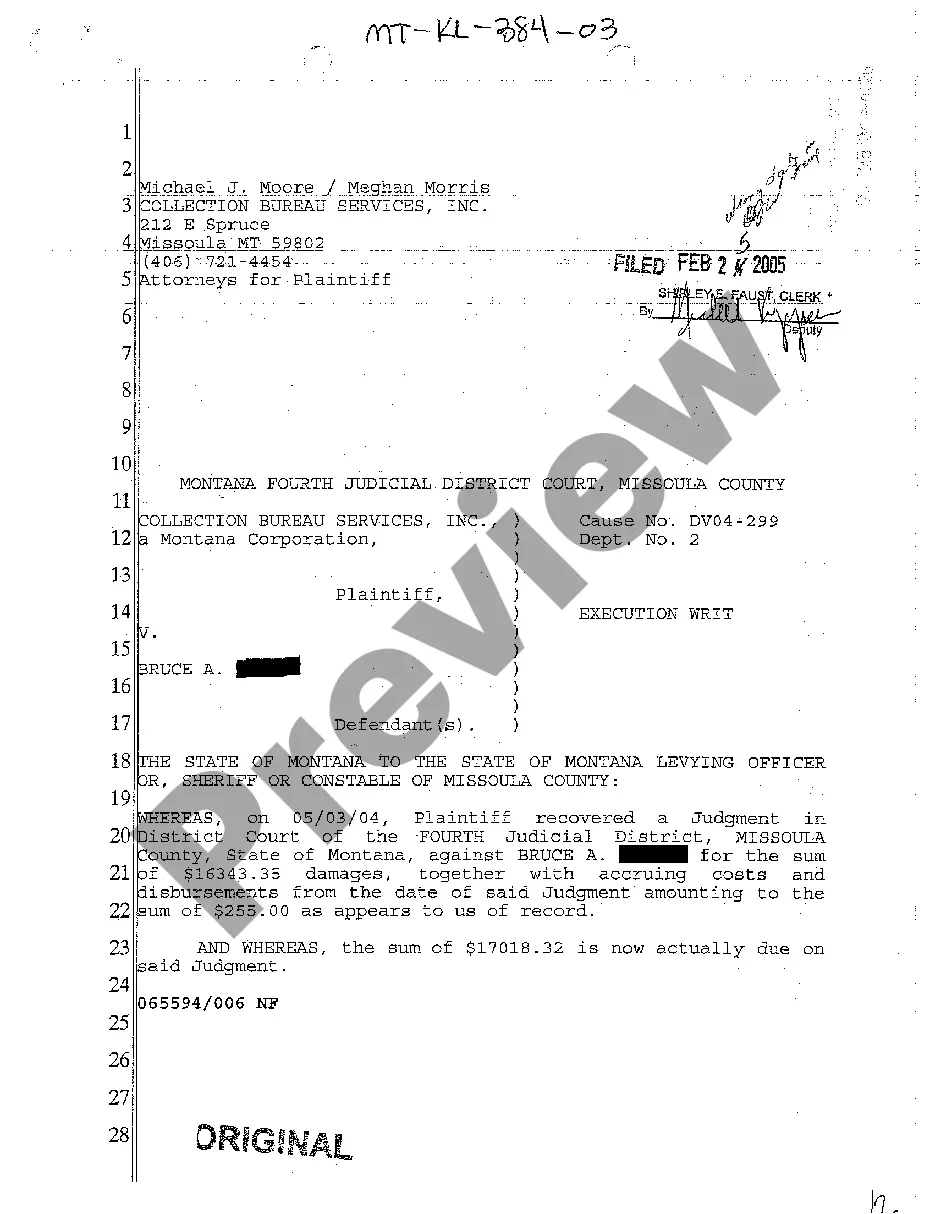

Business Note Buying With Example

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

Securing legal forms that adhere to national and local regulations is crucial, and the web provides numerous alternatives to select from.

However, what is the use of spending time searching for the appropriate Business Note Buying With Example template online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms stands as the largest digital legal repository boasting over 85,000 editable templates crafted by legal professionals for various business and personal situations. They are easy to navigate with all documents sorted by state and intended use.

All templates you discover through US Legal Forms can be reused. To retrieve and fill out forms you have already saved, navigate to the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts keep up with legislative changes, ensuring you can always trust that your form is current and compliant when you obtain a Business Note Buying With Example from our platform.

- Acquiring a Business Note Buying With Example is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In and download the document template you need in the correct format.

- If you are a newcomer to our site, follow the steps outlined below.

- Review the template using the Preview option or via the text summary to confirm it meets your requirements.

Form popularity

FAQ

When structuring a business buyout, it’s essential to establish clear terms that protect both parties. In business note buying with example, you can negotiate seller financing options that provide security through a promissory note. Including terms for payments, interest rates, and contingencies can ensure a smooth transition. Platforms like US Legal Forms offer the necessary tools and templates to streamline the buyout process.

A reasonable interest rate for a promissory note depends on various factors such as the borrower's credit profile and market conditions. Rates typically range from 5% to 12%. Engaging in business note buying with example provides you insights into industry standards and helps you assess what might be fair in your specific case. Always conduct thorough research to secure the best possible rate.

The interest rate on a seller note typically reflects the risk involved and the financial health of the business being sold. Rates usually lie between 5% and 9%. Engaging in business note buying with example can illuminate the best practices and typical rates you should expect. Use this information to negotiate favorable terms.

The typical interest rate for a seller note can vary based on several factors, including the business type and market conditions. Generally, rates can range from 5% to 10%. For specific insights, consider business note buying with example, which helps you understand these variances and ensures you make informed decisions. Consulting financial platforms can also provide guidance tailored to your situation.

The risk of a seller note often lies in borrower default, which can lead to financial loss for the seller. It's also important to consider the market conditions that may affect the buyer's ability to repay. Being aware of these risks is vital in the context of business note buying with example.

Writing a business note involves clearly stating the purpose, terms, and obligations of the parties involved. Incorporate crucial details such as payment timelines and interest rates, ensuring all parties understand the agreement. This clarity is essential for successful business note buying with example.

Seller notes are typically structured with a principal amount, interest rate, and repayment terms. You may choose to create monthly or quarterly payments based on your agreement. Understanding this structure can aid your business note buying with example, as it sets clear expectations.

To structure a seller note effectively, you should outline the key terms, payment schedule, and interest rates. Consider including a clear timeline for repayments and any penalties for late payments. This approach enhances clarity for both parties involved in business note buying with example.

Offering to buy someone's business involves presenting a formal proposal that showcases the advantages of the sale. Begin by expressing your interest clearly and backing it up with market data and personal insights. Establish trust by communicating openly, addressing potential concerns, and outlining the selling process. Tools available on US Legal Forms can guide you in drafting a compelling and professional offer.

The worth of a business with $500,000 in sales generally depends on several factors, such as profitability, industry trends, and market conditions. Traditionally, businesses may be valued at a multiple of sales or earnings, which can vary widely. For a clearer idea, consider consulting valuation tools or professionals who specialize in business note buying with example scenarios. This can give you a more accurate estimate tailored to your unique situation.