Sales Tax By State

Description

How to fill out Mississippi Complaint?

Regardless of whether for commercial reasons or personal issues, everyone must confront legal matters at some point in their lives.

Completing legal documents requires meticulous care, beginning with selecting the correct form example.

Select your payment method: use a credit card or PayPal account. Choose the desired file format and download the Sales Tax By State. Once it is downloaded, you can complete the form using editing software or print it out and finish it by hand. With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the right template for any situation.

- For instance, if you choose an incorrect version of a Sales Tax By State, it will be declined upon submission.

- Thus, it is vital to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need a Sales Tax By State example, adhere to these straightforward steps.

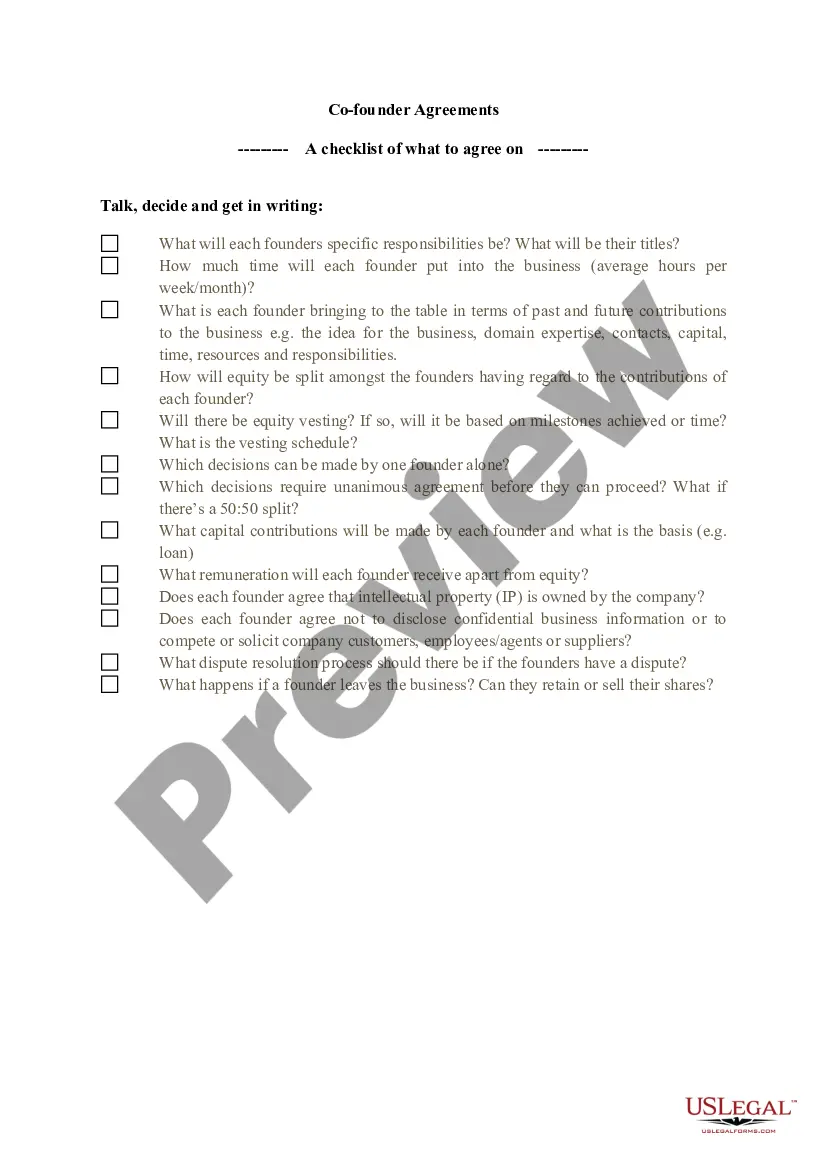

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it fits your situation, state, and locality.

- Click on the form’s preview to examine it.

- If it’s the incorrect form, return to the search feature to find the Sales Tax By State example you need.

- Download the file if it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you may acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Fill out the account registration form.

Form popularity

FAQ

This can make a huge difference in how much you pay for retail items, since rates can range as high as 7.25% in California, ing to research from Tax Foundation. The following five states currently have no statewide sales tax: Alaska, Delaware, Montana, New Hampshire and Oregon.

States With No Income Tax Comparison of States With No Income TaxNo-Tax StateTotal Tax Burden (% of income)Total Tax Burden Rank (1=lowest)Alaska5.06%1New Hampshire6.14%3Tennessee6.22%46 more rows ?

Get the rate you need State base rateTotal rangeCalifornia6.00%7.25%?10.25%Colorado2.90%2.9%?11.2%Connecticut6.35%6.35%Delaware0%0%?0%46 more rows

The five states with the highest average combined state and local sales tax rates are Tennessee (9.548 percent), Louisiana (9.547 percent), Arkansas (9.44 percent), Washington (9.40 percent), and Alabama (9.24 percent).

Here are the 10 states with the highest sales tax rates: California: 7.25%