Ucc Financing Statement Michigan For Leased Equipment

Description

How to fill out Michigan UCC1 Financing Statement?

When it's necessary to file a Ucc Financing Statement Michigan For Leased Equipment that adheres to your local state's statutes and regulations, there are multiple alternatives to select from.

You don't need to scrutinize each form to ensure it meets every legal requirement if you are a subscriber to US Legal Forms.

It is a reliable source that can assist you in acquiring a reusable and current template on any topic.

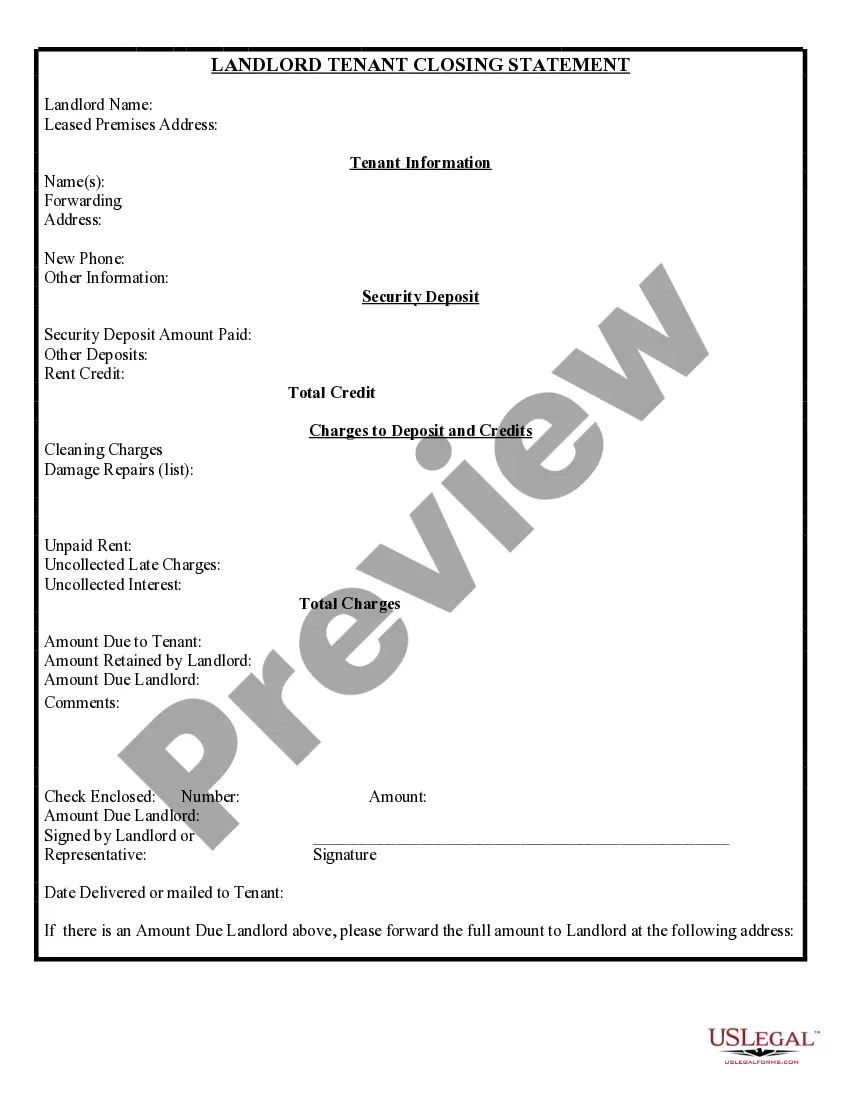

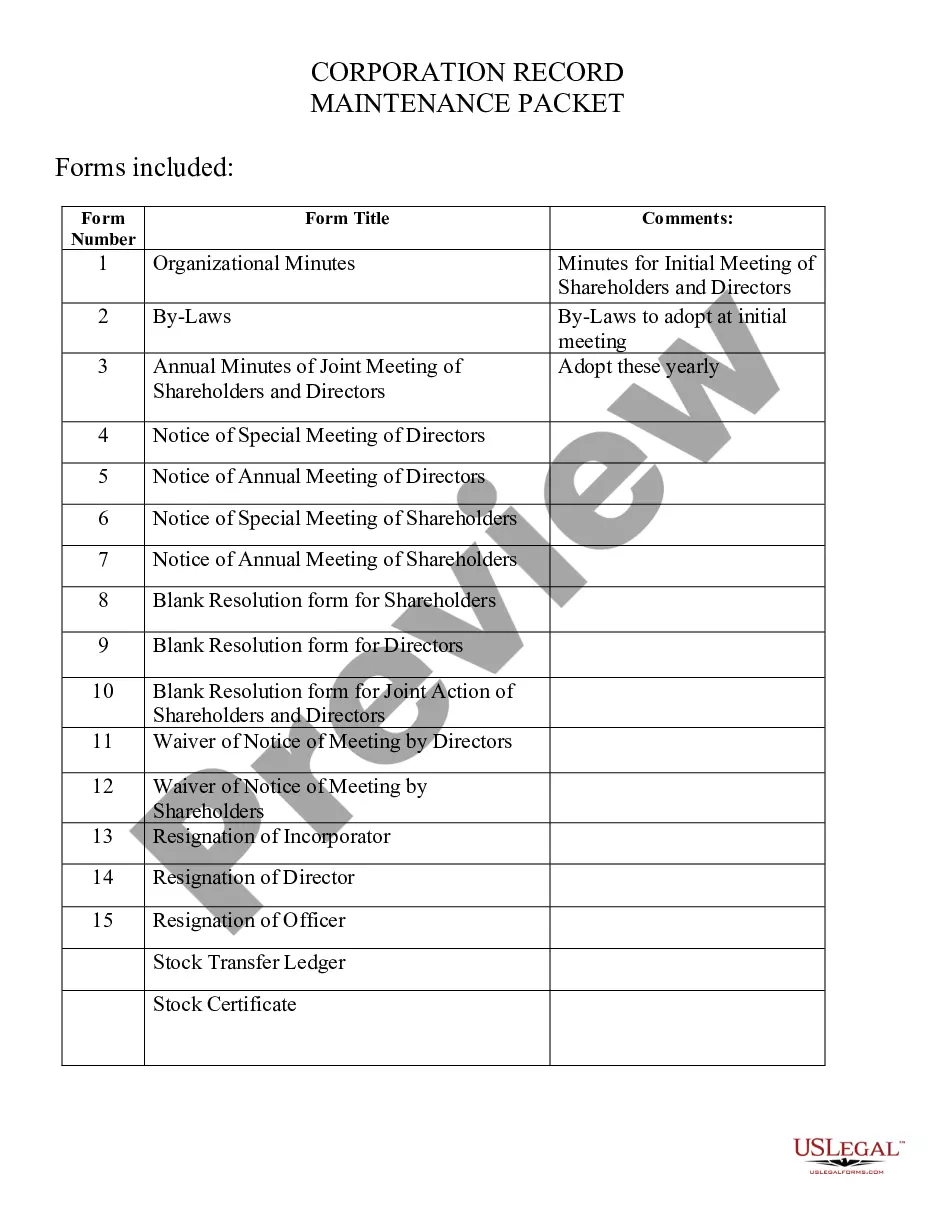

Access the Preview mode and examine the form description if available.

- US Legal Forms is the largest online catalog featuring a compilation of over 85,000 ready-to-use documents for commercial and personal legal situations.

- All templates are validated to meet the regulations of each state.

- Thus, when downloading the Ucc Financing Statement Michigan For Leased Equipment from our site, you can be confident that you possess a legitimate and contemporary document.

- Retrieving the necessary sample from our platform is quite easy.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can navigate to the My documents tab in your profile and access the Ucc Financing Statement Michigan For Leased Equipment anytime.

- If this is your first visit to our website, please follow the instructions below.

- Review the suggested page and verify it complies with your criteria.

Form popularity

FAQ

Addresses. Technically, a correct address is not required for a financing statement to be effective. However, a filing office can (and usually will) reject financing statement without addresses for the Debtor or the Secured Party as allowed under Section 9-516(b)(4) and (5).

A UCC financing statement also called a UCC-1 financing statement or a UCC-1 filing is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

How to complete a UCC1 (Step by Step)Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address.Secured Party Information. Organization or individual's name. Mailing address.Collateral Information. Description of collateral.

Note: Under Article 9 of the Uniform Commercial Code, a financing statement must 1) give the names of the debtor and the secured party, 2) be signed by the debtor, 3) give the address of the secured party, 4) give the address of the debtor, and 5) indicate the items of collateral.

A UCC filing on your business is made to create a lien against the equipment or property used as collateral. Most lenders require a UCC filing because it clearly identifies a specific asset as being the lender's property until the loan or lease is paid and the UCC is released along with title.