Termination Of Real Estate Contract With No Closing Date

Description

How to fill out Terminating Or Termination Of Easement By A General Release?

Acquiring legal document templates that comply with federal and local regulations is essential, and the internet provides numerous choices to choose from.

However, what’s the use of spending time looking for the properly formulated Termination Of Real Estate Contract With No Closing Date sample online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal library featuring over 85,000 editable templates crafted by attorneys for various business and personal situations. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated with legal amendments, ensuring that your form is current and compliant when obtaining a Termination Of Real Estate Contract With No Closing Date from our site.

Click Buy Now once you’ve identified the correct form and select a subscription plan. Create an account or Log In and process your payment with PayPal or a credit card. Choose the format for your Termination Of Real Estate Contract With No Closing Date and download it. All documents you find via US Legal Forms are reusable. To re-download and complete previously saved documents, access the My documents section in your account. Experience the most comprehensive and user-friendly legal document service!

- Acquiring a Termination Of Real Estate Contract With No Closing Date is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you need in the appropriate format.

- If you are visiting our site for the first time, follow the steps below.

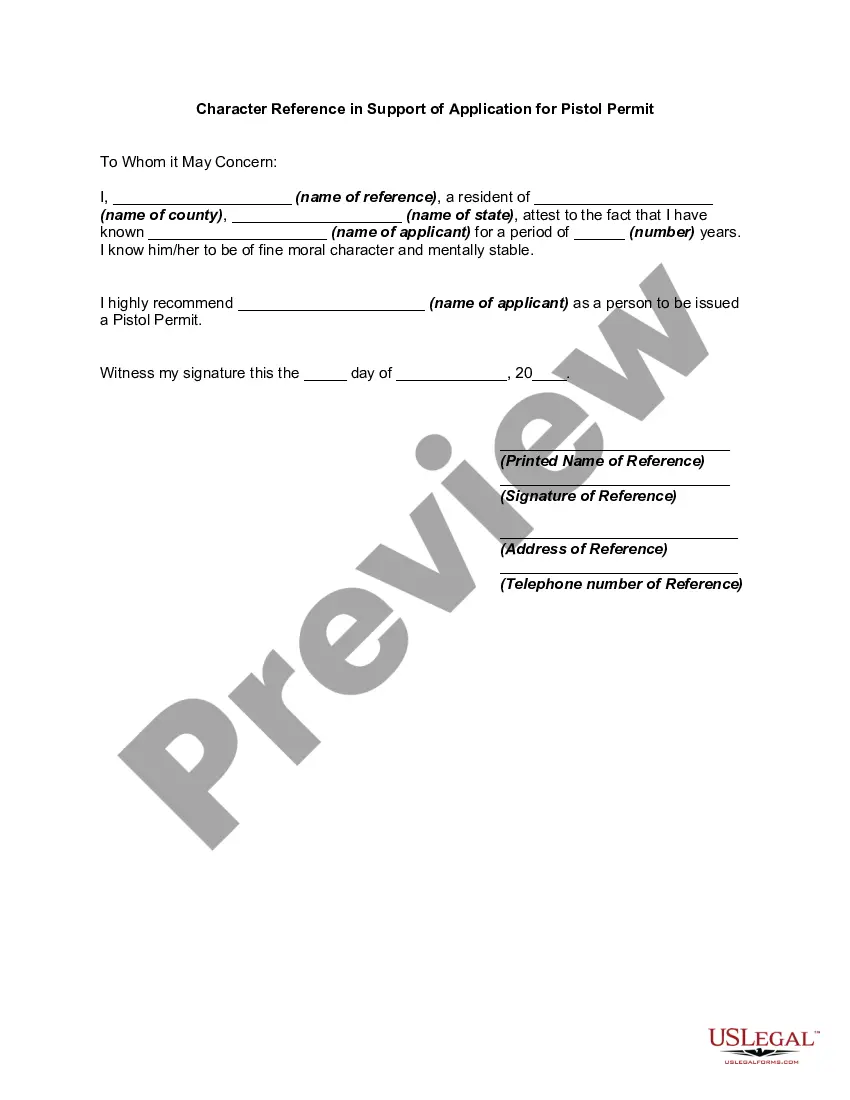

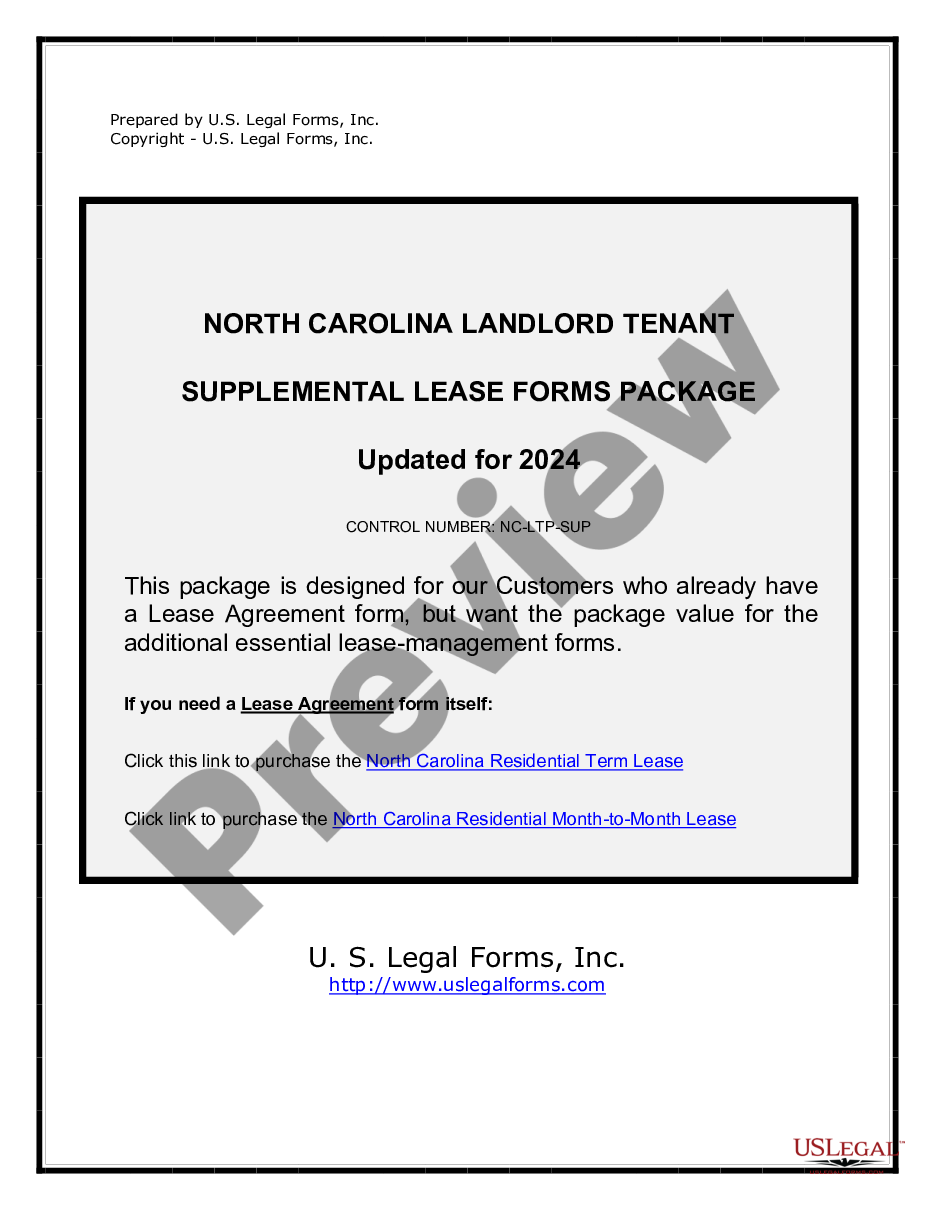

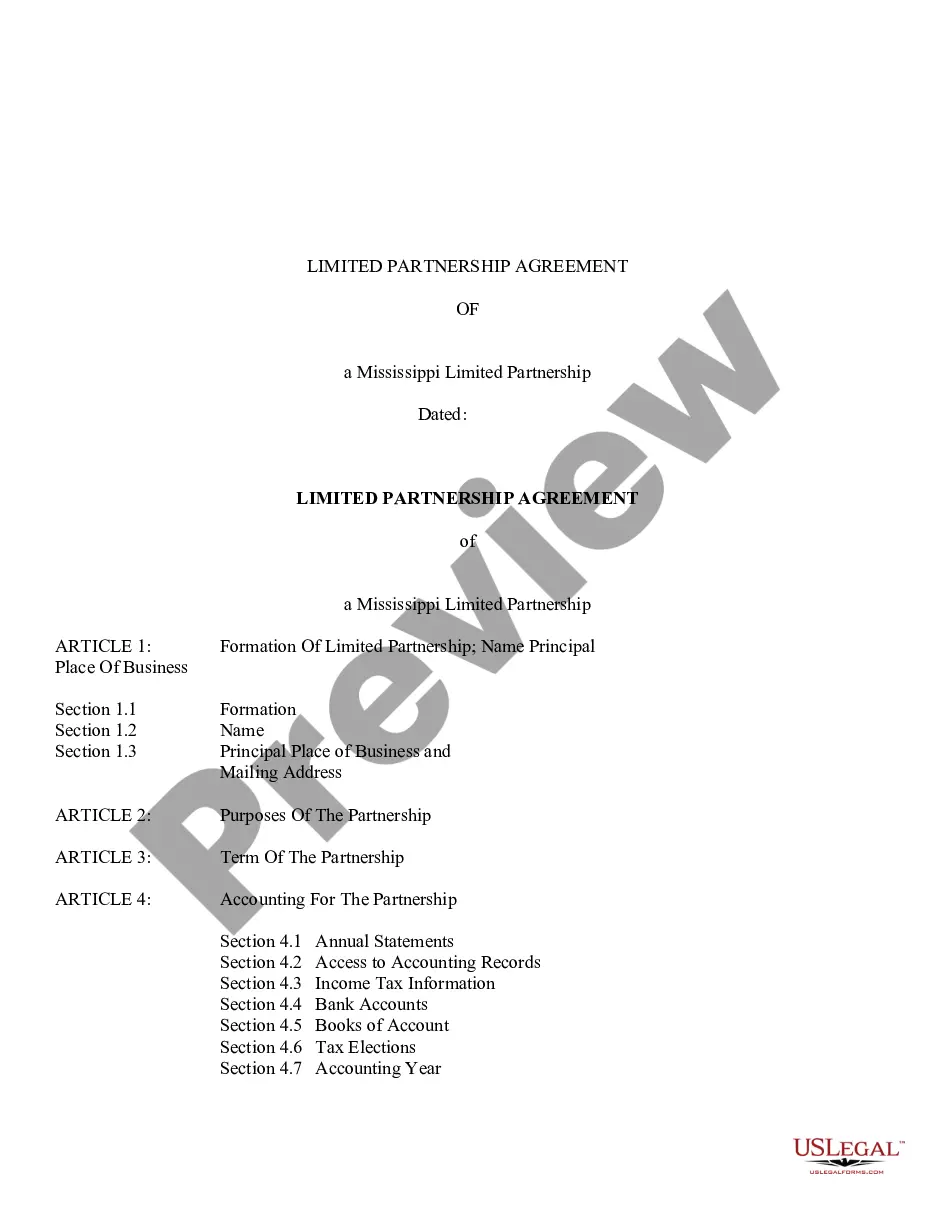

- Review the template using the Preview function or through the text outline to confirm it fulfills your needs.

- Use the search feature at the top of the page to look for another sample if required.

Form popularity

FAQ

What paperwork is required to form an S corp? To form an S corp, you must prepare and file Articles of Incorporation or a Certificate of Incorporation with the proper state authorities. You must also pay filing fees and any applicable initial franchise taxes or other fees.

Filing the PA-20S/PA-65 Information Return This form will report the losses, deductions, income, etc. from the operations of the business. All losses and profits of an S corporation in Pennsylvania can be passed through the business to shareholders, both residing inside and outside of the state.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40. This form is used by Pennsylvania residents who file an individual income tax return.

Businesses that elect federal subchapter S status are considered Pennsylvania S corporations and are subject to the 9.99 percent corporate net income tax only to the extent of built-in-gains. Rather, shareholders in the businesses considered S Corporations are taxed at the personal income tax rate, 3.07 percent.

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Businesses that elect federal subchapter S status are considered Pennsylvania S corporations and are subject to the 9.99 percent corporate net income tax only to the extent of built-in-gains. Rather, shareholders in the businesses considered S Corporations are taxed at the personal income tax rate, 3.07 percent.

Pennsylvania corporations have to file an Articles of Amendment ? Domestic Corporation form with the Corporation Bureau of the Department of State. You will also have to attach 2 copies of the completed Docketing Statement ? Changes. You can file by mail or in person. You also need to pay $70 for the filing.