Dog Breeding Contracts For Beginners

Description

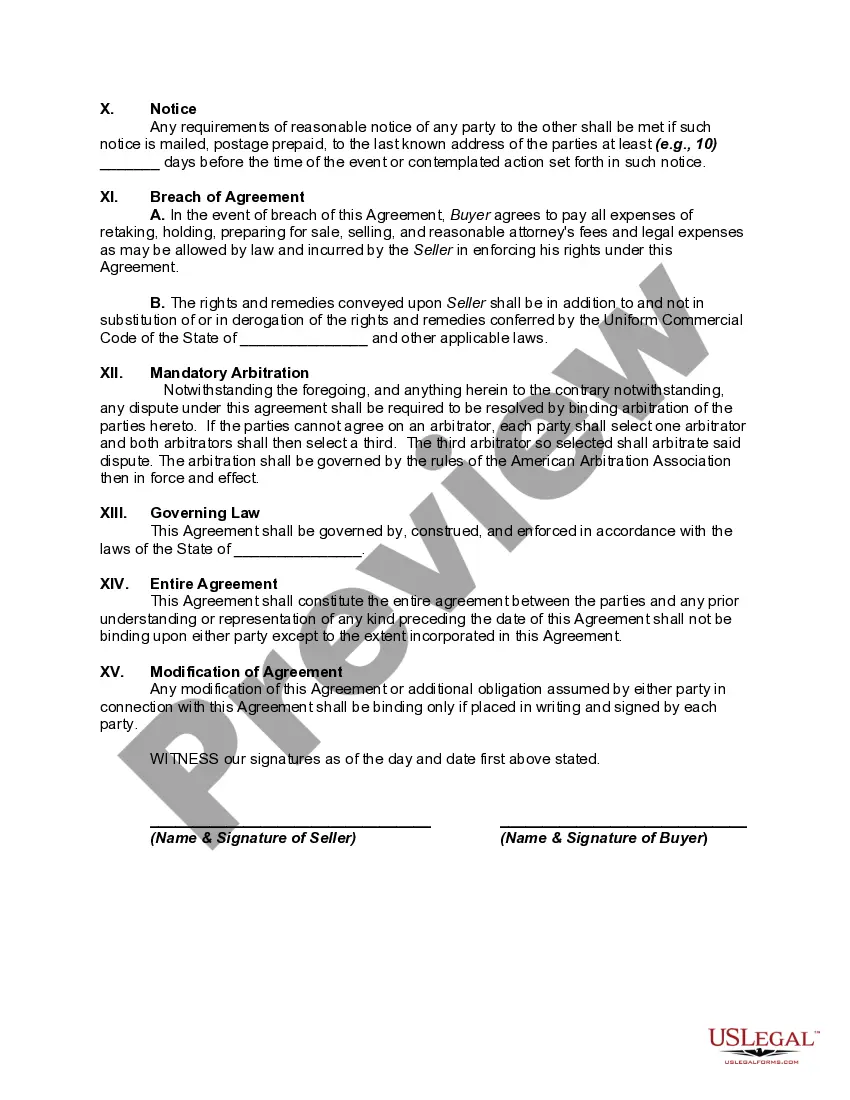

How to fill out Contract Or Agreement For The Sale Of A Puppy Or Dog?

It’s widely known that becoming a legal expert doesn’t happen overnight, nor can you easily learn how to swiftly formulate Dog Breeding Agreements for Novices without a specialized education.

Drafting legal documents is an extensive process that demands specific expertise and training. Thus, why not entrust the formulation of Dog Breeding Agreements for Novices to the experts.

With US Legal Forms, one of the most extensive repositories of legal templates, you can locate everything from court documents to templates for internal business communication.

You can access your documents again from the My documents section at any time. If you’re a current customer, simply Log In, and locate and download the template from the same section.

No matter the objective of your forms—be it legal, financial, or personal—our platform has got you covered. Experience US Legal Forms now!

- Utilize the search bar at the top of the page to discover the form you require.

- If available, preview the form and review the accompanying description to ensure that Dog Breeding Agreements for Novices meets your needs.

- If you require additional forms, restart your search.

- Create a complimentary account and select a subscription plan to acquire the template.

- Click Buy now. After the transaction is completed, you can obtain the Dog Breeding Agreements for Novices, fill it out, print it, and send or mail it to the relevant parties or organizations.

Form popularity

FAQ

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.

At least 25 contiguous acres of forest land managed ing to state standards and an approved forest management plan. Taxed at use value.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Both parties should sign the form, and have it notarized if they deem it necessary, to indicate that at the time of the sale, the items in question were handed over to the buyer for the agreed-upon purchase price.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

To file your federal taxes, use Form 1040, U.S. Individual Income Tax Return, and supporting schedules if needed. To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed.

To order forms by phone: Call 800-338-0505. Select 1 for Personal Income Tax, 2 for Business Entity Information. Select "Forms and Publications"

Use Value Appraisal, or ?Current Use? as it is commonly known, is a property tax incentive available to owners of agricultural and forestry land in Vermont. Eligible landowners can enroll in the program to have their land appraised at its Current Use (farming or forestry) value rather than fair market value.