South Dakota Release Of Mortgage Form Form

Definition and meaning

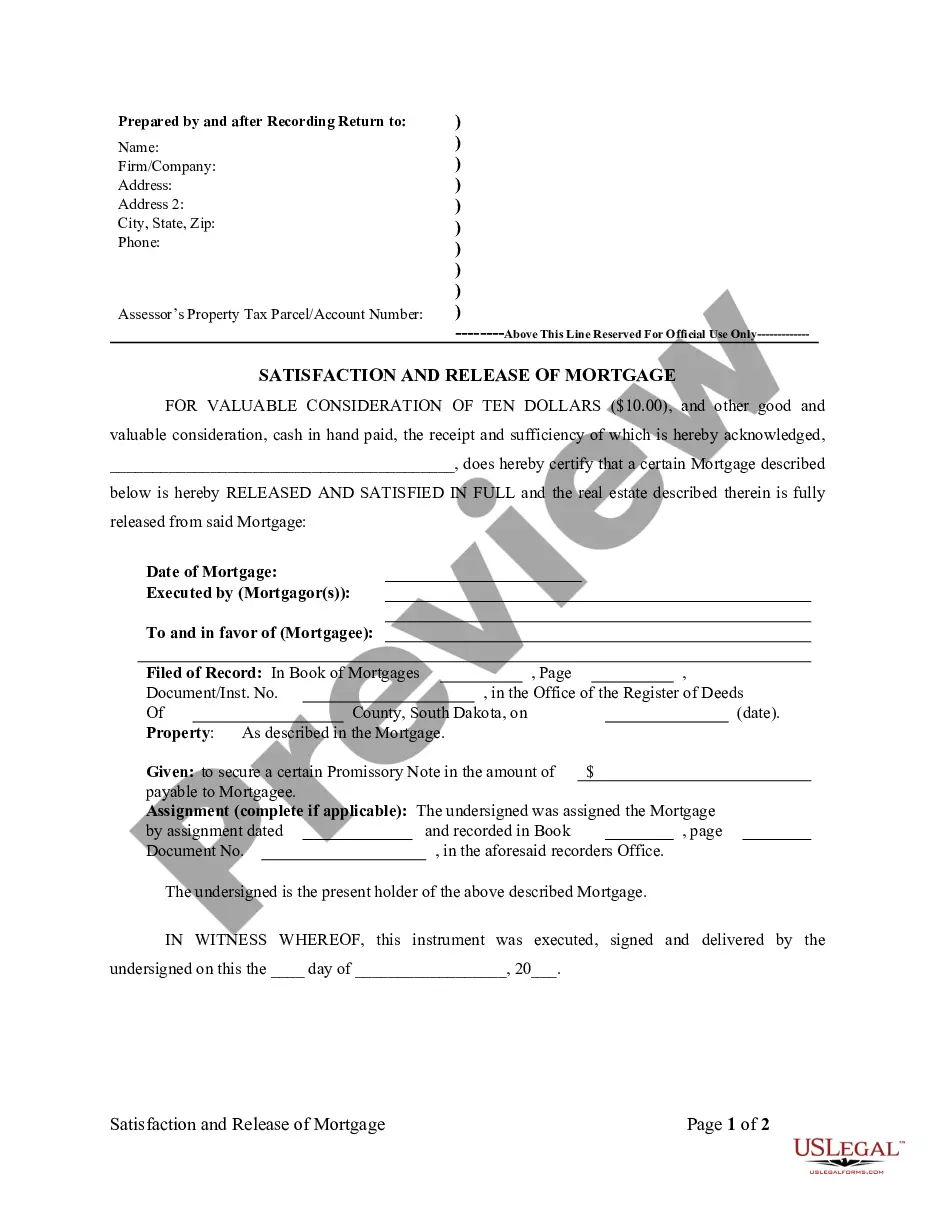

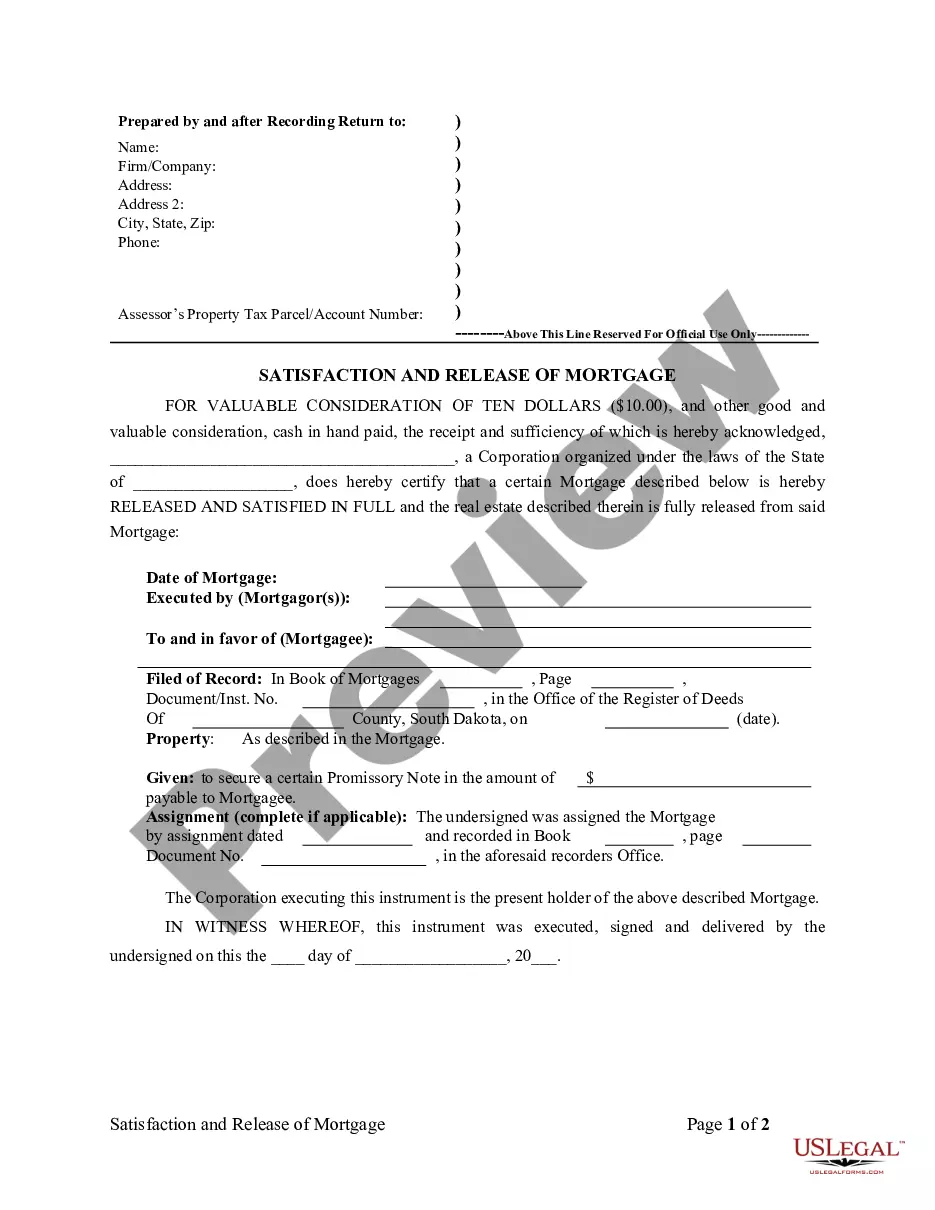

The South Dakota Release of Mortgage Form, also known as the Deed of Release or Satisfaction of Mortgage, is a legal document that formally confirms the satisfaction of a mortgage. This document is essential when a borrower pays off their mortgage, indicating that the lender has no remaining claim on the property. This release allows for clear ownership and transfer of property titles back to the owner.

How to complete a form

Completing the South Dakota Release of Mortgage Form involves several key steps:

- Gather Required Information: Collect details including the original mortgage date, the names of the mortgagor(s) and mortgagee, and the property description.

- Complete the Form: Fill in the necessary sections, ensuring accuracy. This includes recording the date of mortgage and any relevant documentation numbers.

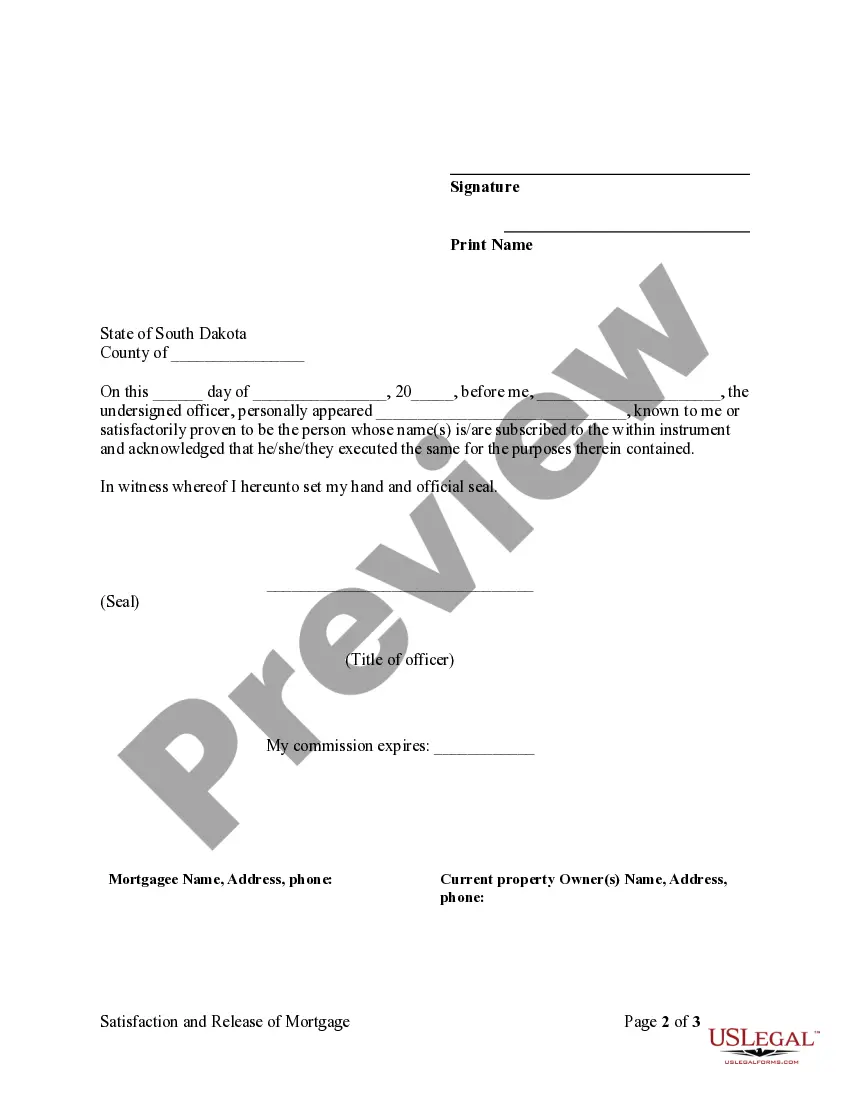

- Sign and Date: Sign the form in the presence of a notary public to ensure validity.

- Record the Document: After notarization, file the completed form with the local county Register of Deeds to officially release the mortgage.

Who should use this form

The South Dakota Release of Mortgage Form should be used by individuals or entities that have fully paid off their mortgage. This includes homeowners who wish to clear their property title from the lender's claim, ensuring their ownership is legally recognized without encumbrances.

Legal use and context

This form serves as a legal instrument to confirm that a mortgage obligation has been fulfilled. It is necessary in real estate transactions to indicate that the mortgage debt has been satisfied, providing assurance to future buyers or lenders that the property is free of the previous mortgage. Its legal validity is reinforced through the notarization process and the official recording in the county office.

Common mistakes to avoid when using this form

When using the South Dakota Release of Mortgage Form, be mindful of these common mistakes:

- Incomplete Information: Ensure all fields are filled out accurately to prevent delays in processing.

- Incorrect Notarization: Verify that the form is signed in the presence of a licensed notary public.

- Failure to Record: Remember to file the completed form at the appropriate county office for it to take effect.

What documents you may need alongside this one

In addition to the South Dakota Release of Mortgage Form, you may need the following documents:

- The original mortgage agreement

- Proof of payment or satisfaction of any outstanding loan amounts

- A copy of the notarized release form for your records

How to fill out South Dakota Release Of Mortgage By Lender - Individual Lender Or Holder?

How to locate professional legal documents that comply with your state's regulations and prepare the South Dakota Release Of Mortgage Form without consulting an attorney.

Numerous services online provide templates to address various legal circumstances and formalities. However, it may require time to ascertain which of the available samples meet both your use case and legal requirements.

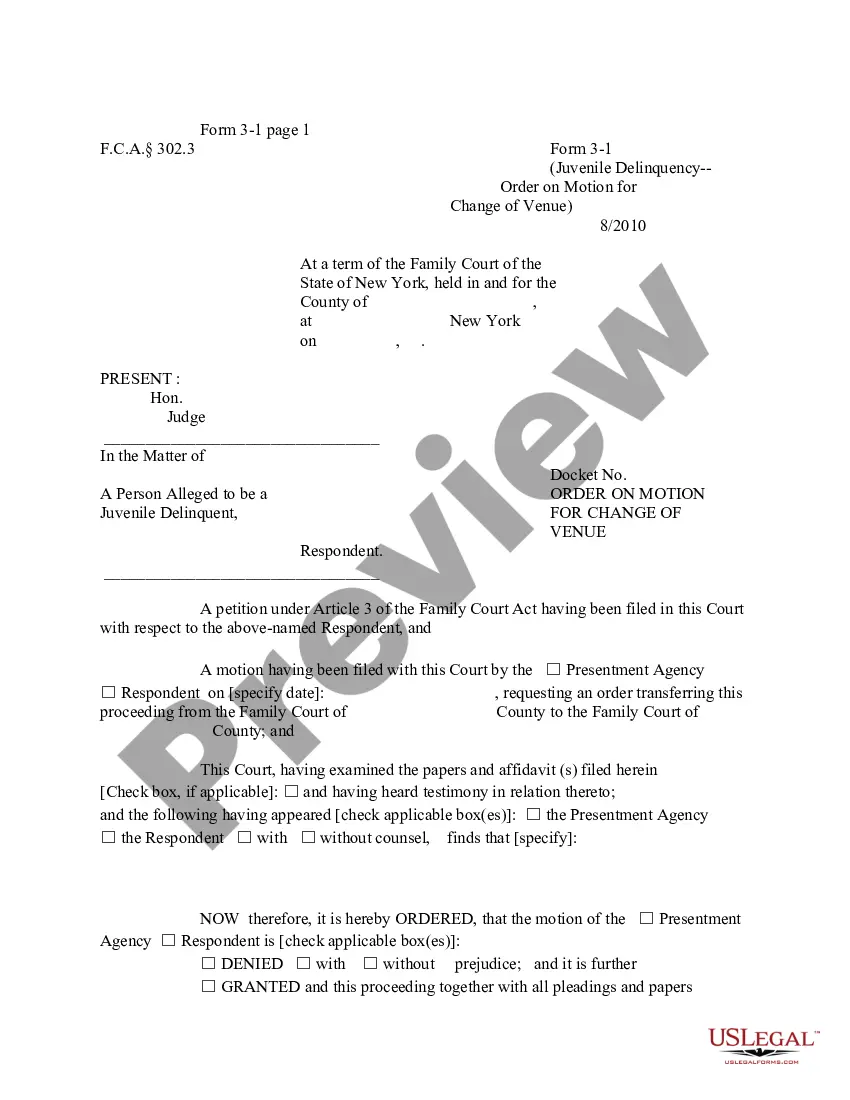

US Legal Forms is a dependable platform that assists you in finding official documents created in alignment with the latest state law updates, helping you save on legal services.

If you do not have an account with US Legal Forms, follow the steps below: Review the webpage you've opened and verify if the form meets your requirements. Utilize the form description and preview options if present. If needed, look for another sample in the header specifying your state. Click the Buy Now button once the appropriate document is located. Select the most suitable pricing plan, then Log In or preregister for an account. Choose your payment method (by credit card or through PayPal). Select the file format for your South Dakota Release Of Mortgage Form and click Download. The obtained templates will remain accessible to you: you can always revisit them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not just a typical web library.

- It is a compilation of over 85,000 verified templates for diverse business and personal scenarios.

- All documents are organized by category and state, facilitating a quicker and easier search process.

- Moreover, it connects with advanced solutions for PDF editing and electronic signatures, allowing Premium subscribers to promptly complete their documentation online.

- It takes minimal time and effort to acquire the required paperwork.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the South Dakota Release Of Mortgage Form using the designated button next to the file name.

Form popularity

FAQ

Satisfaction of mortgage vs.Both a satisfaction of mortgage and deed of reconveyance indicate that the loan has been fully paid and the lien on the property has been released. A deed of reconveyance, however, is typically used in states where a deed of trust is also utilized.

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

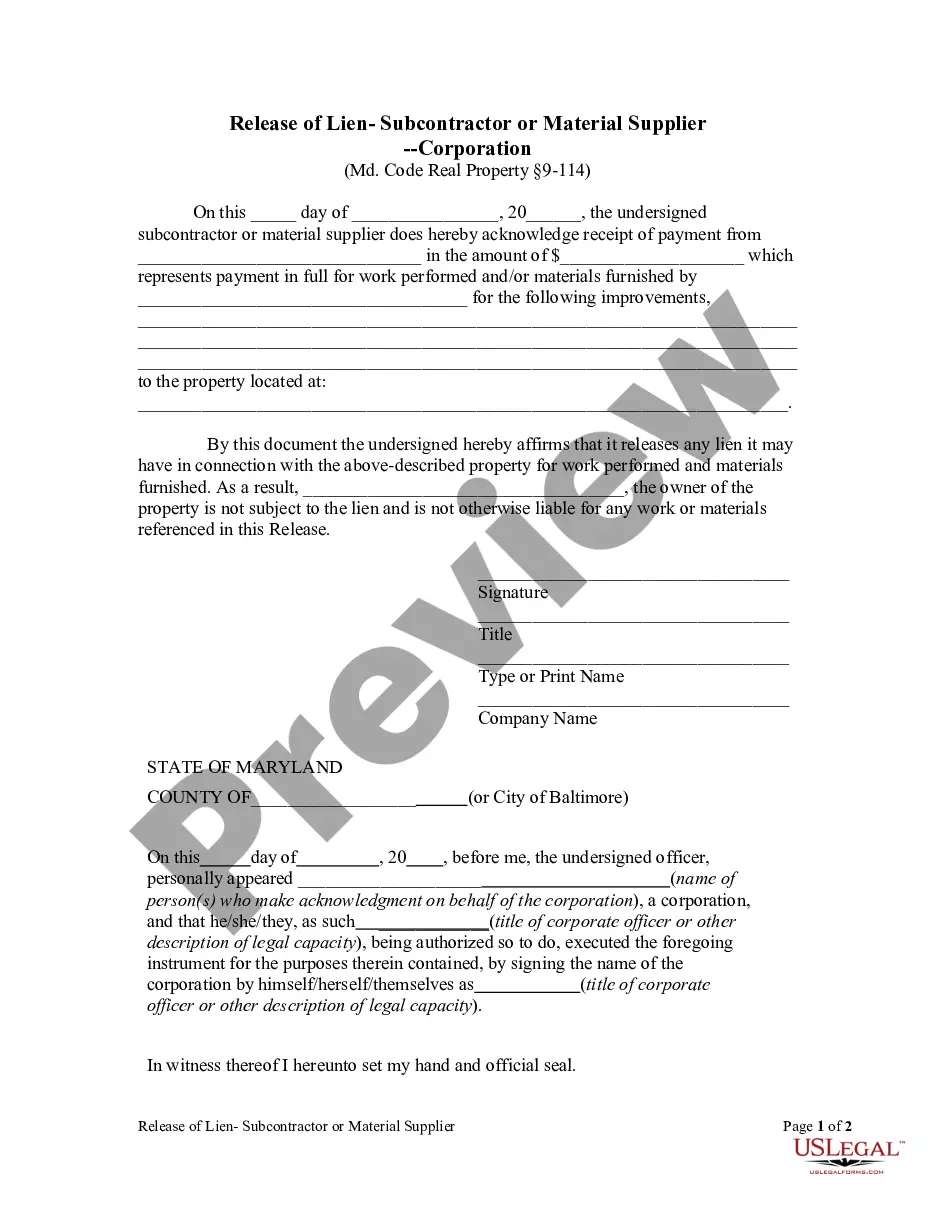

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?