Como Hacer Un Poder Para Autorizar A Otra Persona Without

Description

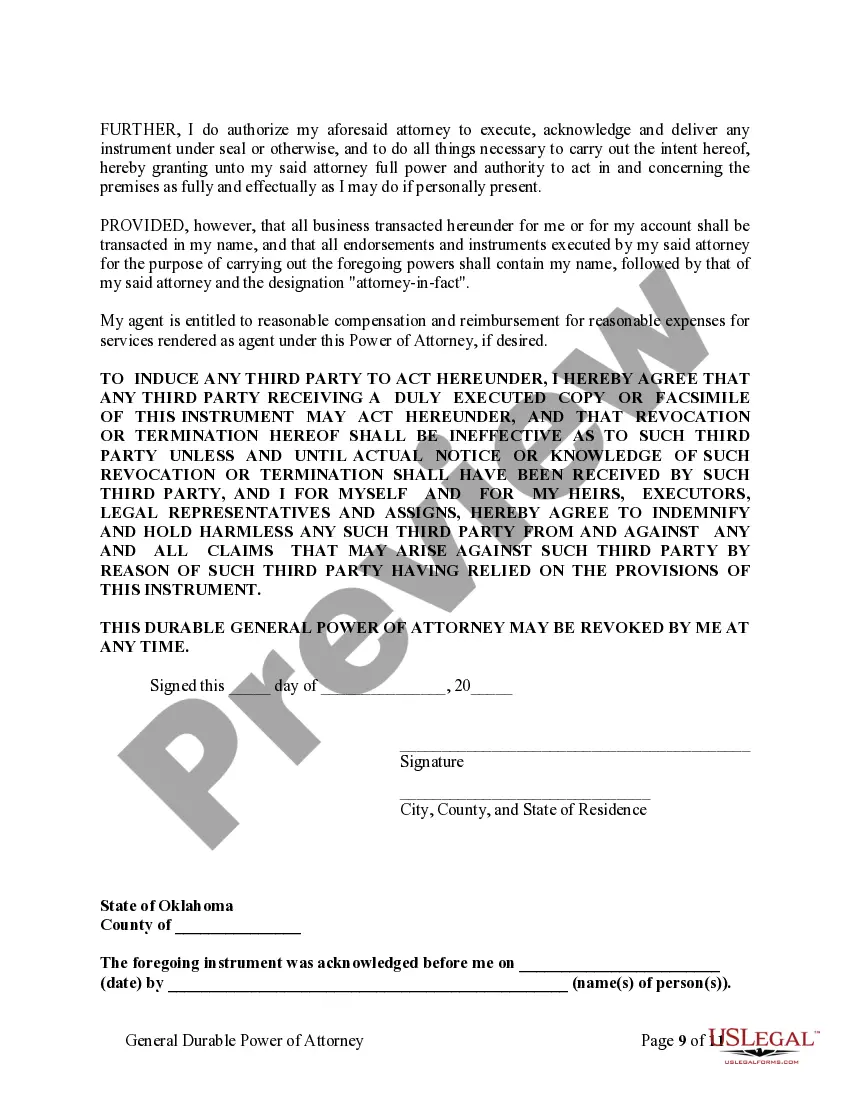

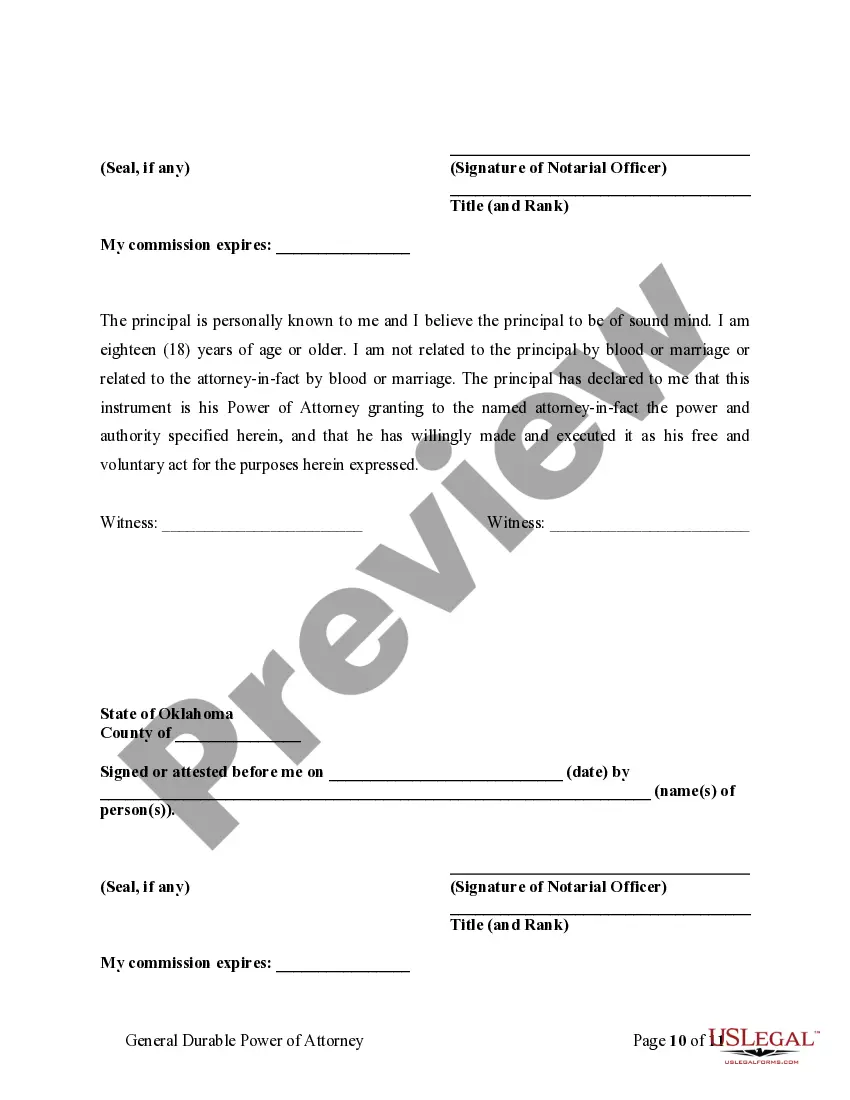

How to fill out Oklahoma General Durable Power Of Attorney For Property And Finances Or Financial Effective Immediately?

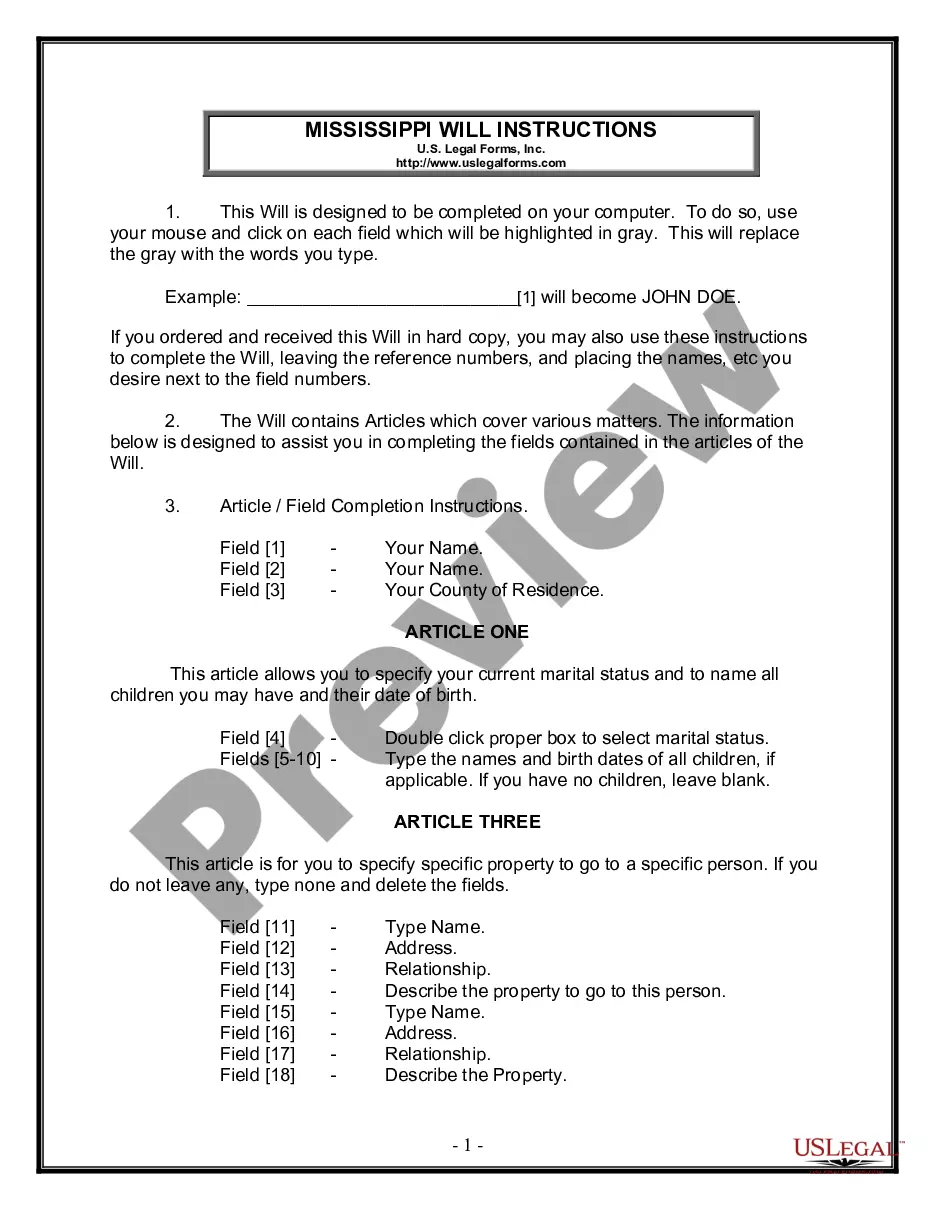

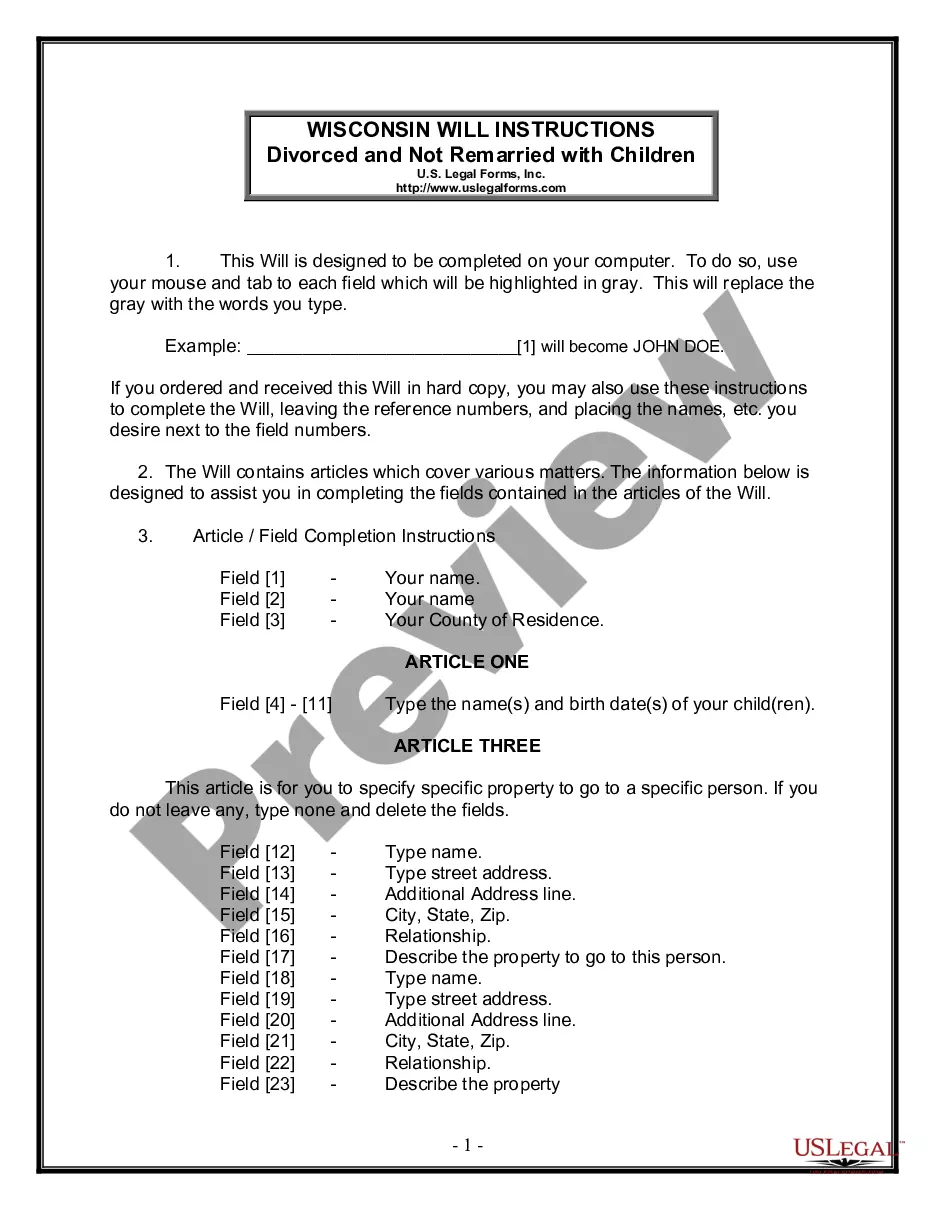

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Como Hacer Un Poder Para Autorizar A Otra Persona Without or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms diligently put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Como Hacer Un Poder Para Autorizar A Otra Persona Without. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and explore the library. But before jumping straight to downloading Como Hacer Un Poder Para Autorizar A Otra Persona Without, follow these tips:

- Check the form preview and descriptions to ensure that you have found the form you are looking for.

- Check if template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Como Hacer Un Poder Para Autorizar A Otra Persona Without.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

The Pennsylvania LLC filing fee is $125 fee, plus $3 per page if you file paper copies. You only need to file your Certificate of Organization once. You'll also need to file what is considered an annual report in most states.

Pennsylvania LLC Processing Times Normal LLC processing time:Expedited LLC:Pennsylvania LLC by mail:6 weeks (plus mail time)Not availablePennsylvania LLC online:5-6 weeksNot available

How Much Does a Business License Cost in Pennsylvania? There is no cost when registering your business with the Department of Revenue. You won't be charged to obtain a sales tax license either. However, you may need to pay a fee if you register for a specific profession or industry.

The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70. If you are not yet ready to file your LLC, Pennsylvania offers a name reservation option.

How Do I Find A Pennsylvania Registered Agent? Perform a Pennsylvania business name search. Use the name of the company you're trying to look up. Look at the PA registered agent's name and registered address.

How much does an LLC in Pennsylvania cost per year? All Pennsylvania LLCs need to pay $7 per year for the Annual Report. These state fees are paid to the Department of State. And these are the only required annual Pennsylvania LLC fees.