Sample Letter For Payment Arrangements

Description

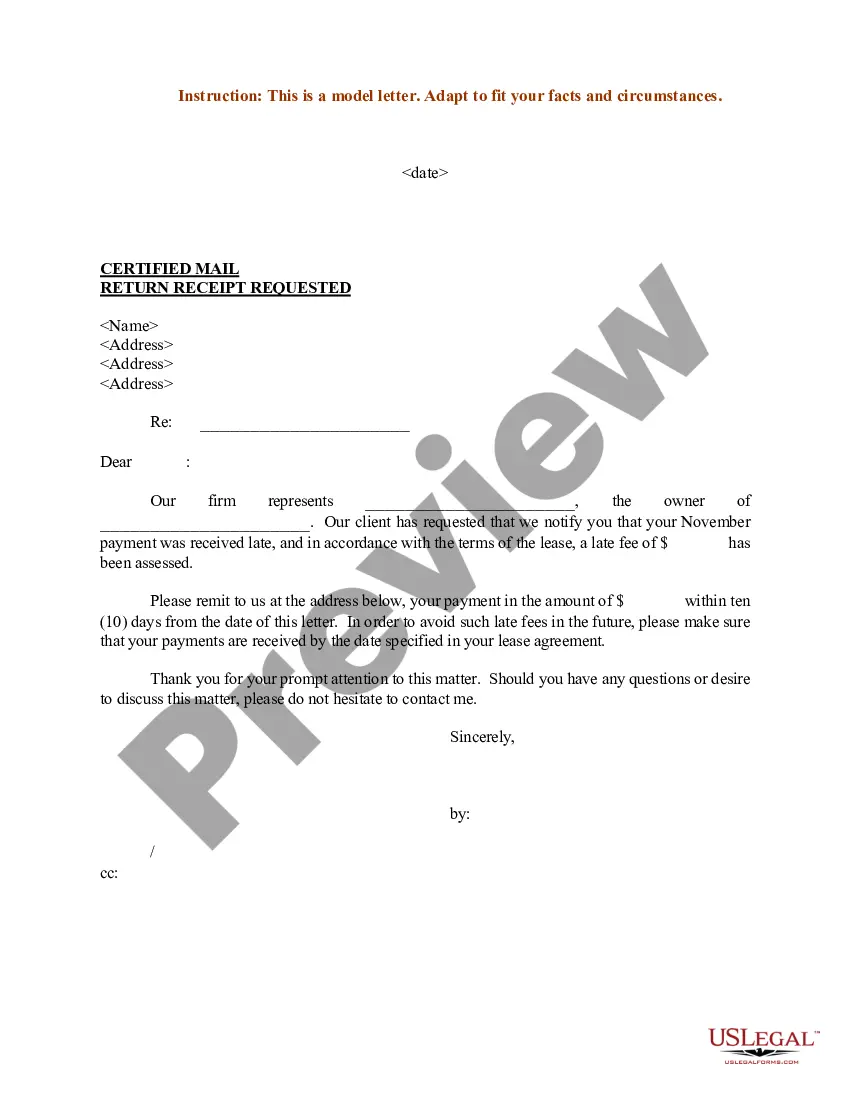

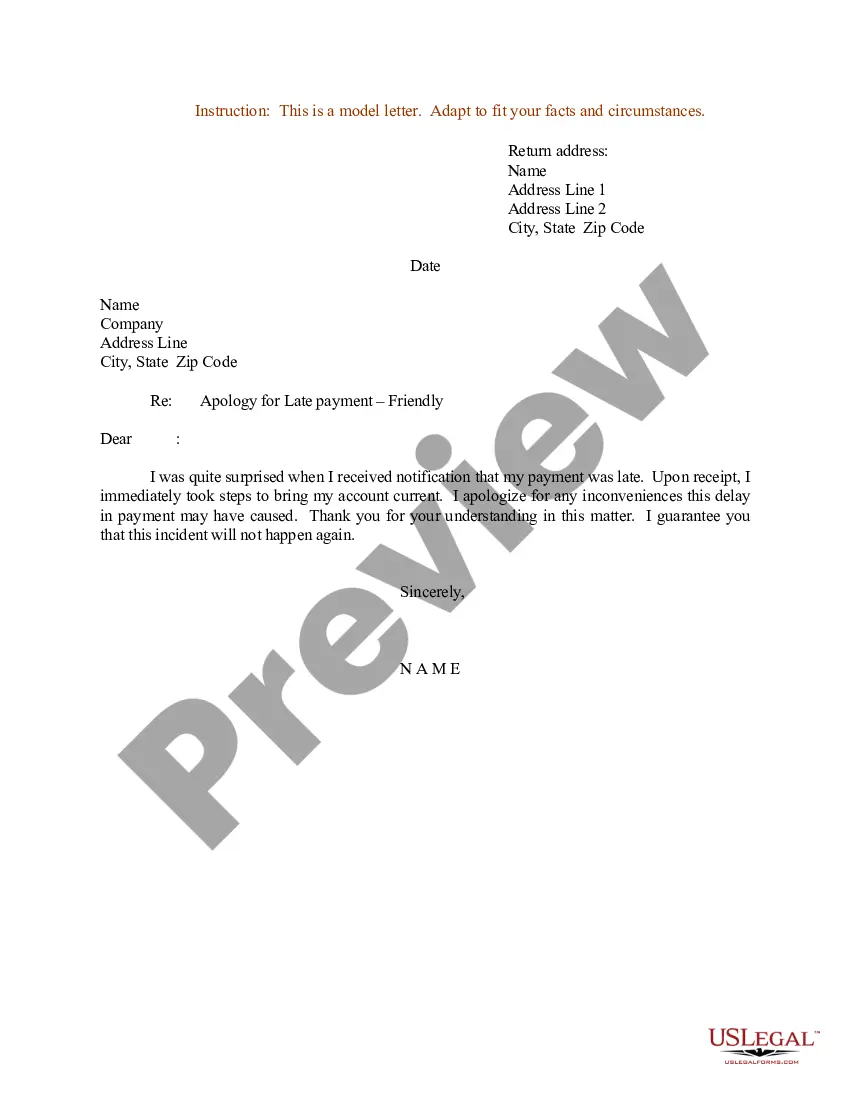

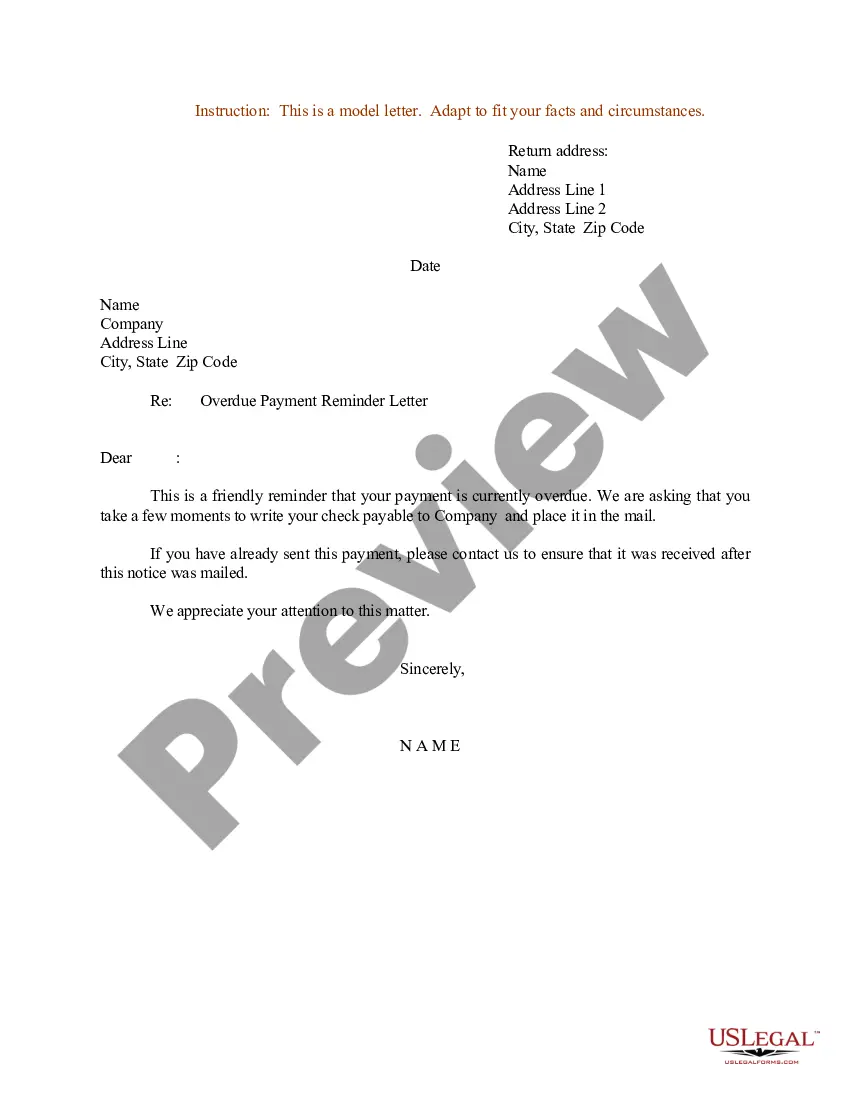

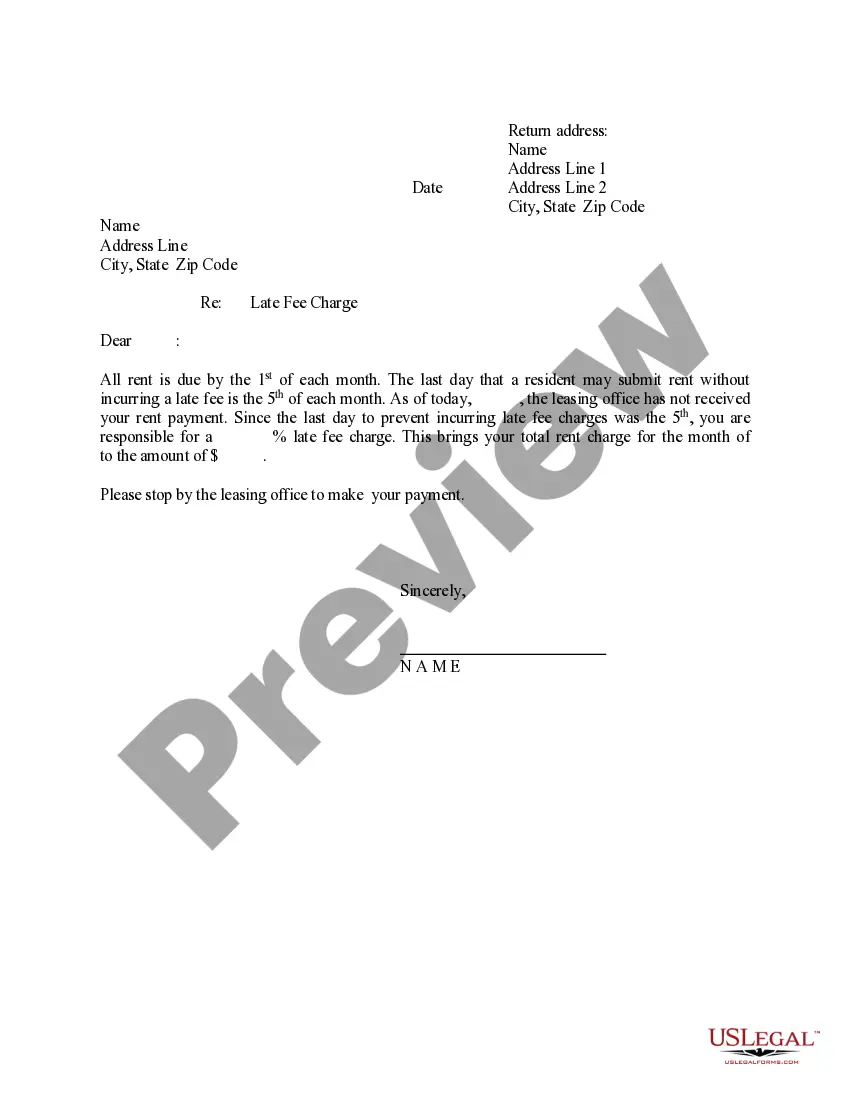

How to fill out Sample Letter For Notification Of Late Payment?

Obtaining legal document templates that comply with federal and local laws is essential, and online resources provide countless choices to select from.

However, what is the benefit of spending time searching for the right Sample Letter For Payment Arrangements template on the internet when the US Legal Forms digital library already contains such formats gathered in one location.

US Legal Forms is the largest online legal resource with more than 85,000 fillable documents prepared by attorneys for every professional and personal situation. They are easy to navigate with all forms sorted by state and intended use. Our specialists keep abreast of legal updates, ensuring you can always trust your form is current and compliant when obtaining a Sample Letter For Payment Arrangements from our site.

Choose Buy Now when you have located the appropriate form and select a subscription plan. Establish an account or sign in and complete the payment using PayPal or a credit card. Opt for the ideal format for your Sample Letter For Payment Arrangements and download it. All documents available on US Legal Forms are reusable. To redownload and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and easy-to-use legal document service!

- To acquire a Sample Letter For Payment Arrangements effortlessly and swiftly for both existing and new users.

- If you currently possess an account with an active subscription, sign in and store the document sample you need in the correct format.

- If you are new to our site, adhere to the instructions below.

- Review the template using the Preview option or through the text outline to ensure it meets your requirements.

- Search for an alternative sample using the search bar at the top of the page if needed.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Here's a step-by-step on writing a simple Loan Agreement with a free Loan Agreement template. Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.