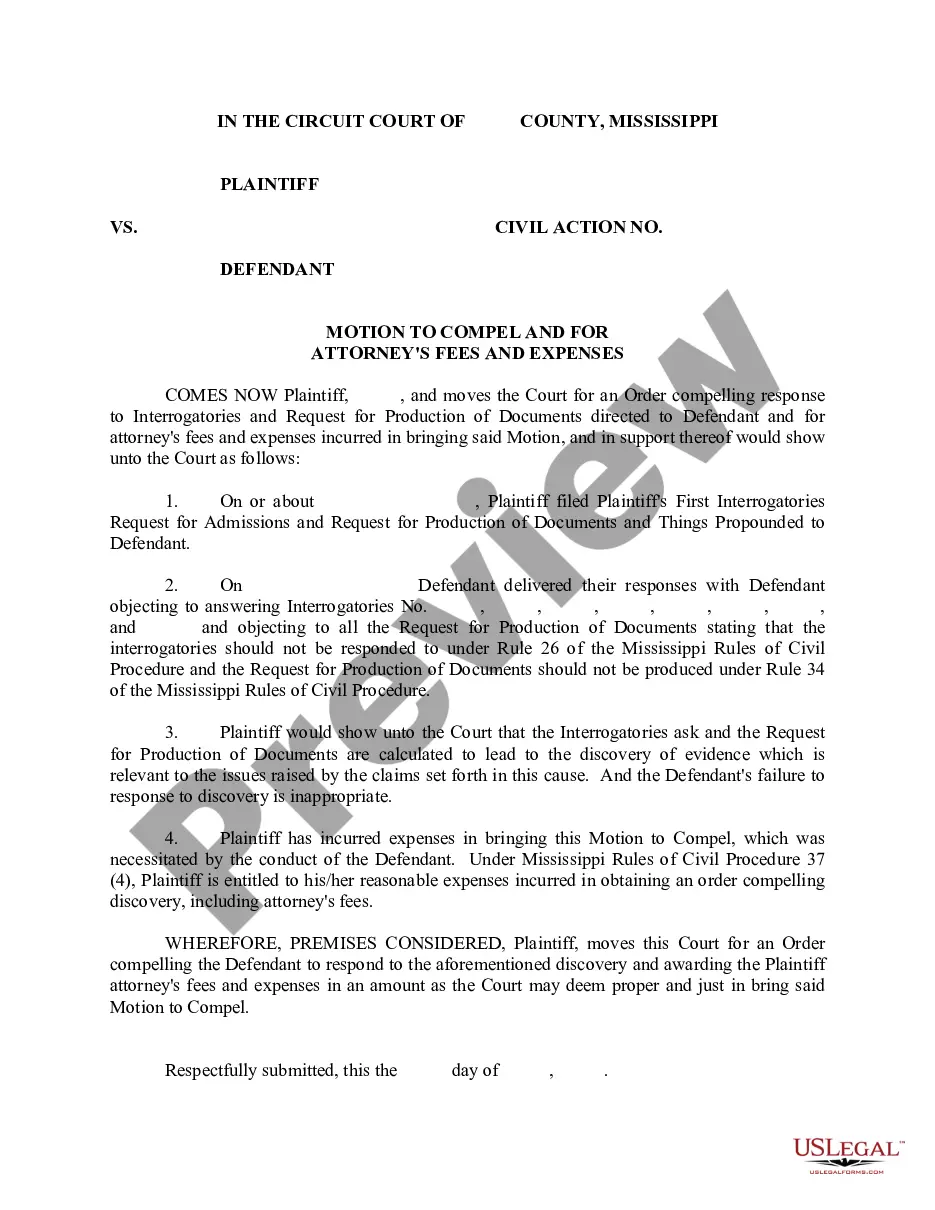

Mississippi Motion to Compel and For Attorney's Fees and Expenses

Description

How to fill out Mississippi Motion To Compel And For Attorney's Fees And Expenses?

Get a printable Mississippi Motion to Compel and For Attorney's Fees and Expenses within several mouse clicks in the most extensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Customers who have already a subscription, must log in directly into their US Legal Forms account, get the Mississippi Motion to Compel and For Attorney's Fees and Expenses see it stored in the My Forms tab. Customers who never have a subscription are required to follow the tips below:

- Make sure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If readily available, review the form to view more content.

- When you’re confident the template suits you, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or credit card.

- Download the form in Word or PDF format.

Once you’ve downloaded your Mississippi Motion to Compel and For Attorney's Fees and Expenses, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

On average, the processing time, from beginning to end takes around 3-5 weeks to form an LLC. There are options to speed up the process if you're in a rush and willing to pay a fee. This is the usual processing speed, of course, the standard option depends on the state you form your LLC. On average it takes 3-5 weeks.

Choose a Name for Your LLC. Appoint a Registered Agent. File a Certificate of Formation. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

LLC registrants are required to complete and submit a Certificate of Formation with the Secretary of State. There is a $50 filing fee that is about $50 that must be paid upon submission of the documents. Fees can change, check with the Secretary of State for the most recent fees.

LLC registrants are required to complete and submit a Certificate of Formation with the Secretary of State. There is a $50 filing fee that is about $50 that must be paid upon submission of the documents. Fees can change, check with the Secretary of State for the most recent fees.

Choose a Name for Your LLC. Appoint a Registered Agent. File a Certificate of Formation. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

Your Mississippi LLC will be approved in 3-5 business days. Once approved, the state will mail you back a stamped and approved copy of your Certificate of Formation, an official Certificate, and a receipt.

Probably the most obvious advantage to forming an LLC is protecting your personal assets by limiting the liability to the resources of the business itself. In most cases, the LLC will protect your personal assets from claims against the business, including lawsuits.There is also the tax benefit to an LLC.

To form a Mississippi LLC, the Certificate of Formation is filed with the Secretary of State, along with the state filing fee of $50.