Set Aside For Judgment

Description

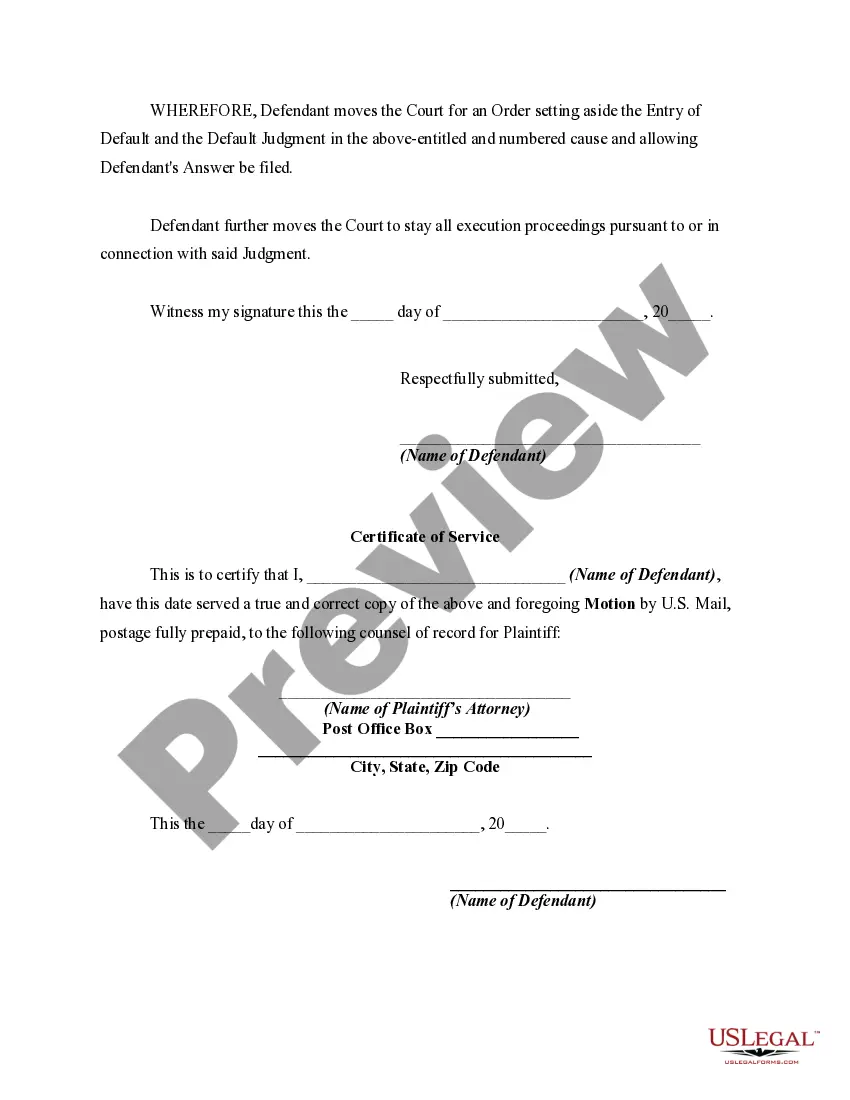

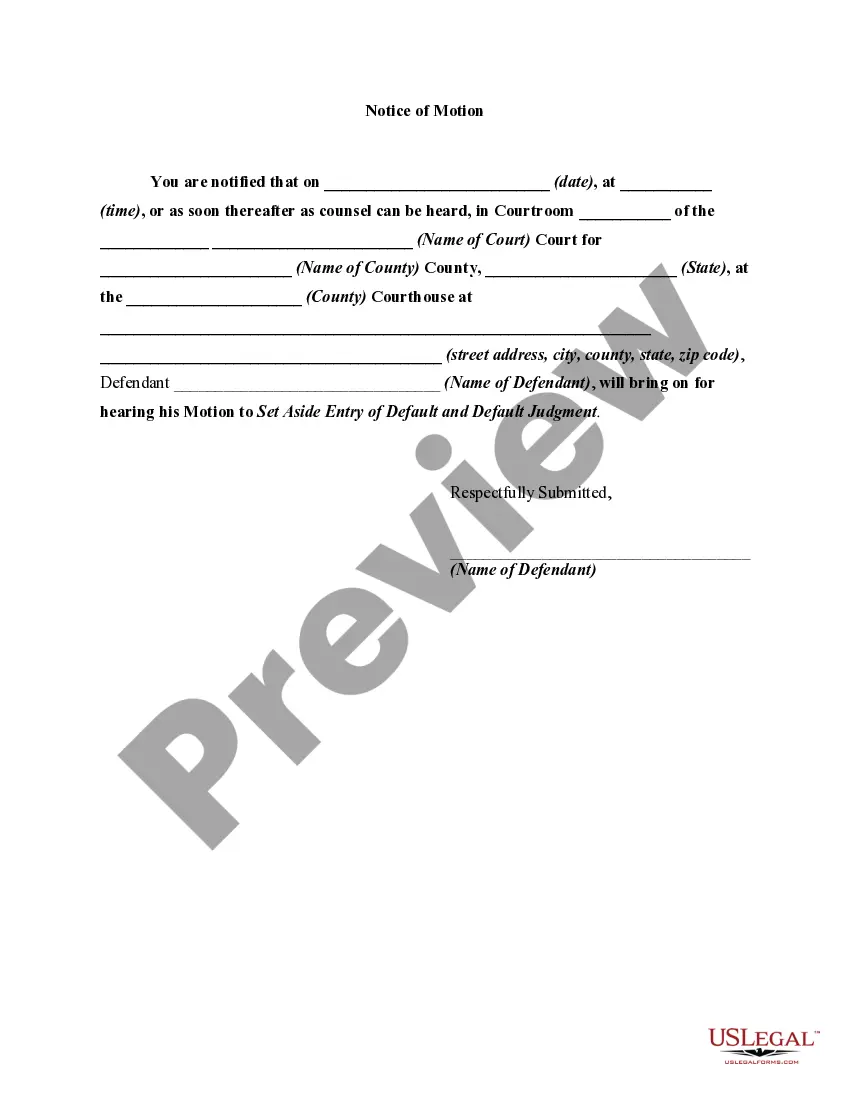

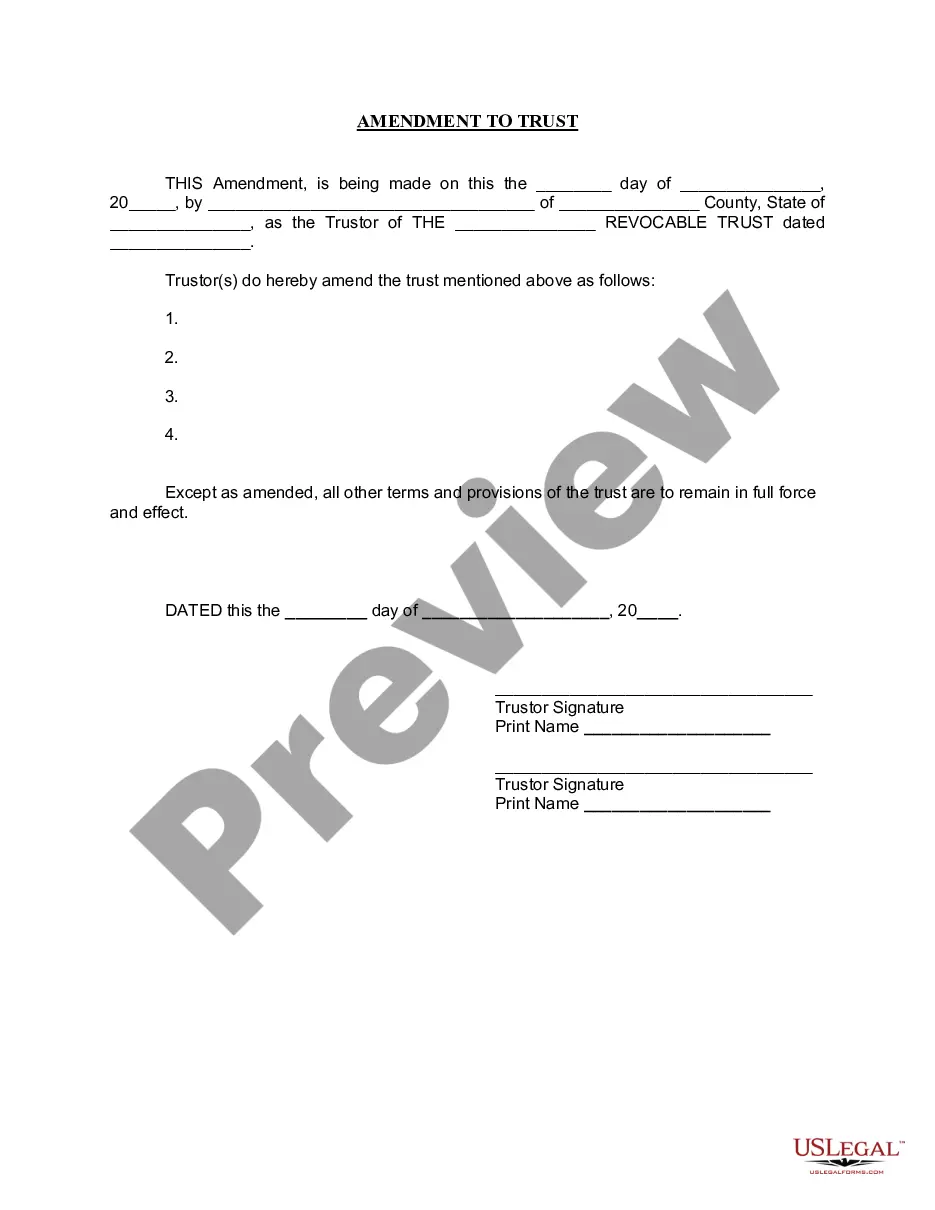

How to fill out Motion To Set Aside Entry Of Default And Default Judgment?

Finding a reliable place to obtain the most up-to-date and pertinent legal templates is part of the challenge in managing bureaucracy.

Identifying the appropriate legal documents requires precision and meticulousness, which is why it is essential to source samples of Set Aside For Judgment exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the stress associated with your legal paperwork. Explore the vast US Legal Forms library to locate legal templates, assess their applicability to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your example.

- Check the form’s details to ensure it meets the standards of your state and locality.

- Examine the form preview, if available, to confirm the template is indeed the one you need.

- Continue the search and seek the right template if the Set Aside For Judgment does not fulfill your criteria.

- When confident about the form’s applicability, download it.

- If you are a verified user, click Log in to validate and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to finalize your order.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Set Aside For Judgment.

- After you have the form on your device, you can modify it using the editor or print it and fill it out manually.

Form popularity

FAQ

To get a judgment set aside, you typically need to file a motion in the court where the judgment was issued. This motion must clearly demonstrate valid reasons for the request, such as lack of proper notification or new evidence that could change the outcome. You may find it helpful to enlist the services of a legal professional to ensure you compile the necessary documentation correctly. Using US Legal Forms can streamline the process, providing templates and guidance to help you navigate your request to set aside for judgment.

Steps to Form an S Corp in Illinois Choose an LLC Name. You'll find when you go to register an LLC one of the first things you need is a name. ... Choose a Registered Agent. ... File Your Articles of Organization. ... Create an Operating Agreement for Your LLC. ... Get an EIN. ... File Form 2553 to Elect S Corp Tax Status.

If you're looking to incorporate in Illinois, you're in the right place. This guide will help you file formation documents, get tax identification numbers, and set up your company records. Incorporation: $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee.

Table of Contents Choose a Business Name. Register Your Business. Get Your Business EIN. Apply for Required Permits or Licenses. Open a Business Bank Account. Get Business Insurance. Start Marketing Your Business. Frequently Asked Questions (FAQs)

Usually, S corporations in Illinois are audited less frequently than partnerships and sole proprietorships. S corporations in Illinois enjoy the advantages of pass-through taxation. This means that the shareholders can avoid the dreaded double taxation that applies to C corporations.

Subchapter S corporations and partnerships pay replacement tax of 1.5 percent (. 015). S corporations and partnerships do not pay Illinois Income Tax. Generally, income from an S corporation or partnership is passed on to the shareholders or partners.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

To start a corporation in Illinois, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Business Services. You can file this document online or by mail. The articles cost a minimum of $175 to file.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.