Agreement Form Montana Withholding Tax

Description

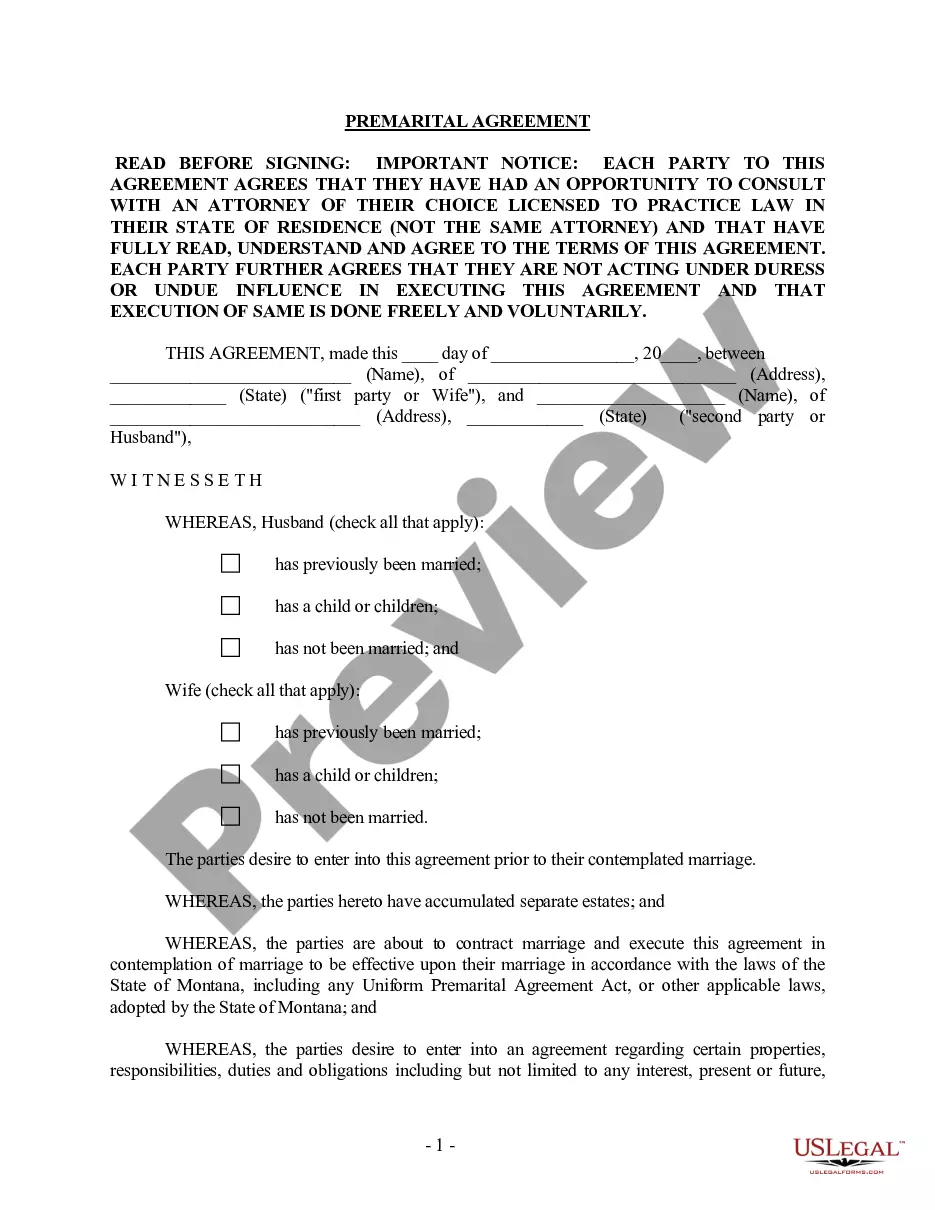

How to fill out Montana Premarital Agreements Package?

Red tape demands exactness and correctness.

If you do not manage completing documents such as the Agreement Form Montana Withholding Tax on a daily basis, it could lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and averts any hassle of resubmitting a document or starting the same task entirely over again.

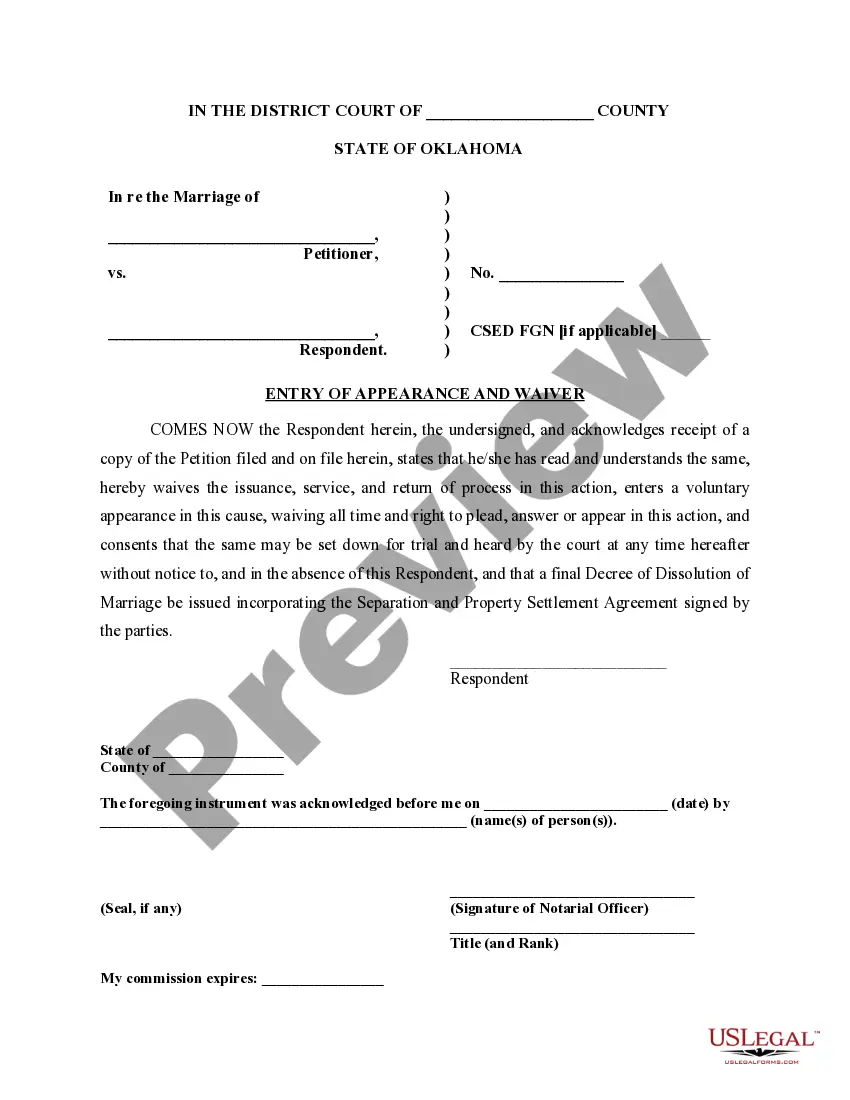

If you are not a registered user, finding the necessary template will require a few extra steps: Locate the template using the search bar. Confirm that the Agreement Form Montana Withholding Tax you have found is suitable for your state or county. View the preview or examine the description containing the details on the template's usage. Once the result fits your search, click the Buy Now button. Select the appropriate choice among the suggested pricing options. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal payment method. Obtain the template in the file format of your choice. Locating the correct and up-to-date templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency with forms.

- You can always find the right template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that holds over 85 thousand templates for various sectors.

- You can obtain the latest and most suitable version of the Agreement Form Montana Withholding Tax by simply exploring it on the website.

- Identify, store, and preserve templates in your profile or review the description to ensure you have the accurate one available.

- With an account at US Legal Forms, it is straightforward to obtain, centralize, and navigate through the templates you save to access them in just a few clicks.

- When on the webpage, click the Log In button to authenticate.

- Then, move to the My documents page, where your form history is kept.

- Browse the form descriptions and save the ones you need at any time.

Form popularity

FAQ

If you want your federal income tax withholding to be more accurate, you should fill out a new Form W-4. This will likely result in a change in your federal income tax withholding, which impacts the amount of your usual tax refund or the amount you usually owe.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

You can change your W-4 exemptions and allowances any time by simply completing and submitting another electronic W-4 form in CLASS-Web. Note: No more paper W-4 forms will be accepted! If you want to update your W-4 exemptions & allowances you must do so using the electronic form in CLASS-Web!

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.