Unconditional Recording Final For The First

Description

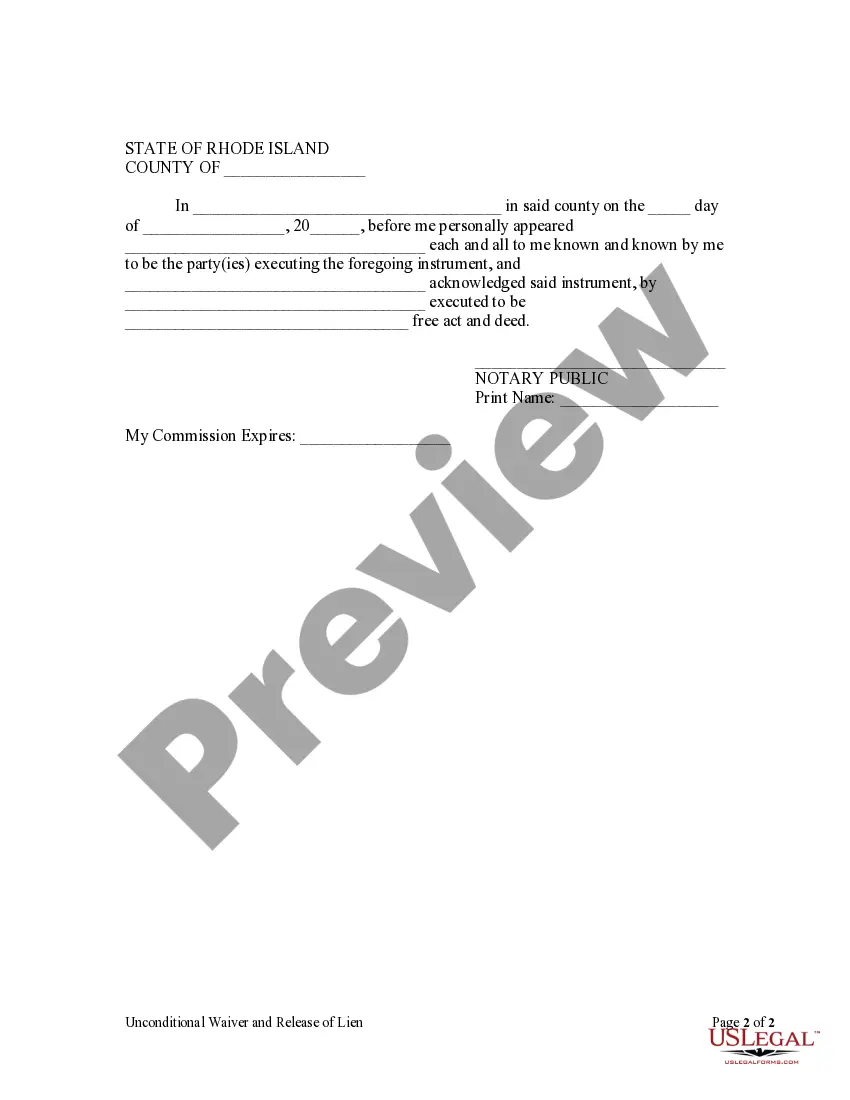

How to fill out Rhode Island Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

- If you're a returning user, log into your account and click Download for the needed template. Confirm your subscription is active; renew it if required.

- If this is your first time, start by browsing our extensive library. Check the Preview mode and form descriptions to select the appropriate document that fits your jurisdiction.

- If you spot a discrepancy or are looking for something specific, use the Search function to pinpoint the correct template.

- Once you've identified the right document, click the Buy Now button and choose your desired subscription plan. You'll need to register for an account to unlock the full library.

- Complete your purchase by entering your credit card or PayPal information to finalize your subscription.

- Finally, download your form and save it to your device. You can access it anytime in the My Forms section of your profile.

US Legal Forms stands out with its robust collection of over 85,000 fillable and editable legal forms, more than any of its competitors, ensuring you have what you need at a similar cost.

Don't hesitate! Start utilizing US Legal Forms today and take advantage of our premium expert assistance to ensure your documents are completed accurately.

Form popularity

FAQ

Unconditional promises to give are recognized as revenues when a commitment is made without any conditions. These promises enhance financial stability and contribute positively to an organization's bottom line. For clarity on this matter, platforms like uslegalforms provide guidance on properly accounting for these transactions, specifically about unconditional recording final for the first.

An unconditional donation is a gift that the donor gives with no strings attached. This type of donation provides immediate financial support to organizations, allowing for reliable budgeting and planning. It's crucial for organizations to understand how to handle these transactions, particularly when focusing on unconditional recording final for the first.

The key difference lies in dependability. Conditional promises depend on specific criteria being fulfilled before the funds are given, while unconditional promises are firm commitments regardless of external factors. Recognizing this difference is vital for grasping the concepts around unconditional recording final for the first and effective financial reporting.

In accounting, promises to give are commitments from donors to contribute funds, usually to a nonprofit organization. These promises can be conditional or unconditional, influencing how they are recorded in financial statements. Learning about these terms can help your understanding of unconditional recording final for the first, ensuring your organization manages its finances accurately.

A conditional promise to give involves a commitment that depends on certain conditions being met. For instance, a donor may pledge a sum only if a specific fundraising goal is achieved. Understanding this type of promise is essential when navigating the realm of unconditional recording final for the first, as it affects revenue recognition.

Generally, unconditional lien waivers do not require notarization to be effective. However, check local regulations as requirements can vary by state or situation. Ensuring you have the right forms will streamline your experience with unconditional recording final for the first.

Filling out an unconditional waiver requires you to fill in relevant details such as project information, payer and payee names, and the amount of payment made. Make sure to include a signature to legally finalize the waiver. This process ensures you successfully handle the unconditional recording final for the first.

To complete a conditional waiver and release on progress payment, you should fill in the project description and the amount being waived, along with all parties' information. After verifying the details, sign the form to make it legally binding. Doing so supports your goal of securing an unconditional recording final for the first.

In Texas, a conditional waiver and release on final payment allows a party to waive their rights to a lien, contingent on receiving payment. It protects both the payer and the payee, establishing a clear agreement before funds are disbursed. Understanding this document is essential for managing your unconditional recording final for the first.

Completing an unconditional waiver and release upon final payment involves entering all relevant project details and confirming receipt of the total payment. Be sure to include the parties' names and sign the document. An accurate unconditional recording final for the first will help finalize the transaction without any lingering claims.