Second Form Trust

Description

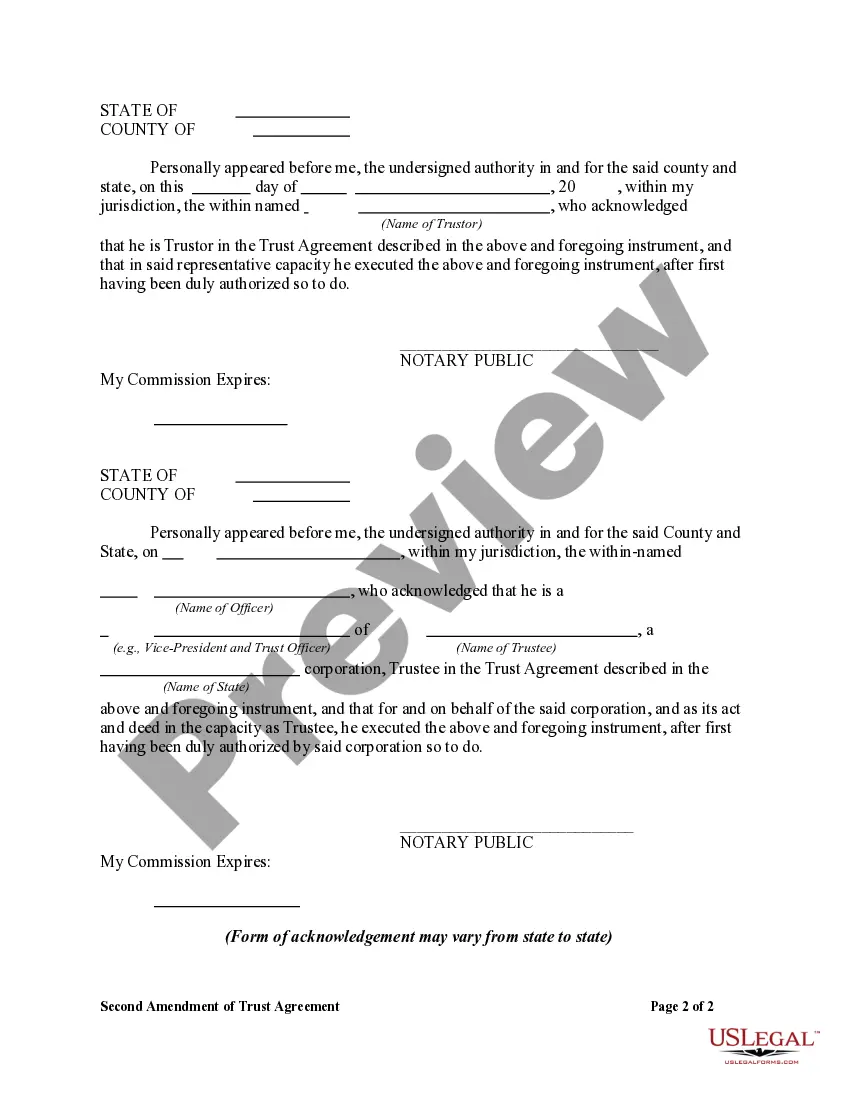

How to fill out Second Amendment Of Trust Agreement?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require substantial research and significant expenditures.

If you are looking for a more direct and budget-friendly method of drafting a Second Form Trust or any other paperwork without hassle, US Legal Forms is readily available.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With a few clicks, you can swiftly find state- and county-specific templates meticulously crafted by our legal professionals.

Ensure the form you select adheres to the laws and regulations of your state and county. Choose the appropriate subscription plan to acquire the Second Form Trust. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make document execution a simple and efficient process!

- Utilize our service whenever you require dependable and trustworthy assistance to easily find and acquire the Second Form Trust.

- If you are a returning user and have set up an account with us before, simply Log In to your account, search for the form and download it or retrieve it again anytime from the My documents section.

- No account yet? No problem. Setting one up is quick and straightforward.

- But before diving straight into downloading the Second Form Trust, consider these suggestions.

- Examine the form preview and details to ensure you have the correct document.

Form popularity

FAQ

Setting up a trust involves several key steps, beginning with defining the purpose and type of trust you want to create. You need to appoint a trustee, decide on beneficiaries, and draft the trust document. Using a platform like US Legal Forms can simplify this process by offering comprehensive templates and guidance for establishing a second form trust that meets your needs.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

So a Restatement would say ?I hereby take my entire trust named TRUST dated DATE and replace it with this whole new trust named TRUST dated TODAY'S DATE.? A restatement is generally cleaner, and a preferred way to amend trusts, as opposed to amendments.

Yes. It is always a good idea to have a trust to handle your assets after your death. Although naming the beneficiaries of your accounts ensures that they can avoid probate, it overrides any estate planning you may have in place already.

For example, you might use a trust amendment form to: Update your trustee or successor trustee: If your chosen trustee is no longer willing or able to manage the trust, or you'd like to designate someone else, you can use an amendment form to name another person or organization to manage your trust.