What is Power of Attorney?

A Power of Attorney is a legal document that allows one person to act on behalf of another. It's often used in financial or healthcare matters. Explore state-specific templates to suit your needs.

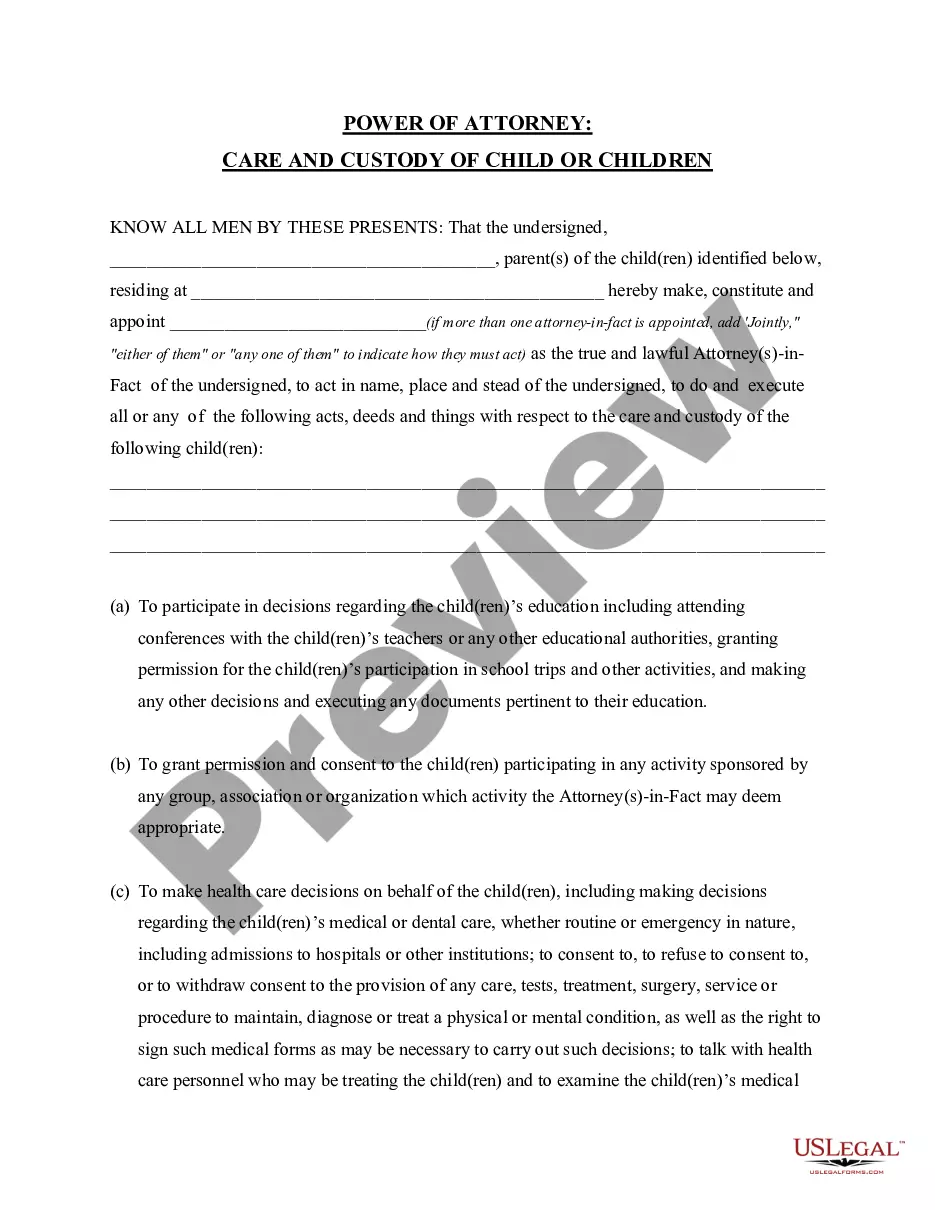

Power of Attorney documents empower individuals to make decisions for others. Attorney-drafted templates are quick and easy to complete.

Get essential legal forms for planning your life and health in one convenient package, ensuring peace of mind for you and your loved ones.

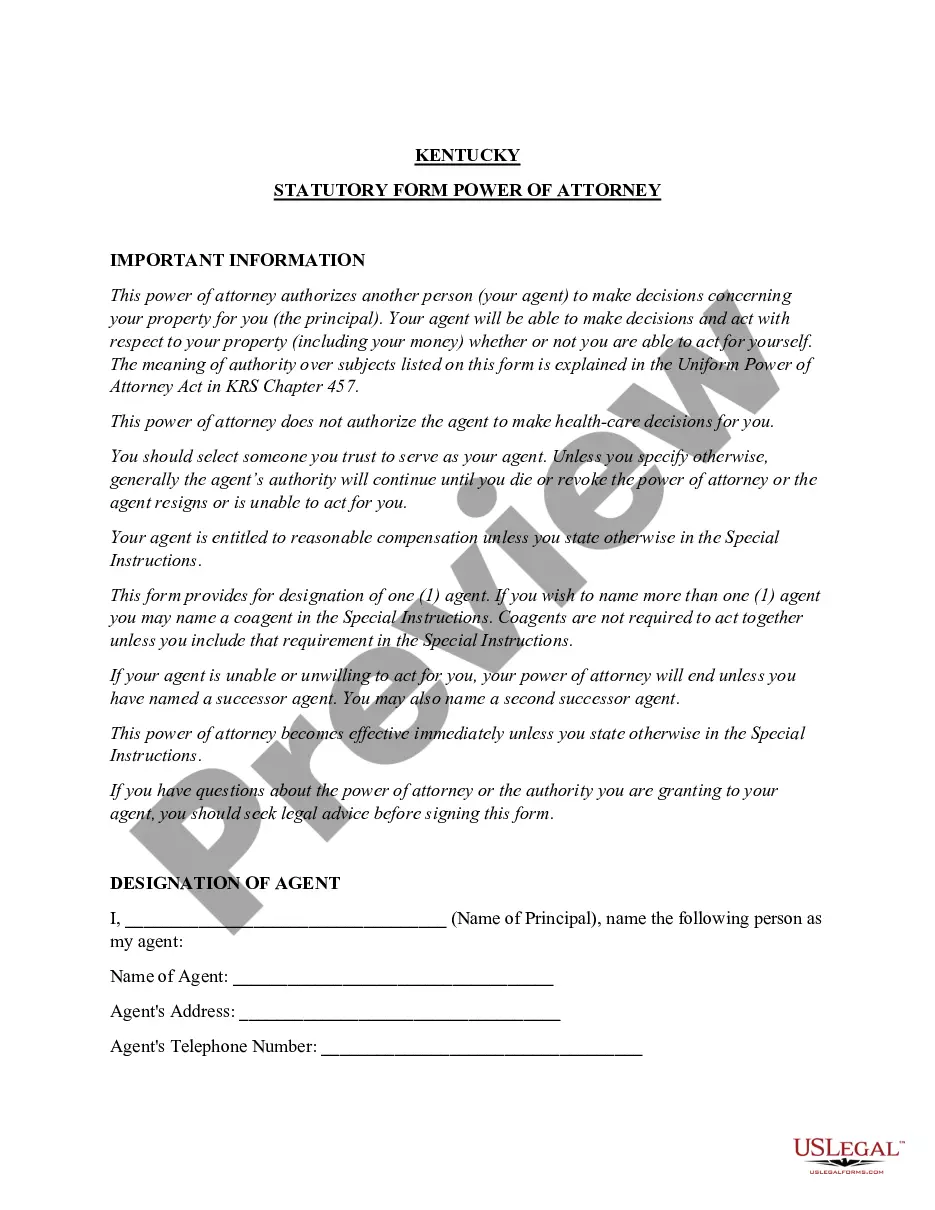

Designate someone to manage your property and finances, even if you become incapacitated. It's crucial for ensuring your affairs are handled as you wish.

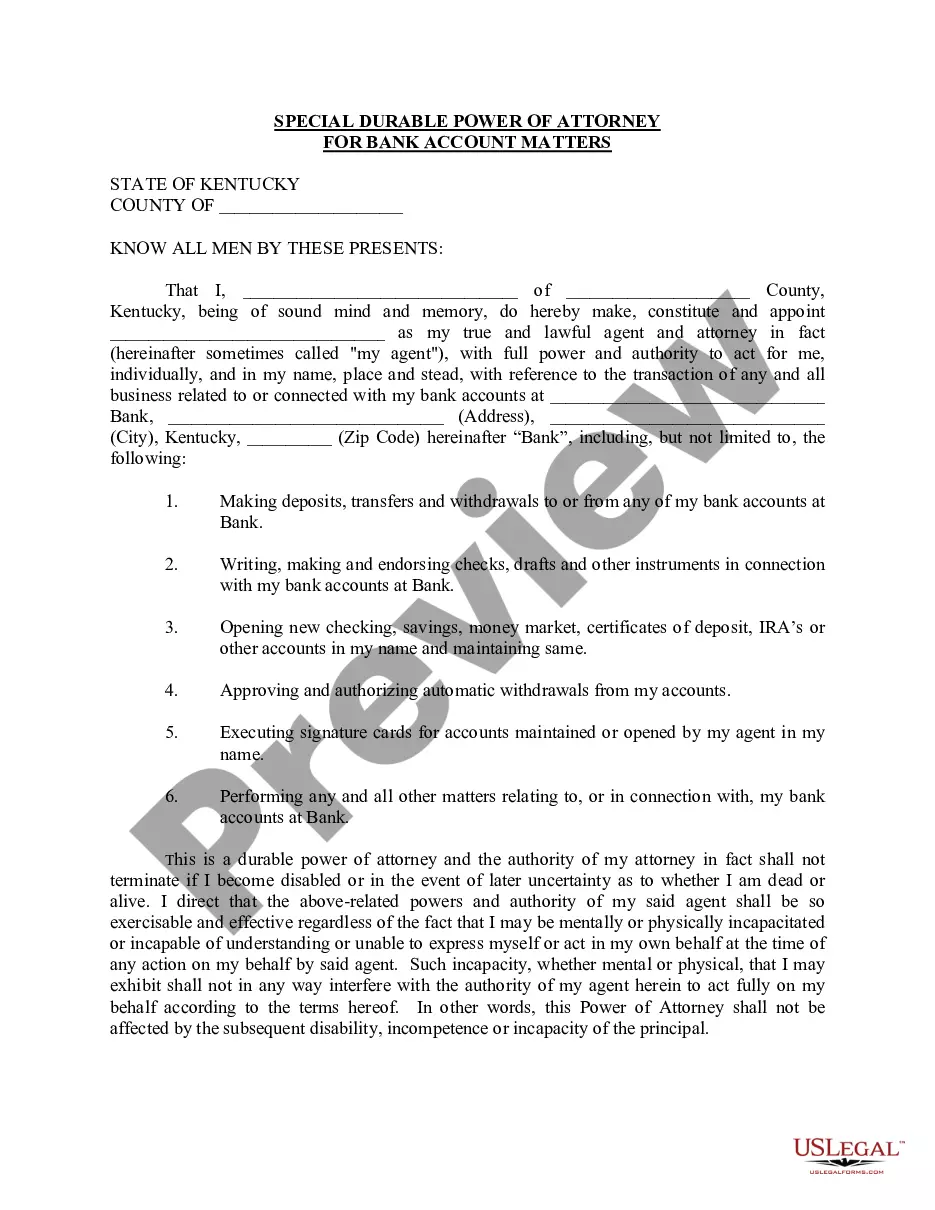

Create a document allowing someone to manage your property if you become disabled, ensuring your financial matters are handled according to your wishes.

Get essential legal forms to protect your health, finances, and personal affairs—all in one convenient package.

Authorize someone to make crucial decisions about your child's care and education when you cannot be present.

Create a legal document that allows someone to manage your financial affairs when you can’t. Choose a trusted agent to act on your behalf.

Ensure your medical wishes are honored with this complete package of essential legal forms.

Empower an agent to manage your bank accounts even if you become incapacitated, ensuring your financial affairs continue smoothly.

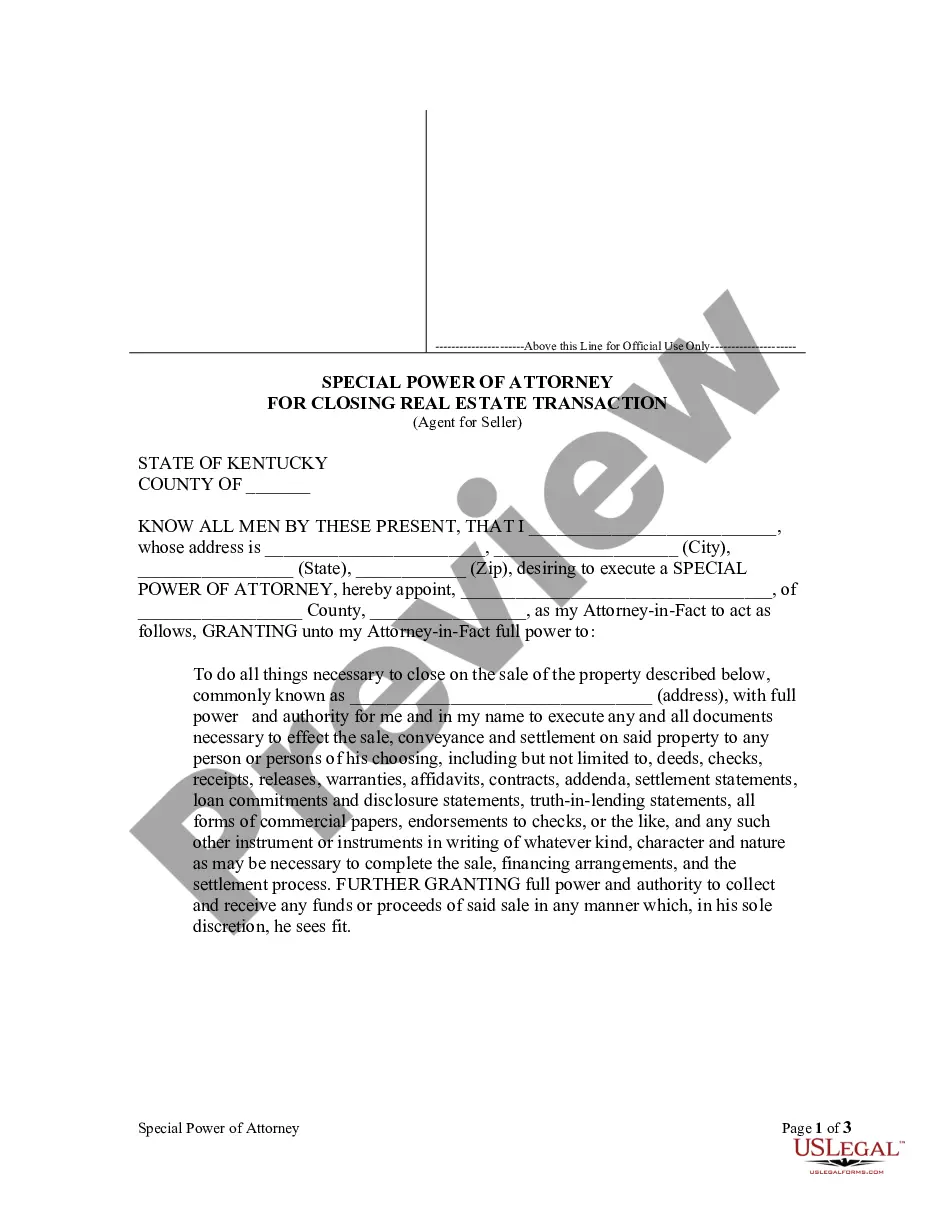

Assigns someone to handle the sale of your property securely and efficiently, ensuring all necessary legal documents are processed.

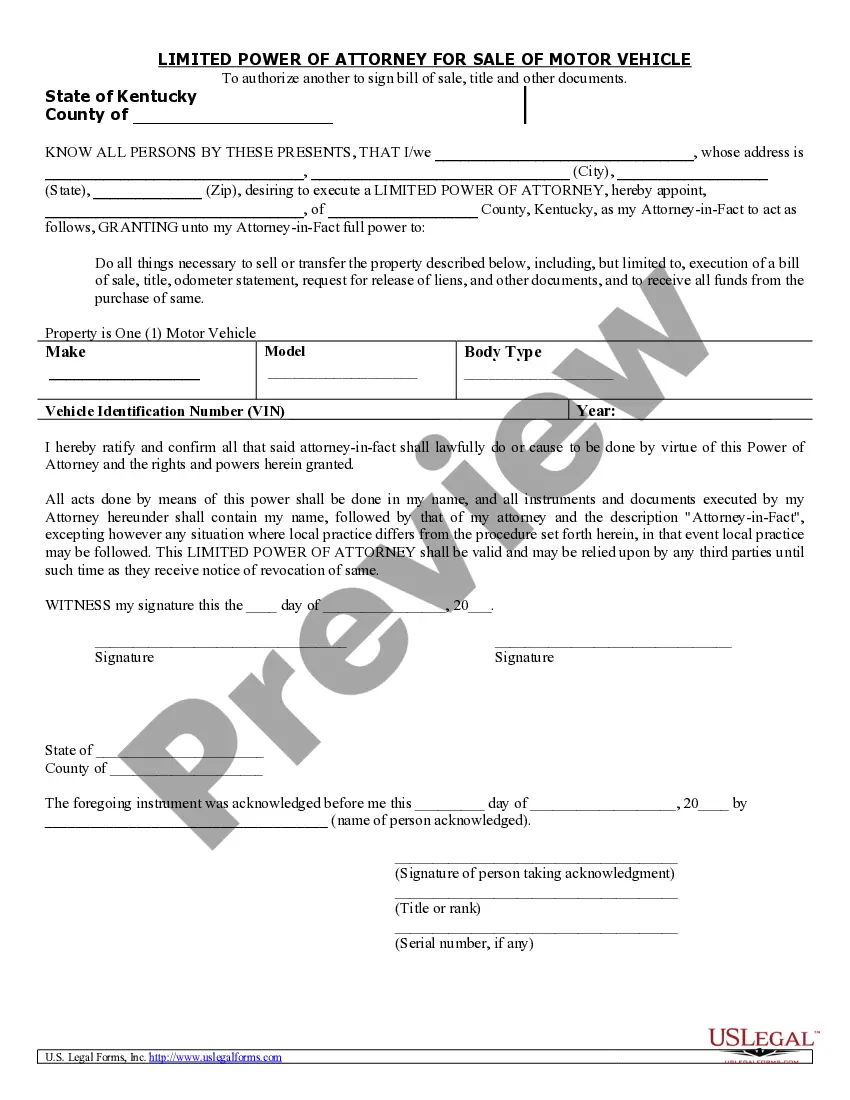

Authorize someone to handle the sale of your vehicle and sign necessary documents on your behalf.

A Power of Attorney can be revoked at any time by the principal.

The agent must act in the best interest of the principal.

Not all Powers of Attorney are created equal; options vary in authority.

Many documents require notarization or witnesses to be valid.

An agent can be a trusted friend, family member, or professional.

Understanding the scope of authority is crucial for both parties.

Powers can be limited to specific situations or be general.

Begin easily with these straightforward steps.

Do I need a trust if I have a will?

What happens if I do nothing?

How often should I update my plan?

How do beneficiary designations interact with my plan?

Can different people handle finances and health decisions?