Liability Pllc With 5 Members

Description

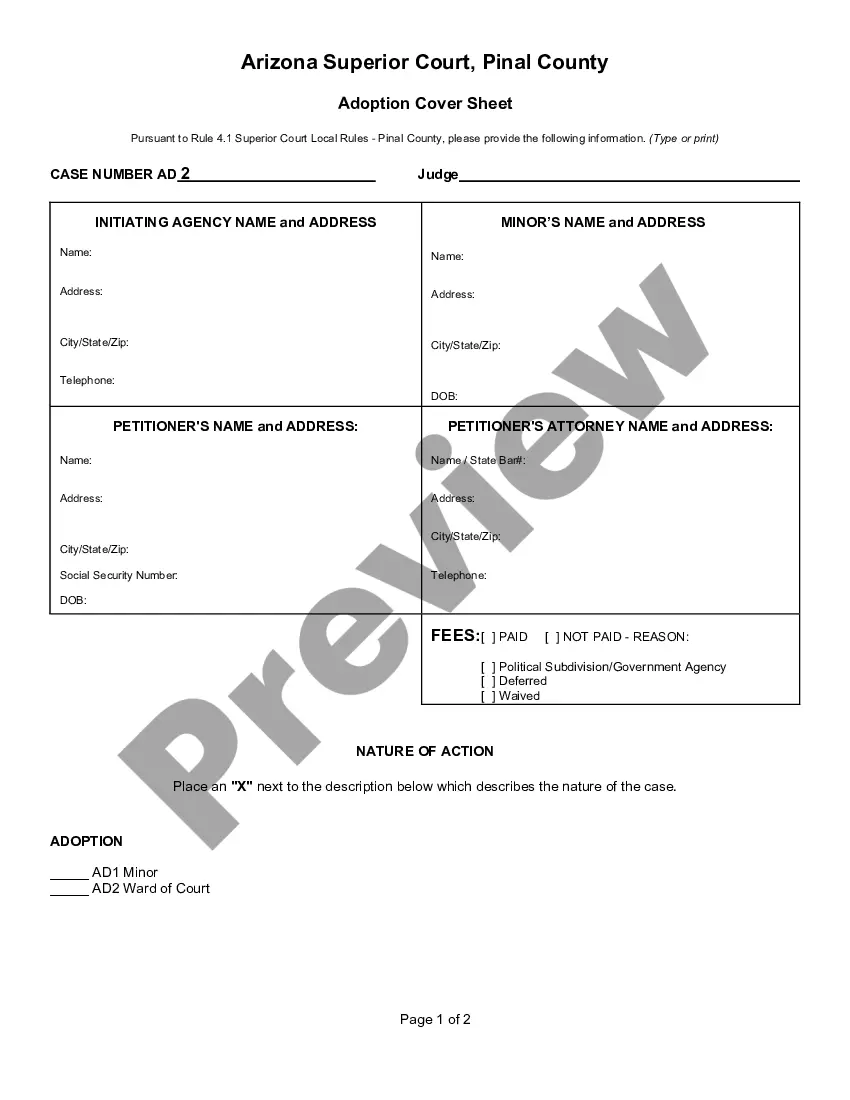

How to fill out Florida Professional Limited Liability Company PLLC Formation Package?

The Liability Pllc With 5 Members displayed on this page is a versatile formal template created by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any business and personal situation. It is the fastest, simplest, and most trustworthy method to acquire the necessary paperwork, as the service ensures bank-level data protection and anti-malware security.

Select the format you desire for your Liability Pllc With 5 Members (PDF, DOCX, RTF) and save the document on your device. Complete and sign the paperwork. Print the template for manual completion. Alternatively, use an online multifunctional PDF editor to efficiently and accurately fill out and sign your form with an eSignature. Download your paperwork again. Reuse the same document whenever needed. Access the My documents tab in your profile to redownload any previously acquired forms. Register for US Legal Forms to have authenticated legal templates for all of life’s situations at your fingertips.

- Look for the document you need and review it.

- Browse through the file you searched and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, use the search bar to locate the right one. Click Buy Now when you have found the template you require.

- Choose and Log In.

- Pick the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

What Is Limited Liability? Limited liability is a type of legal structure for an organization where a corporate loss will not exceed the amount invested in a partnership or limited liability company (LLC). In other words, investors' and owners' private assets are not at risk if the company fails.

8 Steps to Forming a Multi-Member LLC in California Pick a Name for Your Multi-Member LLC. ... Get an Employer Identification Number (EIN) ... Pick a Registered Agent. ... File Your Multi-Member LLC's Articles of Organization. ... File an Initial Statement of Information. ... Decide on Your LLC Business Management Structure.

8 Steps to Forming a Multi-Member LLC in California Pick a Name for Your Multi-Member LLC. ... Get an Employer Identification Number (EIN) ... Pick a Registered Agent. ... File Your Multi-Member LLC's Articles of Organization. ... File an Initial Statement of Information. ... Decide on Your LLC Business Management Structure.

There is no maximum number of members. Most states also permit ?single-member? LLCs, those having only one owner. A few types of businesses generally cannot be LLCs, such as banks and insurance companies. Check your state's requirements and the federal tax regulations for further information.

The limited liability company (LLC) exists as a separate entity from its owners, legally ensuring that the members cannot be held personally responsible for business debts and liabilities in most cases. An LLC also allows for pass-through taxation because income earned is not taxed at the entity level.