South Dakota Divorce Forms With Child

Description

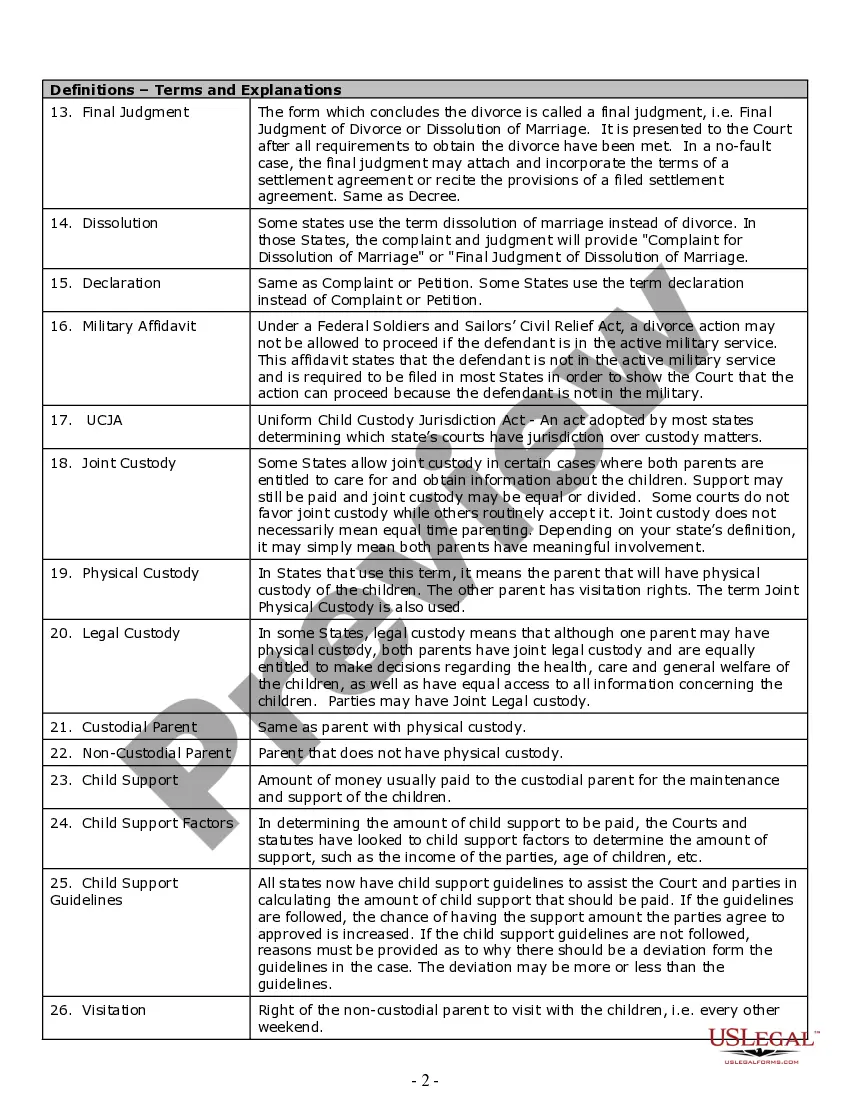

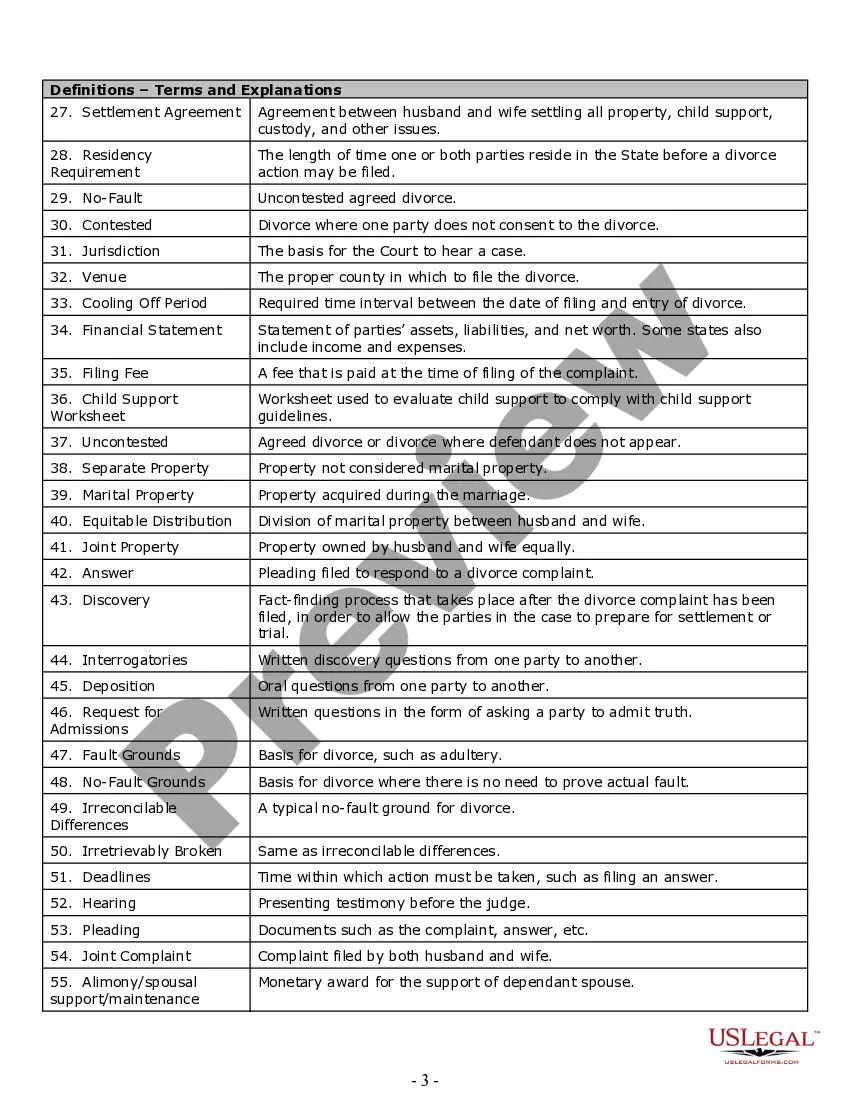

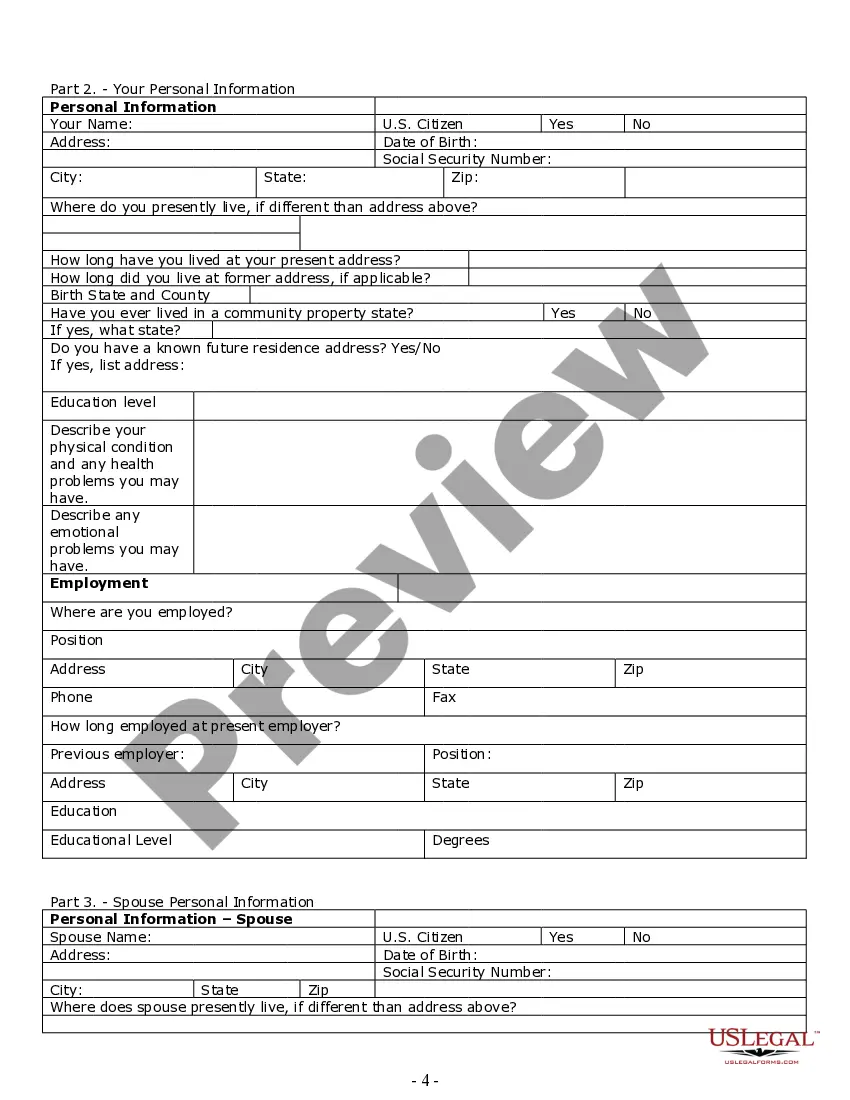

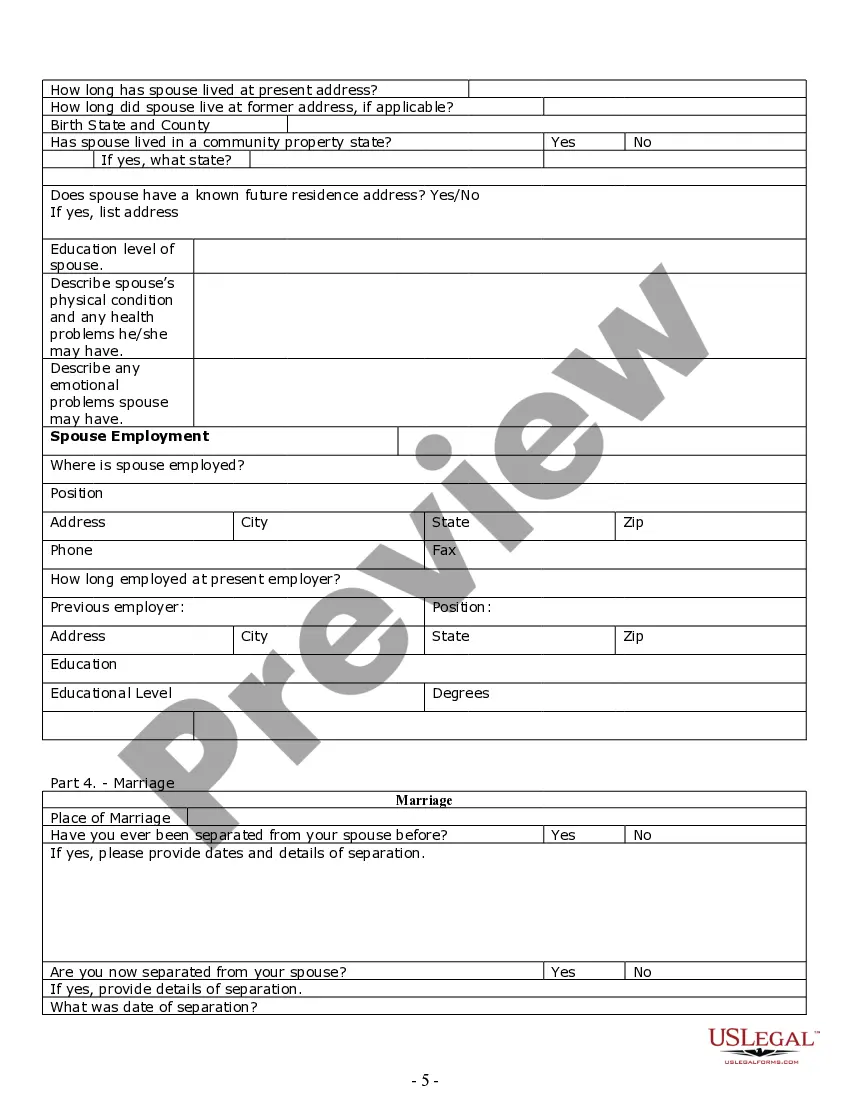

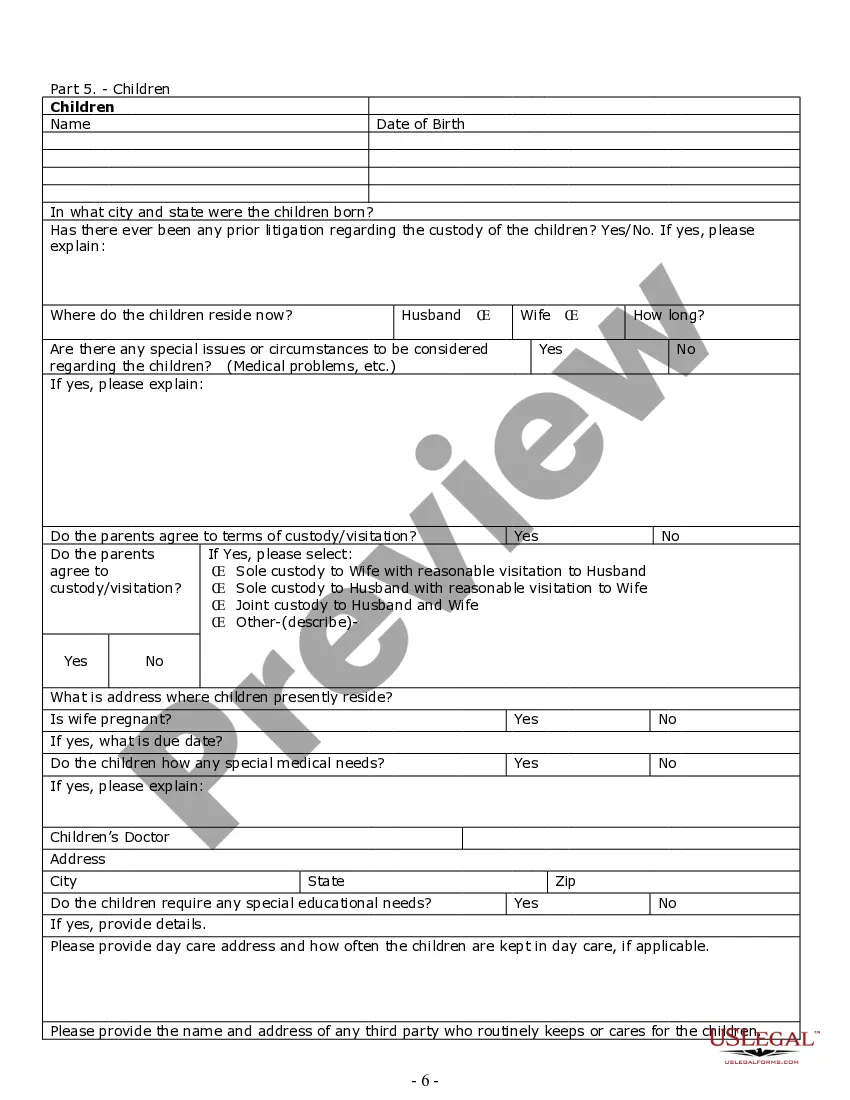

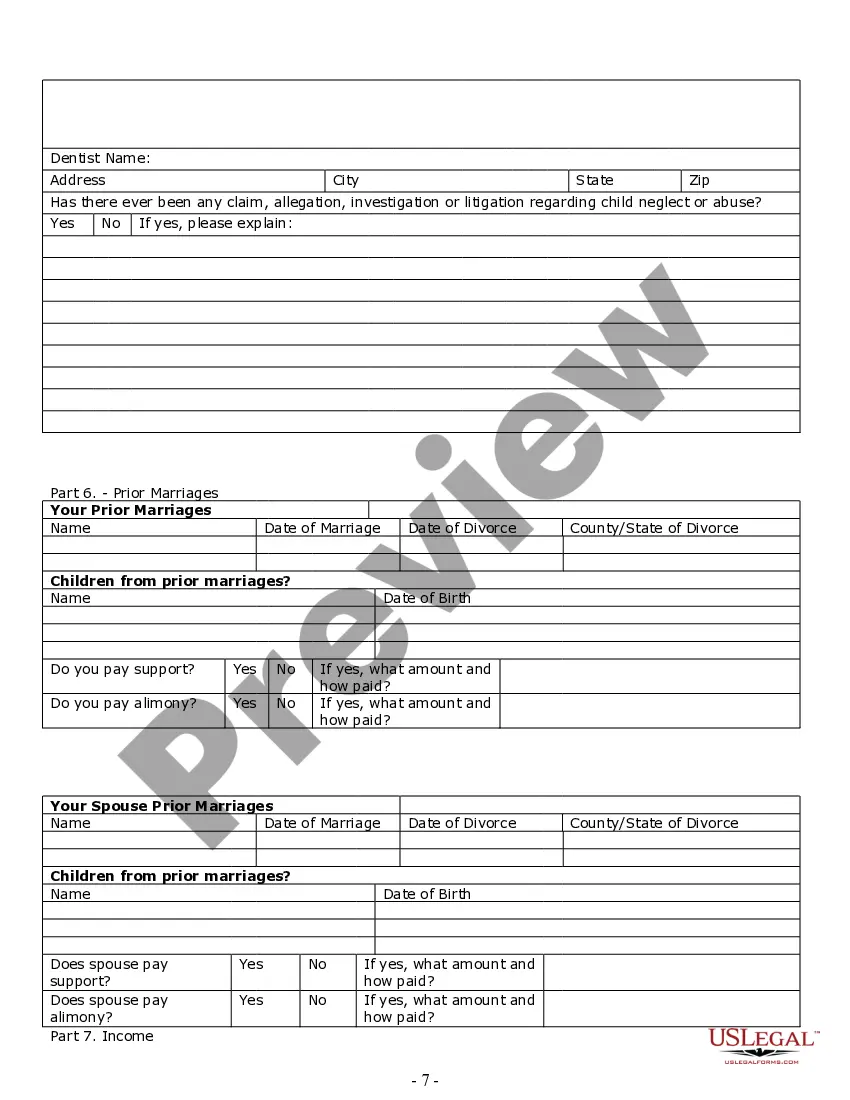

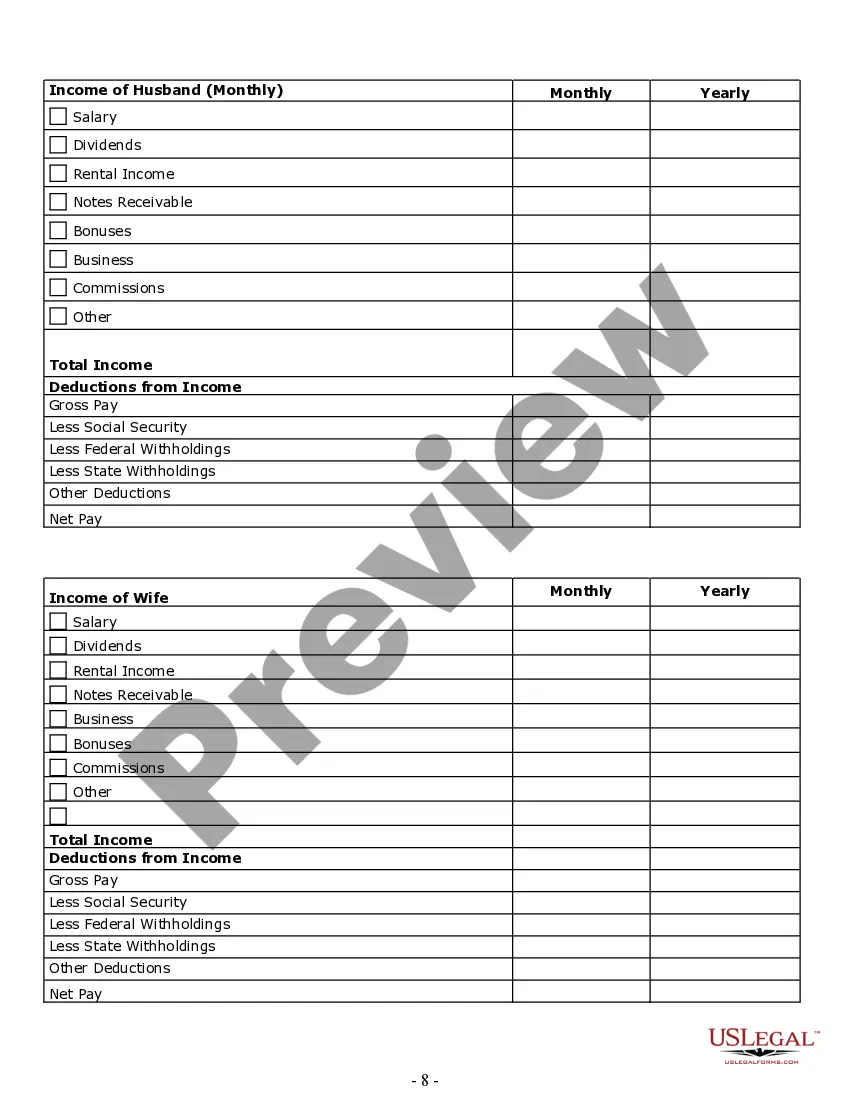

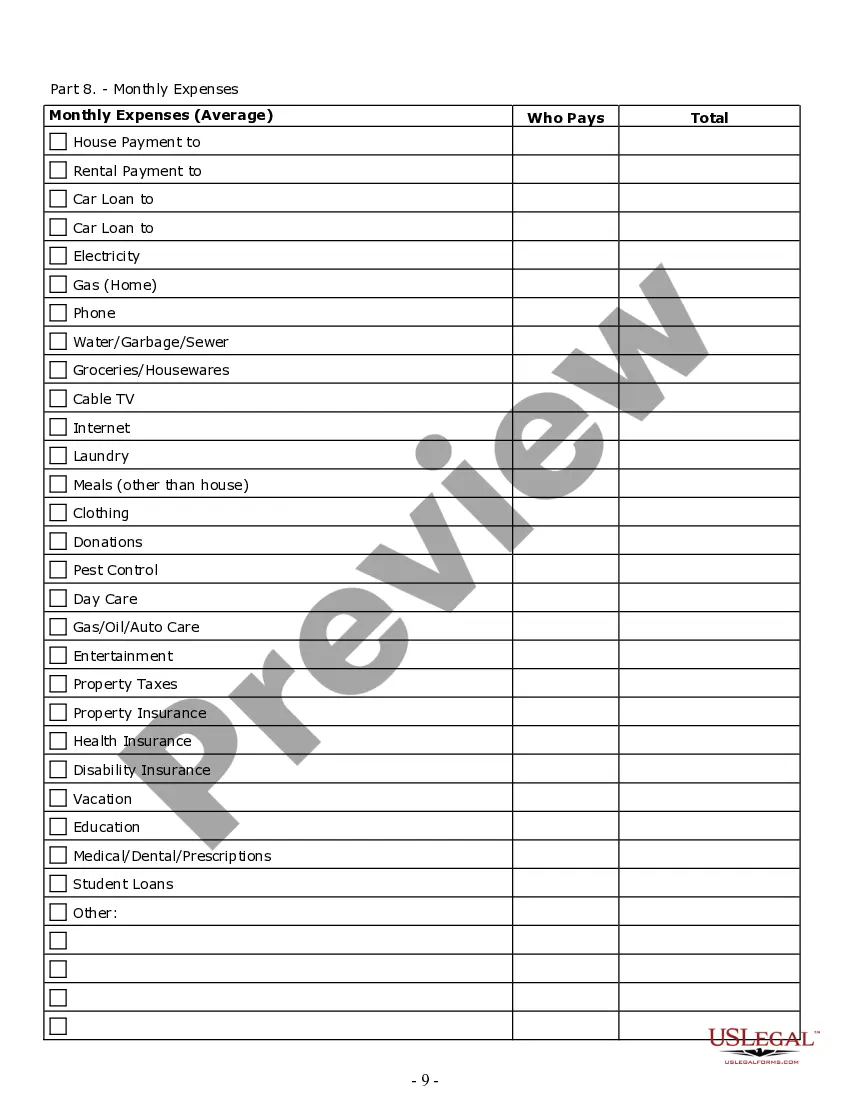

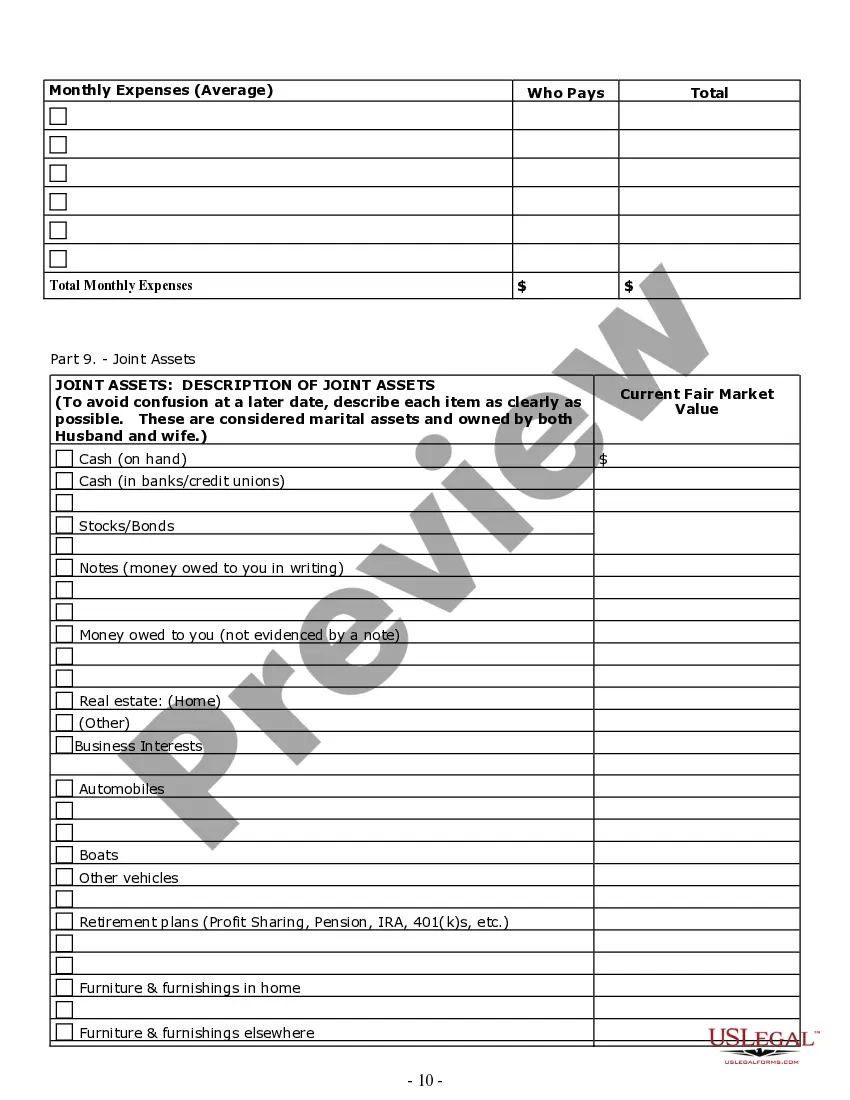

How to fill out South Dakota Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

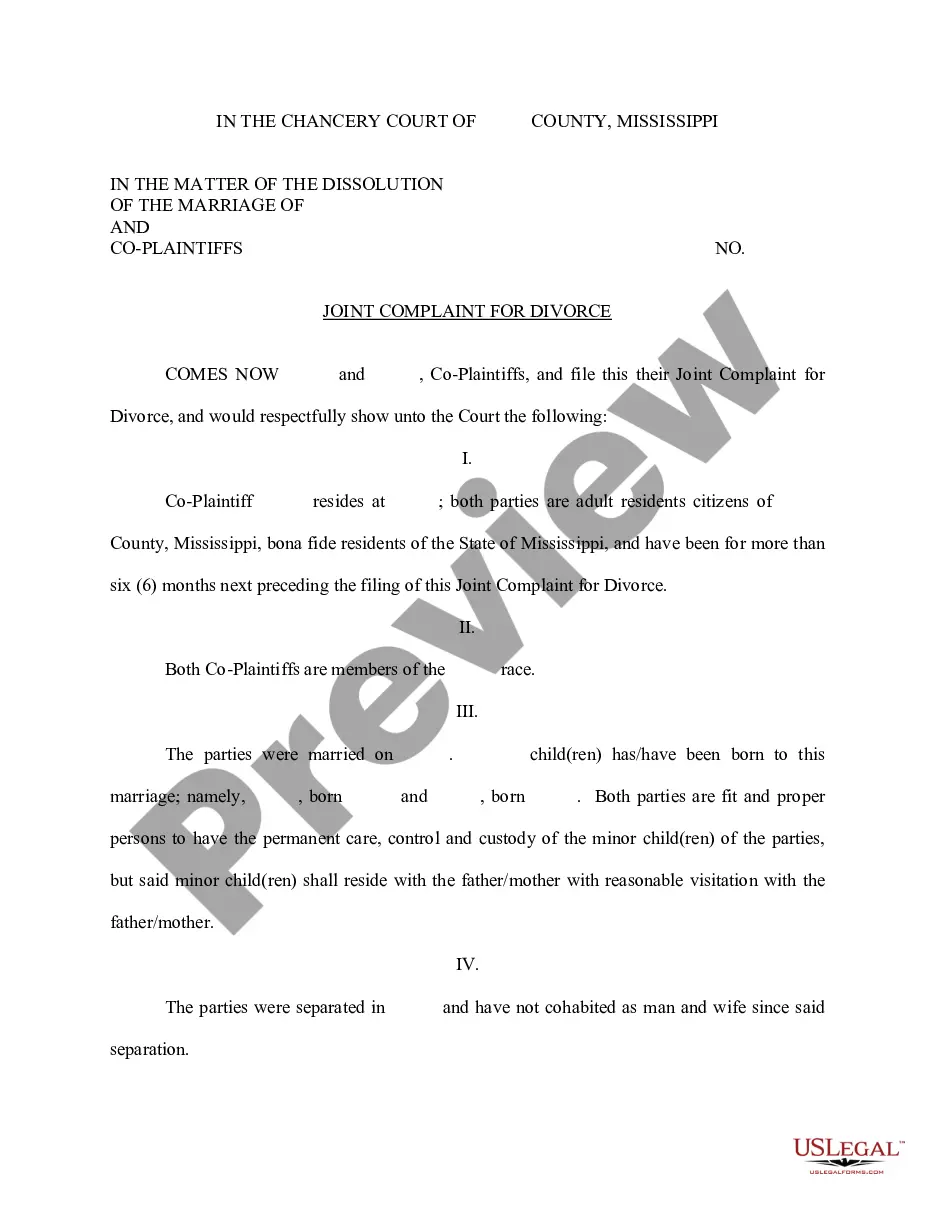

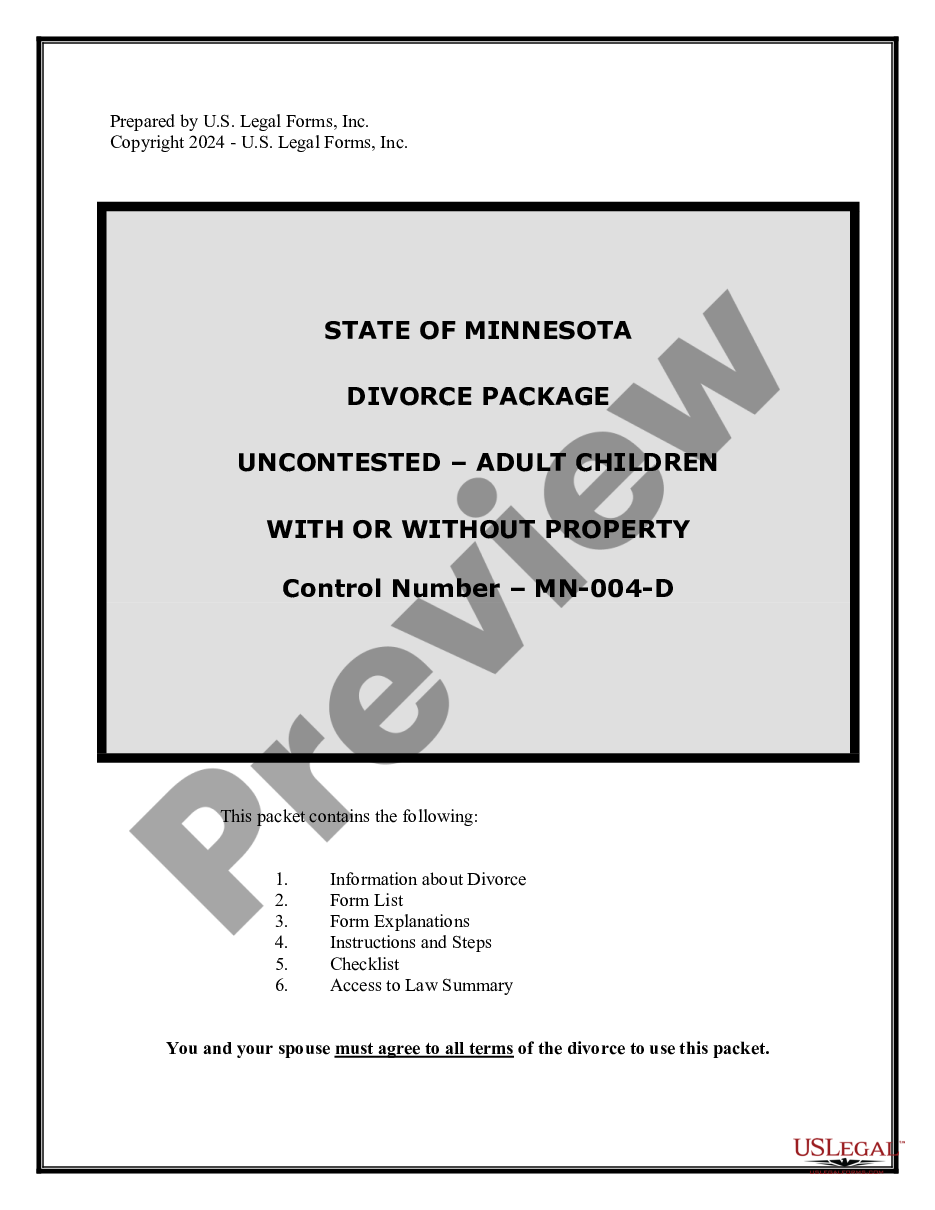

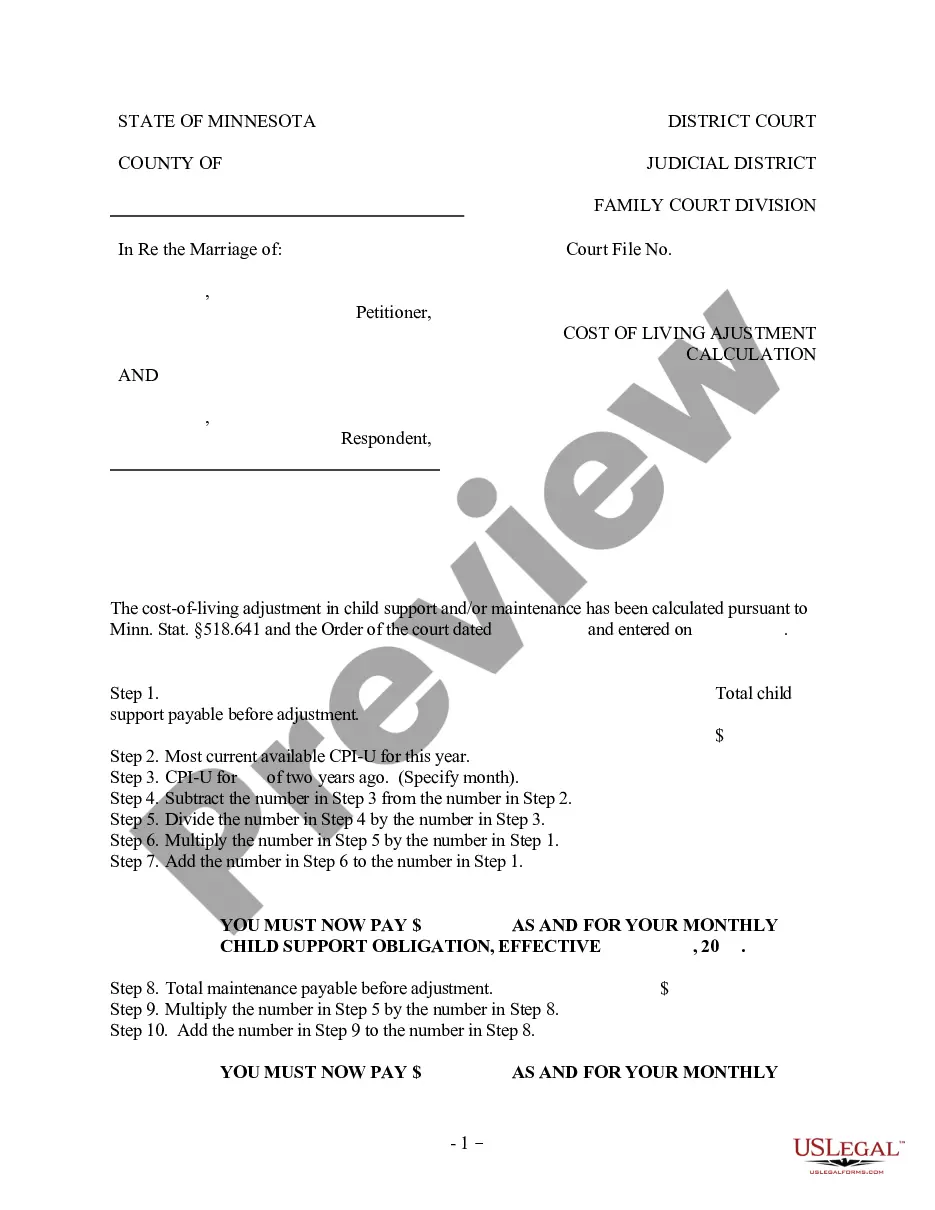

The South Dakota Divorce Papers Involving Children that you observe on this site is a reusable official template crafted by skilled attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific documents for any commercial and personal circumstance. It represents the quickest, easiest, and most reliable method to acquire the papers you require, as the service promises the utmost level of data security and anti-malware safeguards.

Complete and sign the document. Print out the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature. Download your documents one more time. Utilize the same document again whenever necessary. Access the ‘My documents’ tab in your profile to re-download any previously saved forms. Subscribe to US Legal Forms to have validated legal templates for all of life’s situations readily available.

- Search for the form you require and review it.

- Browse through the document you found and preview it or examine the form description to ensure it meets your requirements. If it falls short, utilize the search bar to locate the suitable one. Click 'Buy Now' once you've identified the template you desire.

- Register and Log In.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Pick the format you desire for your South Dakota Divorce Papers Involving Children (PDF, DOCX, RTF) and save the example on your device.

Form popularity

FAQ

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

If you've been contacted by a collection agency, the collectors are required to send you a written notice within five days of the first contact. If you have not received a debt validation letter, you have the right to request one by writing a debt verification letter, or a debt dispute letter.

For closed installment accounts, the statute of limitations runs 6 years after the final payment date. For open accounts, such as credit cards, the statute of limitations begins 6 years from the first uncured missed payment, whether or not there is an acceleration clause.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one. Why? Because it helps you determine if the debt is actually yours and if there's anything fishy going on behind the scenes.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

A debt validation letter is a letter that debt collectors must provide that includes information about the size of your debt, when to pay it, and how to dispute it. A debt collection letter essentially proves you owe the debt collector money.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.