Kentucky Child Support Withholding Limits

Description

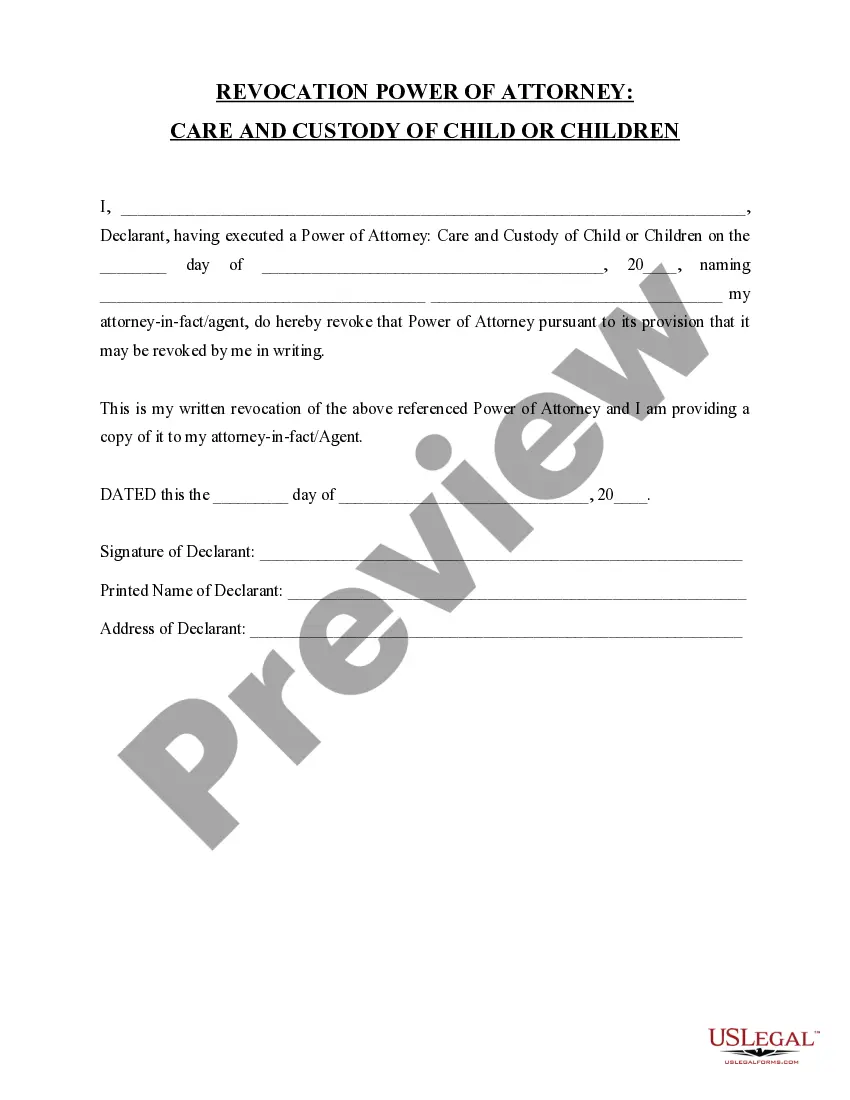

How to fill out Kentucky Revocation Of General Power Of Attorney For Care And Custody Of Child Or Children?

What is the most reliable service to secure the Kentucky Child Support Withholding Limits and other current versions of legal documents? US Legal Forms is your solution!

It's the best repository of legal forms for any application. Every document is correctly prepared and verified for adherence to federal and local regulations.

Document compliance evaluation. Prior to obtaining any template, you should verify whether it meets your usage needs and complies with your state's or county's laws. Review the form description and make use of the Preview option if accessible. Alternative form search. If there are any discrepancies, use the search bar at the top of the page to locate another template. Click Buy Now to choose the appropriate one. Account registration and subscription purchase. Choose the most fitting pricing plan, Log In or create an account, and pay for your subscription via PayPal or credit card. Downloading the documents. Choose the format you wish to save the Kentucky Child Support Withholding Limits (PDF or DOCX) and click Download to retrieve it. US Legal Forms is a fantastic resource for anyone who needs to manage legal documents. Premium members can benefit even more by completing and signing previously saved files electronically at any time using the built-in PDF editing tool. Give it a try today!

- They are organized by region and state of applicability, making it easy to find the one you require.

- Experienced users of the platform just need to Log In, confirm if their subscription is active, and click the Download button next to the Kentucky Child Support Withholding Limits to access it.

- Once saved, the form is available for future reference in the My documents section of your account.

- If you do not yet have an account with us, here are the steps you need to follow to create one.

Form popularity

FAQ

Kentucky child support withholding limits specify that the maximum rate of child support varies depending on the combined adjusted gross income of both parents. Typically, these rates are structured in a way that considers the basic needs of the child along with other financial responsibilities the parent may have. To navigate these calculations effectively, it's beneficial to consult the legal forms and resources offered by US Legal Forms, ensuring you stay within the appropriate limits.

The maximum child support amount in Kentucky is calculated based on both parents' incomes and the number of children involved. Factors include healthcare, education, and other childcare costs, which all contribute to the final support amount. State guidelines help establish a fair amount that protects the children's welfare while balancing the parents' financial capabilities. For accurate calculations, consider using resources available at US Legal Forms.

In Kentucky, the child support withholding limits are set to ensure that non-custodial parents can meet their financial obligations while maintaining a reasonable standard of living. Typically, a maximum of 50% of disposable income may be withheld for child support if the non-custodial parent supports other children. It's important to understand these limits when planning your financial obligations, as exceeding them may affect the parent's ability to provide for their other needs.

A warrant for arrest can be issued if an individual falls significantly behind on child support, typically after several missed payments or if the owed amount reaches a certain threshold. Courts may also take this action if they determine that the noncustodial parent is willfully failing to make payments. Knowing about Kentucky child support withholding limits can help you understand the consequences of non-payment and make informed decisions. If necessary, consult US Legal Forms for assistance in handling your situation.

Your ex can fall behind on child support payments significantly before facing serious legal consequences. However, even one missed payment can lead to complications, including legal actions. It's important to know that Kentucky child support withholding limits exist to protect both parties and ensure fair enforcement. If you face ongoing issues, you might want to explore solutions available on platforms like US Legal Forms to help navigate your options.

Recent changes to custody laws in Kentucky focus on the best interests of the child, with an emphasis on shared parenting arrangements. These updates are designed to promote more balanced parenting post-separation or divorce. To fully understand these new custody laws and how they may affect child support, you can rely on tools provided by US Legal Forms to assist you.

In Kentucky, there is no specific limit on how much a parent can be behind in child support, but the consequences of falling behind can be serious. Accumulating arrears can lead to wage garnishments and legal penalties. It’s crucial to stay current with payments, and if you are struggling, seek guidance from legal resources or US Legal Forms to explore your options.

In Kentucky, child support typically continues until the child turns 18, but it can extend beyond that under certain circumstances, such as if the child is still in high school. Therefore, parents should remain informed about when their responsibilities may end. Utilizing platforms like US Legal Forms can help clarify these details and ensure compliance with Kentucky laws.

Kentucky law dictates that both parents are responsible for financially supporting their children. The laws outline the process for determining child support amounts, including factors like income and the needs of the child. For individuals needing assistance in understanding these laws, US Legal Forms offers tools and resources that can simplify the process.

In Kentucky, the maximum amount that can be withheld from a parent’s income for child support is generally governed by federal and state guidelines. These Kentucky child support withholding limits ensure that parents contribute fairly while allowing them to maintain some financial stability. You can consult legal resources to understand how these limits apply to your specific situation.