Oregon Dmv Affidavit Of Heirship Without A Will

Description

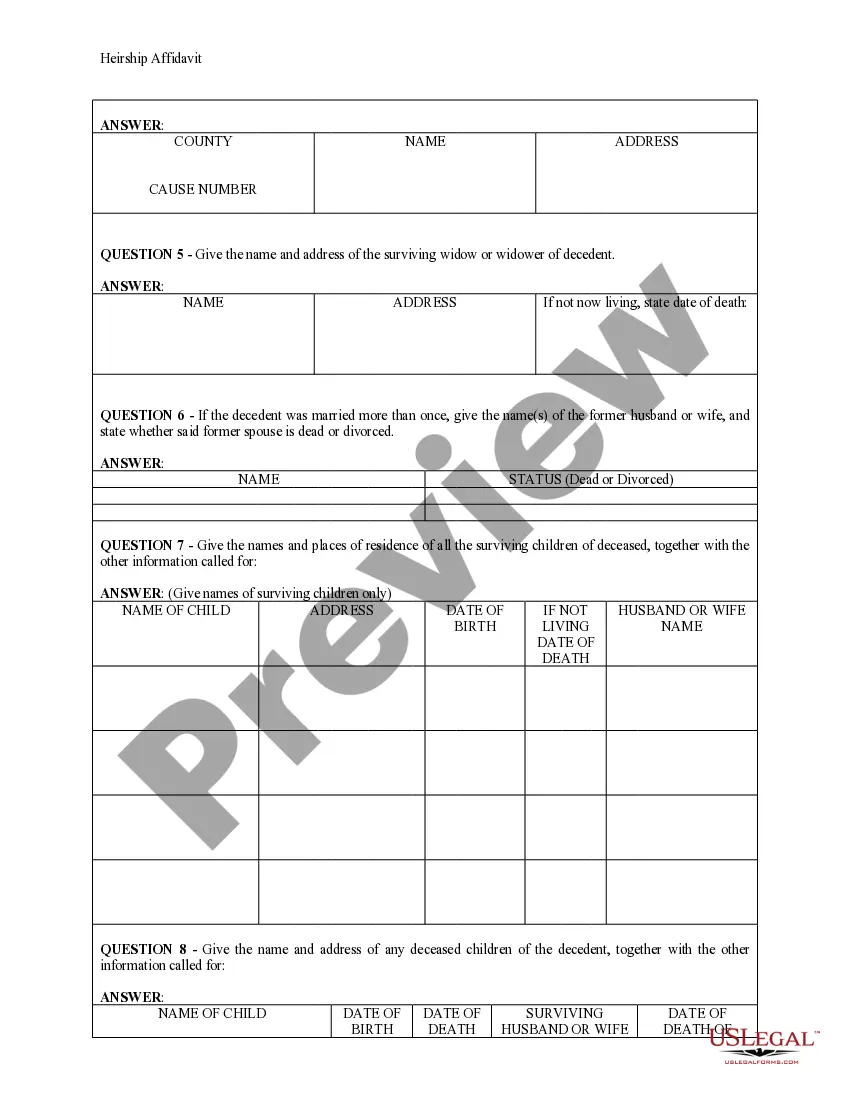

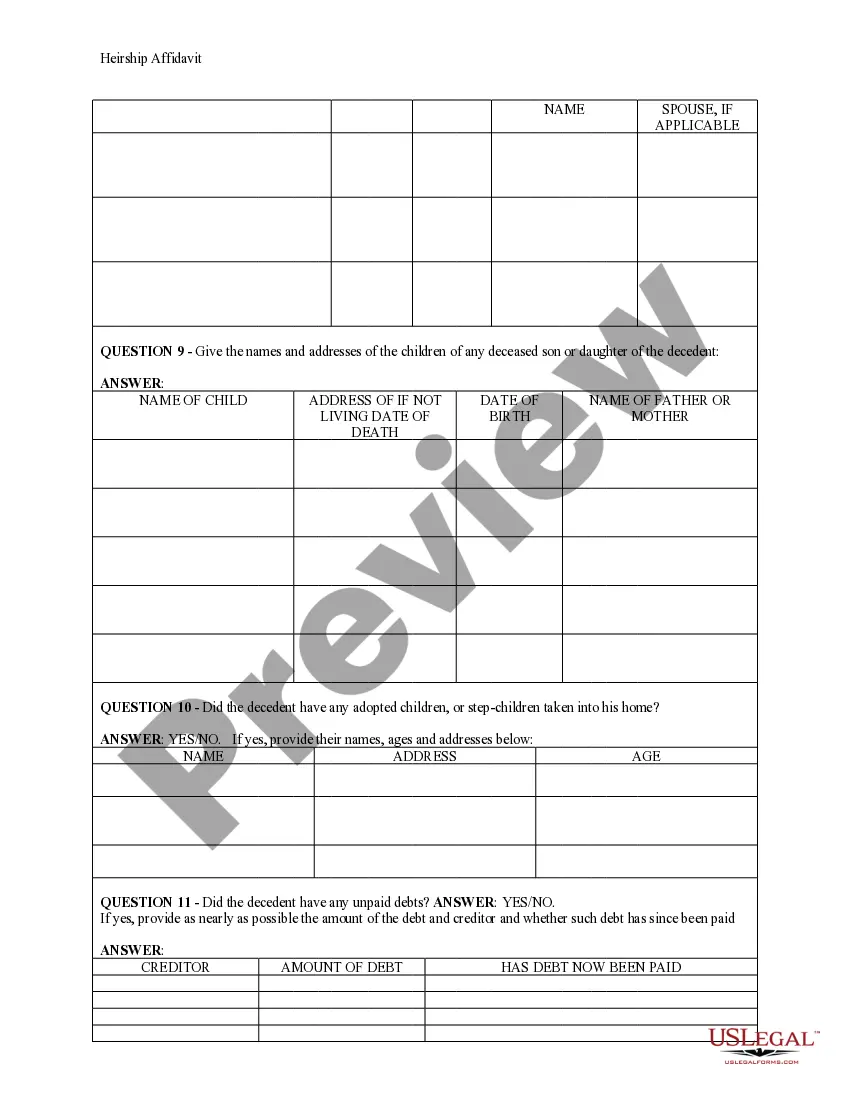

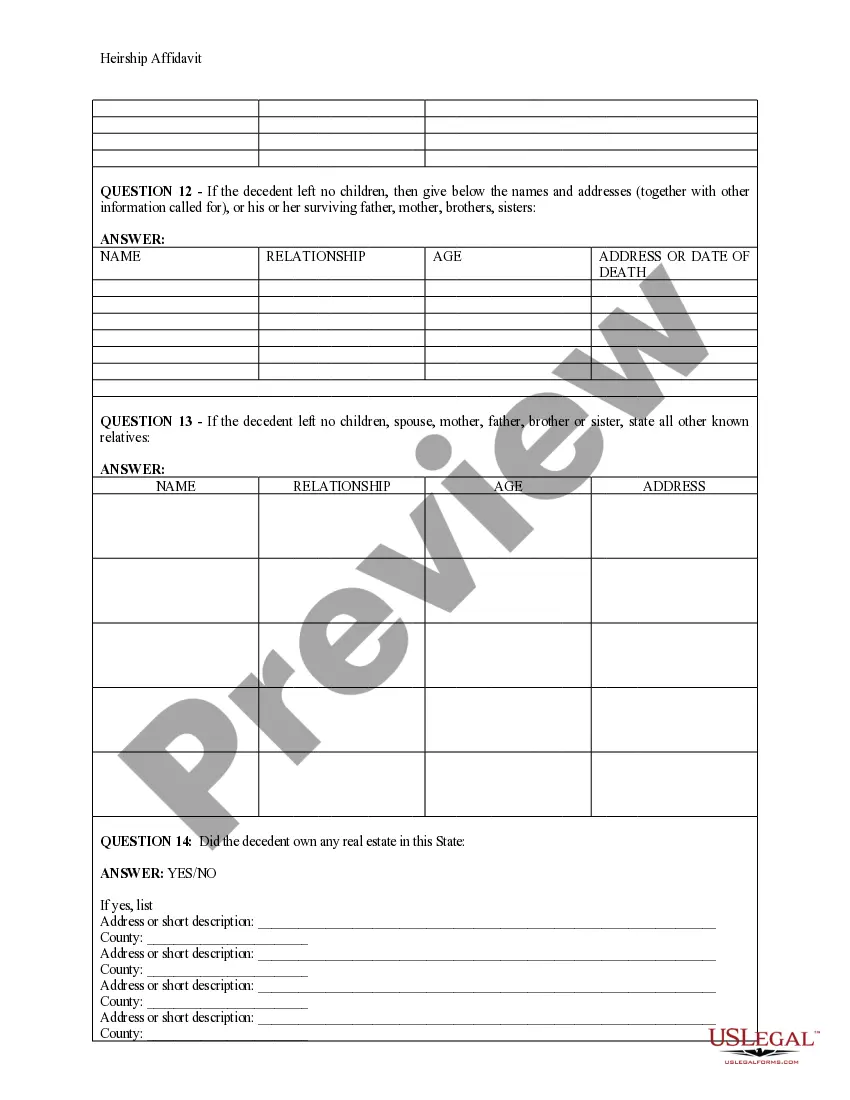

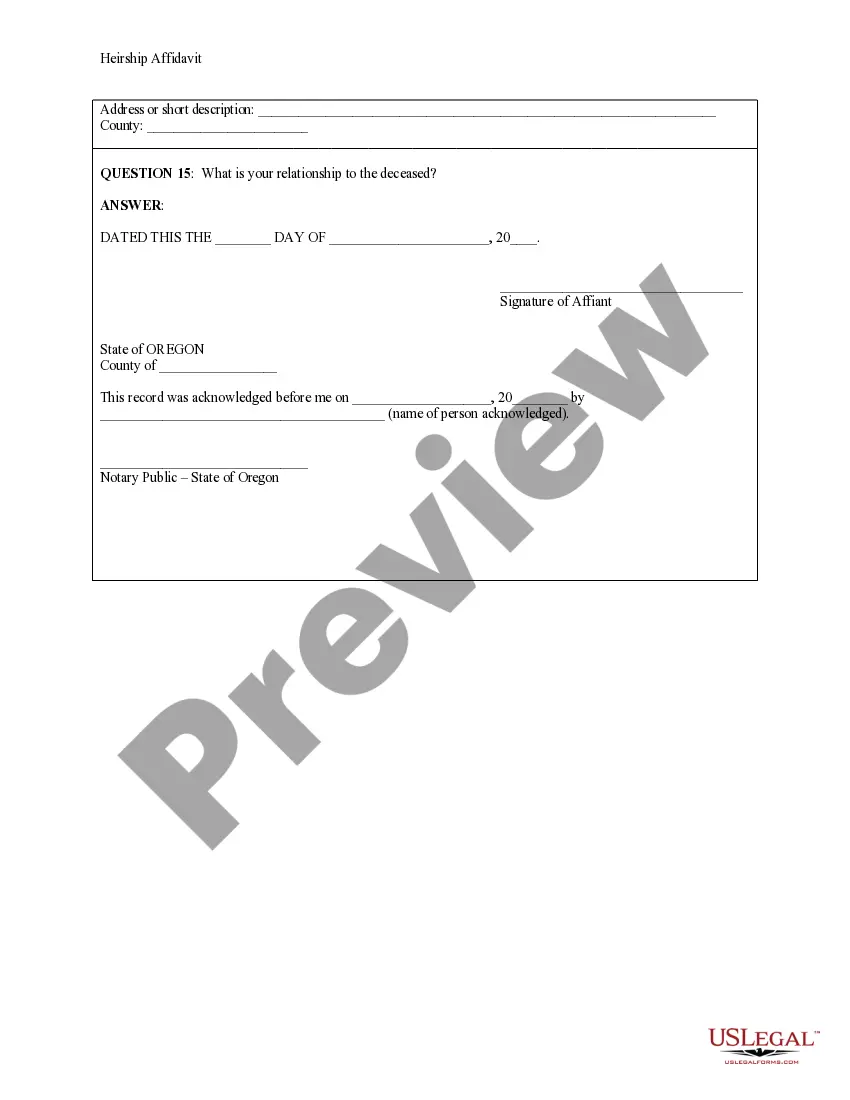

How to fill out Oregon Heirship Affidavit - Descent?

The Oregon Dmv Affidavit Of Heirship Without A Will you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Oregon Dmv Affidavit Of Heirship Without A Will will take you just a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or review the form description to ensure it suits your requirements. If it does not, make use of the search option to find the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Select the format you want for your Oregon Dmv Affidavit Of Heirship Without A Will (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your paperwork one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Title transfer in Oregon if the owner has passed away The original vehicle title, if you have it. An Application for Title and Registration. The heir must fill out Inheritance Affidavit and have it notarized. Odometer disclosure, if applicable. Any bill of sale or lien release from prior owner(s) (not the deceased)

ORS 93.180 provides that two or more individuals may take title in a survivorship estate. For two people who are unmarried, the election of a survivorship estate must be stated expressly in the deed, e.g., John Doe, Fred Jones, and Mary May, each as to an undivided one-third interest with rights of survivorship.

A copy of their emancipation papers must be submitted with the Form 516. If the heirs sell the vehicle, they may release on the title, a separate bill of sale, or secure odometer disclosure. The heirs may assign their interest to a buyer by naming that person on Form 516.

To notify the Oregon DMV, you need to send a written notice to the DMV. The notice should include the deceased's full name, date of birth, and driver license number if known. In case of a vehicle, you need to provide the vehicle identification number (VIN).