Ca Form Wills For Nov 2023

Description

How to fill out California Estate Planning Questionnaire And Worksheets?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal files needs precision and attention to detail, which explains why it is very important to take samples of Ca Form Wills For Nov 2023 only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the details regarding the document’s use and relevance for the circumstances and in your state or region.

Take the following steps to complete your Ca Form Wills For Nov 2023:

- Make use of the catalog navigation or search field to locate your sample.

- View the form’s description to check if it fits the requirements of your state and county.

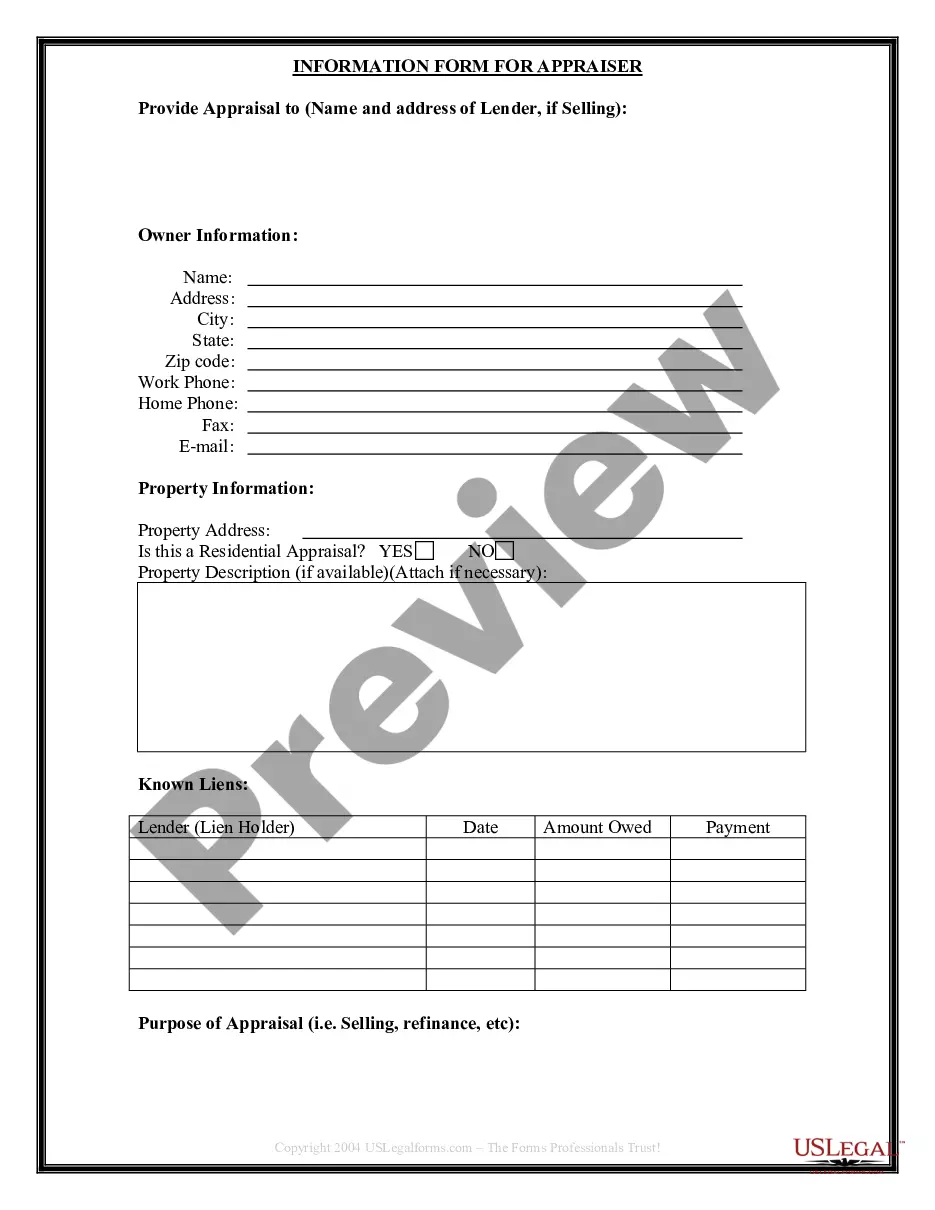

- View the form preview, if there is one, to ensure the form is the one you are searching for.

- Resume the search and look for the appropriate document if the Ca Form Wills For Nov 2023 does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Ca Form Wills For Nov 2023.

- Once you have the form on your device, you can alter it using the editor or print it and finish it manually.

Remove the headache that comes with your legal paperwork. Discover the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

FTB Form 588, Nonresident Withholding Waiver Request Nonresident payee who qualifies can use Form 588 to get a waiver from withholding based generally on California tax filing history. Form 588 must be submitted at least 21 business days before payment is made.

Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. This schedule will allow the FTB to allocate the withholding payments to the payee upon receipt of the completed Form 592.

Resident and Nonresident Withholding Tax Statement (Form 592-B) must be sent to all payees (domestic nonresident partners, members, shareholders, foreign partners or members, and nonresident independent contractors) to report the amount of payment or distribution subject to withholding and tax withheld as reported to ...

When and Where to File. Submit a request for a waiver at least 21 business days before making a payment to allow the FTB time to process the request. Online filing ? Registered users can file Form 588 online though MyFTB. Log in to MyFTB.