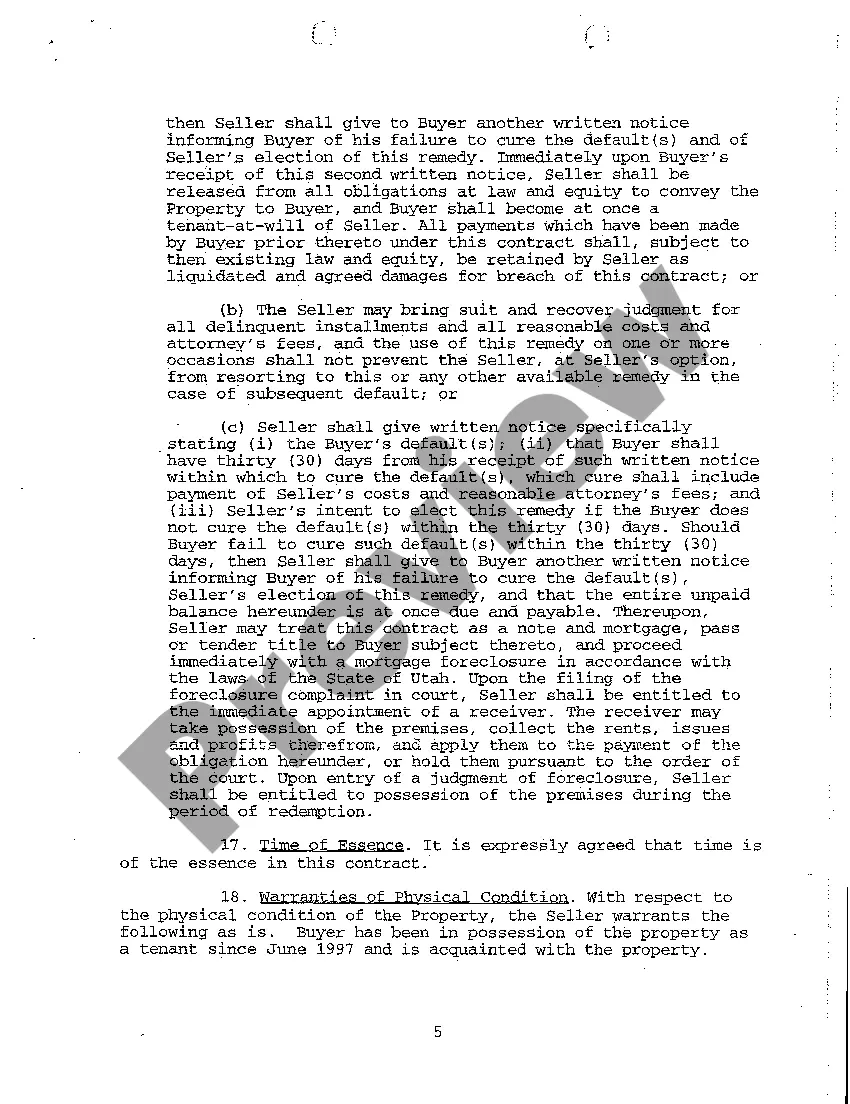

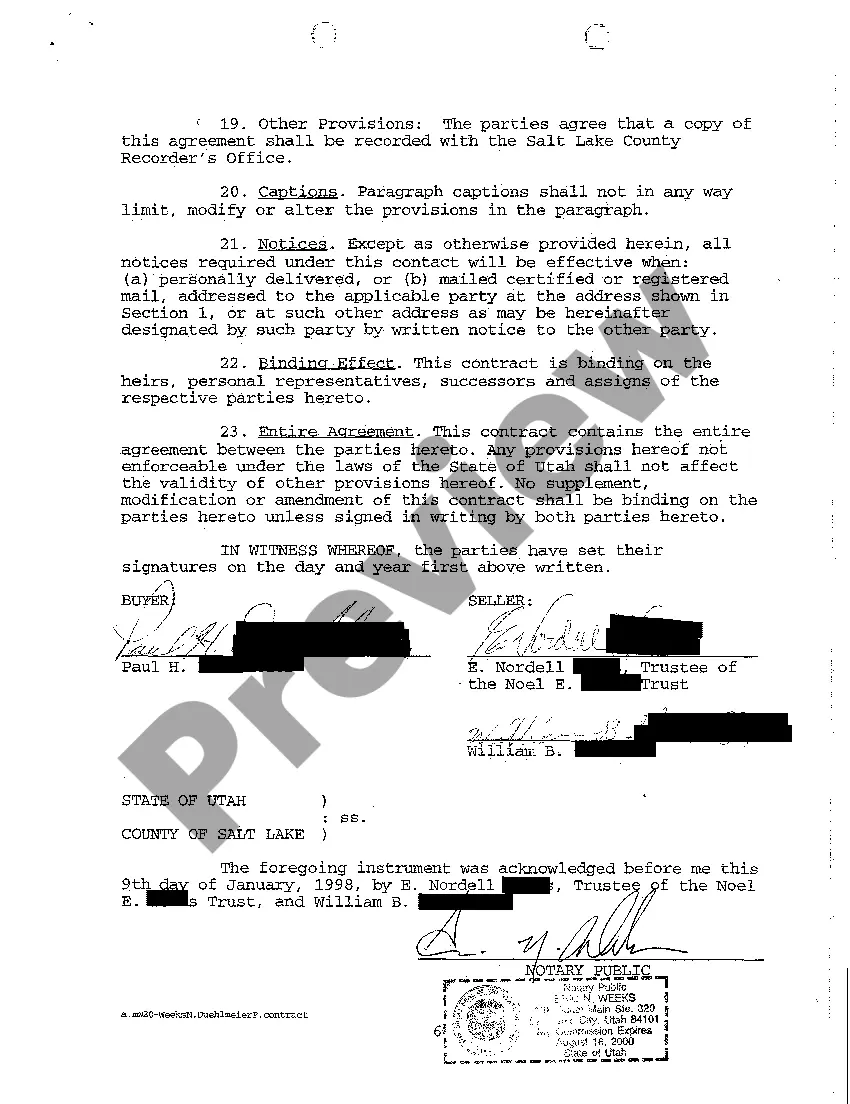

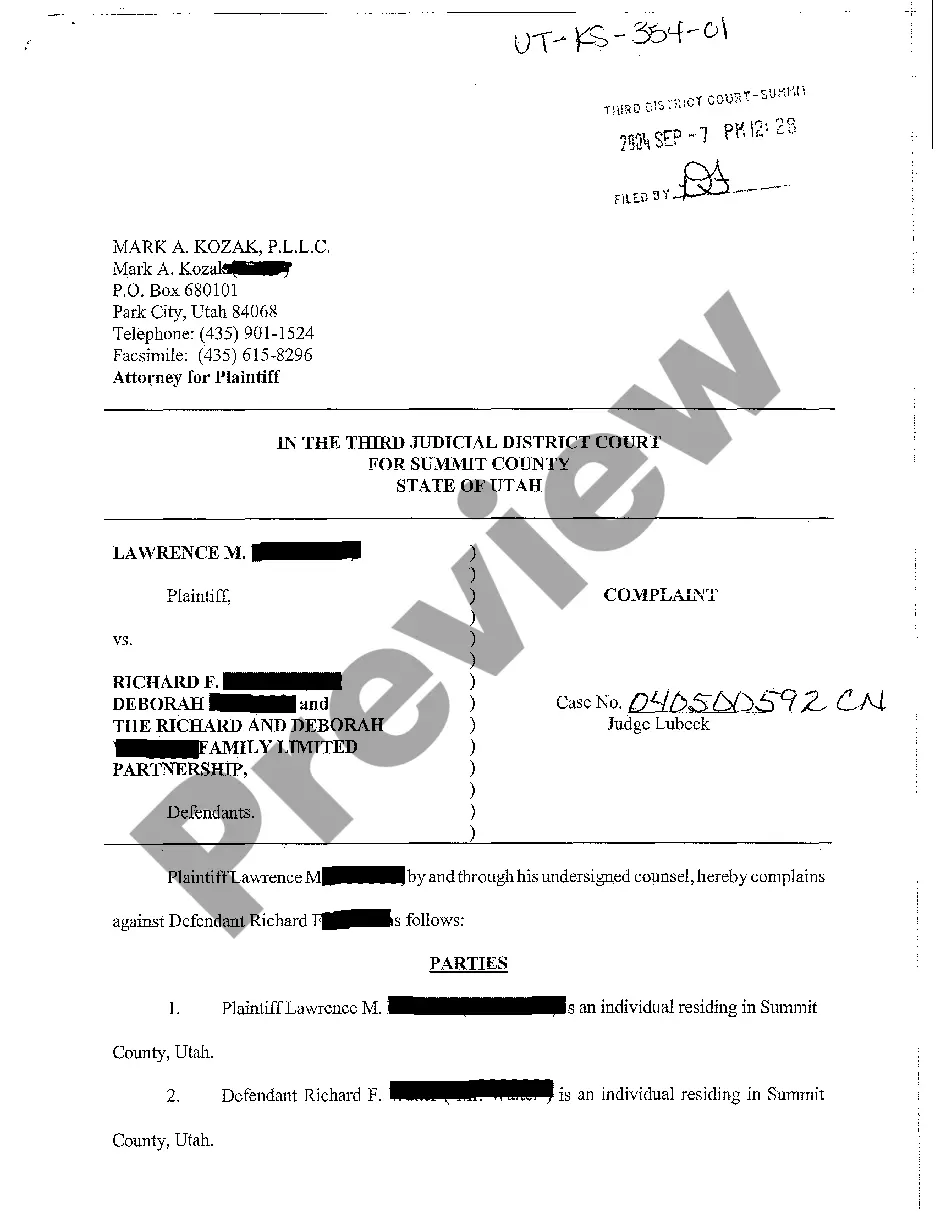

Utah Uniform Real Estate Contract

Description

How to fill out Utah Uniform Real Estate Contract?

Among hundreds of free and paid samples that you’re able to find online, you can't be sure about their accuracy. For example, who made them or if they are competent enough to deal with the thing you need these to. Always keep relaxed and utilize US Legal Forms! Locate Utah Uniform Real Estate Contract samples made by professional lawyers and avoid the costly and time-consuming procedure of looking for an attorney and after that paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you are using our service the very first time, follow the guidelines below to get your Utah Uniform Real Estate Contract quickly:

- Ensure that the document you discover is valid where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and bought your subscription, you can utilize your Utah Uniform Real Estate Contract as many times as you need or for as long as it continues to be active where you live. Revise it in your favored editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

New South Wales: You have five business days starting from the exchange of contract through to 5 pm on the fifth day. You will have to forfeit 0.25 per cent of the purchase price to the seller to cancel the contract.

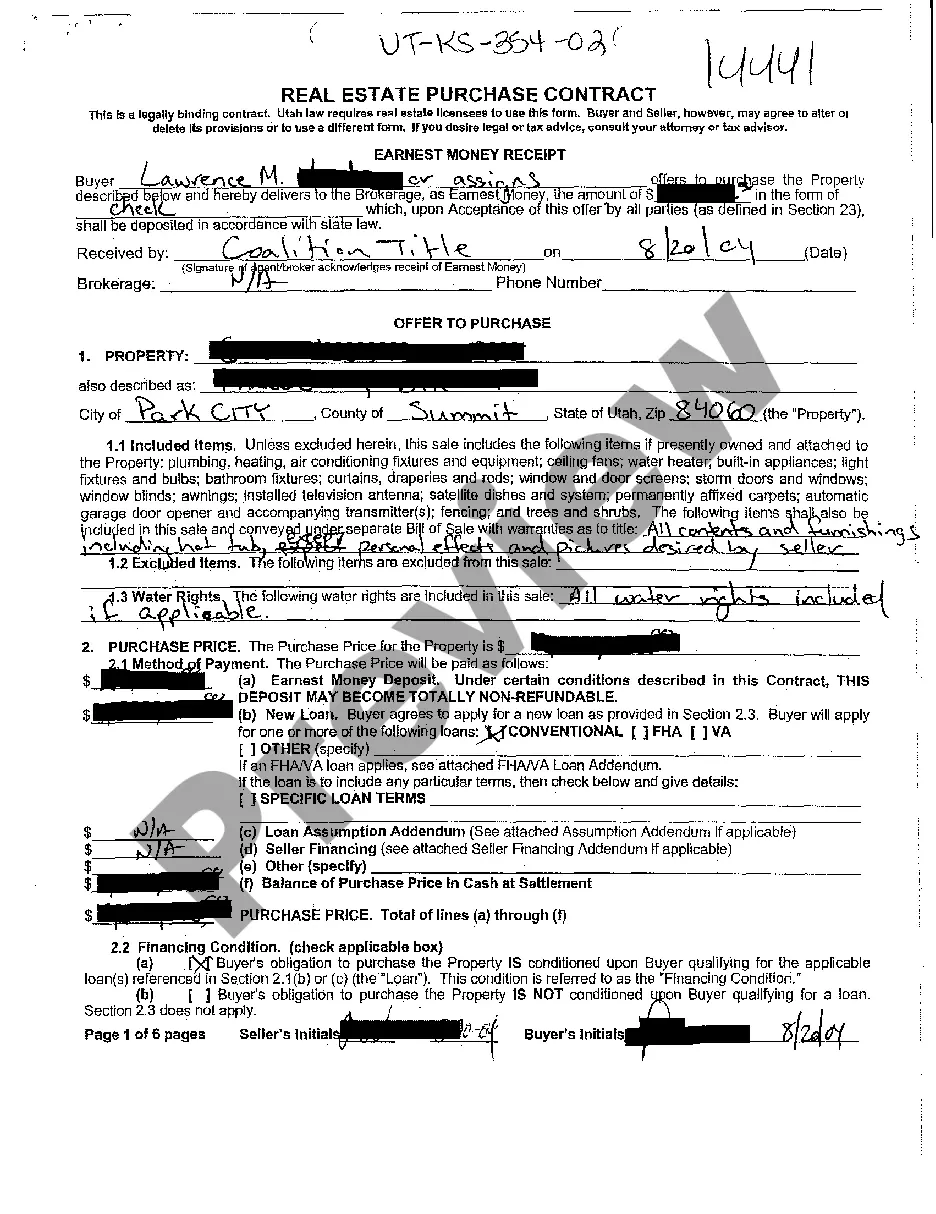

Date. REAL ESTATE PURCHASE CONTRACT. This is a legally binding Real Estate Purchase Contract (REPC). Utah law requires real estate licensees to use this form. Buyer and Seller, however, may agree to alter or delete its provisions or to use a different form.

A REPC (pronounced REP C) is the Real Estate Purchase Contract. This document outlines the terms and conditions of a purchase of real estate. It lists the buyer(s) and seller(s), agent(s), purchase price, concessions, what comes with the home, deadlines, contingencies and other legal contractual goodies.

MEC: Mutual Execution of Contract. Mechanic's lien: A lien created by statute which exists against real property in favor of persons who have performed work or furnished materials for the improvement of the real estate.

Are there alternatives to earnest money? Buyers who qualify for a home loan that doesn't require a down payment, like a VA loan, will sometimes have difficulty coming up with earnest money. These buyers have an option to offer a promissory note instead of an earnest money deposit.

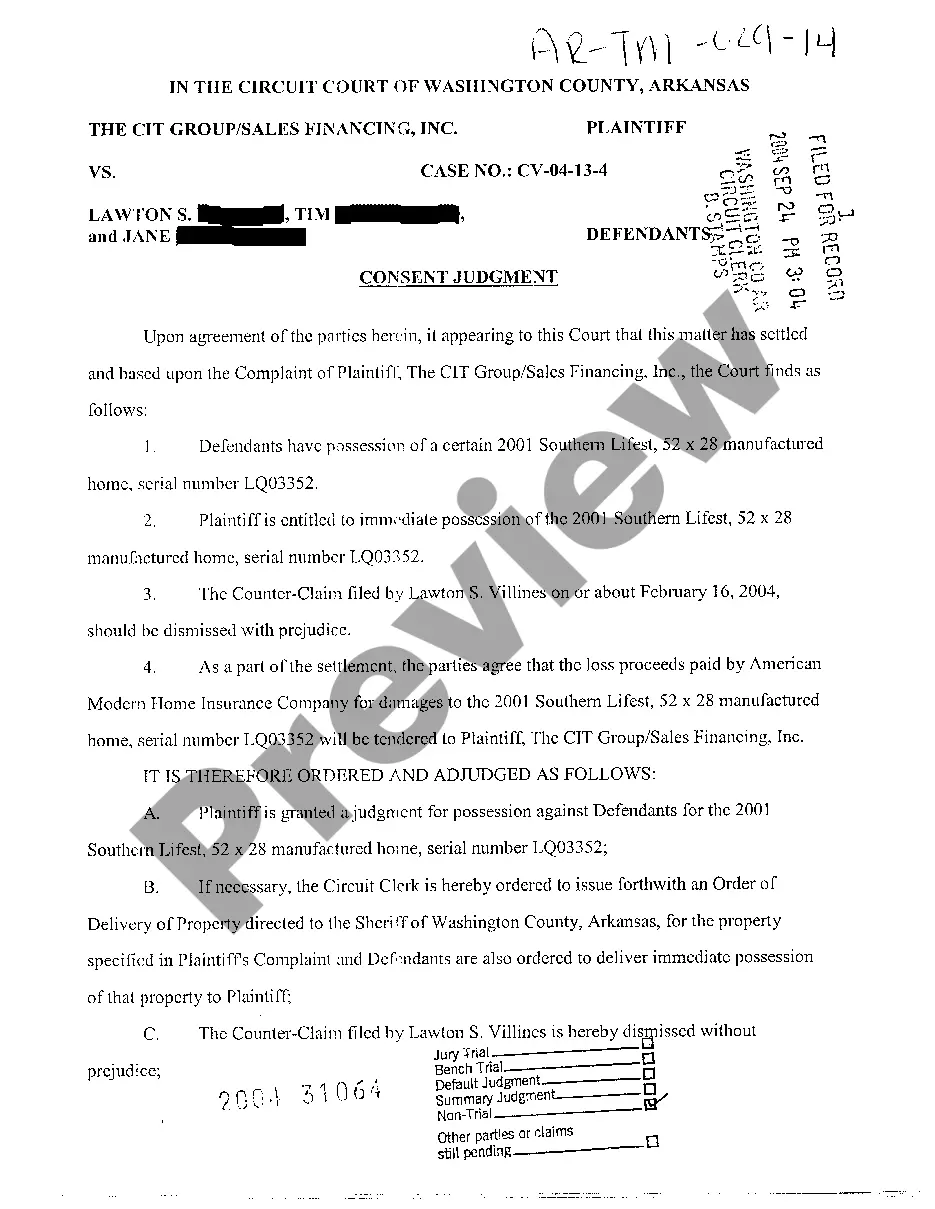

No, the buyer does not have 3 days to back out. In the State of California in a real estate purchase contract there are a number of contingencies that must be met before the contract moves forward.

A void contract has no legal force.If that is true, the contract is void as it violates one of the four essential elements of a valid contract: mutual consent, lawful object, capable parties, and consideration.

The New Loan Termination Deadline is to aid the Buyer determining whether the new loan is satisfactory to their needs. This includes payments, interest rate, terms, conditions, and cost. This deadline is for the sole benefit of the Buyer. This is usually 24-30 days from the MEC.

Appraisal Objection Deadline If the appraised value of the property is lower than the purchase price, this is the deadline for the Buyer to object to the appraisal and appraised value of the property.