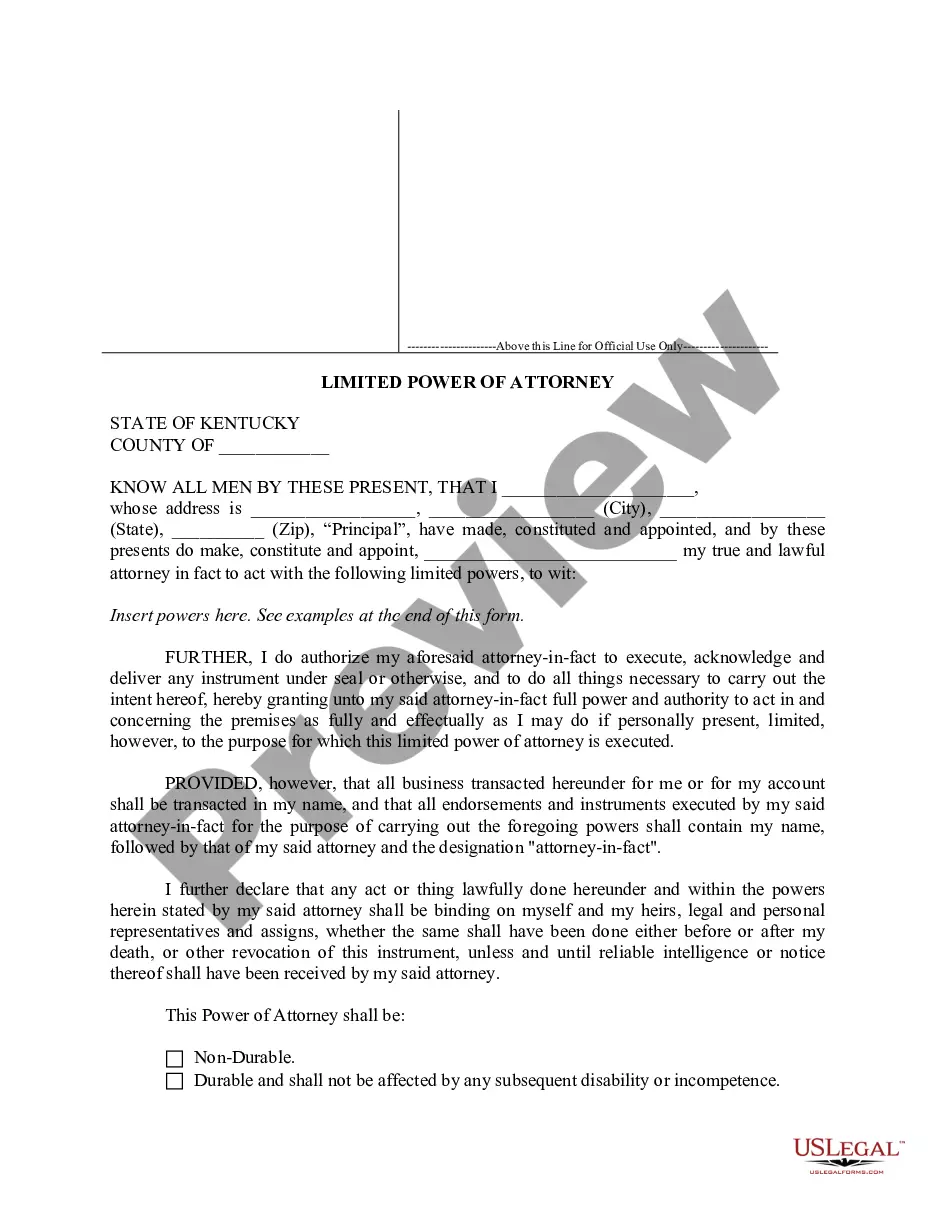

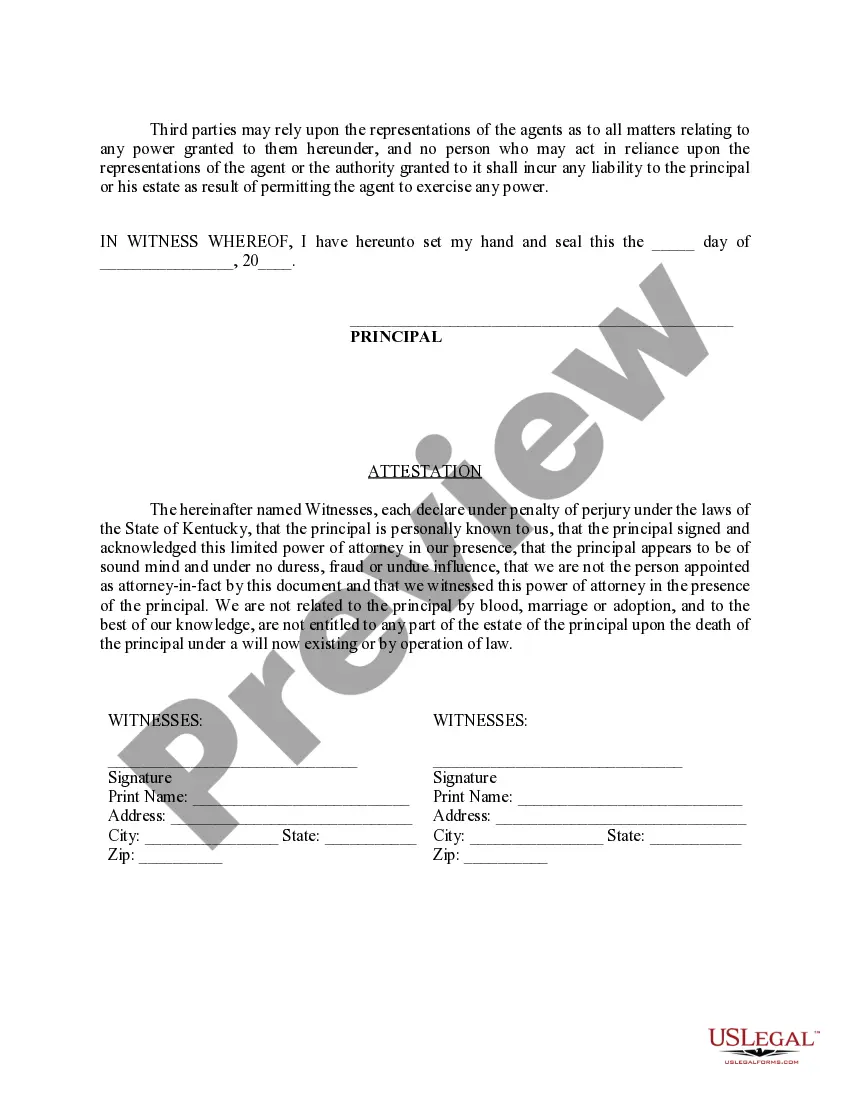

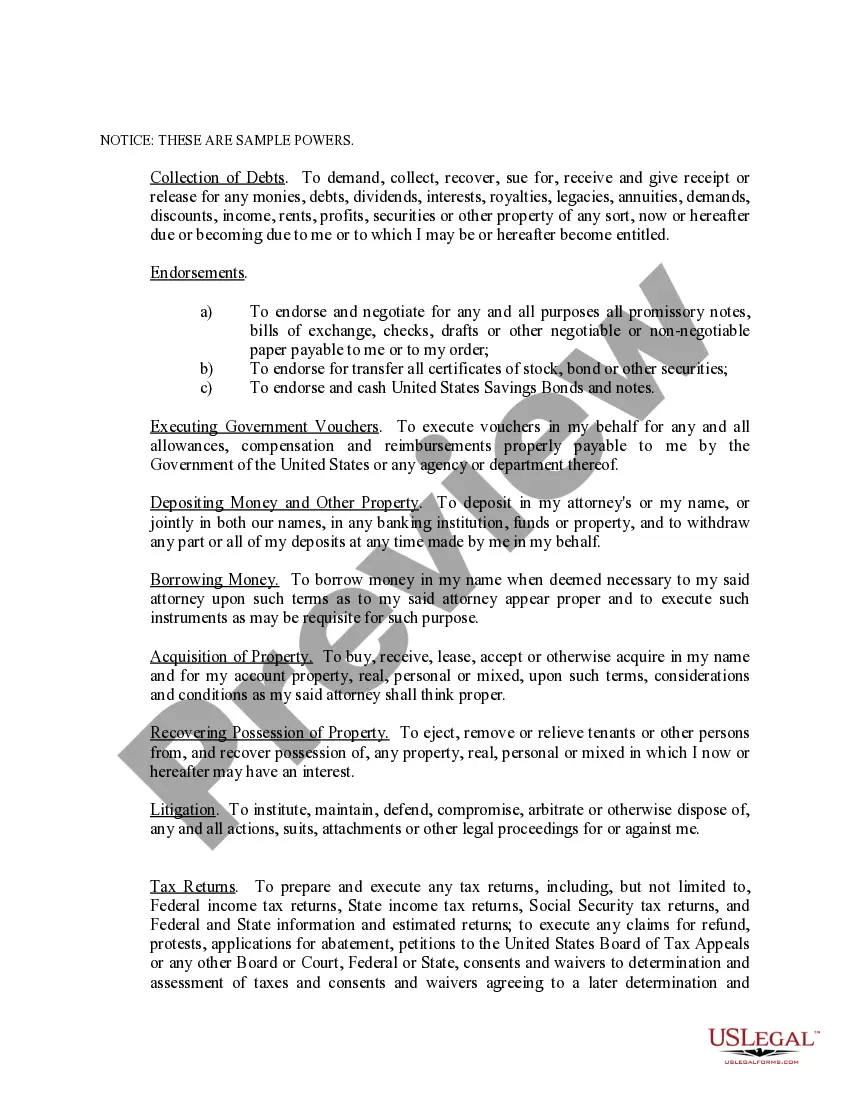

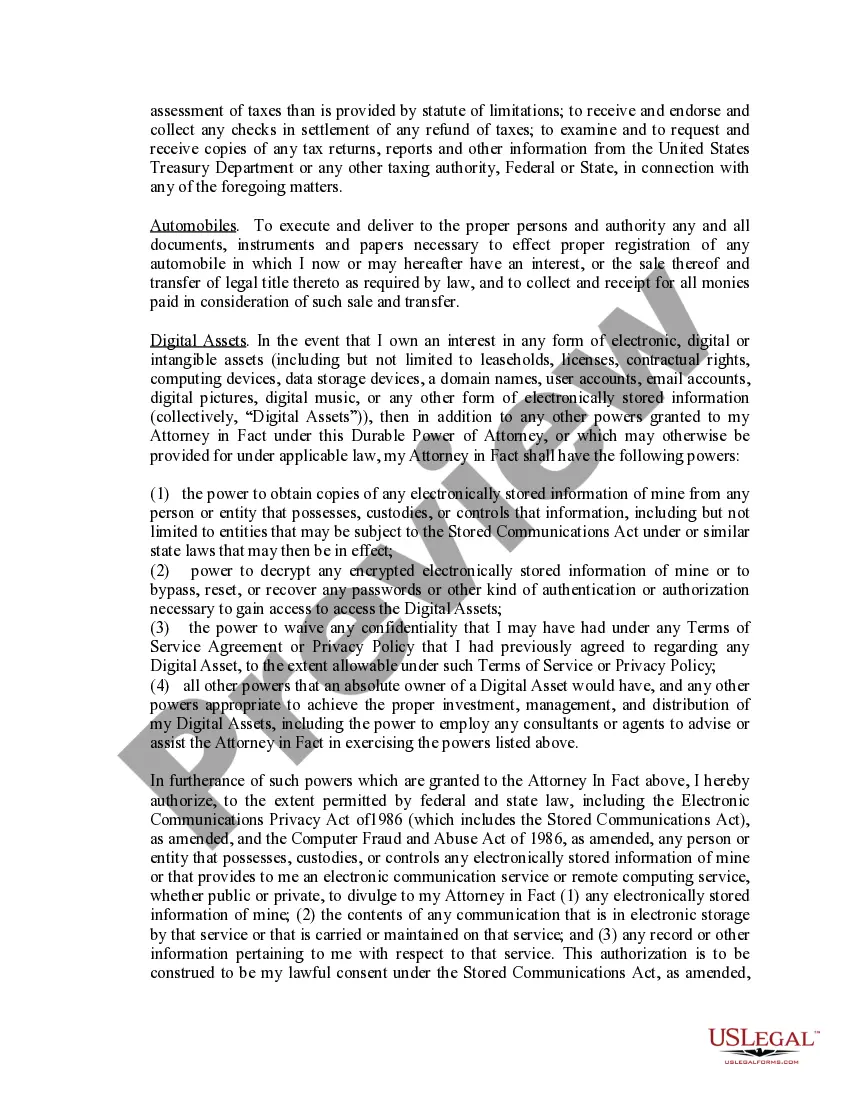

This is a limited power of attorney for Kentucky. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Kentucky Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Kentucky Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Seeking to locate Kentucky Limited Power of Attorney where you Define Powers with Sample Powers Included formats and completing them can be rather a task.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your jurisdiction in just a few clicks.

Our attorneys prepare all paperwork, so you merely have to fill them in. It is genuinely so effortless.

Choose your plan on the pricing page and establish your account. Indicate if you prefer to pay via card or PayPal. Save the document in your desired format. You can either print the Kentucky Limited Power of Attorney where you Define Powers with Sample Powers Included form or fill it out using any online editor. No need to be concerned about typos, as your template can be used and submitted multiple times, and printed out as many instances as you require. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage and download the example.

- All of your downloaded samples are kept in My documents and are always accessible for future use.

- If you haven't signed up yet, you need to create an account.

- Review our thorough instructions on how to acquire the Kentucky Limited Power of Attorney where you Define Powers with Sample Powers Included template in just a few minutes.

- To obtain a valid template, verify its applicability for your state.

- Examine the example using the Preview feature (if available).

- If there's an explanation, read it to understand the specifics.

- Click on the Buy Now button if you've found what you're looking for.

Form popularity

FAQ

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

Non-Durable Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Medical Power of Attorney. Springing Power of Attorney. Create Your Power of Attorney Now.

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.

A general power of attorney gives broad authorizations to the agent. The agent may be able to make medical decisions, legal choices, or financial or business decisions.For example, you could create a special power of attorney which only allows your spouse to make medical decisions on your behalf.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

A general power of attorney ends on your death or incapacitation unless you rescind it before then. Durable. A durable power of attorney can be general or limited in scope, but it remains in effect after you become incapacitated.