Report Accident With Geico

Description

How to fill out Sample Letter Requesting Copy Of Accident Report?

It’s clear that you cannot become a legal professional instantaneously, nor can you learn how to swiftly create Report Accident With Geico without a specialized education.

Drafting legal paperwork is a lengthy process that necessitates particular training and expertise. So why not entrust the creation of the Report Accident With Geico to the experts.

With US Legal Forms, which boasts one of the most comprehensive collections of legal templates, you can discover everything from court documents to templates for internal corporate correspondence. We recognize how vital it is to comply with both federal and state regulations. Therefore, all of our forms are specific to your location and continually updated.

You can regain access to your documents from the My documents section whenever needed. If you are an existing client, simply Log In, and find and download the template from the same section.

Regardless of the purpose of your forms—whether financial, legal, or personal—our platform caters to all your needs. Experience US Legal Forms today!

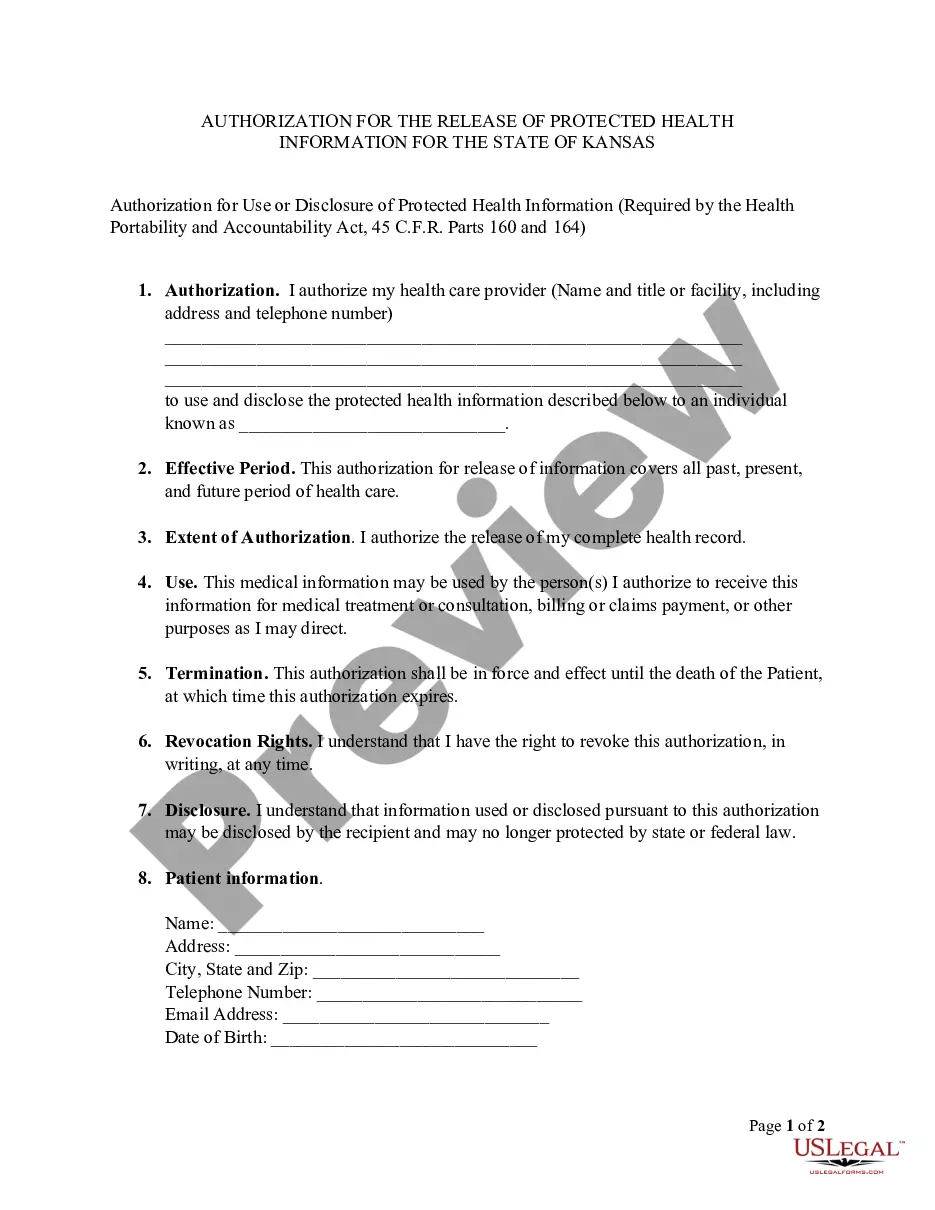

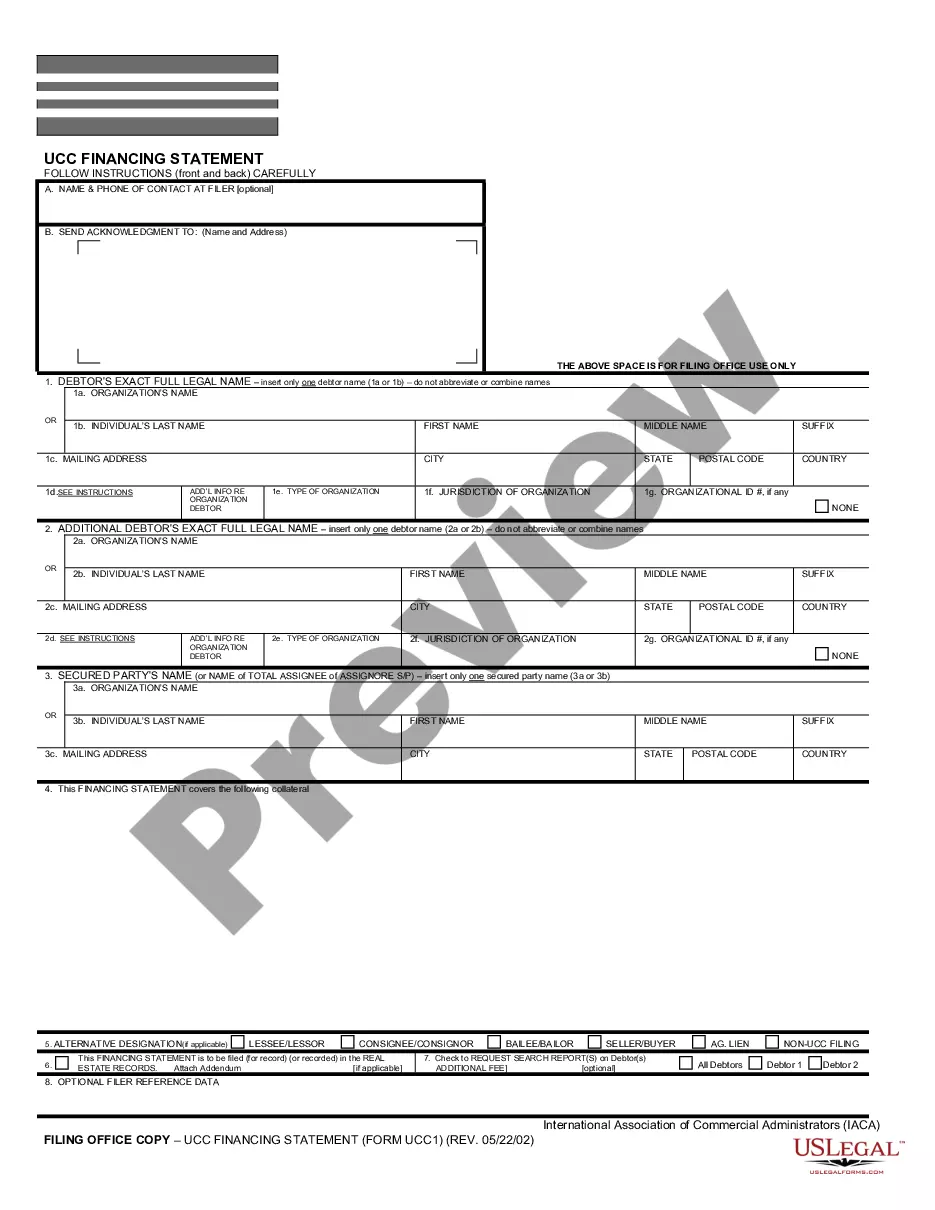

- Locate the document you require by utilizing the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Report Accident With Geico matches your needs.

- Begin your search anew if you require any other document.

- Sign up for a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. After the payment is processed, you can download the Report Accident With Geico, fill it out, print it, and send or mail it to the required individuals or organizations.

Form popularity

FAQ

Geico is owned by Berkshire Hathaway, a major American multinational conglomerate. This acquisition enhances Geico's capacity to serve you better, offering reliable insurance coverage. When you report an accident with Geico, you benefit from the robust resources and stability of a reputable company. Their solid backing ensures you have the support required during challenging times.

Track and manage your claim any time using the GEICO Mobile app. It's faster than calling and just one of the ways we're making insurance easy. You can also visit the GEICO Claims Express page to access your claim fast and securely. You'll need your claim number to get started.

1. Access your claim on your mobile device from our app or geico.com and select Easy Photo Estimate as your repair estimate type. 2. Take pictures of your damage from a few angles and upload them to your claim (we'll guide you).

Section 11 of the Limitation Act 1980 (LA 1980) states the limitation period for a personal injury claim, which include road traffic accident claims, is three years. The three-year time limit applies to either of the following. Three years from the date of the accident.

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident?if you have that available.

Most policies do not provide a strict deadline or window of time (30 days, 60 days, etc.). Instead, you are usually required to make your claim "promptly" or "within a reasonable time." Some states (especially those that follow a no-fault car insurance system) have passed laws that specifically address this issue.