Agree Paid Wage Within

Description

How to fill out California On Duty Meal Period Agreement?

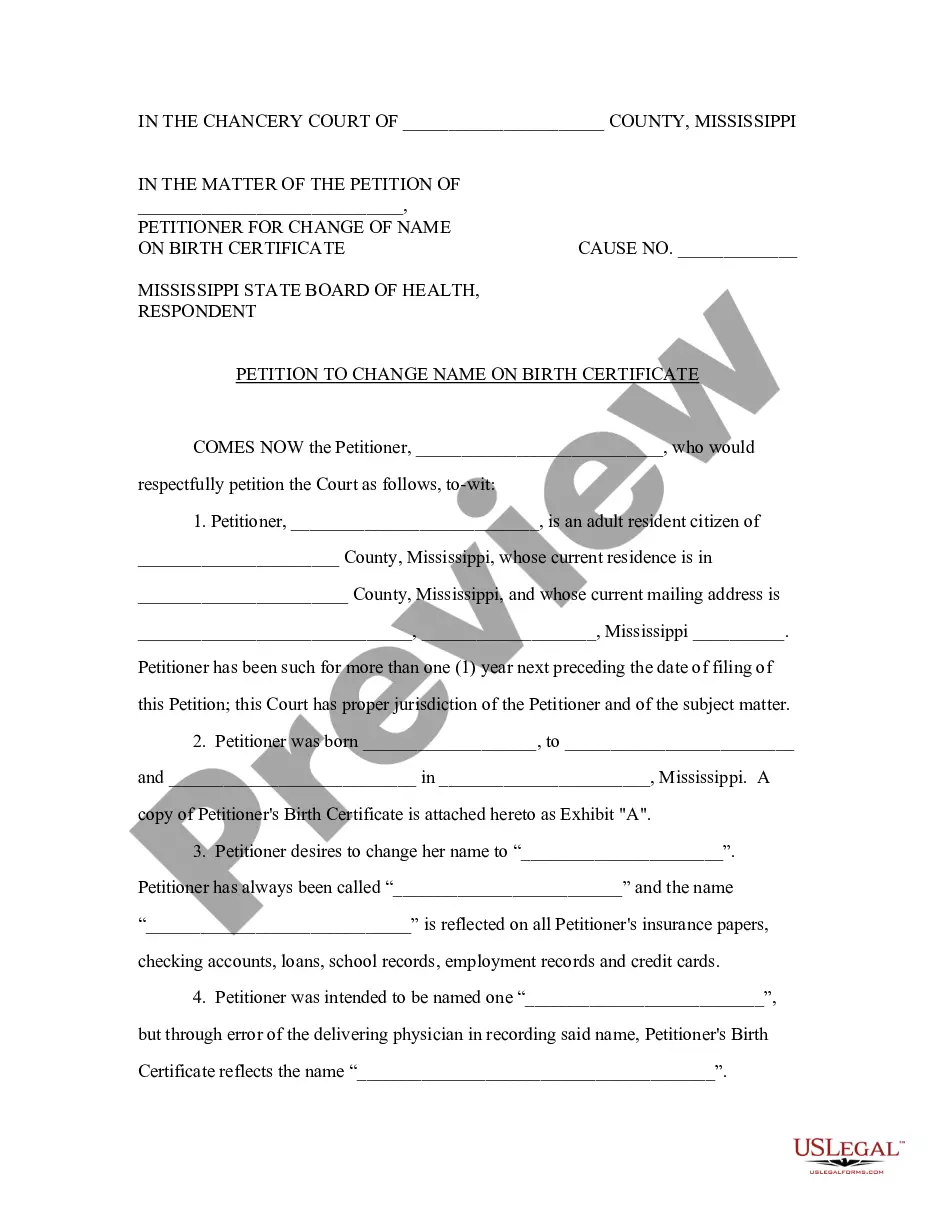

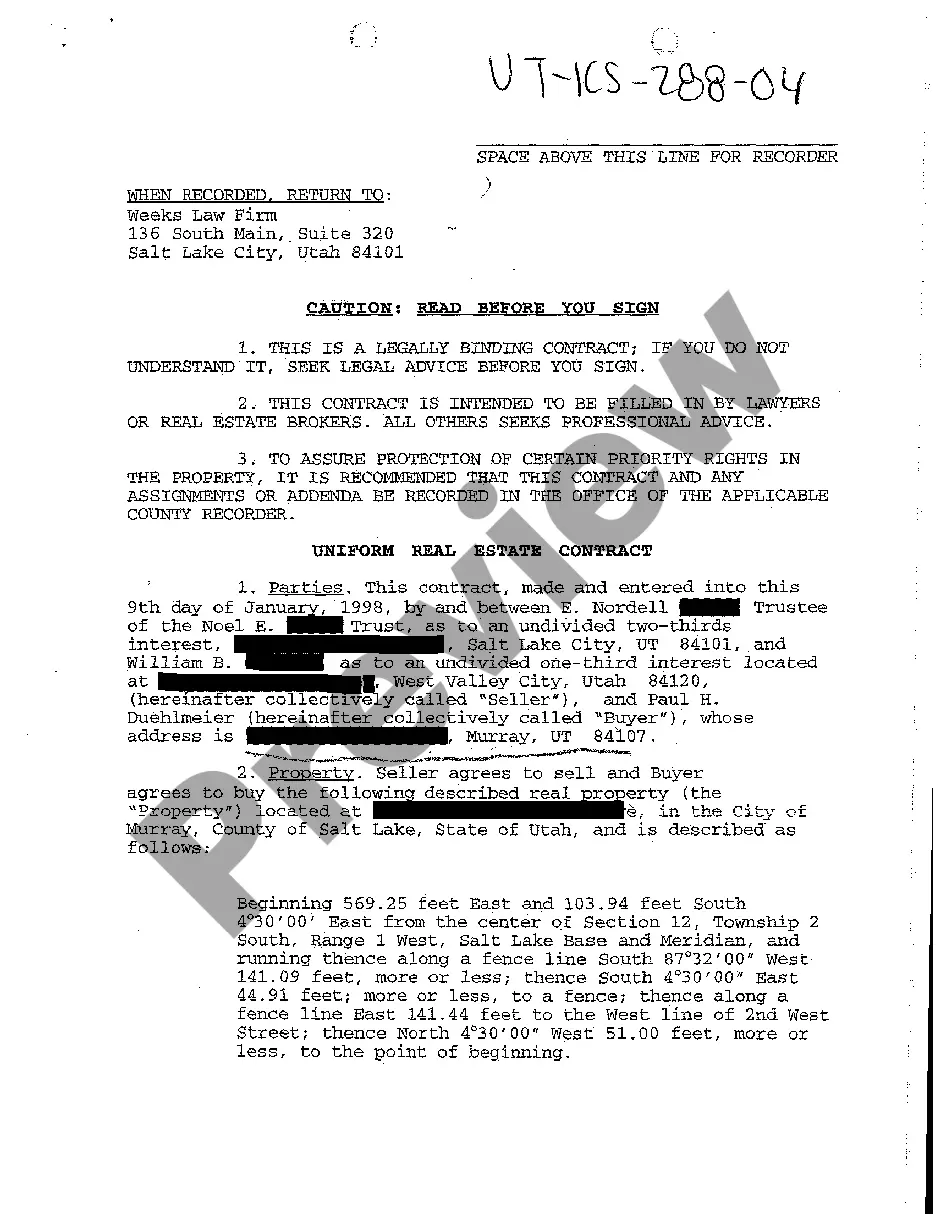

It’s no secret that you can’t become a legal expert overnight, nor can you figure out how to quickly draft Agree Paid Wage Within without the need of a specialized background. Creating legal forms is a time-consuming venture requiring a particular education and skills. So why not leave the creation of the Agree Paid Wage Within to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the document you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Agree Paid Wage Within is what you’re looking for.

- Begin your search again if you need a different form.

- Register for a free account and choose a subscription option to buy the template.

- Pick Buy now. As soon as the transaction is through, you can get the Agree Paid Wage Within, fill it out, print it, and send or send it by post to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

One Minute Takeaway: StateIf the Employee QuitCaliforniaWithin 72 hours or immediately if the employee gave at least 72 hours' noticeColoradoNext scheduled paydayConnecticutNext scheduled paydayDelawareNext scheduled payday47 more rows ?

File a Wage Claim The online claim process allows you to submit a complete and accurate claim on IDOL's website to avoid delays in the process. IDOL's online clam process also allows you to log in and check the status of your wage claim at your convenience.

File a complaint: If your boss won't respond to your concerns about payment under the minimum wage or failure to pay a premium for overtime hours, you can file a complaint with the U.S. Department of Labor, Wages and Hour Division, which enforces the Fair Labor Standards Act (FLSA).

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. For example, when an employer pays you an annual salary of $40,000 per year, this means you have earned $40,000 in gross pay.

If the regular payday for the last pay period an employee worked has passed and the employee has not been paid, contact the Department of Labor's Wage and Hour Division or the state labor department. The Department also has mechanisms in place for the recovery of back wages.