Interest Possessor Without

Description

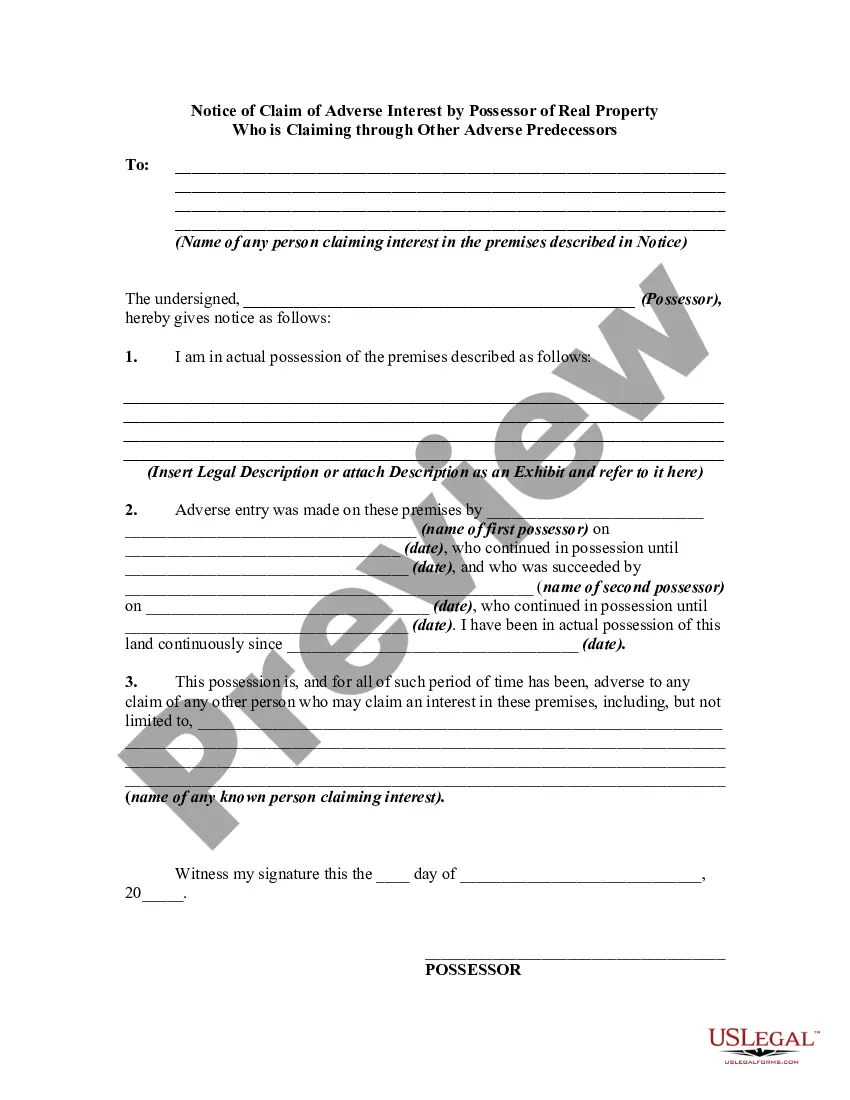

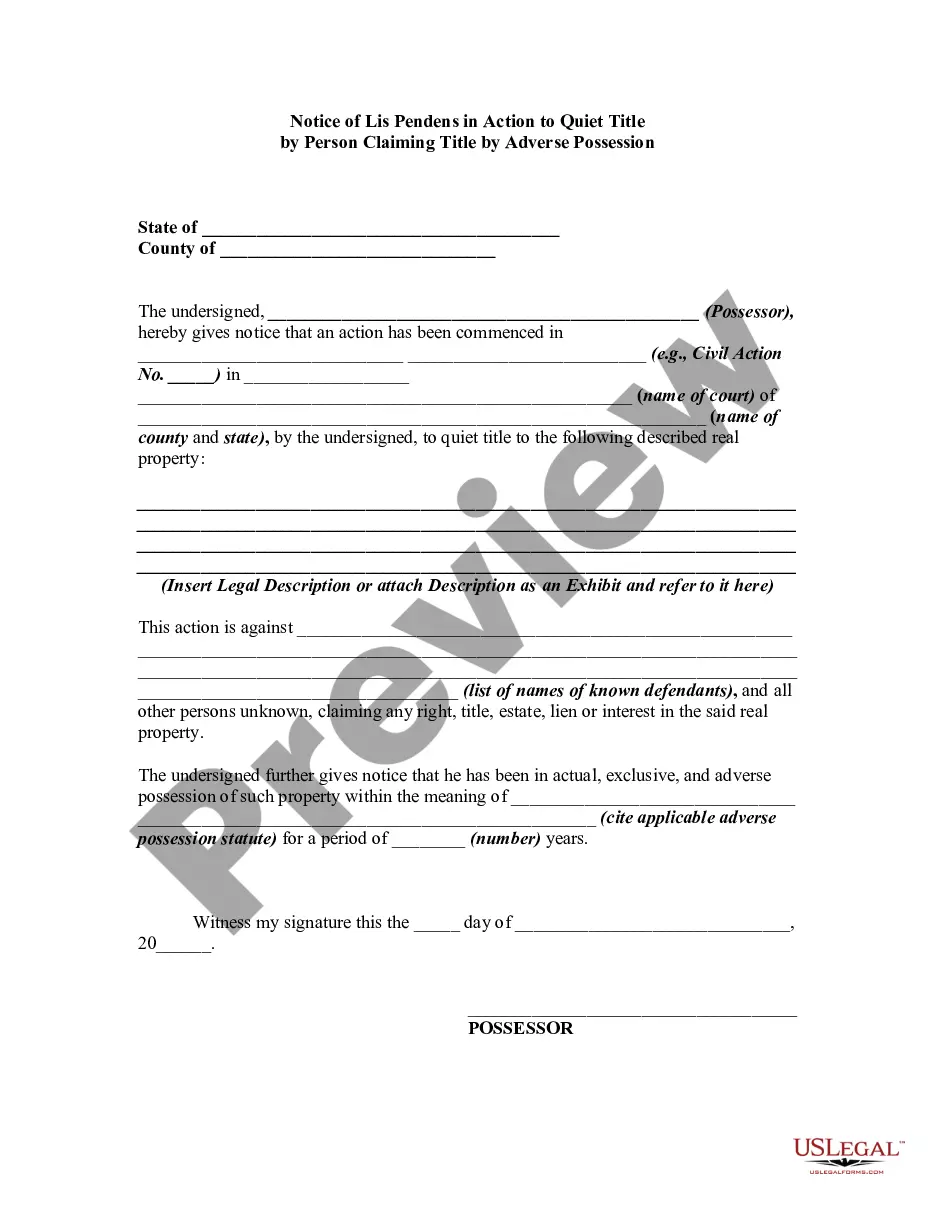

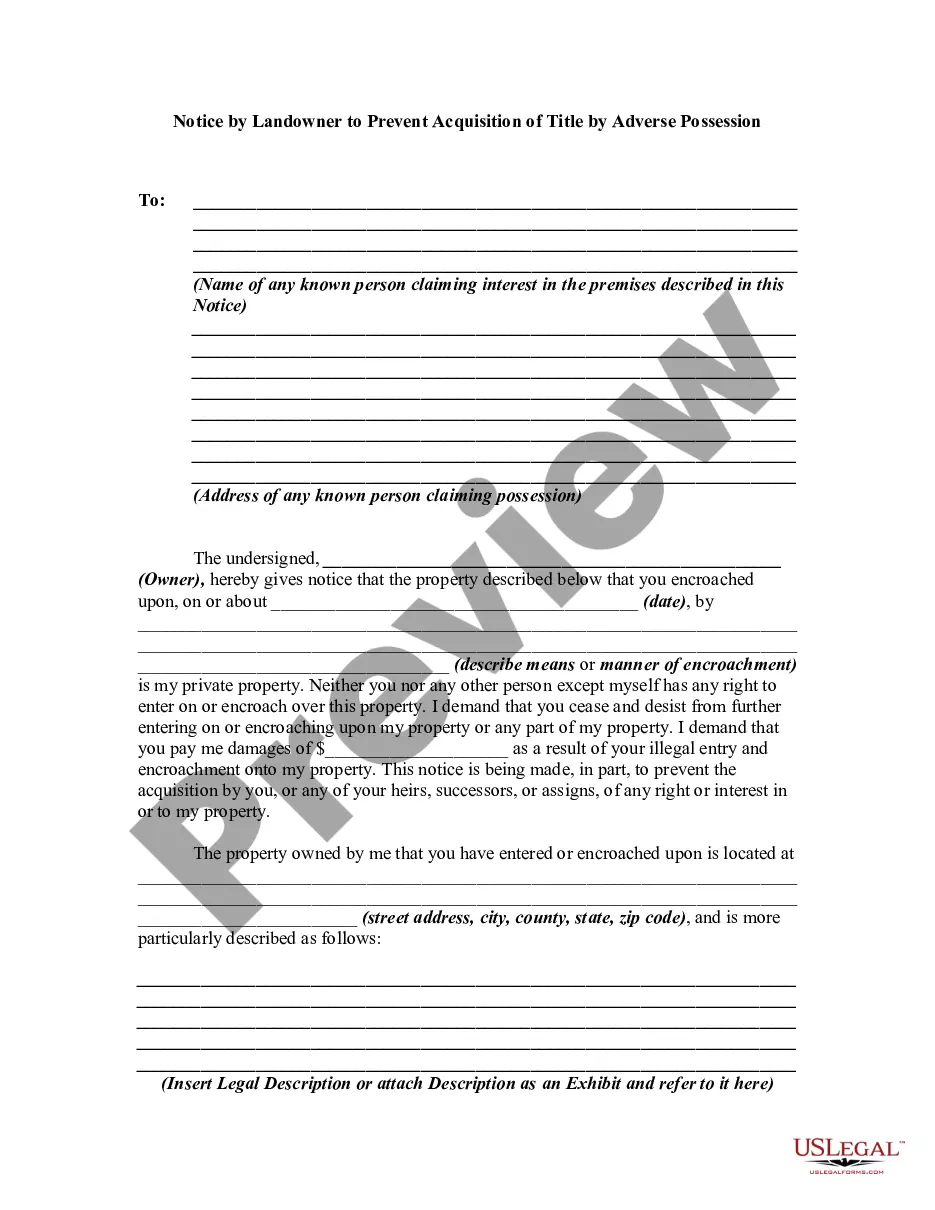

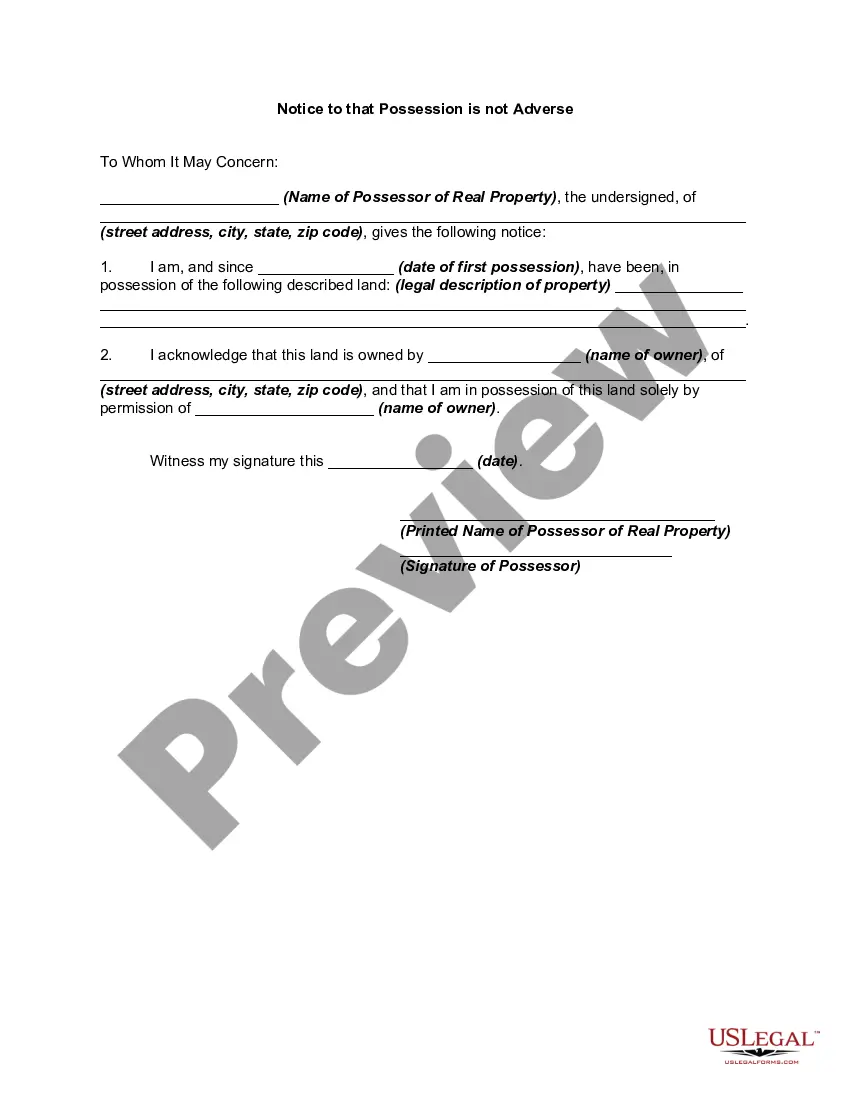

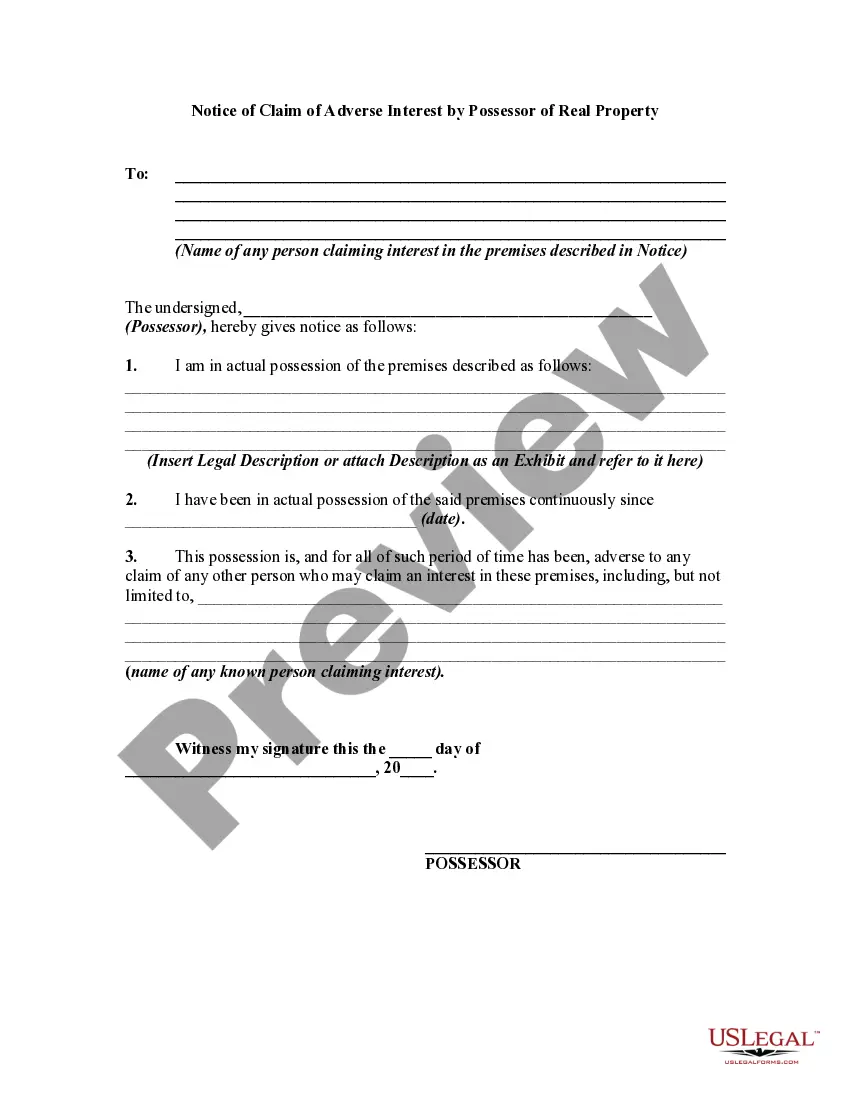

How to fill out Notice Of Claim Of Adverse Interest By Possessor Of Real Property - Squatters Rights?

Accessing legal templates that comply with federal and state laws is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the appropriate Interest Possessor Without sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are simple to browse with all papers grouped by state and purpose of use. Our specialists keep up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Interest Possessor Without from our website.

Obtaining a Interest Possessor Without is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the steps below:

- Examine the template utilizing the Preview option or via the text description to ensure it meets your requirements.

- Look for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Interest Possessor Without and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

An easement is a non-possessory interest in a portion of real estate. Possession of an easement, however, does not own the real estate that is subject to that easement. Ownership remains with the landowner. However, the easement allows another person to use the real estate for a specific purpose.

Some examples of taxable possessory interests include cabins located on publicly owned land, aircraft hangars and tie-downs at publicly owned airports, grazing permits issued on publicly owned land, and concessionaires at county owned fairgrounds.

There are three main types of possessory interests: fee simple absolute, life estate, and leasehold.

Types of nonpossessory interests include real property or interests (any right, claim, or privilege an individual has toward land or real property). An encumbrance is anything that can lessen the value or use and enjoyment of a property, such as a lien or restrictive covenant.

Possessory interests are interests in real property that exist when a person or entity leases, rents or uses real estate owned by a government agency for its exclusive use under any form of agreement or permit. Some of these Possessory Interests are Taxable.