Answer Lawsuit Template For Google Docs

Description

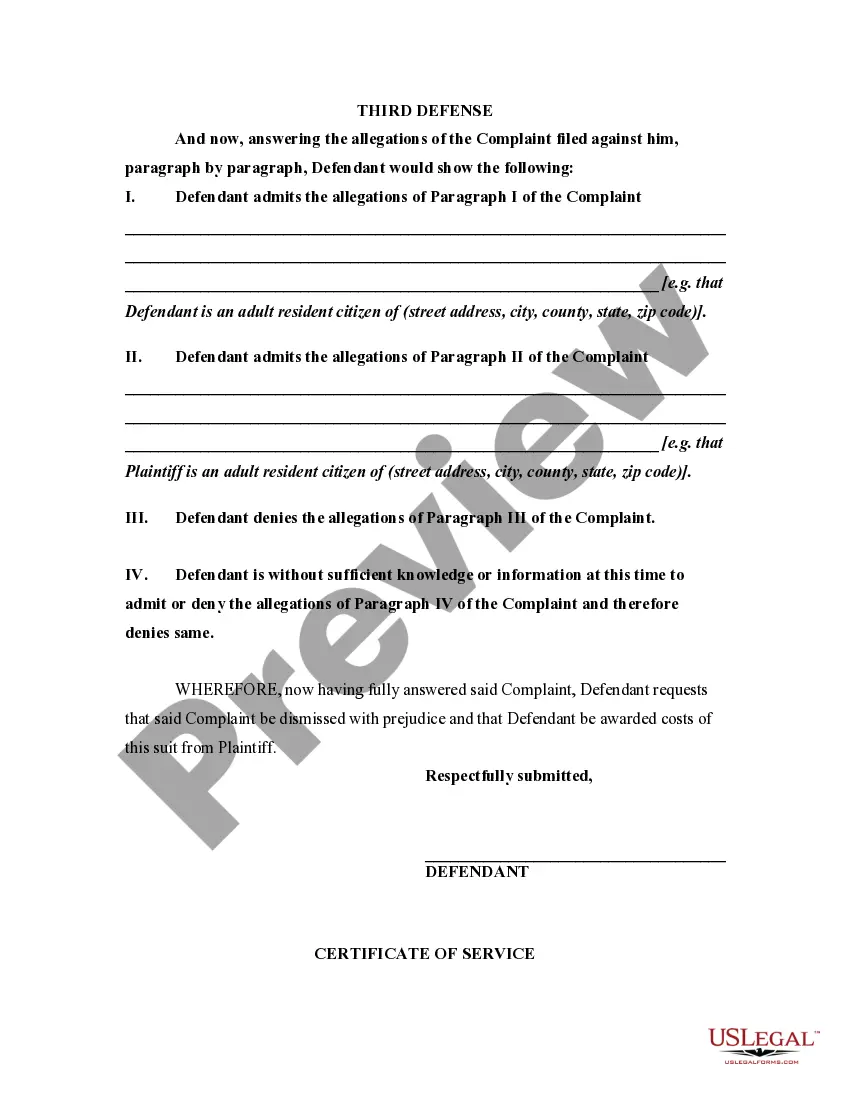

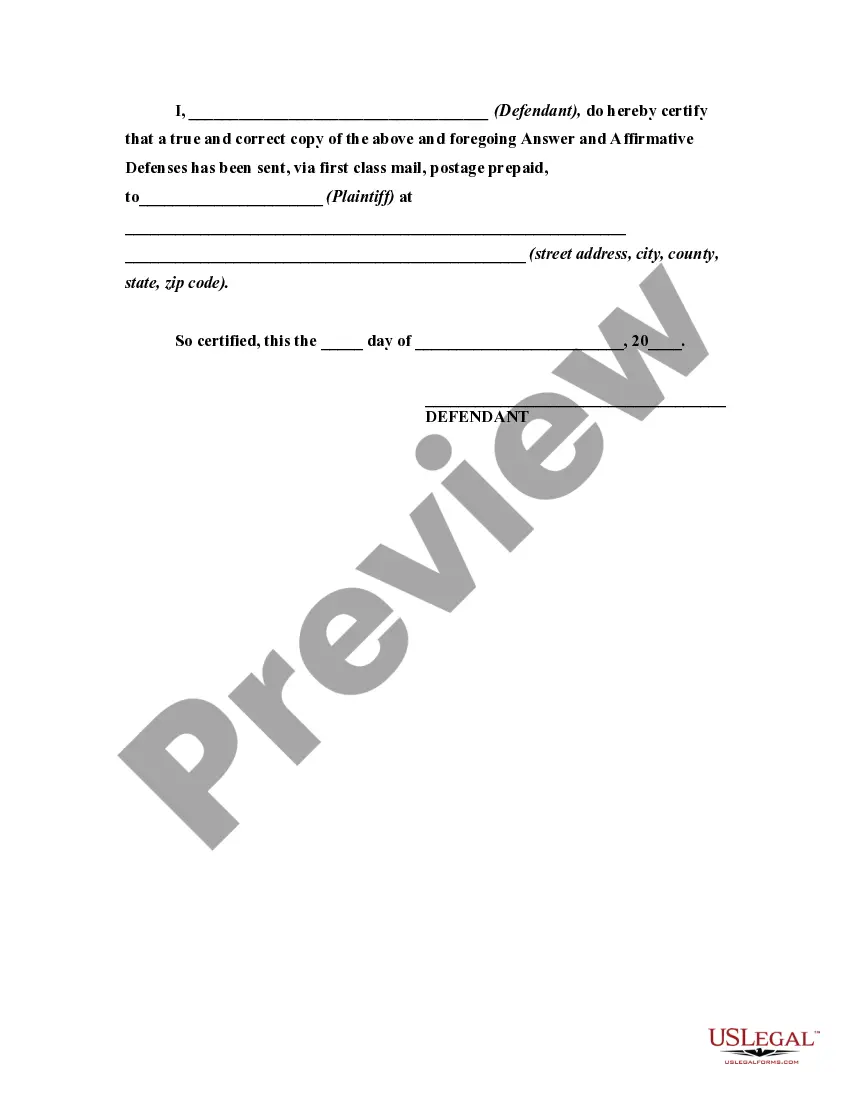

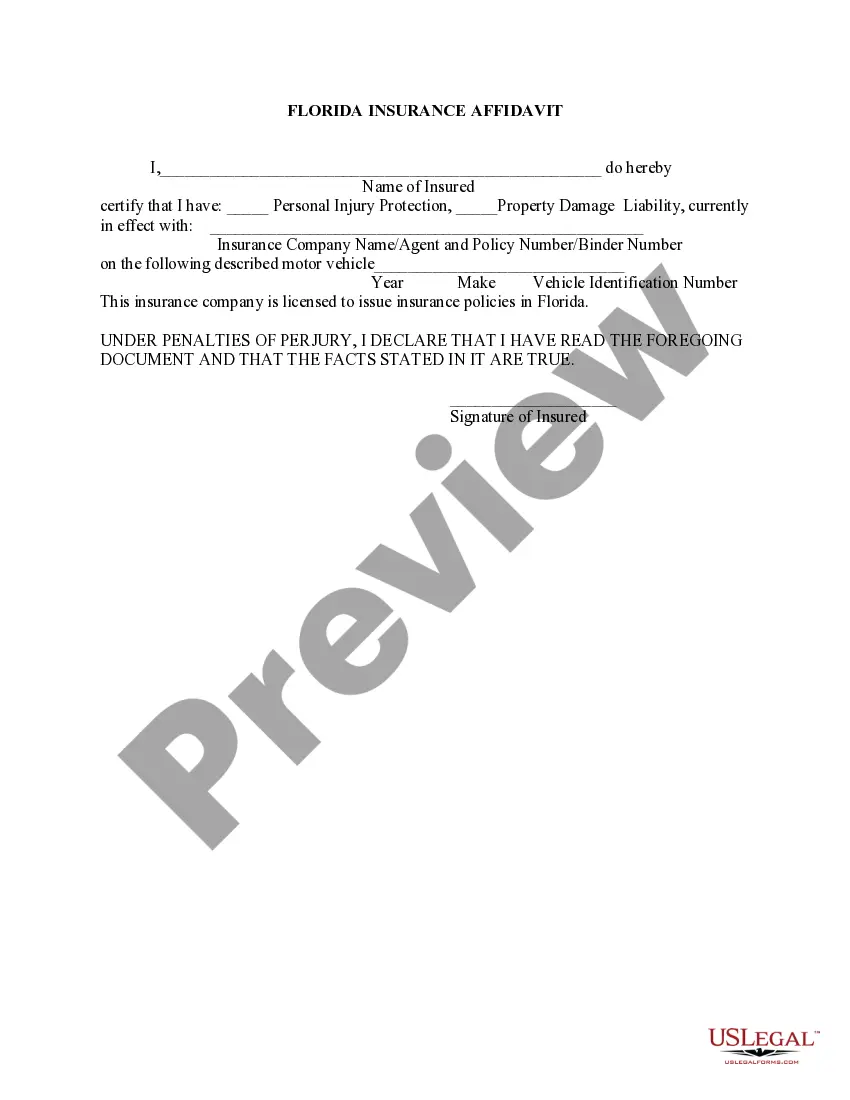

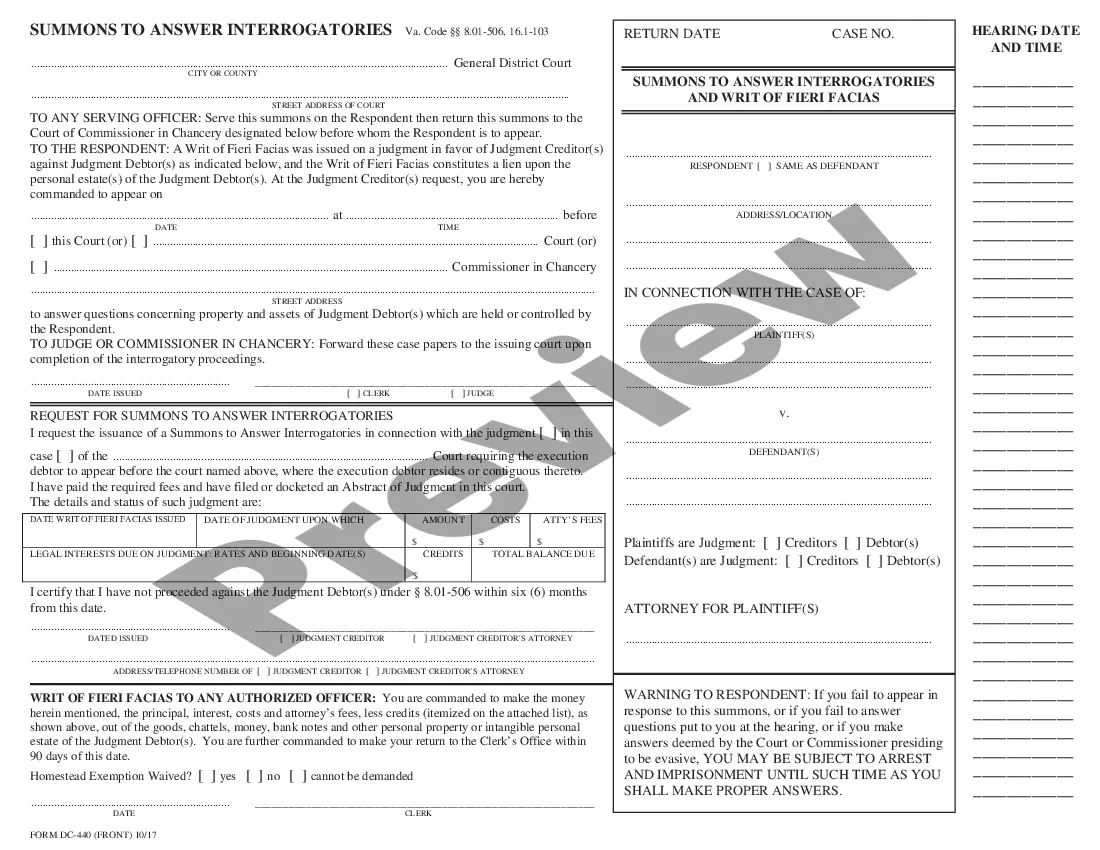

How to fill out Answer By Defendant In A Civil Lawsuit Alleging The Affirmative Defense Of The Cause Of Action Being Barred By Waiver Of Terms Of Contract By Plaintiff?

It’s widely known that you cannot instantly become a legal expert, nor can you swiftly acquire the ability to create an Answer Lawsuit Template For Google Docs without a unique skill set.

Drafting legal documents is a lengthy process that necessitates specific education and expertise. So, why not entrust the creation of the Answer Lawsuit Template For Google Docs to the professionals.

With US Legal Forms, one of the largest repositories of legal documents, you can discover everything from legal filings to templates for internal business correspondence. We understand how essential it is to comply with federal and state regulations. Therefore, on our site, all forms are tailored to specific locations and are current.

You can regain access to your forms at any time from the My documents section. If you are an existing user, you can simply Log In, and find and download the template from the same section.

Regardless of your document's purpose—be it financial, legal, or personal—our website caters to your needs. Give US Legal Forms a try today!

- Utilize the search bar at the top of the page to locate the document you require.

- View it (if this feature is available) and review the accompanying description to determine if the Answer Lawsuit Template For Google Docs fits your needs.

- If you need a different form, restart your search.

- Create a complimentary account and choose a subscription plan to purchase the form.

- Click Buy now. Once your payment is processed, you will have access to the Answer Lawsuit Template For Google Docs, fill it out, print it, and deliver it to the designated parties or organizations.

Form popularity

FAQ

There is no annual fee (sometimes called an ?Annual Report?) in Ohio for LLCs. Should I hire an LLC formation service? You aren't required to hire a professional service company to form your Ohio LLC.

File Your LLC Ohio Articles of Organization For LLCs based in Ohio, you'll need to fill out and file Form 610. For LLCs organized in other states that wish to do business in Ohio, Form 617 is the correct form. The filing fee for both forms is $99 each, and you can file either online or via mail.

Plan to keep your LLC compliant and in active status on the state's website. Ohio LLCs are not required to file an annual report. You may need to pay quarterly tax payments and may also need to maintain a registered agent for your business.

Ohio does not require LLCs to file an annual report. Taxes. For complete details on state taxes for Ohio LLCs, visit Business Owner's Toolkit or the State of Ohio .

Ohio LLCs don't have to file Annual Reports There are no Annual Reports for Ohio LLCs. The Ohio Secretary of State doesn't require you to file any annual information form or pay any annual fee for your LLC. Ohio is one of only 5 states that have a true ?No Annual Report Due?.

Starting an LLC in Ohio is absolutely free with Inc Authority. Simply pay the mandatory state filing fee of $99 and Inc Authority will take care of the rest for you at no extra charge.

No, you don't need to renew your LLC every year in Ohio or file annual reports. Instead, you have to consistently maintain state obligations like registered agent requirements and business levies.

The price to start an Ohio LLC is $99. Forming your LLC in Ohio starts with filing Articles of Organization with Ohio's Secretary of State. Regular filings (mail, in person, and online) take about 3-7 days to be processed. Expedited filings are available for additional fees, starting at $100 for 2-day process.

You can form an Ohio LLC online or by submitting Form 610, Articles of Organization for a Domestic Limited Liability Company. The filing fee is $99. To file online, visit the Ohio Secretary of State's business filing portal. Otherwise, you may download the documents and mail them to P.O. Box 670, Columbus, Ohio 43216.

ANSWER: No. Filing the annual notice is not a requirement in order to be treated as an S corporation for Ohio franchise and income tax purposes.