Affidavit Of Heirship In Oregon

Description

How to fill out Oregon Heirship Affidavit - Descent?

Locating a reliable source for the most up-to-date and pertinent legal templates constitutes a significant part of dealing with bureaucracy. Acquiring the appropriate legal documents necessitates accuracy and meticulousness, which clarifies why it is crucial to obtain samples of the Affidavit Of Heirship In Oregon solely from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns. You can access and examine all the information regarding the document’s applicability and relevance for your specific situation and in your state or county.

Consider the outlined steps to finalize your Affidavit Of Heirship In Oregon.

Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms collection where you can find legal templates, evaluate their relevance to your situation, and download them instantly.

- Utilize the library navigation or search box to find your template.

- Check the details of the form to ensure it meets the requirements of your region and locality.

- Examine the form preview, if available, to confirm that the template is what you're looking for.

- Return to the search and seek out the appropriate template if the Affidavit Of Heirship In Oregon does not fulfill your needs.

- If you are confident about the document’s applicability, download it.

- When you are a registered member, click Log in to verify your identity and access your selected documents in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Select the pricing option that fits your needs.

- Proceed with the registration to complete your order.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Affidavit Of Heirship In Oregon.

- Once you have the form on your device, you can modify it using the editor or print it and fill it out manually.

Form popularity

FAQ

In Arkansas, an affidavit of heirship can be filled out by the heirs of the deceased or individuals who have knowledge of the family history and relationships to the deceased. This document is crucial for establishing the rightful heirs, especially in cases where formal probate is not pursued. If you need more guidance on filling out the affidavit, consider using platforms like US Legal Forms for templates and instructions.

While this FAQ focuses on Oregon, you can file an affidavit of heirship on your own in Texas as well. The process involves similar steps, including drafting the affidavit according to state laws and obtaining notarization. For those seeking assistance, platforms like US Legal Forms offer resources that simplify the filing process in various states, including Texas.

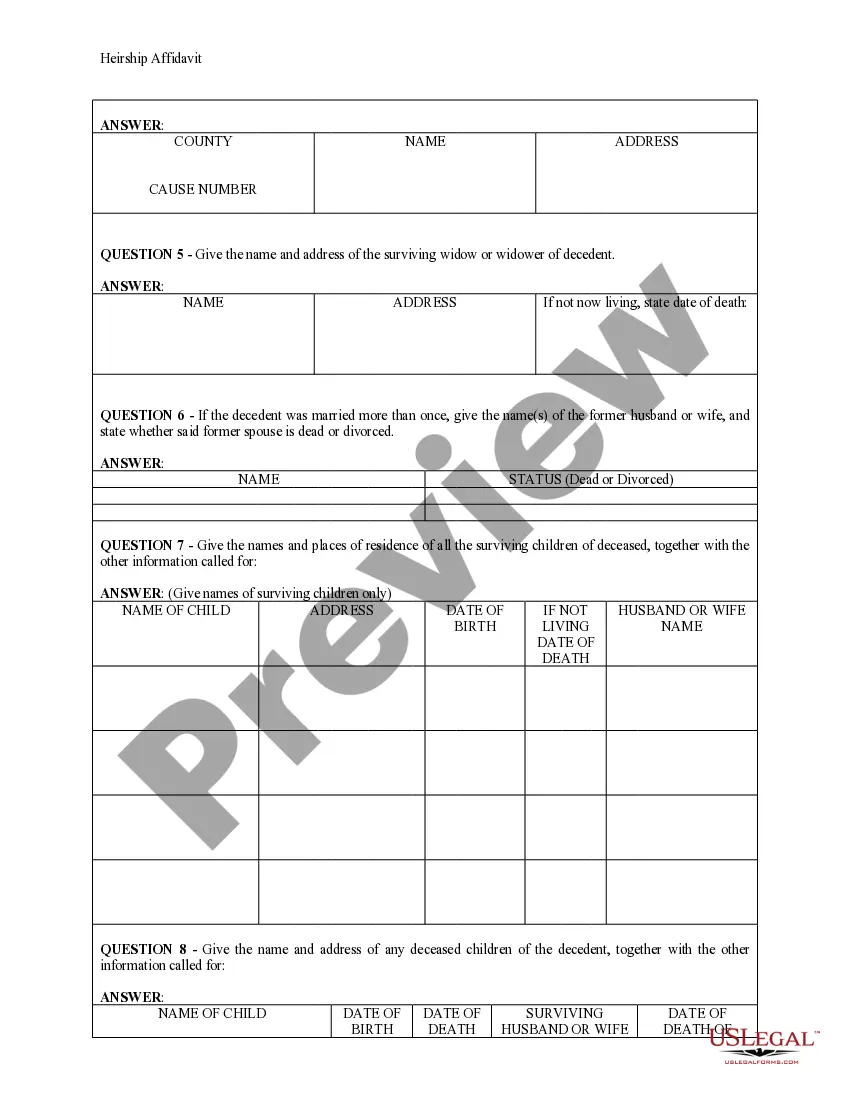

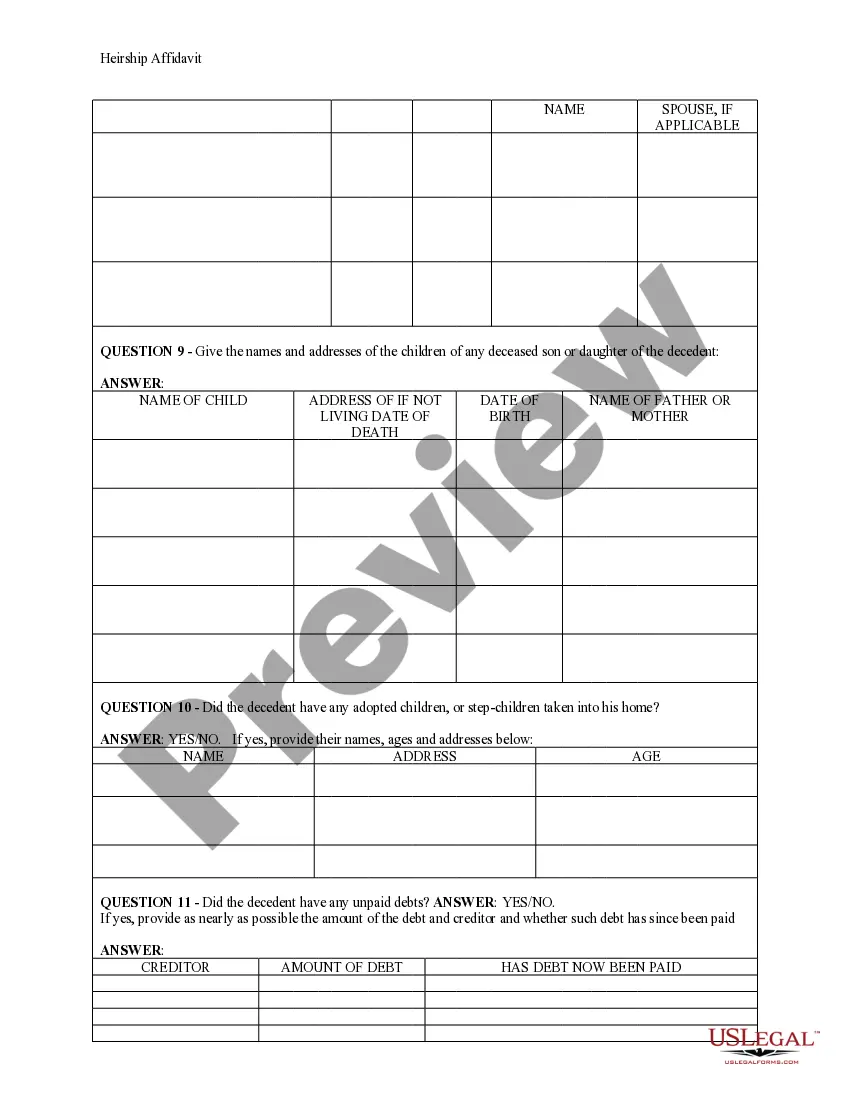

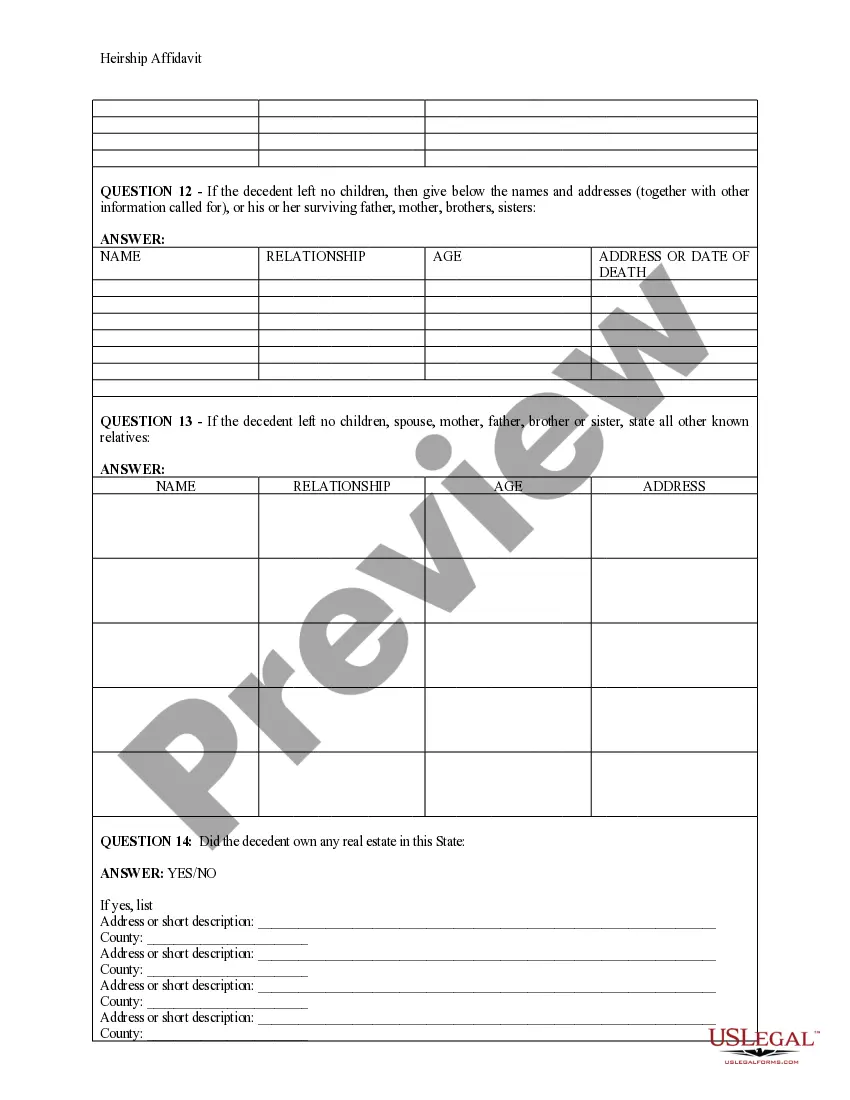

The requirements for an affidavit of heirship in Oregon include identifying the deceased, listing the heirs, and providing evidence of their relationship to the deceased. The affidavit must be signed by the heirs and notarized to validate the document. Ensuring that all information is accurate and complete is crucial for the affidavit to serve its intended purpose in estate matters.

You do not necessarily need a lawyer to file an affidavit of heirship in Oregon, but consulting with one can be beneficial. A lawyer can help you understand the process, ensure that all necessary information is included, and guide you through any potential legal complications. If you're comfortable navigating the legal system, you can use resources like US Legal Forms to assist with the filing process.

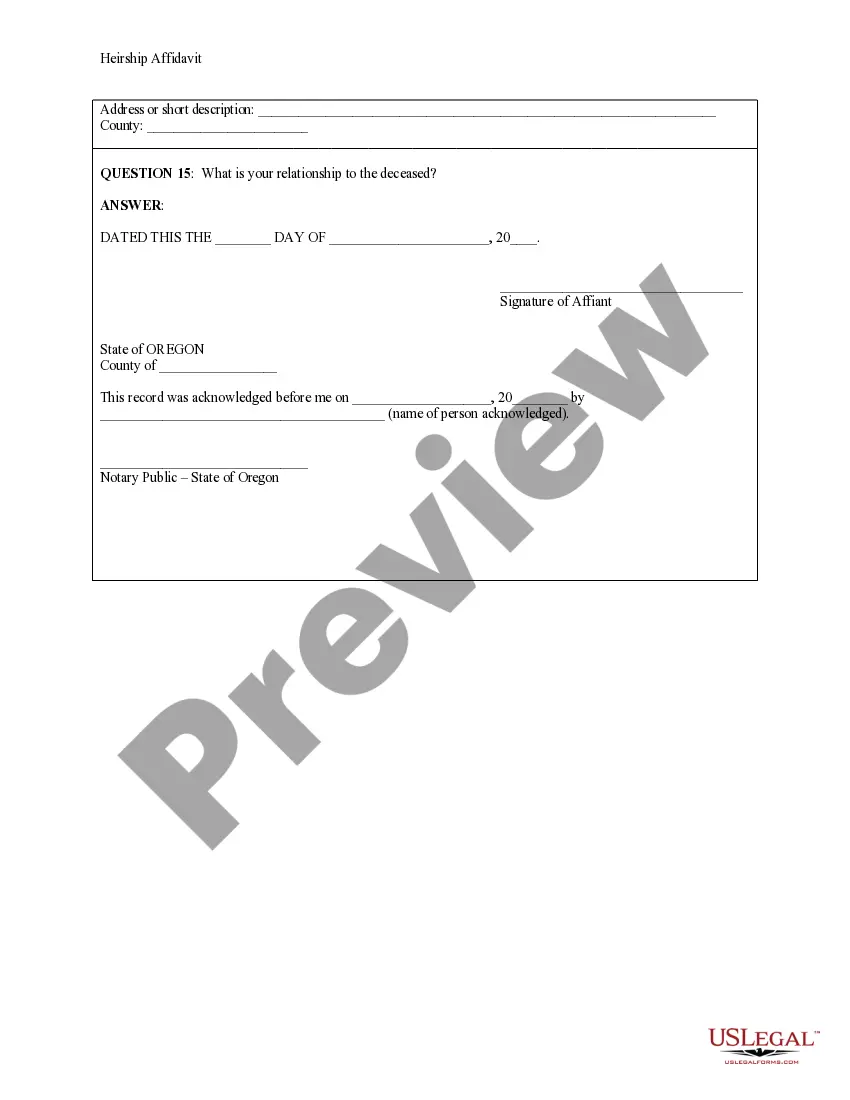

Yes, an affidavit of heirship in Oregon typically requires notarization to be considered valid. This means that the document must be signed in the presence of a notary public, who will then authenticate the signatures. Notarization adds an extra layer of legitimacy, ensuring that the information provided is true and can be relied upon in legal proceedings.

Yes, you can write your own affidavit of heirship in Oregon, but it's essential to follow the specific legal requirements to ensure it is valid. The document must contain accurate information about the deceased, the heirs, and their relationship to the deceased. While it's possible to draft your own affidavit, using a service like US Legal Forms can provide templates and guidance to ensure compliance with state laws.

In Oregon, an heir is typically defined as a person who is entitled to inherit property from a deceased individual under the state's laws. This can include children, spouses, and other relatives, depending on the circumstances. The determination of heirs can be complex, especially in cases of blended families or intestate succession. An affidavit of heirship in Oregon helps clarify who qualifies as an heir and can simplify the inheritance process.

Properly filling out an affidavit of heirship in Oregon requires careful attention to detail. Make sure to include all relevant information about the deceased and the heirs, and verify that all signatures are present. For added assurance, consider using US Legal Forms, which provides templates designed to comply with Oregon's legal standards, making the process smoother for you.

To fill out an affidavit of heirship in Oregon, begin by entering the deceased person's full name and date of death. Next, list the names and relationships of all heirs. Using US Legal Forms can provide you with a structured format and expert advice, ensuring that your affidavit meets all legal requirements in Oregon.

Filling out an affidavit of heirship in Oregon involves detailing the deceased's information, identifying the heirs, and stating the relationship between them. Ensure that you provide accurate and complete information to avoid potential legal issues later. US Legal Forms offers user-friendly templates to assist you in completing this document correctly.