Residence Trust Real Estate Without

Description

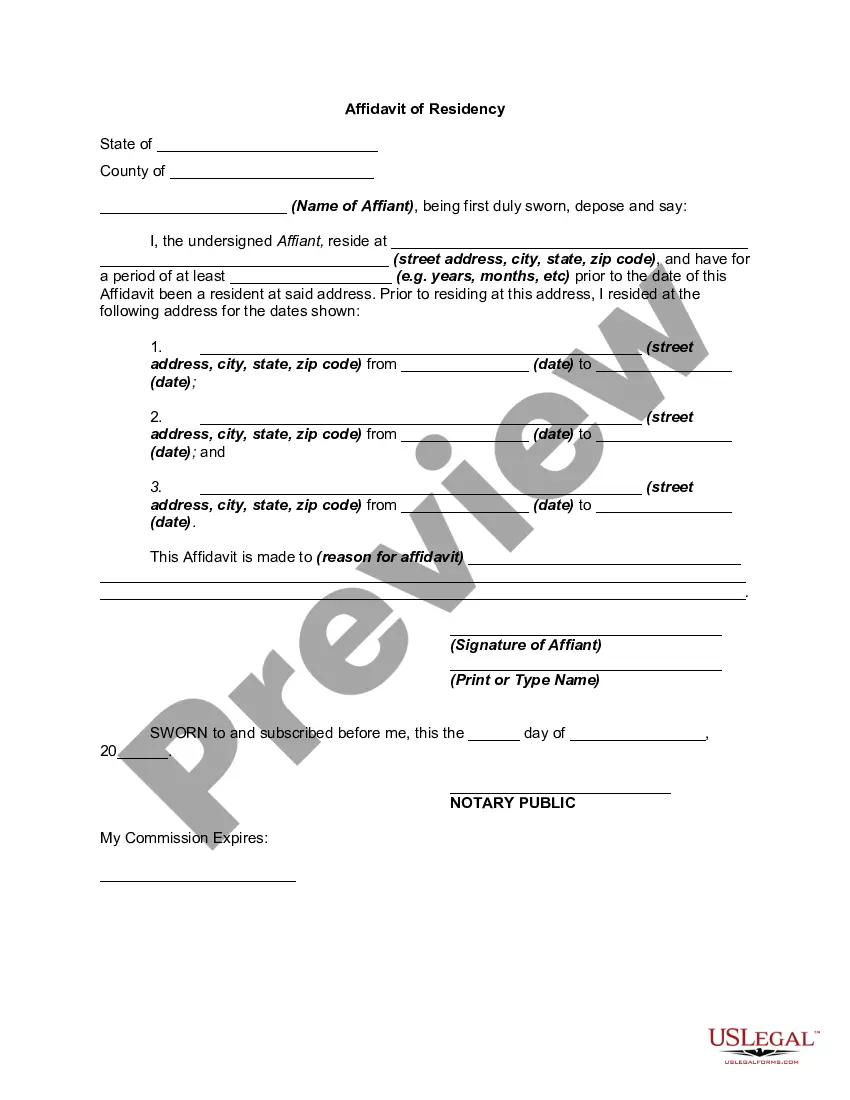

How to fill out Personal Residence Trust?

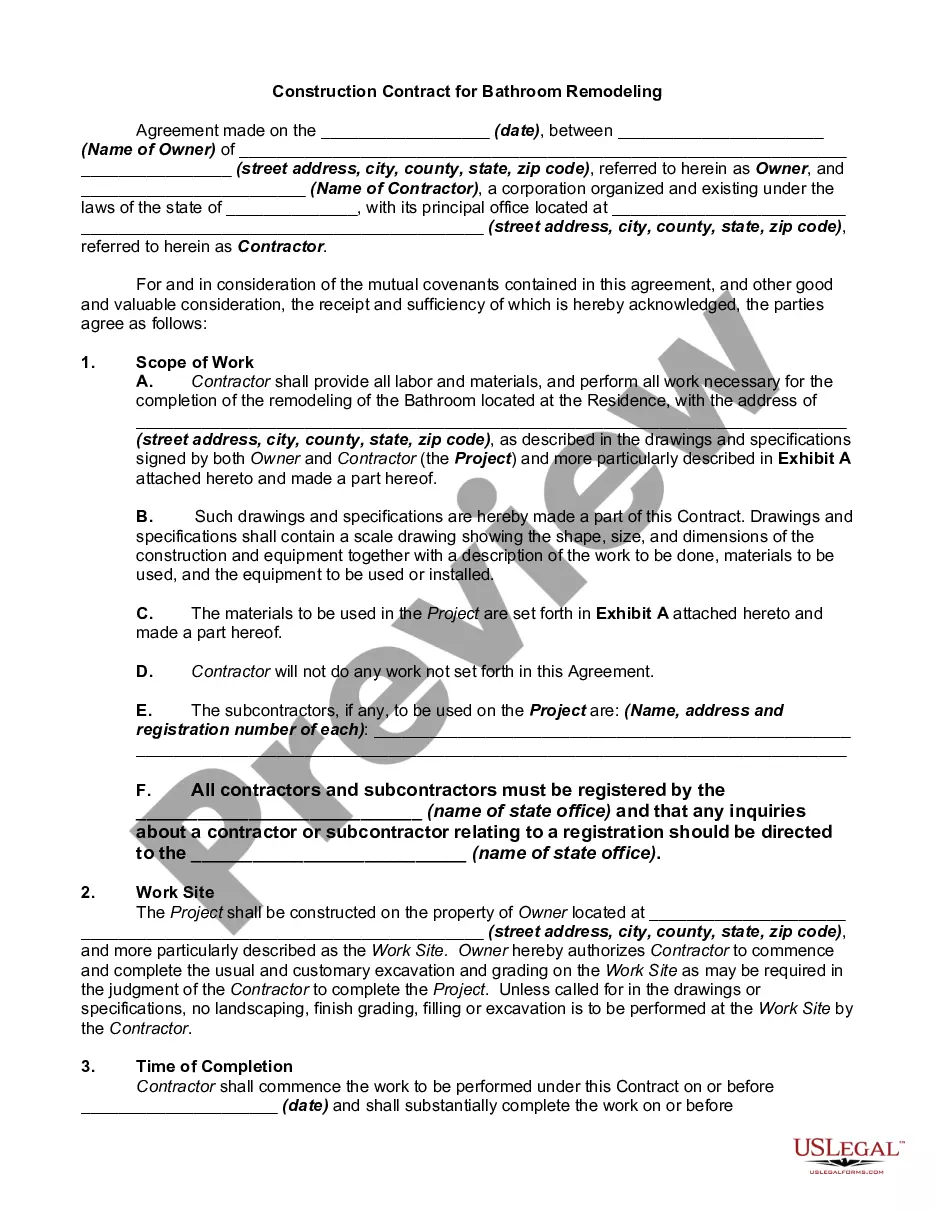

It’s clear that you cannot instantly become a legal authority, nor can you rapidly learn how to efficiently draft Residence Trust Real Estate Without the necessity of a specialized skill set.

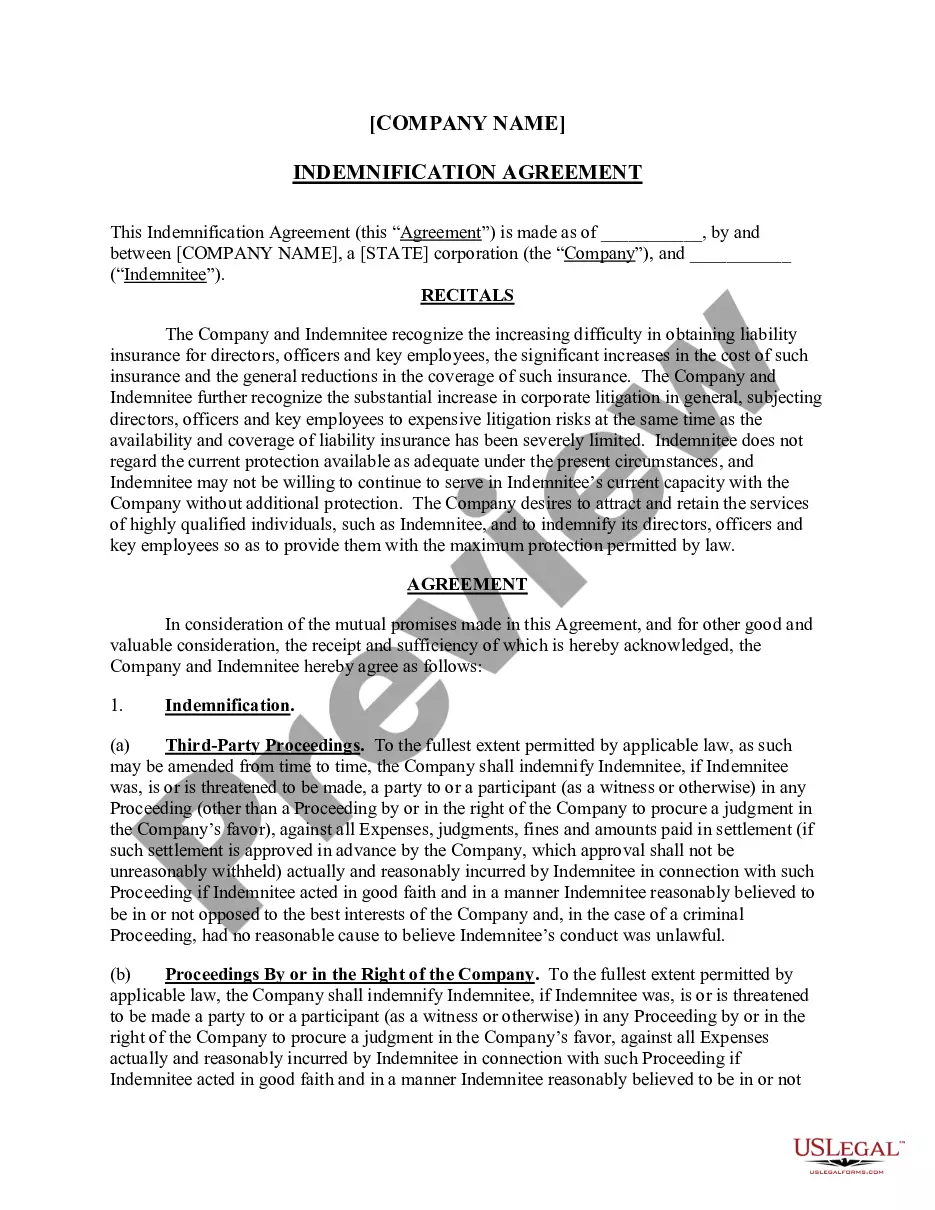

Assembling legal documents is a lengthy undertaking that demands particular education and expertise. So why not entrust the creation of the Residence Trust Real Estate Without to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can find anything from court papers to templates for in-office correspondence.

If you need a different template, begin your search again.

Establish a free account and choose a subscription plan to purchase the form. Select Buy now. Once the transaction is completed, you can download the Residence Trust Real Estate Without, fill it out, print it, and send or mail it to the specified individuals or organizations.

- We recognize how vital compliance and adherence to federal and local laws and regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to start with our platform and obtain the form you need in just minutes.

- Find the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Residence Trust Real Estate Without is what you require.

Form popularity

FAQ

A qualified personal residence trust (QPRT) is an irrevocable trust that allows the Trustor, the creator of the trust, to move a real primary or secondary home out of their personal estate. This is done for the key benefit of transferring the home to a future beneficiary with gift tax savings.

How to Get a QPRT Write the Irrevocable Trust Agreement. Fund the Trust With Your Residence. Obtain an Appraisal of Your Residence for Gift Tax Purposes. Report Your Gift to the IRS. After You Set Up Your QRPT. Transfer Ownership to Your Ultimate Beneficiaries.

7 Steps to Use a QPRT Draft the Trust. The first step in a Qualified Personal Residence Trust is to have a professional write up the irrevocable trust agreement. ... Place Home in Trust. ... Appraise Home. ... Report to IRS. ... Reside in the Home. ... Transfer to Beneficiaries. ... Fair Market Rent.

Possible Downsides of QPRTs In some states, holding a personal residence in a QPRT can result in reassessment of property tax liability and higher property taxes or a loss of certain property tax exemptions or abatements.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who are the equitable owners of the trust property.