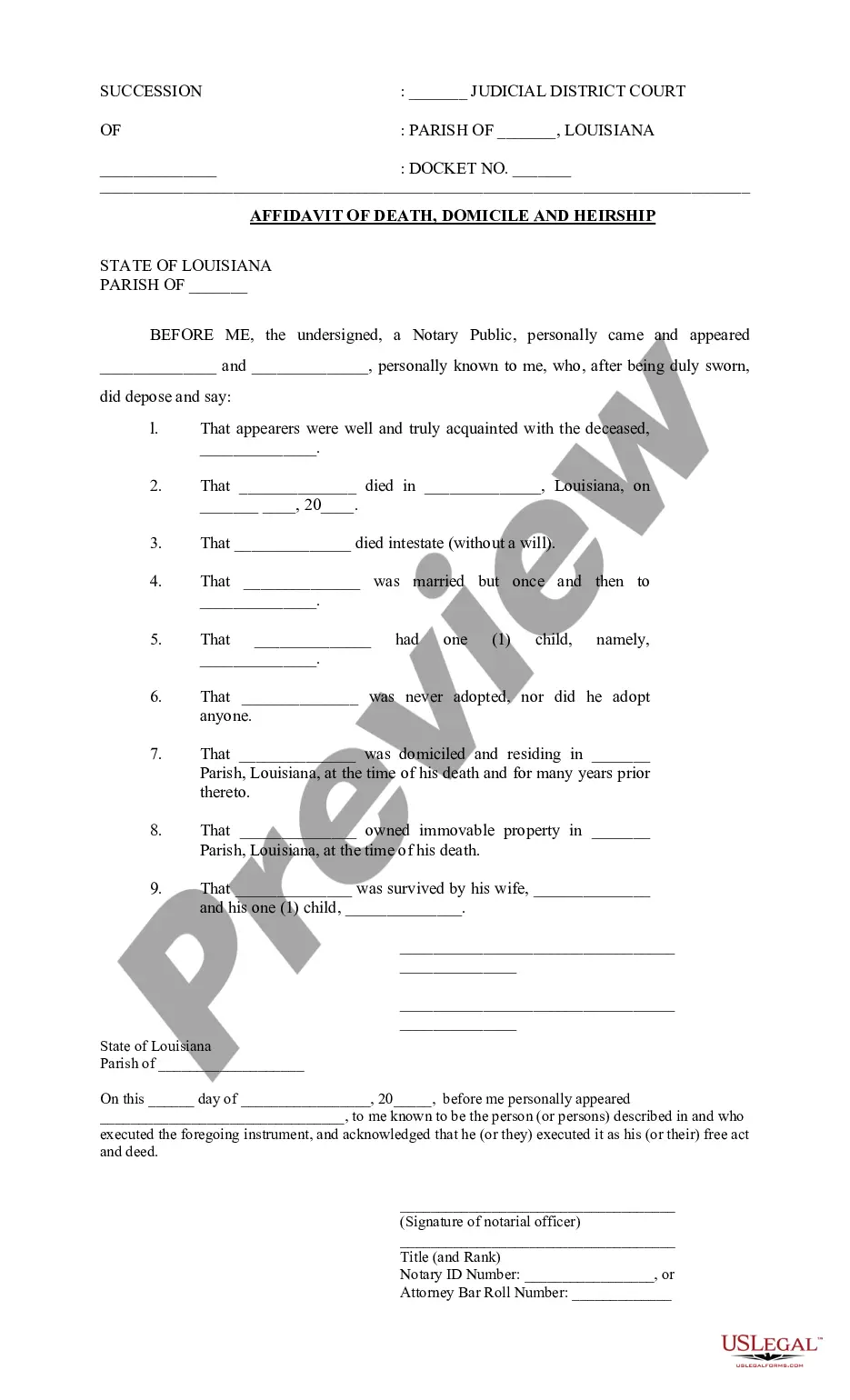

Transfer Deed Form For Bike

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

It’s evident that you cannot instantly become a legal expert, nor can you swiftly draft a Transfer Deed Form For Bike without a specialized skill set.

Assembling legal documents is a lengthy process requiring specific education and expertise. So why not delegate the creation of the Transfer Deed Form For Bike to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can access everything from court documents to templates for internal corporate correspondence.

You can regain access to your documents from the My documents tab at any time.

If you’re a returning customer, you can simply Log In and find and download the template from the same tab.

- Start by locating the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if the Transfer Deed Form For Bike meets your requirements.

- Initiate your search again if you require any other form.

- Create a free account and select a subscription plan to purchase the form.

- Select Buy now. Once the payment is processed, you can obtain the Transfer Deed Form For Bike, complete it, print it, and deliver it or send it by post to the necessary parties or organizations.

Form popularity

FAQ

One such recent development impacting consumer debt collections is the newly enacted Regulation F. Effective November 30, 2021, the Consumer Financial Protection Bureau (?CFPB?) enacted Regulation F to the Fair Debt Collection Practice Act (FDCPA). The full text of the Rule can be found here.

The Fair Debt Collection Practices Act was signed into law by President Jimmy Carter on September 20, 1977. The act prohibits certain debt collection practices, and requires debt collectors to identify themselves when communicating with a consumer and to validate the debt at the consumer's request.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.

Consumer Credit and the Removal of Medical Collections from Credit Reports. The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

Starting November 30, 2021, debt collectors face new restrictions under changes to the federal Fair Debt Collection Practices Act (FDCPA). The Fair Debt Collection Practices Act (FDCPA) (15 U.S.C. § 1692 and following) protects consumers from abusive debt collectors.