Affidavit Of Heirship Oregon Without A Will

Description

How to fill out Oregon Heirship Affidavit - Descent?

Utilizing legal document templates that comply with federal and local laws is essential, and the internet provides countless alternatives to select from.

However, what's the benefit of squandering time looking for the properly prepared Affidavit Of Heirship Oregon Without A Will example online when the US Legal Forms digital library already contains such documents conveniently gathered in one location.

US Legal Forms serves as the largest web-based legal repository with more than 85,000 fillable forms developed by attorneys for any business and personal circumstances. They are easy to navigate with all forms categorized by state and intended use. Our experts keep pace with legal updates, ensuring that your form remains current and compliant when acquiring a Affidavit Of Heirship Oregon Without A Will from our platform.

Press Buy Now once you've found the correct form and choose a subscription plan. Set up an account or Log In and process your payment via PayPal or credit card. Select the appropriate format for your Affidavit Of Heirship Oregon Without A Will and download it. All templates accessed via US Legal Forms are reusable. To re-download and complete previously obtained documents, navigate to the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Acquiring a Affidavit Of Heirship Oregon Without A Will is quick and effortless for both existing and new clients.

- If you already possess an account with an active subscription, Log In and store the document sample you need in the appropriate format.

- If you're new to our site, follow the instructions below.

- Inspect the template using the Preview feature or through the text outline to confirm it fulfills your needs.

- Search for an alternative sample using the search function at the top of the page if needed.

Form popularity

FAQ

You can write your own affidavit of heirship, provided you include all necessary information and follow the correct format. It is crucial to ensure that the affidavit meets all legal requirements to avoid complications later. If writing it seems daunting, consider using USLegalForms, which offers user-friendly templates and step-by-step guidance to make the process easier.

Yes, you can file an affidavit of heirship on your own in Texas. The process involves completing the form with accurate information about the deceased and their heirs. While it is doable independently, double-checking your work or using legal resources can enhance accuracy. Platforms like USLegalForms can provide the templates and instructions needed for a successful filing.

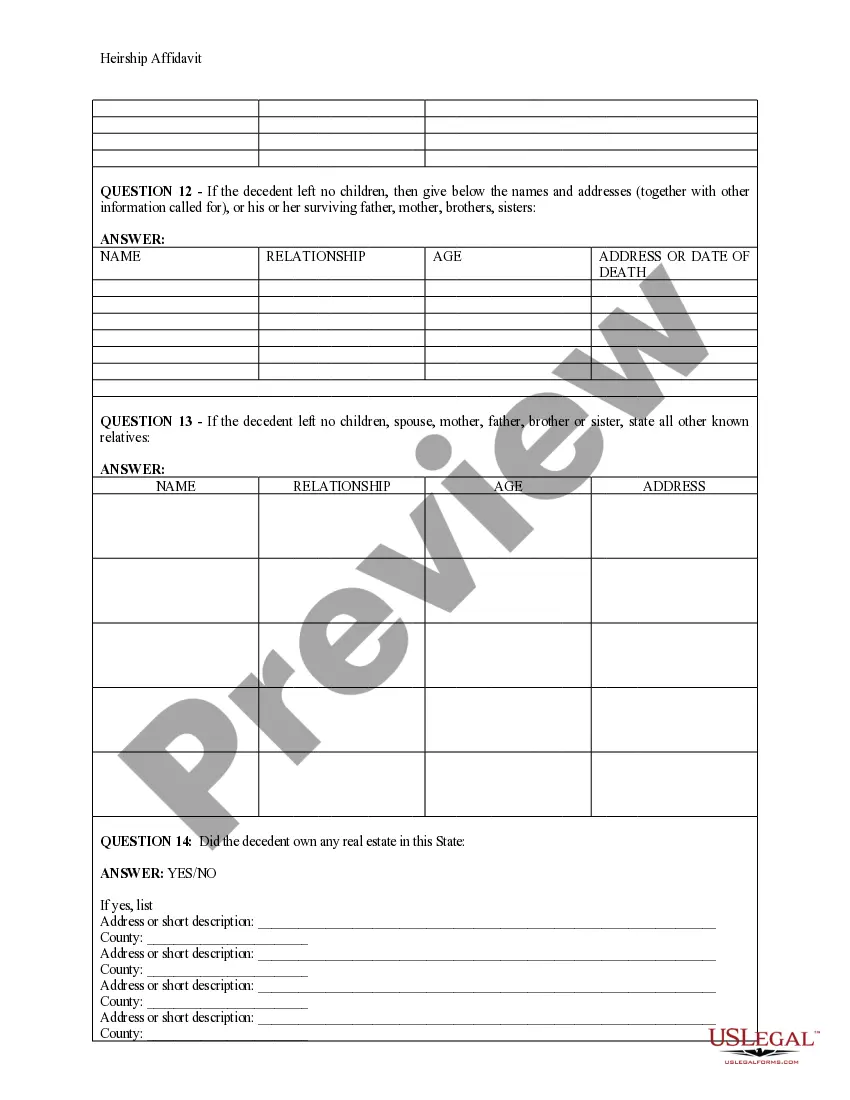

When someone dies in Oregon without a will, their estate will be subject to intestate succession laws. This means the state will determine how the deceased's assets are distributed among their heirs. In many cases, an affidavit of heirship can help establish the rightful heirs and expedite the process. To ensure you meet all necessary requirements, consider utilizing USLegalForms for guidance.

You do not necessarily need a lawyer to file an affidavit of heirship in Oregon without a will. Many individuals successfully complete the process on their own, provided they follow the requirements accurately. However, if you feel unsure, seeking legal advice can help clarify any doubts. USLegalForms offers resources that can assist you in preparing your affidavit confidently.

In Arkansas, the affidavit of heirship is typically filled out by a family member or a close friend of the deceased. This person should have knowledge of the deceased's family situation and can provide accurate information about the heirs. It’s essential to ensure that the affidavit is completed correctly to avoid any legal issues later. For assistance, consider using USLegalForms to access templates and guidance.

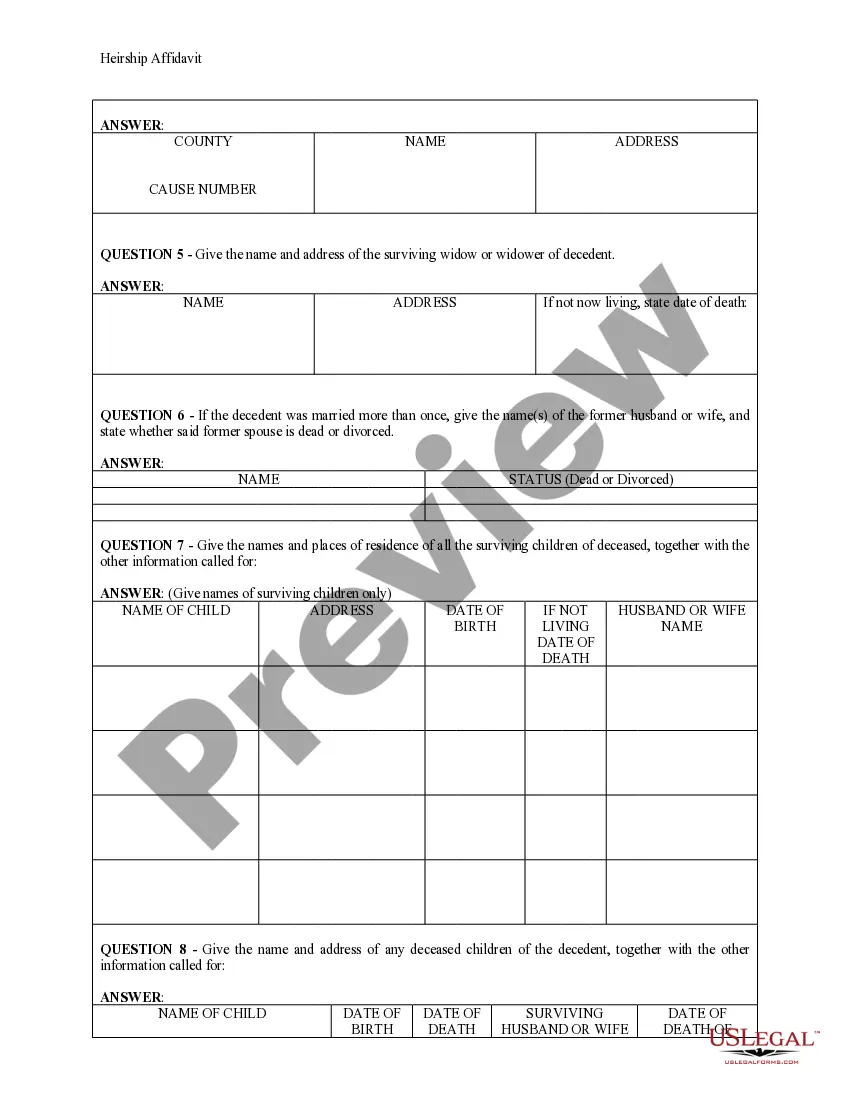

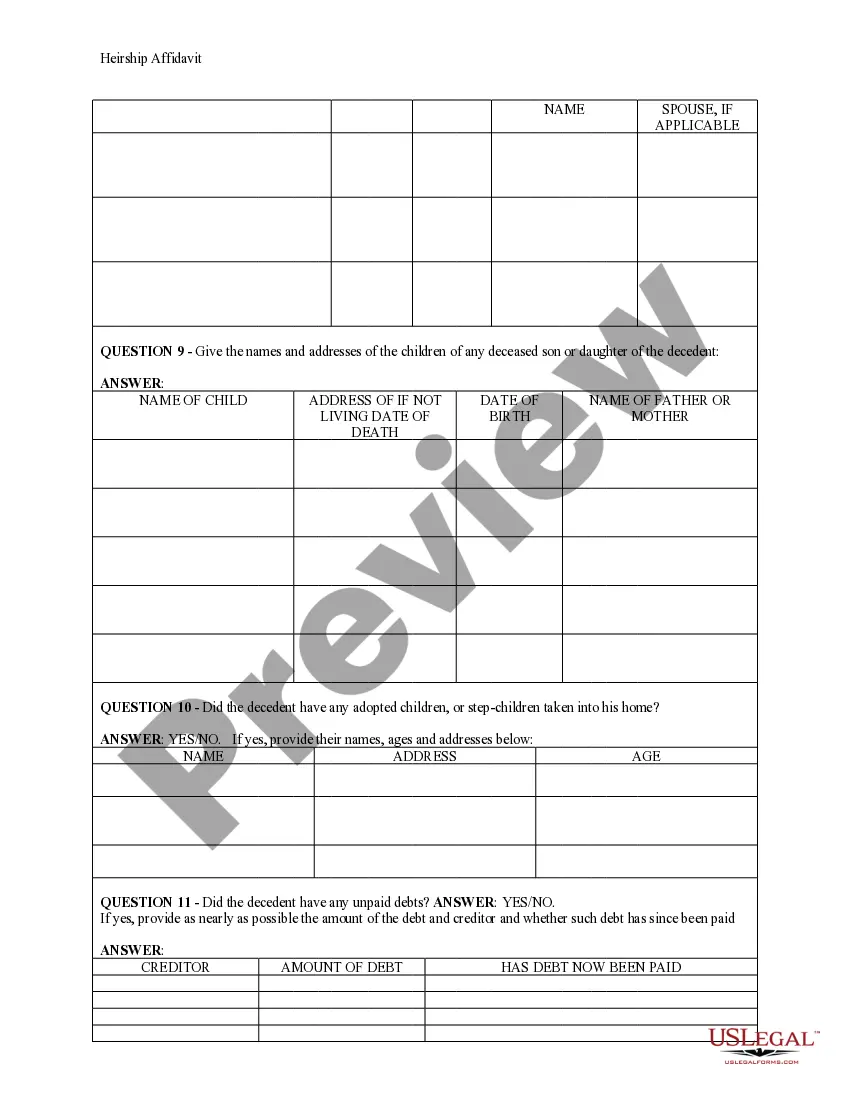

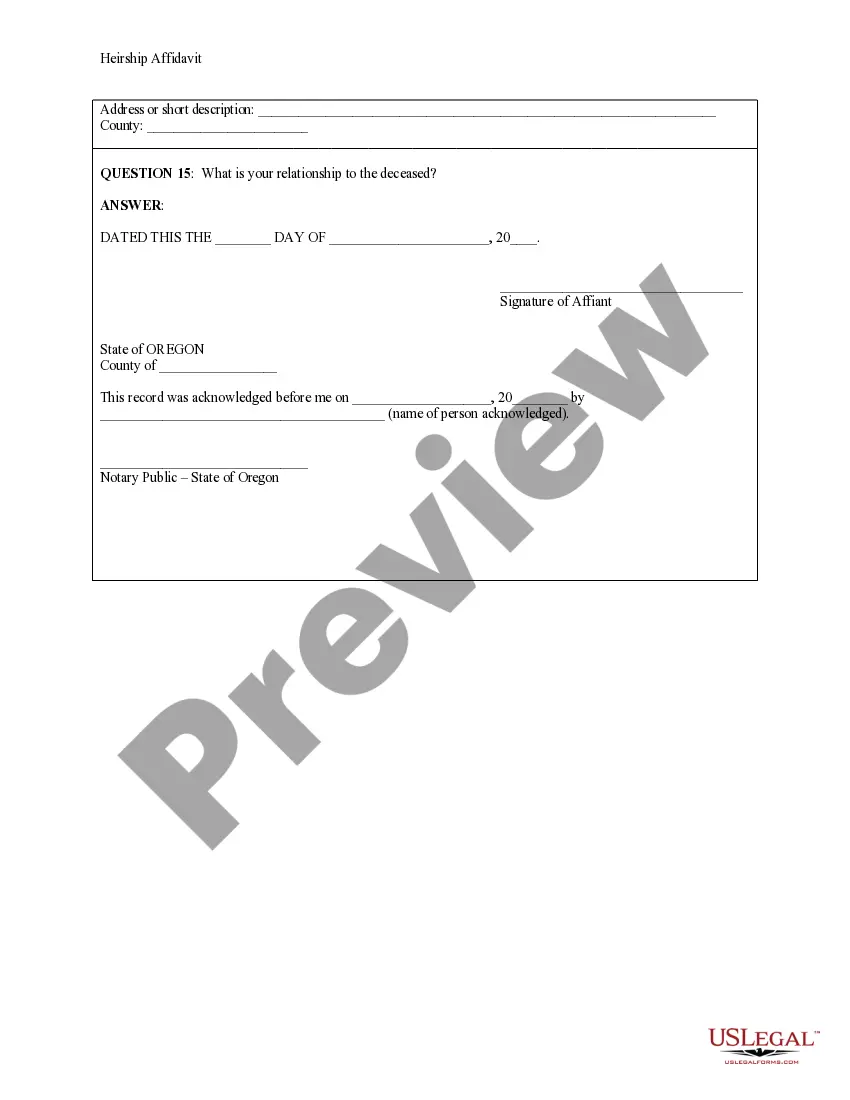

To create an affidavit of heirship in Oregon without a will, you need to gather specific information about the deceased and their heirs. This includes the full name, date of birth, and date of death of the deceased, along with the names and relationships of the heirs. Additionally, the affidavit must be signed in the presence of a notary public. Using a reliable platform like USLegalForms can help you navigate this process smoothly.

Yes, an affidavit of heirship typically needs to be notarized to ensure its validity in Oregon. Notarization provides an official acknowledgment of the document and can help prevent disputes over the claims made within. When you use resources from US Legal Forms, you can find detailed information on notarization requirements for your affidavit.

Yes, you can write an affidavit of heirship in Oregon without a lawyer, as long as you follow the correct guidelines. Ensure that you include all required information and adhere to legal standards. However, using a platform like US Legal Forms can simplify the process by providing templates and instructions that help you create a legally sound affidavit.

Writing a self-declaration for a legal heir certificate involves stating your relationship to the deceased and providing necessary details such as names and dates. Clearly outline your claim as an heir and include any supporting evidence, like birth certificates or marriage licenses. For a reliable format, consider using resources from US Legal Forms, which can help you draft an effective declaration.

To complete an affidavit of heirship in Oregon without a will, you need to gather information about the deceased and their heirs. Begin by detailing the decedent's name, date of death, and any relevant property information. Next, list the names and relationships of all potential heirs. You can utilize online resources from US Legal Forms to find templates that guide you through this process.