Oregon Dmv Affidavit Of Heirship Form Texas

Description

How to fill out Oregon Heirship Affidavit - Descent?

Regardless of whether it is for corporate needs or personal matters, everyone eventually has to address legal issues at some point in their life.

Completing legal documents necessitates meticulous care, commencing with selecting the correct form example. For example, if you choose an incorrect edition of the Oregon Dmv Affidavit Of Heirship Form Texas, it will be rejected once submitted.

With an extensive US Legal Forms catalog available, you need not waste time searching for the right sample throughout the internet. Utilize the library’s user-friendly navigation to find the suitable form for any circumstance.

- Locate the form sample you need using the search bar or catalog navigation.

- Review the form’s description to ensure it aligns with your situation, state, and county.

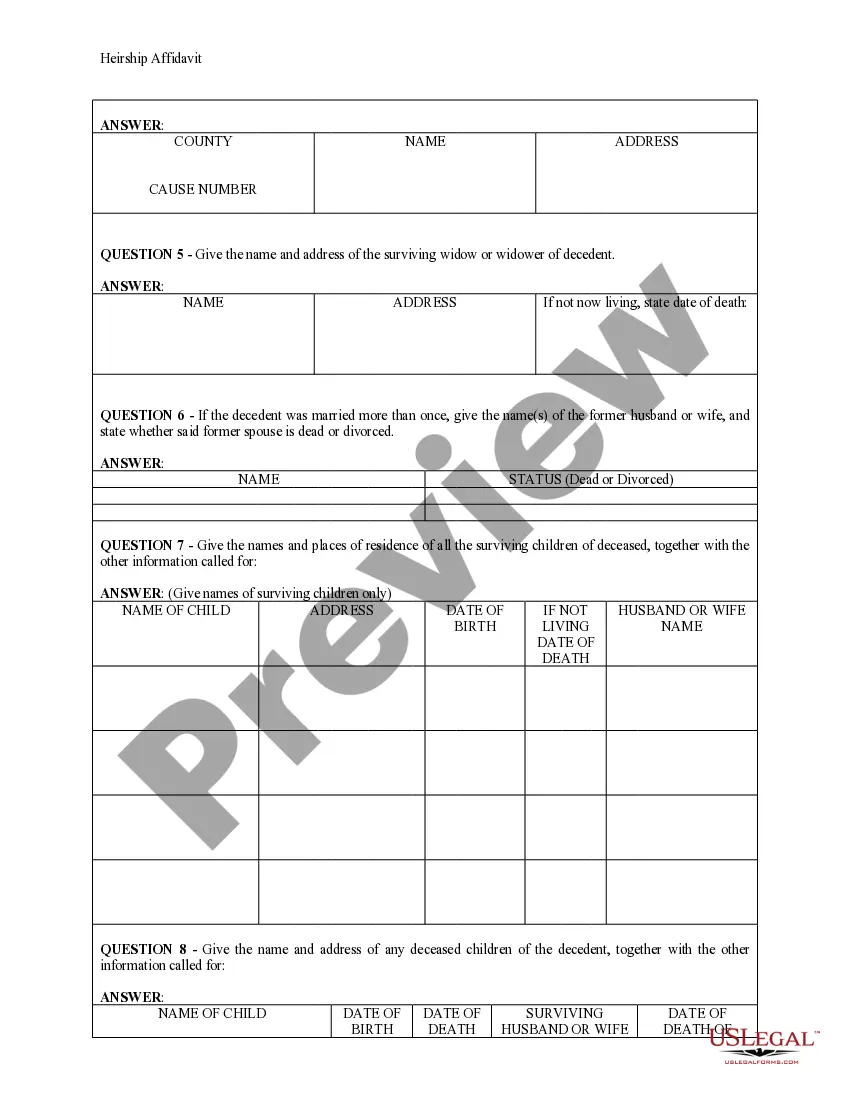

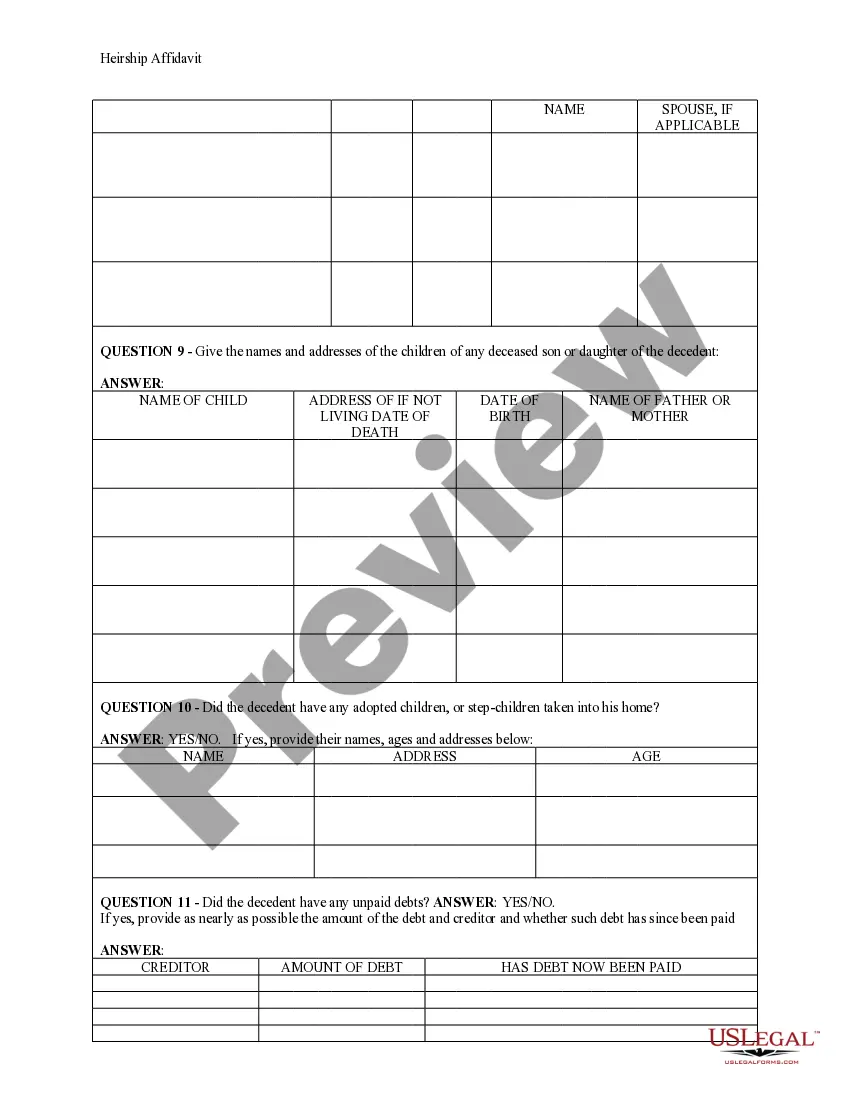

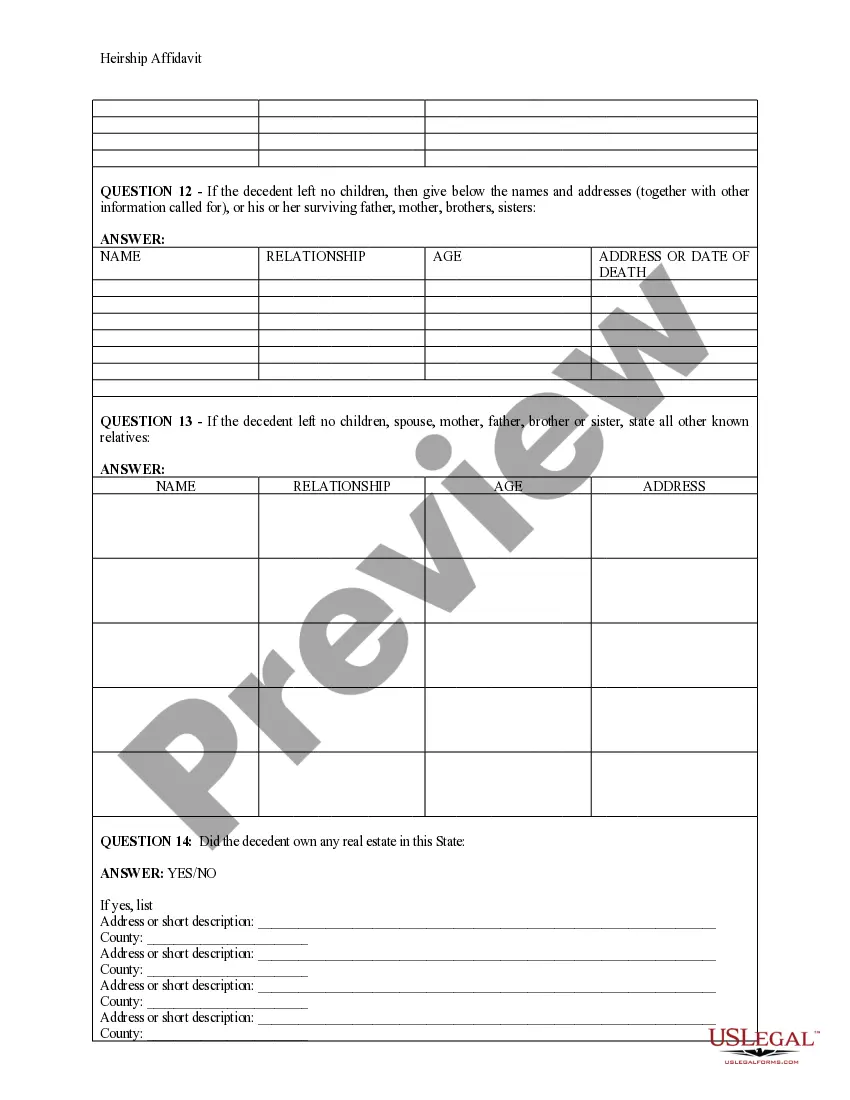

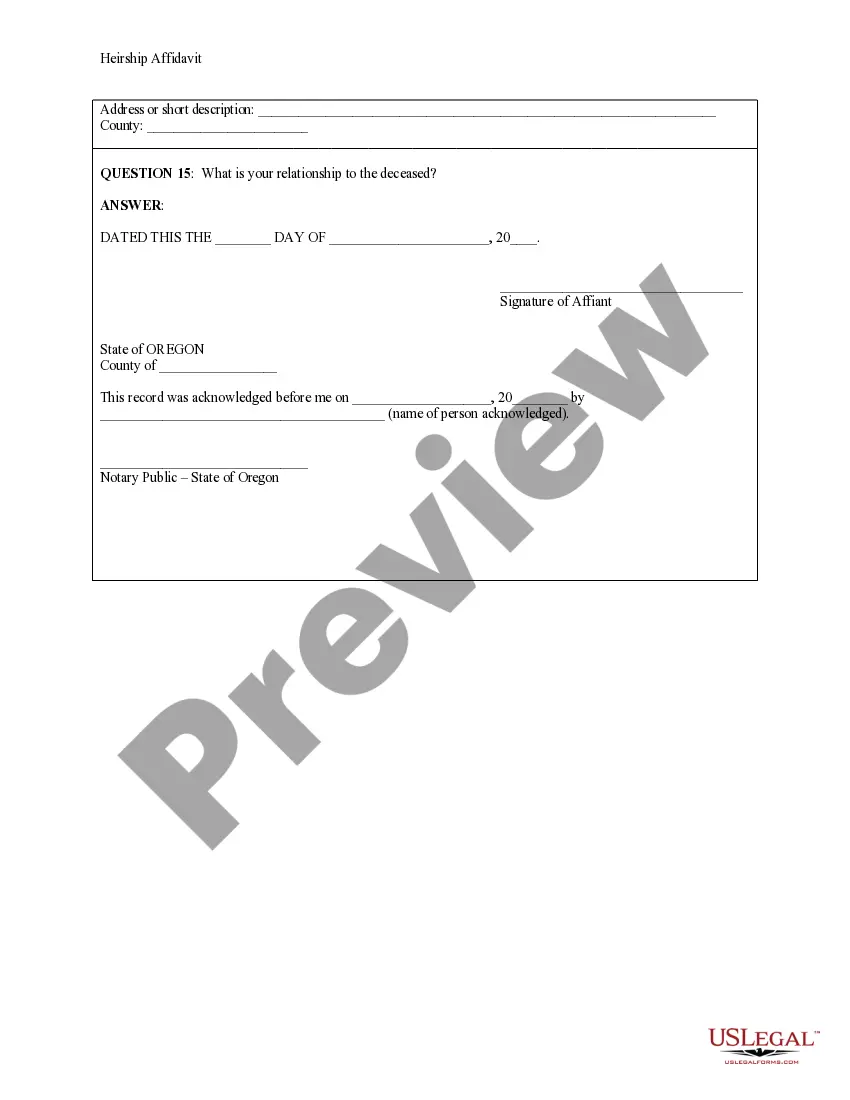

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to find the Oregon Dmv Affidavit Of Heirship Form Texas sample you need.

- Download the document when it satisfies your requirements.

- If you hold a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you have not created an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the document format you desire and download the Oregon Dmv Affidavit Of Heirship Form Texas.

- After it is saved, you can fill out the form using editing software or print it to complete it by hand.

Form popularity

FAQ

Yes, an affidavit of heirship can help transfer a car title in Texas. However, it is important to check if the vehicle was solely owned by the deceased. By completing the Oregon dmv affidavit of heirship form Texas through USLegalForms, you can simplify the process for transferring the title to the rightful heirs. Always verify with the local DMV to ensure you meet all additional requirements.

The requirements for an affidavit of heirship in Texas include providing detailed information about the deceased, such as their full name, date of death, and place of residence. Additionally, you must list the heirs and their relationships to the deceased. When using the Oregon dmv affidavit of heirship form Texas from USLegalForms, ensure that all signatures are notarized. This will help establish the legitimacy of the document in legal matters.

To obtain an affidavit of heirship, start by gathering the necessary information about the deceased person and their heirs. You can visit trusted platforms like USLegalForms to access the Oregon dmv affidavit of heirship form Texas. Fill out the form accurately, then have it signed by witnesses or a notary, as required by Texas law. Once completed, you can submit it to the appropriate authorities to officially document the heirship.

To effectively fill an affidavit form, start with the title of the document followed by your personal information. Include a statement that establishes the purpose of the affidavit, along with any relevant facts or claims. Make sure to conclude with your signature and date, as well as have it notarized if necessary. The Oregon DMV affidavit of heirship form Texas is a great resource, providing a clear example that makes this task easier.

Filling out an affidavit of heirship involves clearly identifying the deceased and listing all legal heirs. Ensure that you provide detailed information about each heir's relationship to the deceased, including names and addresses. It's critical to sign the document in the presence of a notary public for it to be legally binding. Using the Oregon DMV affidavit of heirship form Texas simplifies this process, as it provides a structured format.

To fill out the proof of heirship affidavit, begin by gathering necessary information about the deceased, including full name, date of death, and any pertinent estate details. Follow the provided sections in the form to detail the relationship of each heir to the deceased. Remember to include signatures and dates to validate the document. A well-completed Oregon DMV affidavit of heirship form Texas will help ensure a smooth transition of assets.

Filling out an affidavit of heirship for a motor vehicle begins with obtaining the vehicle's title and the decedent's details. You will need to indicate who the rightful heirs are and their relationships to the deceased. It's crucial to comply with any local laws to ensure the affidavit's legitimacy, especially for documents like the Oregon DMV affidavit of heirship form Texas. To make this process easier, uslegalforms offers guidance and templates.

To fill out an affidavit of heirship, start by gathering pertinent details about the deceased, such as their full name, date of death, and heir information. Clearly state your relationship to the deceased and ensure you include the required signatures of witnesses or notaries as needed by state law. For forms and guidelines specific to the Oregon DMV affidavit of heirship form Texas, check uslegalforms for comprehensive resources.

Filling out an affidavit of inheritance for a motor vehicle involves collecting essential information such as the vehicle's title, the deceased person's details, and the heirs' names. You need to state your relationship to the deceased and include any necessary documentation to support your claim. Make sure to follow any state-specific requirements, including those for the Oregon DMV affidavit of heirship form Texas, which you can explore on uslegalforms.

Yes, affidavits in Oregon usually need to be notarized to ensure their validity. Notarization serves as a confirmation that the document was signed voluntarily and that the signer is who they claim to be. This process helps maintain the integrity of legal documents, including the Oregon DMV affidavit of heirship form Texas. You can find resources and forms on uslegalforms to help you with notarization requirements.