Limited Lliability

Description

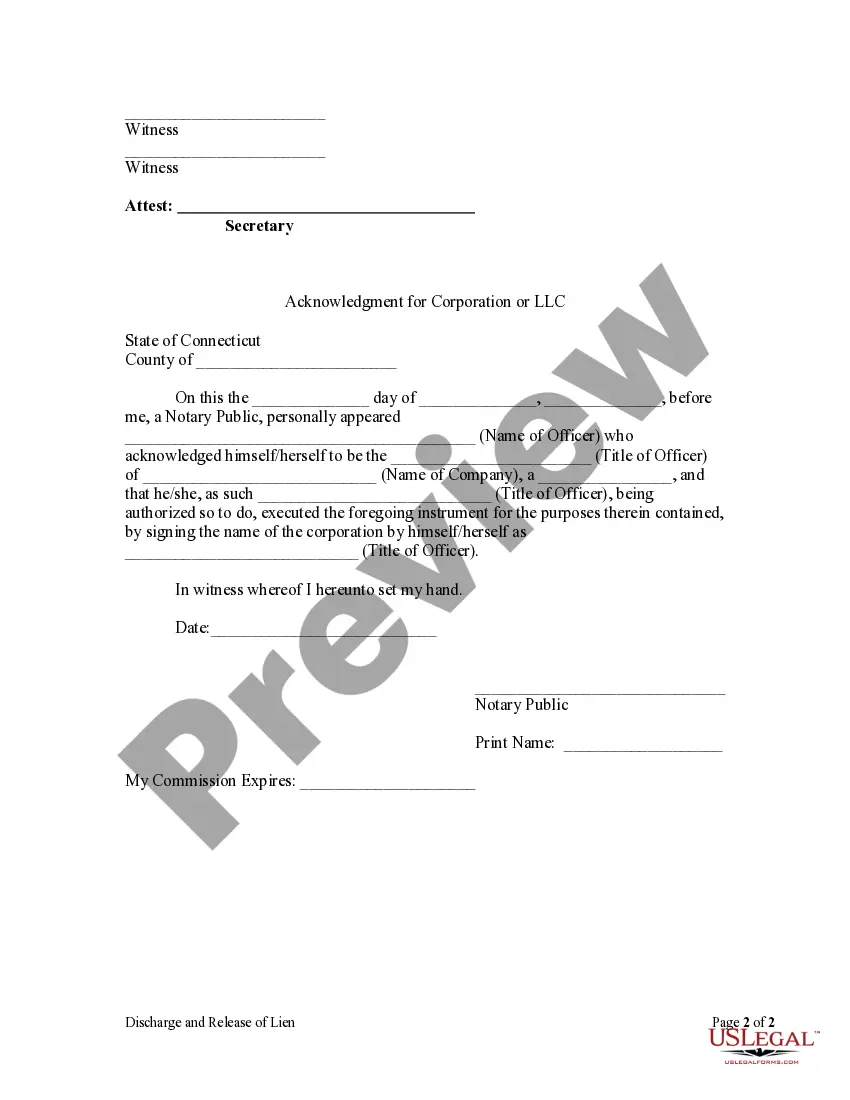

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

- First, log in to your US Legal Forms account. If this is your first time, create a new account by selecting the registration option.

- Browse the extensive library of over 85,000 legal forms. Utilize the Preview mode to view form details and ensure it meets your requirements.

- If you can't find the right form, use the Search feature to help you locate any additional templates that may fit your needs.

- Select the appropriate subscription plan by clicking the 'Buy Now' button for the document you wish to purchase.

- Proceed with your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your form and save it to your device for easy access. You'll be able to find it under 'My Forms' in your account anytime.

Obtaining legal documents does not have to be difficult. US Legal Forms provides an easy and comprehensive solution for accessing necessary paperwork.

Start your journey to legal protection today by visiting US Legal Forms and explore the wealth of resources available to you!

Form popularity

FAQ

An example of a limited liability company in the US is Amazon, LLC. This structure allows it to limit personal liability for its owners while facilitating business operations. Many start-ups and small businesses in the US also choose this model, benefiting from the protection provided by limited liability.

A limited liability company, or LLC, is a legal business structure that combines the benefits of a corporation with those of a partnership. It protects its owners from personal liability for business debts and legal actions. This means individuals can operate their businesses without worrying about risking their personal assets, which is why many entrepreneurs opt for this form of limited liability.

Filling out an LLC typically involves completing the articles of organization form provided by your state’s Secretary of State. You'll need to include details such as the LLC name, business address, and names of members. To ensure you fully understand the process and maintain limited liability, consider using resources from platforms like uslegalforms for guided assistance.

To write a limited liability company (LLC), start by choosing a unique name that complies with state regulations. Then, draft an operating agreement that outlines the structure and operational procedures of your LLC. Finally, file the articles of organization with your state, paying attention to the guidelines that specify how to establish limited liability for your business.

An example of a limited company is a company limited by shares, often referred to as Ltd in the United States. In this structure, shareholders have limited liability, which means they are only responsible for the company's debts up to the amount they invested. This setup encourages investment while reducing risk for individual owners, thereby promoting a secure business environment.

A common example of limited liability can be found in corporate structures, like a corporation. If a corporation faces legal issues or debt, the personal assets of its shareholders remain protected. This means that while the business may suffer, the personal finances of the owners typically do not get impacted, showcasing the essential nature of limited liability.

There is no specific income threshold required to form an LLC, but it makes sense to establish one when you expect consistent revenue. If you're generating income that exceeds your costs, forming an LLC can provide valuable limited liability protection. Consider your future business goals and the level of risk you're willing to take. Using US Legal Forms can simplify the process of establishing an LLC when you decide the time is right.

Determining a reasonable salary for an LLC owner depends on various factors, including the type of business and its income. Generally, you should aim for a salary that reflects the industry standard for your role and ensures you meet your personal financial needs. Remember, paying yourself a reasonable salary helps maintain your limited liability status. Consulting with a financial advisor can provide personalized guidance on salary expectations.

While an LLC provides limited liability protection, there are some downsides to consider. You may face higher fees and increased paperwork compared to other business structures. Additionally, profits from an LLC may be subject to self-employment taxes, impacting your personal income. It's essential to weigh these factors against the benefits of limited liability.

You should consider forming an LLC as soon as you start engaging in business activities. This applies to solo entrepreneurs and small businesses alike. An LLC helps shield your personal assets from business liabilities, providing you with limited liability protection. If you plan to hire employees or seek funding, establishing an LLC can enhance your credibility.