Financial Form Sample For Tax Purposes

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Accessing legal templates that comply with federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the correctly drafted Financial Form Sample For Tax Purposes sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any business and personal scenario. They are simple to browse with all papers collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be confident your form is up to date and compliant when acquiring a Financial Form Sample For Tax Purposes from our website.

Obtaining a Financial Form Sample For Tax Purposes is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Examine the template utilizing the Preview option or through the text description to ensure it meets your needs.

- Browse for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Financial Form Sample For Tax Purposes and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Lay out your income statement. Put the net sales on one line. Underneath that, put the cost of sales. ... Put the operating costs in general categories underneath the gross profit. ... Next, have a line each for the interest and the taxes. ... The final line should be the net income.

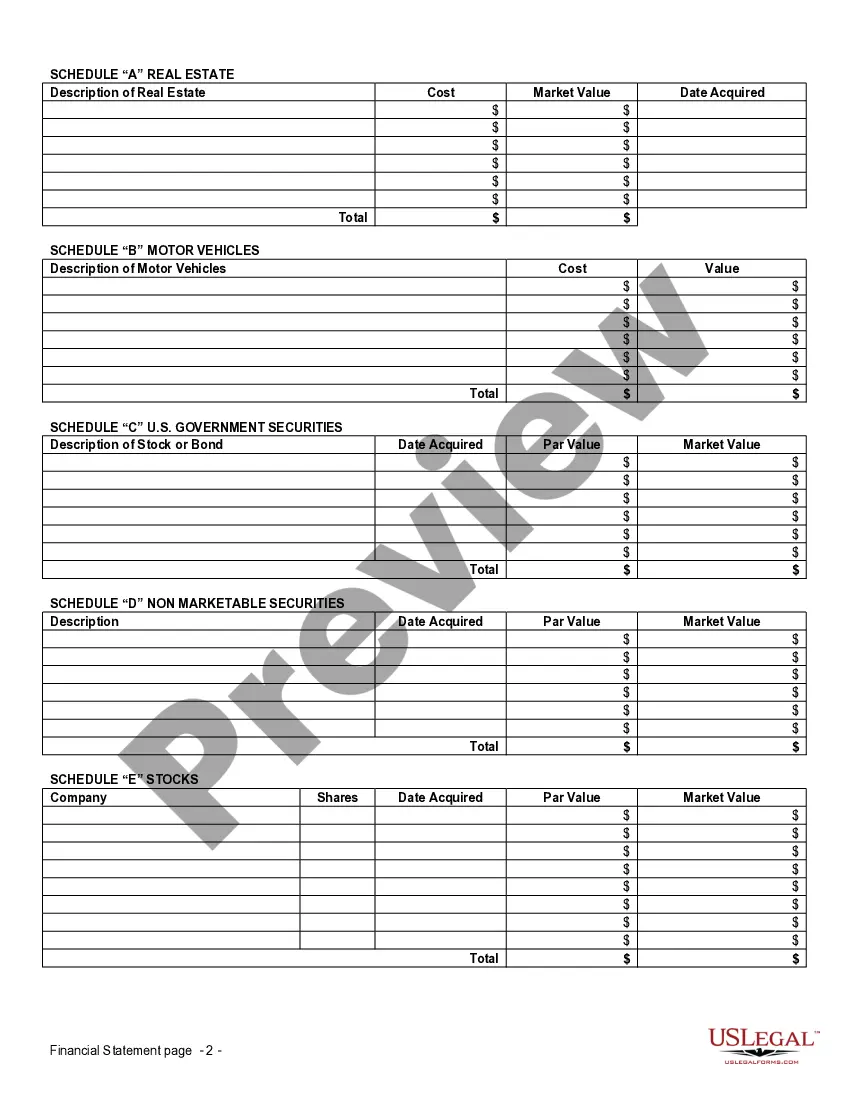

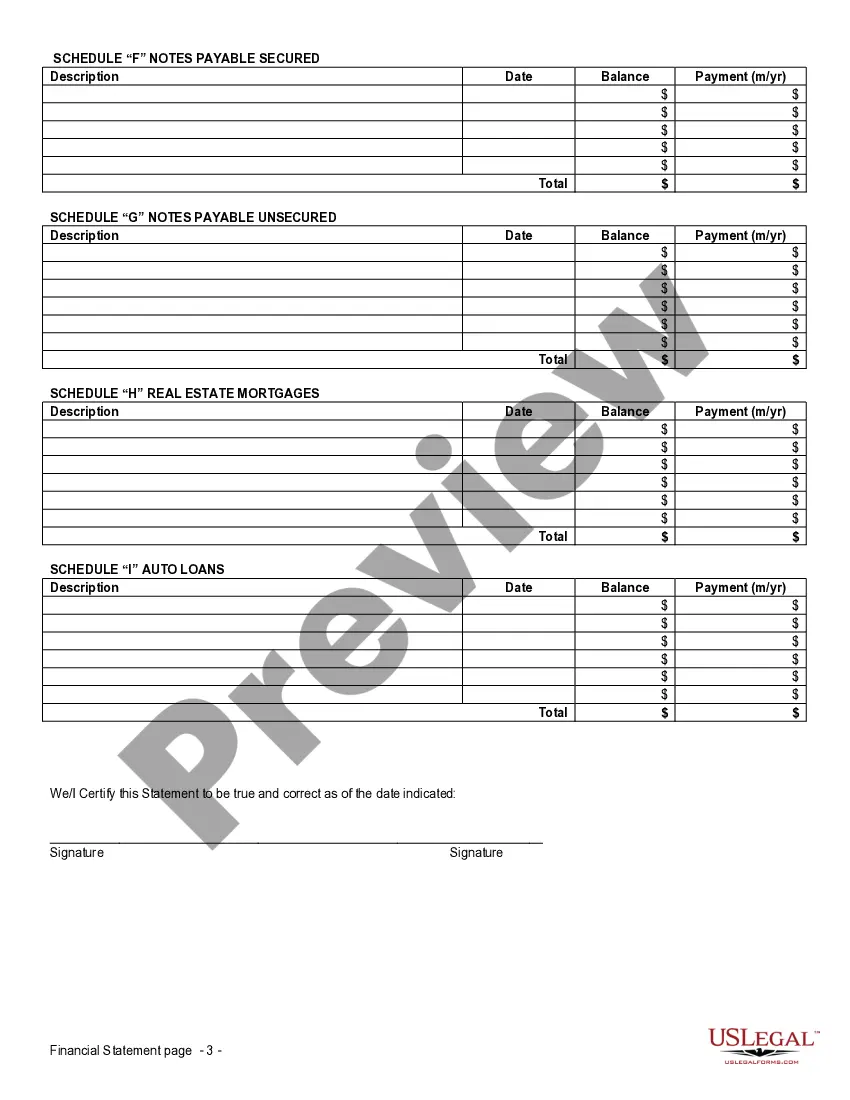

A personal financial statement is a spreadsheet that details the assets and liabilities of an individual, couple, or business at a specific point in time. Typically, the spreadsheet consists of two columns, with assets listed on the left and liabilities on the right.

How to Fill Out Form 1040 for 2022 | Taxes 2023 | Money Instructor YouTube Start of suggested clip End of suggested clip Finally you will determine your tax bill or refund. This will tell you whether you have already paidMoreFinally you will determine your tax bill or refund. This will tell you whether you have already paid any or all of your tax bill and whether you are eligible for a refund if you have overpaid.

Form 1040 for IRS Tax Filing Document is the most commonly used form.

IRS Form 1040 is the standard federal income tax form people use to report their income, claim tax deductions and credits, and calculate the amount of their tax refund or tax bill for the year.