Tax Sales And Use

Description

How to fill out Mississippi Complaint?

Legal management can be daunting, even for the most knowledgeable professionals.

When you are looking for a Tax Sales And Use and don’t have the time to dedicate to finding the correct and updated version, the procedures can be stressful.

US Legal Forms meets any requirements you may have, from personal to business documents, all in one location.

Utilize innovative tools to accomplish and manage your Tax Sales And Use.

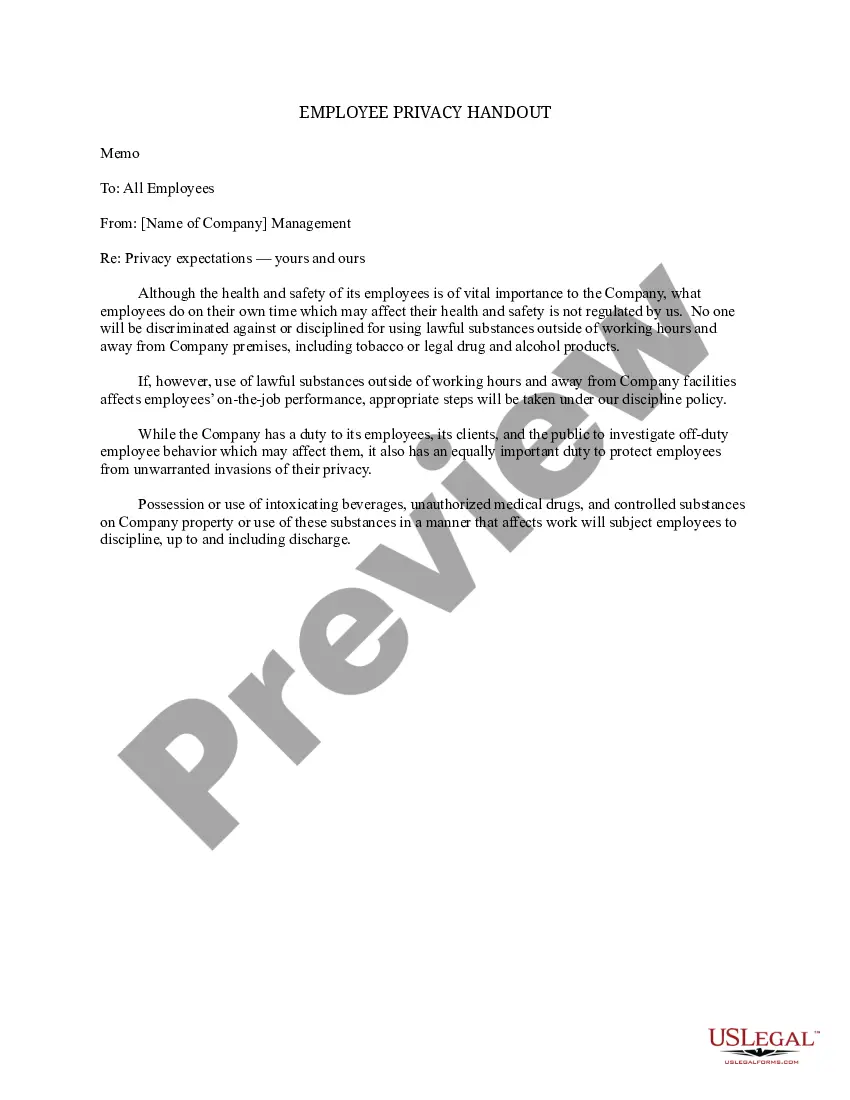

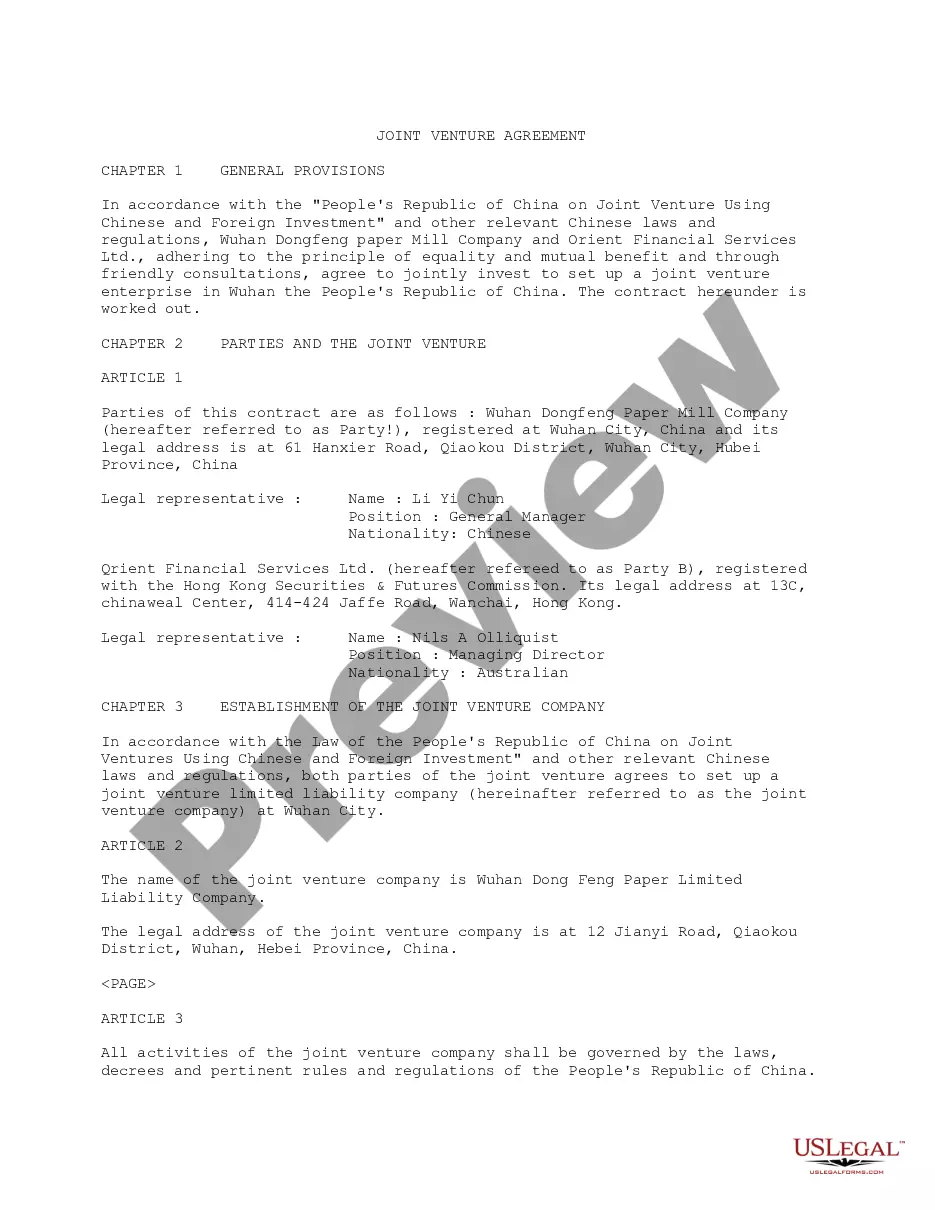

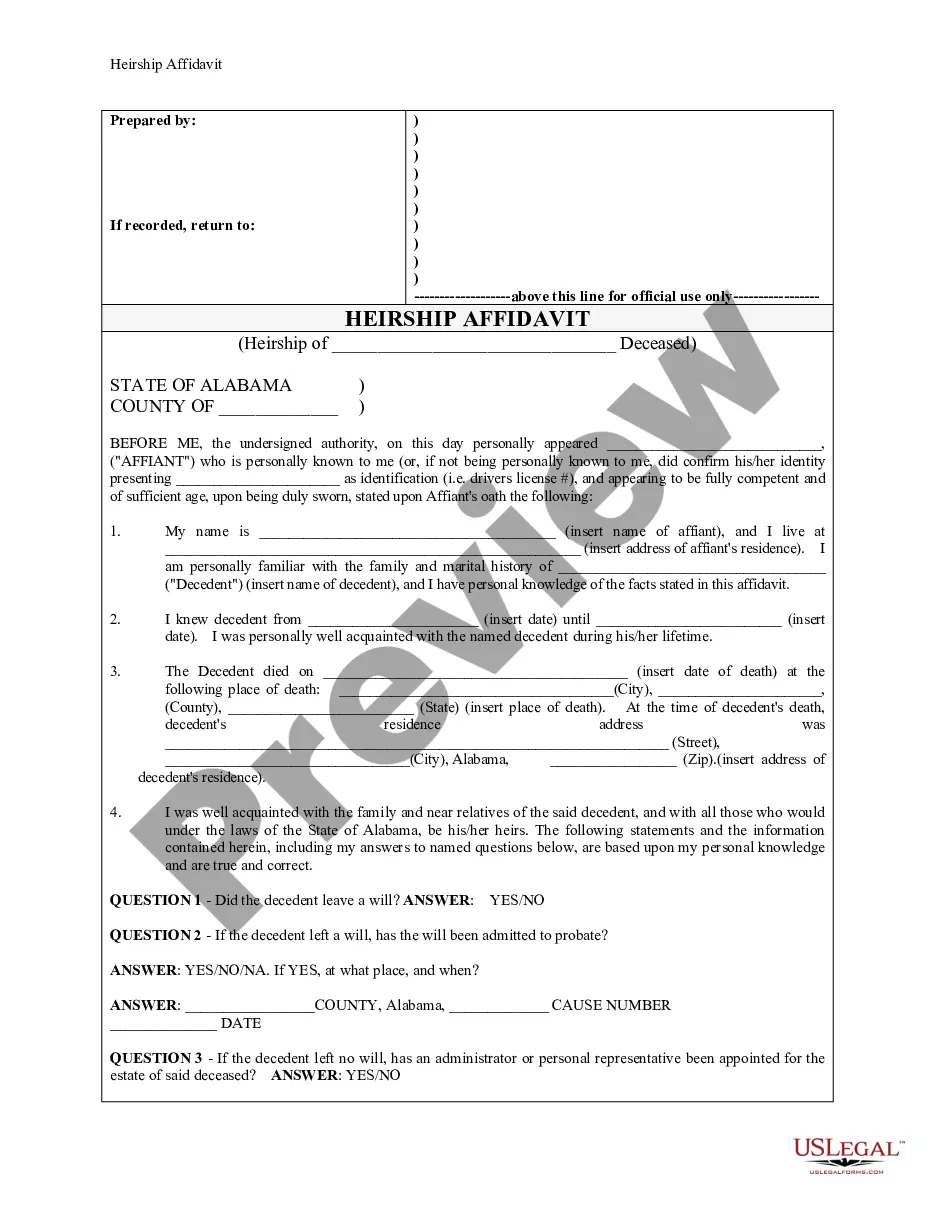

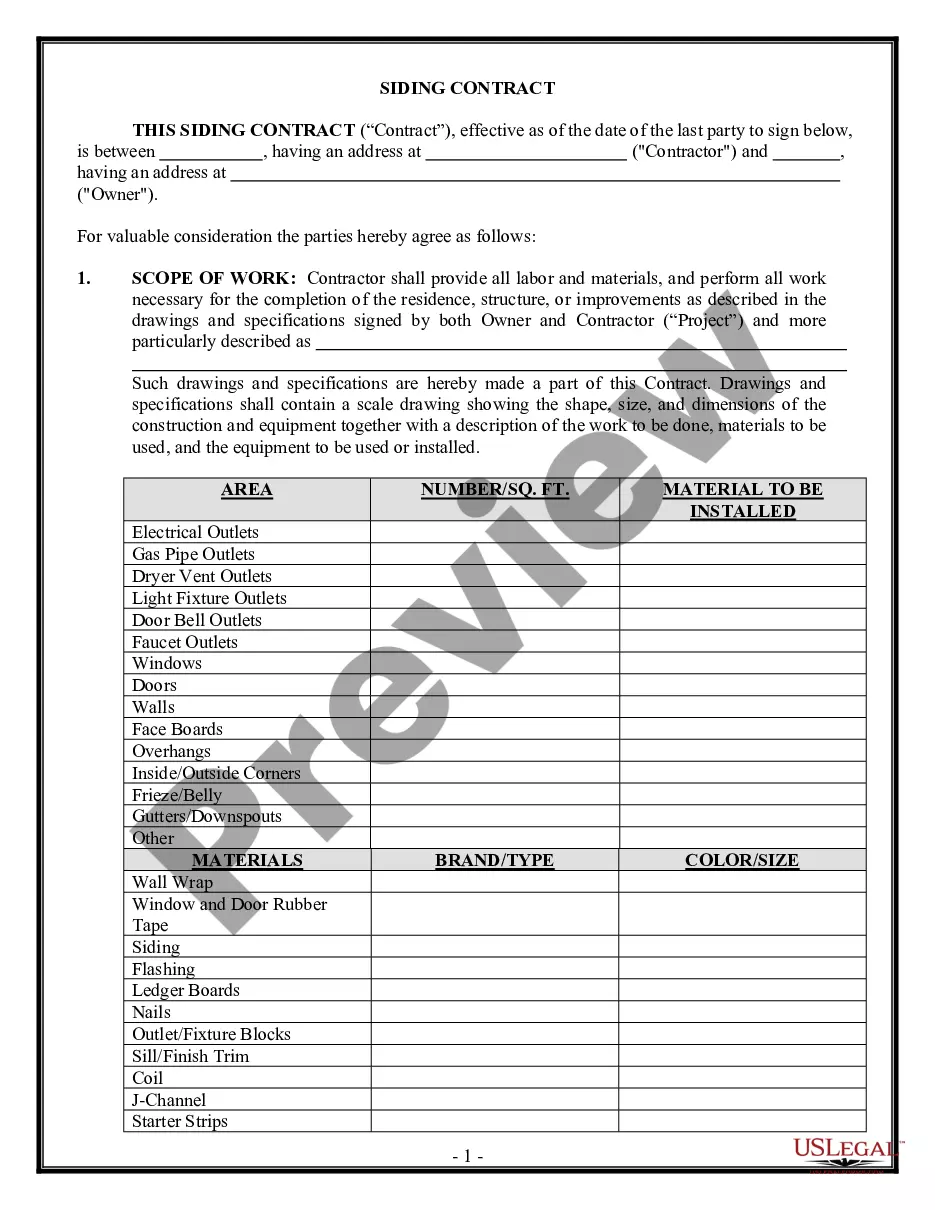

Here are the steps to follow after accessing the form you need: Confirm this is the correct form by previewing it and reading its description, ensure that the sample is recognized in your state or county, choose Buy Now when you are ready, select a subscription plan, choose the format you prefer, and Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online directory, supported by 25 years of experience and trustworthiness. Transform your everyday document management into a straightforward and user-friendly process today.

- Access a valuable resource library of articles, guides, and manuals relevant to your situation and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms’ sophisticated search and Review tool to find Tax Sales And Use and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents tab to view the documents you have previously downloaded and to organize your folders as you wish.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all platform benefits.

- A comprehensive web form directory could be a game changer for anyone who wishes to manage these situations efficiently.

- US Legal Forms is a frontrunner in online legal forms, with over 85,000 state-specific legal documents available to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

In conclusion, both sales tax and use tax are types of taxes that are levied on different transactions. Sales tax is typically charged at the point of sale on goods and services, while use tax is usually charged on items that were purchased outside of the state but are used within the state.

If you will make sales in Maryland, you will need to obtain a sales and use tax license. To obtain one, complete a Combined Registration Application. The application provides a one-stop method for registering a variety of tax accounts, including the sales and use tax license.

How much does it cost to apply for a sales tax permit in Maryland? It is free to register for a sales tax permit in Maryland. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business.

You have three options for filing and paying your Texas sales tax: File online ? File online at the ?TxComptroller eSystems? site. You can remit your payment through their online system. ... File by mail ? You can also download a Texas Sales and Use tax return here. AutoFile ? Let TaxJar file your sales tax for you.

The Washington (WA) state sales tax rate is currently 6.5%. Depending on local municipalities, the total tax rate can be as high as 10.4%. Other, local-level tax rates in the state of Washington are quite complex compared against local-level tax rates in other states.