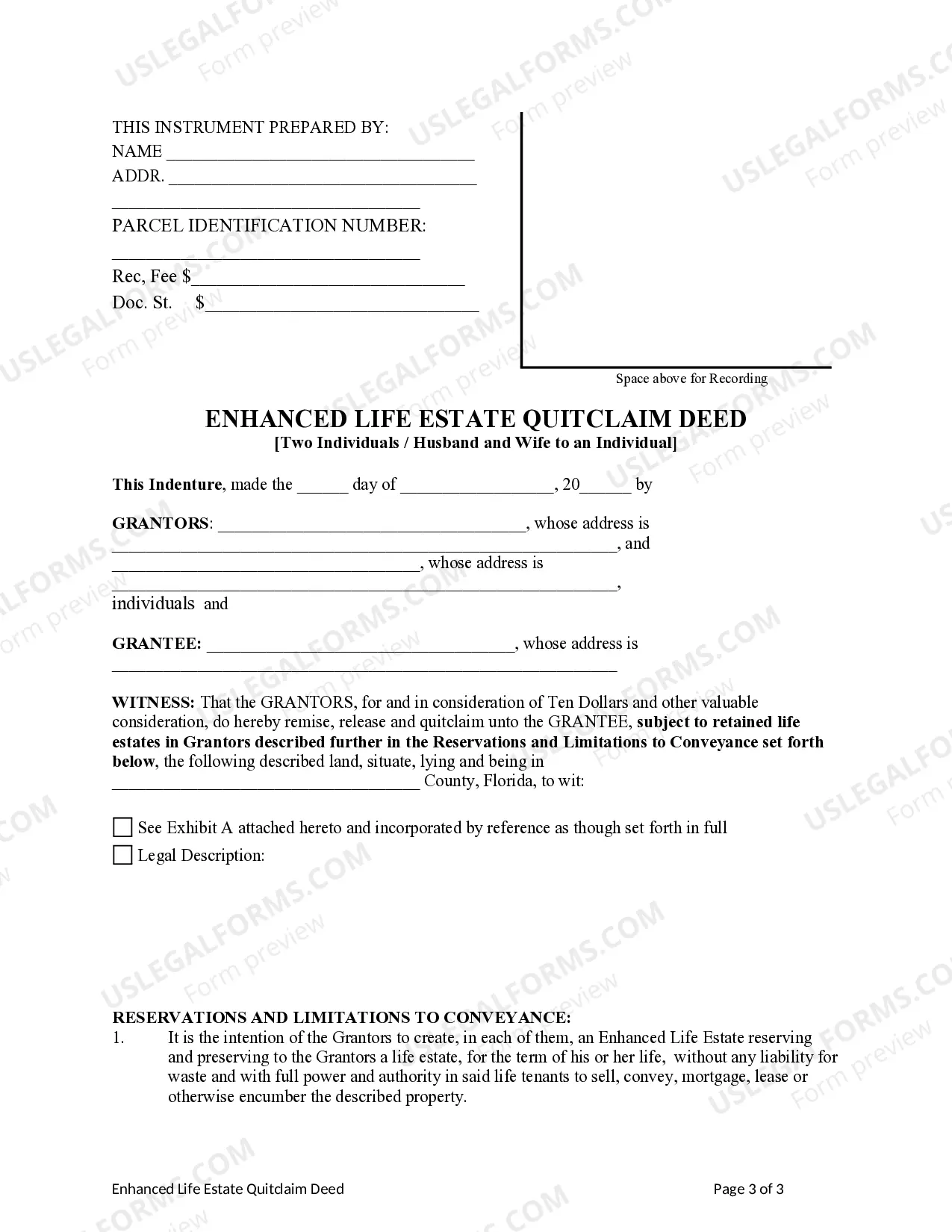

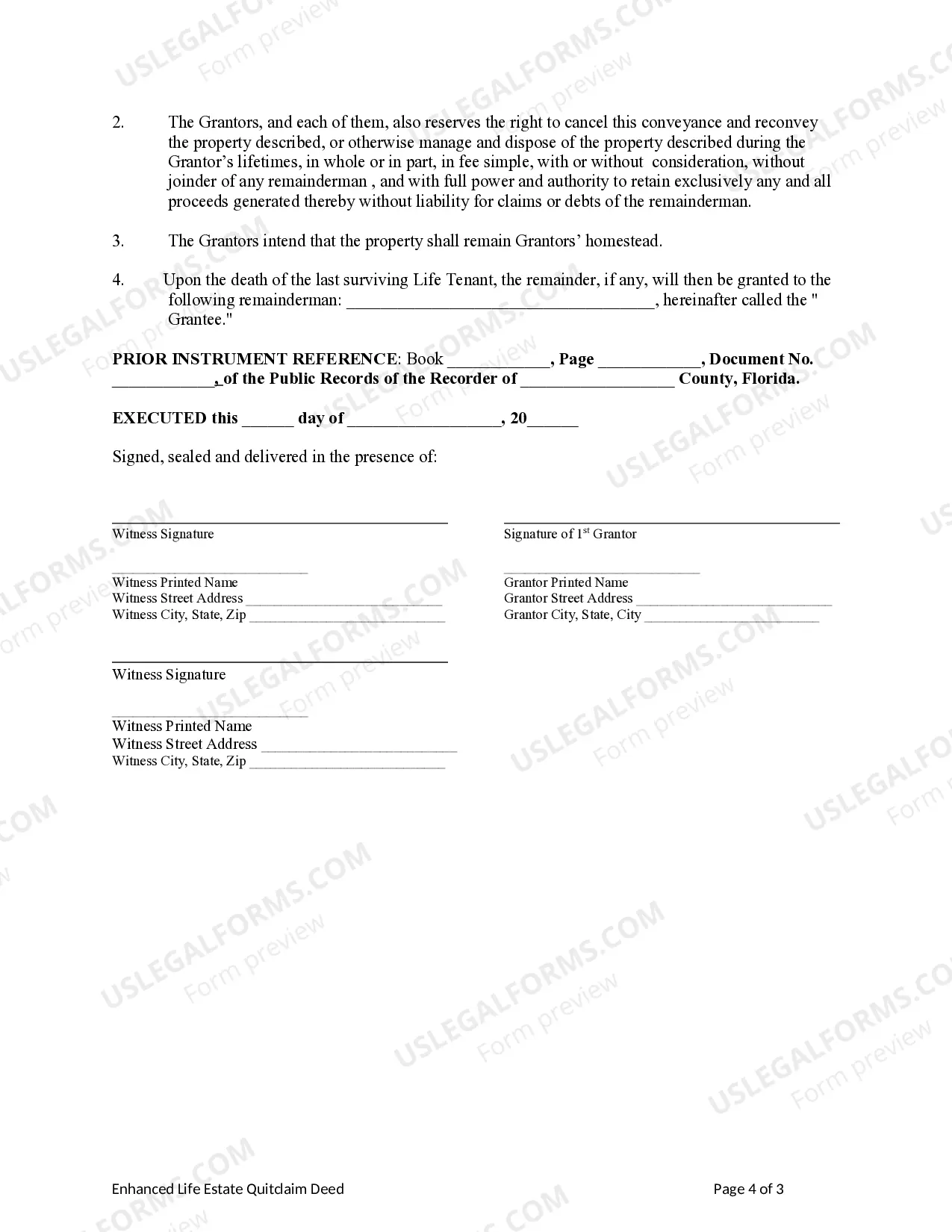

Quit Claim Deed

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Two Individual Or Husband And Wife To Individual?

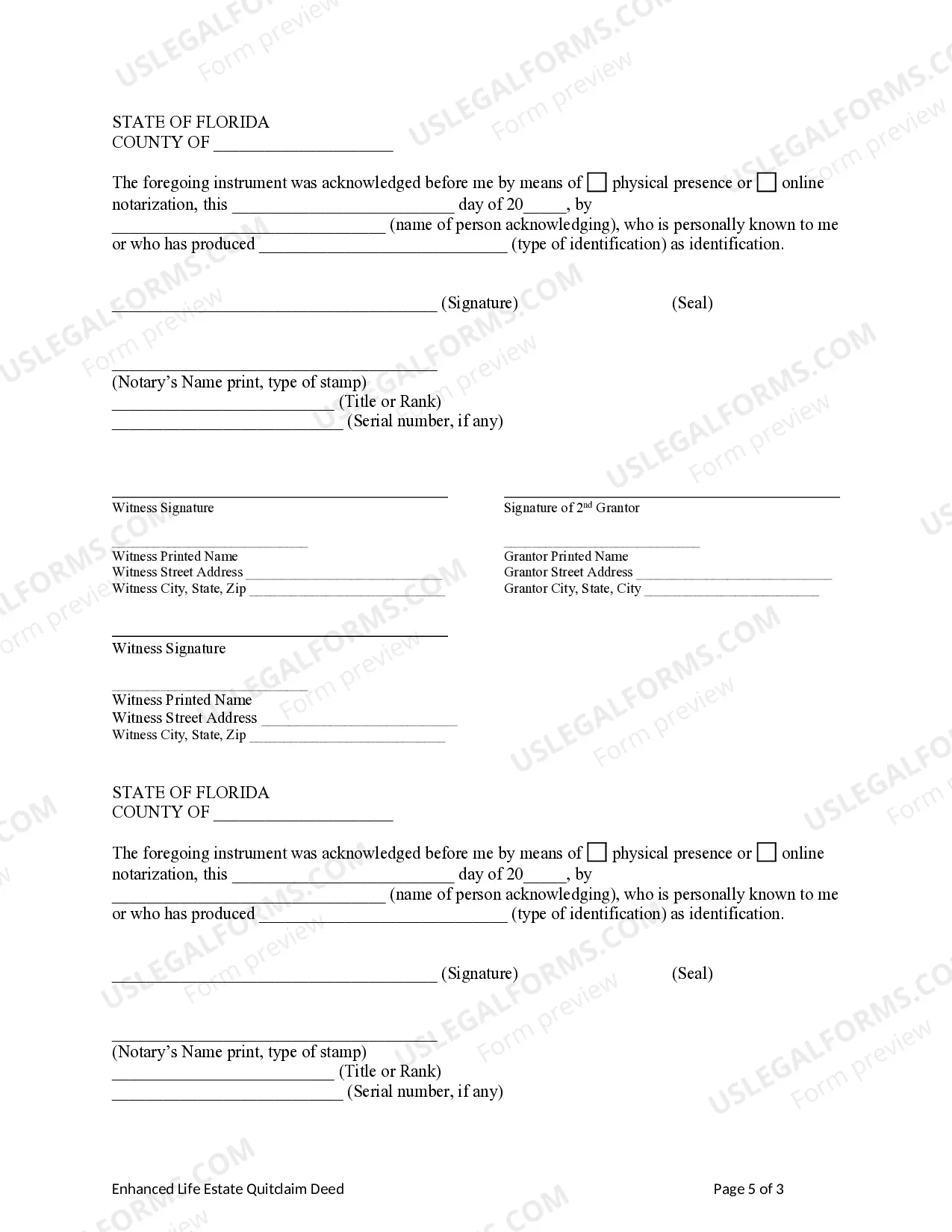

- If you're a returning user, log in to your account and ensure your subscription is active. Download the necessary template by clicking the Download button.

- If you're new to US Legal Forms, start by reviewing the form options. Use the Preview mode to assess the quit claim deed and check that it meets your state requirements.

- If the provided template isn't suitable, employ the Search feature to find the correct document tailored to your needs.

- Once you locate the right quit claim deed, click on the Buy Now button. Select the subscription plan that best fits your needs and create an account.

- After registering, enter your payment details and confirm your purchase for full access.

- Download the quit claim deed to your device, and retrieve it anytime from the My Forms section.

In conclusion, US Legal Forms empowers users by offering an extensive collection of over 85,000 legal templates, ensuring that you can easily find the quit claim deed that suits your needs. The platform also provides access to expert assistance to guarantee that your documents are accurate and legally valid.

Start your journey today with US Legal Forms and ensure your properties are managed effectively!

Form popularity

FAQ

In Missouri, a quit claim deed must include a description of the property, the name and address of the grantor and grantee, and it must be signed by the grantor. The deed should also be notarized to validate the transfer. It's advisable to consult resources like US Legal Forms for detailed guidance specific to Missouri.

A quit claim deed can be rendered void if it was executed under duress, fraud, or if the grantor lacked the legal capacity to transfer ownership. Additionally, if the deed is not recorded within a statutory period, it may lose its legal effect against subsequent claimants. Always ensure that the quit claim deed follows the correct legal procedures to maintain its validity.

Yes, you can complete a quit claim deed yourself, but careful attention is necessary to ensure accuracy. Various online platforms, like US Legal Forms, can help simplify the process with templates and guidance. However, consider consulting a legal professional if your situation is more complex.

One downside of a quitclaim deed is that it offers no warranties about the property title, meaning you could inherit defects or claims against it. Also, once executed, there is no way to retract a quitclaim deed if disputes arise. It's essential to weigh these risks before deciding if a quitclaim deed fits your needs.

A quitclaim deed may not be effective in situations involving complex property transfers or when a title insurance policy is a requirement. Additionally, it cannot be used to resolve title defects or disputes, as it does not guarantee ownership. In cases of divorce or inheritance, it's often advisable to consult a legal expert rather than rely solely on a quitclaim deed.

You do not necessarily need a lawyer to file a quit claim deed in Illinois. Many homeowners choose to handle this process on their own, especially if the transfer of property is straightforward. However, consulting with a legal professional can provide clarity and ensure all legal requirements are met. Using uslegalforms can simplify the process by providing the necessary forms and guidance.

Individuals involved in family matters, such as divorces or estate settlements, typically benefit most from a quit claim deed. This type of deed allows for fast transfers of property interests without the need for extensive legal processes. Additionally, it can help resolve property ownership disputes simply. If you’re considering a quit claim deed, US Legal Forms offers solutions to guide you through creating this document effectively.

The main purpose of a quit claim deed is to transfer ownership rights of a property quickly and easily. This is often used in situations like family transfers or divorces, where one party wants to convey their interest in a property. A quit claim deed can simplify this process, but it does not guarantee the property's title. For seamless transactions, consider using the US Legal Forms platform to streamline your quit claim deed needs.

While a quit claim deed is a simple way to transfer property, it lacks legal protections that other deeds provide. This type of deed does not assure the recipient that the property title is valid. Consequently, if issues with ownership come up, the recipient may face significant challenges. We recommend evaluating your situation carefully to decide if a quit claim deed is the right approach for you.

A quit claim deed can leave you vulnerable because it does not guarantee clear ownership of the property. If there are any liens or claims against the property, the recipient assumes those risks. Additionally, the quit claim deed does not provide warranties, meaning if issues arise later, you may have limited recourse. It's important to understand these risks before using a quit claim deed.